Enlarge image

1111111111222222222233333333334444444444555555555566666666667777777777888

34567890123456789012345678901234567890123456789012345678901234567890123456789012

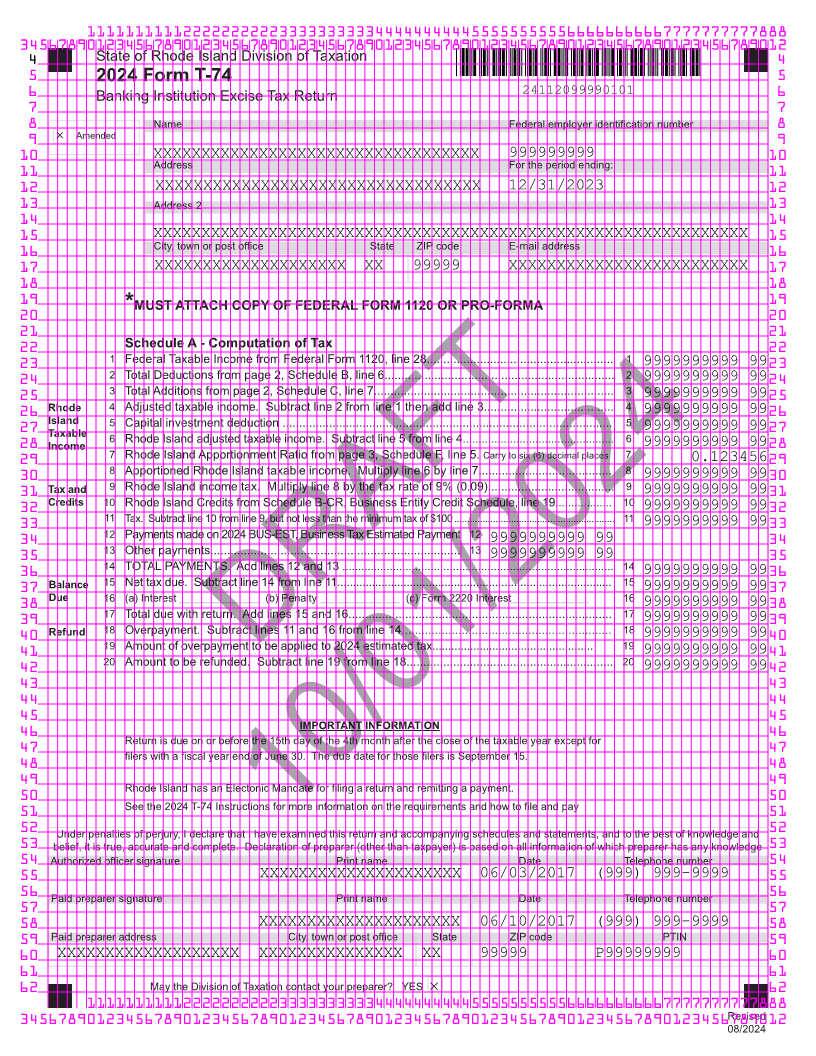

4 State of Rhode Island Division of Taxation 4

5 2024 Form T-74 5

6 Banking Institution Excise Tax Return 24112099990101 6

7 7

8 Name Federal employer identification number 8

9 Amended 9

10 10

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXAddress 999999999For the period ending:

11 11

12 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 12/31/2023 12

13 Address 2 13

14 14

15 15

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXCity, town or post office State ZIP code E-mail address

16 16

17 XXXXXXXXXXXXXXXXXXXX XX 99999 XXXXXXXXXXXXXXXXXXXXXXXXX 17

18 18

19 *MUST ATTACH COPY OF FEDERAL FORM 1120 OR PRO-FORMA 19

20 20

21 21

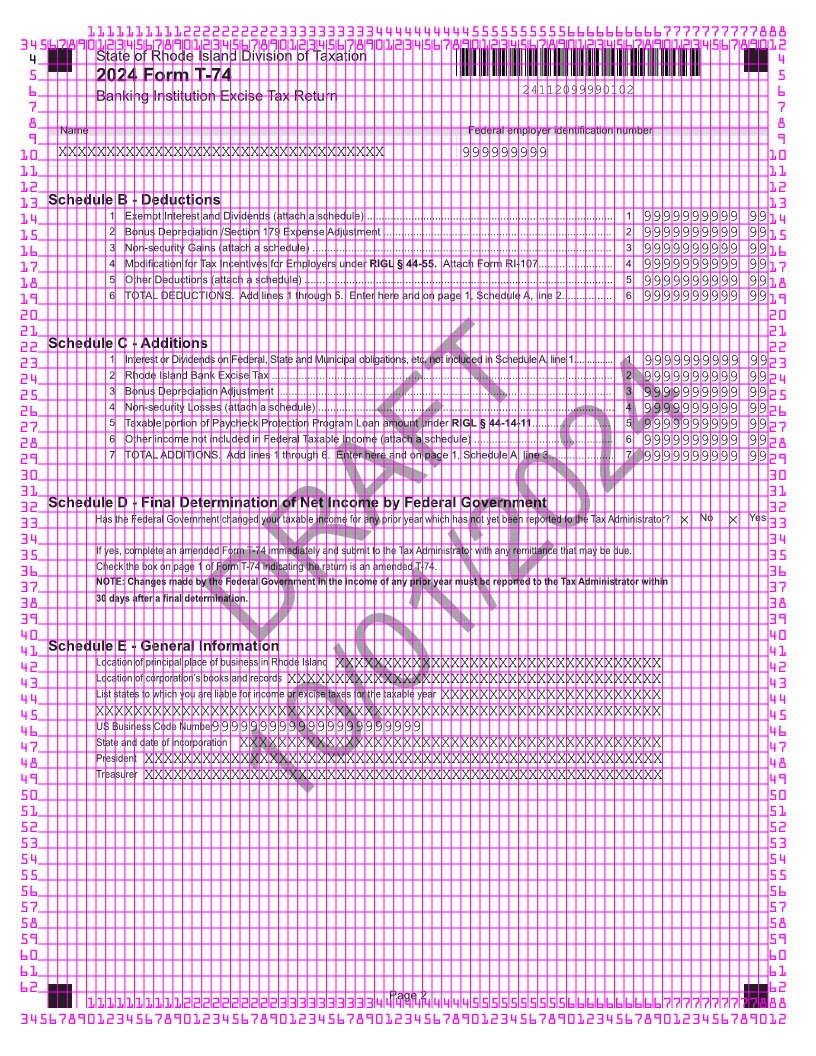

22 Schedule A - Computation of Tax 22

23 1 Federal Taxable Income from Federal Form 1120, line 28........................................................ 1 9999999999 99 23

24 2 Total Deductions from page 2, Schedule B, line 6..................................................................... 2 9999999999 99 24

25 3 Total Additions from page 2, Schedule C, line 7........................................................................ 3 9999999999 99 25

26 Rhode 4 Adjusted taxable income. Subtract line 2 from line 1 then add line 3....................................... 4 9999999999 99 26

Island 5 Capital investment deduction ................................................................................................... 5

27 Taxable 6 Rhode Island adjusted taxable income. Subtract line 5 from line 4................................................ 6 9999999999 99 27

28 Income 9999999999 99 28

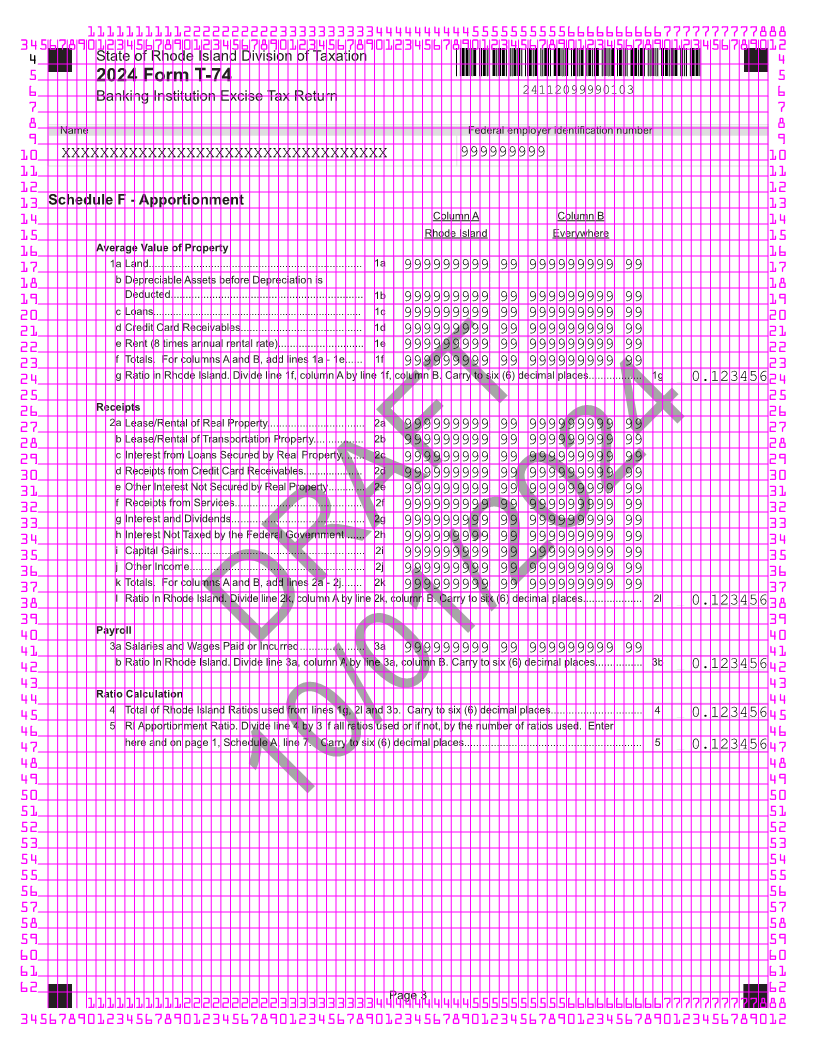

29 7 Rhode Island Apportionment Ratio from page 3, Schedule F, line 5. Carry to six (6) decimal places 7 _ . __________0.12345629

30 8 Apportioned Rhode Island taxable income. Multiply line 6 by line 7........................................ 8 9999999999 99 30

31 Tax and 9 Rhode Island income tax. Multiply line 8 by the tax rate of 9% (0.09)...................................... 9 9999999999 99 31

Credits 10 Rhode Island Credits from Schedule B-CR, Business Entity Credit Schedule, line 19.................. 10

32 32

11 Tax. Subtract line 10 from line 9, but not less than the minimum tax of $100.............................................................. 11 9999999999 99

33 33

12 Payments made on 2024 BUS-EST, Business Tax Estimated Payment 12 9999999999 99

34 34

13 Other payments........................................................................... 13 9999999999 99

35 35

14 TOTAL PAYMENTS. Add lines 12 and 13 ......................................................................................9999999999 99 14

36 9999999999 99 36

37 Balance 15 Net tax due. Subtract line 14 from line 11....................................................................................... 15 9999999999 99 37

Due 16 (a) Interest (b) Penalty (c) Form 2220 Interest 16

38 38

17 Total due with return. Add lines 15 and 16............................................................................... 17 9999999999 99

39 9999999999 99 39

40 Refund 18 Overpayment. Subtract lines 11 and 16 from line 14............................................................... 18 9999999999 99 40

19 Amount of overpayment to be applied to 2024 estimated tax................................................... 19

41 41

20 Amount to be refunded. Subtract line 19 from line 18.............................................................. 20 9999999999 99

42 DRAFT 9999999999 99 42

43 43

44 44

45 45

IMPORTANT INFORMATION

46 46

Return is due on or before the 15th day of the 4th month after the close of the taxable year except for

47 47

filers with a fiscal year end of June 30. The due date for those filers is September 15.

48 48

49 49

Rhode Island has an Electonic Mandate for filing a return and remitting a payment.

50 50

51 See the 2024 T-74 Instructions for more information on the requirements and how to file and pay 51

52 52

Under penalties of perjury, I declare that I have examined10/01/2024this return and accompanying schedules and statements, and to the best of knowledge and

53 belief, it is true, accurate and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge 53

54 Authorized officer signature Print name Date Telephone number 54

55 XXXXXXXXXXXXXXXXXXXXX 06/03/2017 (999) 999-9999 55

56 Paid preparer signature Print name Date Telephone number 56

57 57

58 XXXXXXXXXXXXXXXXXXXXX 06/10/2017 (999) 999-9999 58

59 Paid preparer address City, town or post office State ZIP code PTIN 59

60 XXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXX XX 99999 P99999999 60

61 61

62 May the Division of Taxation contact your preparer? YES 62

1111111111222222222233333333334444444444555555555566666666667777777777888

34567890123456789012345678901234567890123456789012345678901234567890123456789012Revised

08/2024