Enlarge image

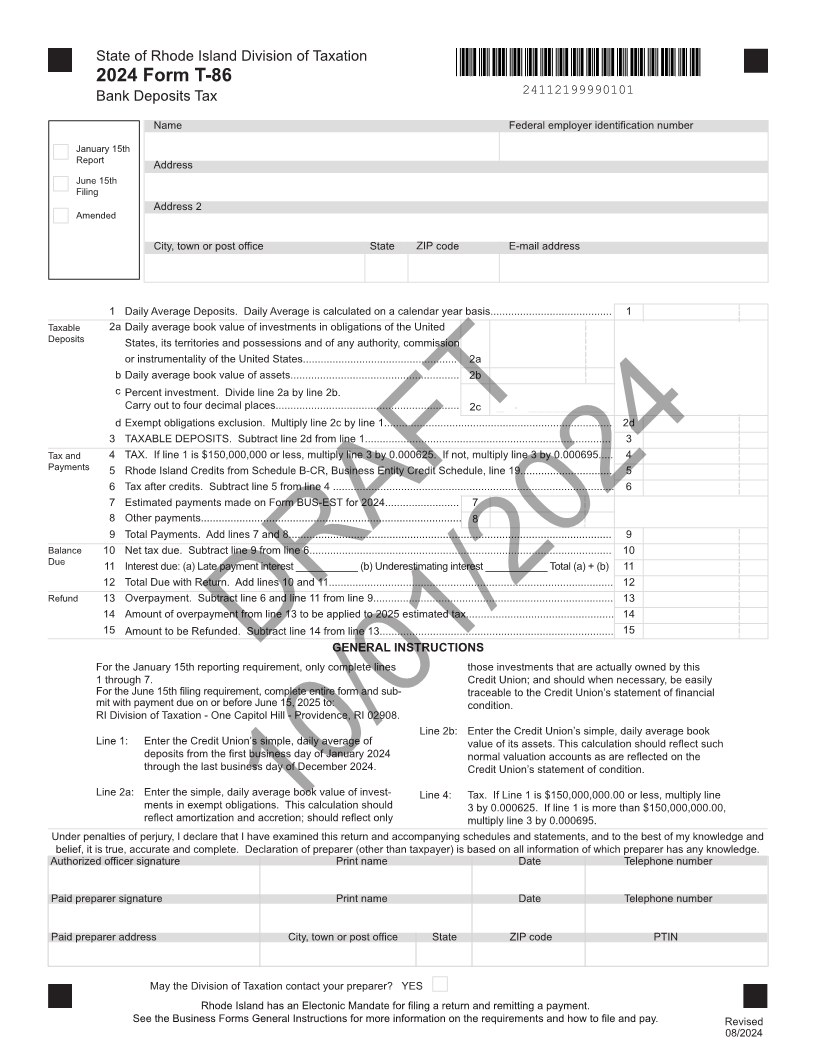

State of Rhode Island Division of Taxation

2024 Form T-86

Bank Deposits Tax 24112199990101

Name Federal employer identification number

January 15th

Report Address

June 15th

Filing

Address 2

Amended

City, town or post office State ZIP code E-mail address

1 Daily Average Deposits. Daily Average is calculated on a calendar year basis......................................... 1

Taxable 2a Daily average book value of investments in obligations of the United

Deposits States, its territories and possessions and of any authority, commission

or instrumentality of the United States.................................................... 2a

b Daily average book value of assets......................................................... 2b

c Percent investment. Divide line 2a by line 2b.

Carry out to four decimal places.............................................................. 2c _ . __________

d Exempt obligations exclusion. Multiply line 2c by line 1............................................................................. 2d

3 TAXABLE DEPOSITS. Subtract line 2d from line 1................................................................................... 3

Tax and 4 TAX. If line 1 is $150,000,000 or less, multiply line 3 by 0.000625. If not, multiply line 3 by 0.000695..... 4

Payments 5 Rhode Island Credits from Schedule B-CR, Business Entity Credit Schedule, line 19............................... 5

6 Tax after credits. Subtract line 5 from line 4 ............................................................................................... 6

7 Estimated payments made on Form BUS-EST for 2024......................... 7

8 Other payments........................................................................................ 8

9 Total Payments. Add lines 7 and 8............................................................................................................. 9

Balance 10 Net tax due. Subtract line 9 from line 6...................................................................................................... 10

Due 11 Interest due: (a) Late payment interest ___________ (b) Underestimating interest ___________ Total (a) + (b) 11

12 Total Due with Return. Add lines 10 and 11................................................................................................ 12

Refund 13 Overpayment. Subtract line 6 and line 11 from line 9................................................................................. 13

14 Amount of overpayment from line 13 to be applied to 2025 estimated tax.................................................. 14

15 Amount to be Refunded. Subtract line 14 from line 13............................................................................... 15

GENERAL INSTRUCTIONS

For the January 15th reporting requirement, only complete lines DRAFT those investments that are actually owned by this

1 through 7. Credit Union; and should when necessary, be easily

For the June 15th filing requirement, complete entire form and sub- traceable to the Credit Union’s statement of financial

mit with payment due on or before June 15, 2025 to: condition.

RI Division of Taxation - One Capitol Hill - Providence, RI 02908.

Line 2b: Enter the Credit Union’s simple, daily average book

Line 1: Enter the Credit Union’s simple, daily average of value of its assets. This calculation should reflect such

deposits from the first business day of January 2024 normal valuation accounts as are reflected on the

through the last business day of December 2024. Credit Union’s statement of condition.

Line 2a: Enter the simple, daily average book value of invest- Line 4: Tax. If Line 1 is $150,000,000.00 or less, multiply line

ments in exempt obligations. This calculation should 3 by 0.000625. If line 1 is more than $150,000,000.00,

reflect amortization and accretion; should reflect only multiply line 3 by 0.000695.

Under penalties of perjury, I declare that I have examined10/01/2024this return and accompanying schedules and statements, and to the best of my knowledge and

belief, it is true, accurate and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Authorized officer signature Print name Date Telephone number

Paid preparer signature Print name Date Telephone number

Paid preparer address City, town or post office State ZIP code PTIN

May the Division of Taxation contact your preparer? YES

Rhode Island has an Electonic Mandate for filing a return and remitting a payment.

See the Business Forms General Instructions for more information on the requirements and how to file and pay. Revised

08/2024