Enlarge image

1111111111222222222233333333334444444444555555555566666666667777777777888

34567890123456789012345678901234567890123456789012345678901234567890123456789012

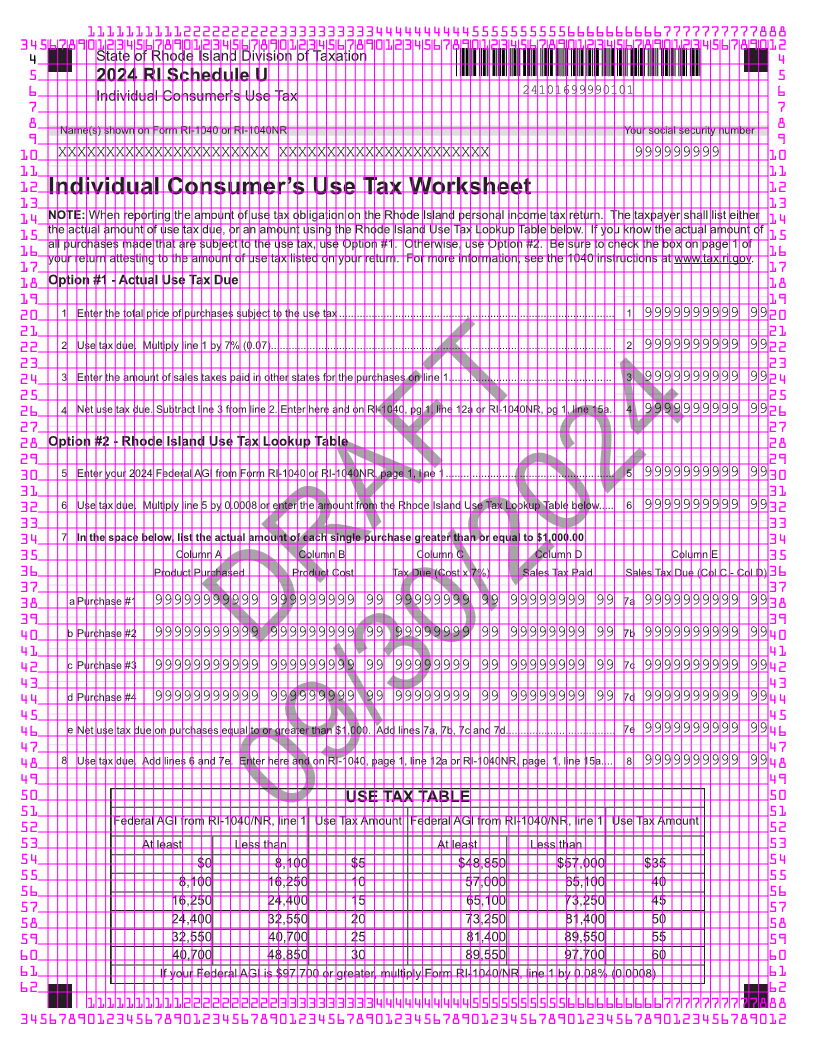

4 State of Rhode Island Division of Taxation 4

5 2024 RI Schedule U 5

6 Individual Consumer’s Use Tax 24101699990101 6

7 7

8 Name(s) shown on Form RI-1040 or RI-1040NR Your social security number 8

9 9

10 XXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXX 999999999 10

11 11

12 Individual Consumer’s Use Tax Worksheet 12

13 13

14 NOTE: When reporting the amount of use tax obligation on the Rhode Island personal income tax return. The taxpayer shall list either 14

the actual amount of use tax due, or an amount using the Rhode Island Use Tax Lookup Table below. If you know the actual amount of

15 15

all purchases made that are subject to the use tax, use Option #1. Otherwise, use Option #2. Be sure to check the box on page 1 of

16 your return attesting to the amount of use tax listed on your return. For more information, see the 1040 instructions at www.tax.ri.gov. 16

17 17

18 Option #1 - Actual Use Tax Due 18

19 19

20 1 Enter the total price of purchases subject to the use tax ............................................................................................. 1 9999999999 99 20

21 21

22 2 Use tax due. Multiply line 1 by 7% (0.07)................................................................................................................... 2 9999999999 99 22

23 23

24 3 Enter the amount of sales taxes paid in other states for the purchases on line 1....................................................... 3 9999999999 99 24

25 25

26 4 Net use tax due. Subtract line 3 from line 2. Enter here and on RI-1040, pg 1, line 12a or RI-1040NR, pg 1, line 15a. 4 9999999999 99 26

27 27

28 Option #2 - Rhode Island Use Tax Lookup Table 28

29 29

30 5 Enter your 2024 Federal AGI from Form RI-1040 or RI-1040NR, page 1, line 1......................................................... 5 9999999999 99 30

31 31

32 6 Use tax due. Multiply line 5 by 0.0008 or enter the amount from the Rhode Island Use Tax Lookup Table below..... 6 9999999999 99 32

33 33

34 7 In the space below, list the actual amount of each single purchase greater than or equal to $1,000.00 34

35 Column A Column B Column C Column D Column E 35

36 Product Purchased Product Cost Tax Due (Cost x 7%) Sales Tax Paid Sales Tax Due (Col C - Col D) 36

37 37

38 a Purchase #1 99999999999 999999999 99 99999999 99 99999999 99 7a 9999999999 99 38

39 39

40 b Purchase #2 99999999999 999999999 99 99999999 99 99999999 99 7b 9999999999 99 40

41 41

42 c Purchase #3 99999999999 999999999DRAFT99 9999999999 99999999 997c 999999999999 42

43 43

44 d Purchase #4 99999999999 999999999 99 99999999 99 99999999 99 7d 9999999999 99 44

45 45

46 e Net use tax due on purchases equal to or greater than $1,000. Add lines 7a, 7b, 7c and 7d..................................... 7e 9999999999 99 46

47 47

48 8 Use tax due. Add lines 6 and 7e. Enter here and on RI-1040, page 1, line 12a or RI-1040NR, page, 1, line 15a.... 8 9999999999 99 48

49 49

50 USE TAX TABLE 50

51 51

Federal AGI from RI-1040/NR, line 1 Use Tax Amount Federal AGI from RI-1040/NR, line 1 Use Tax Amount

52 52

09/30/2024

53 At least Less than At least Less than 53

54 $0 8,100 $5 $48,850 $57,000 $35 54

55 8,100 16,250 10 57,000 65,100 40 55

56 56

16,250 24,400 15 65,100 73,250 45

57 57

58 24,400 32,550 20 73,250 81,400 50 58

59 32,550 40,700 25 81,400 89,550 55 59

60 40,700 48,850 30 89,550 97,700 60 60

61 If your Federal AGI is $97,700 or greater, multiply Form RI-1040/NR, line 1 by 0.08% (0.0008) 61

62 62

1111111111222222222233333333334444444444555555555566666666667777777777888

34567890123456789012345678901234567890123456789012345678901234567890123456789012