Enlarge image

1111111111222222222233333333334444444444555555555566666666667777777777888

34567890123456789012345678901234567890123456789012345678901234567890123456789012

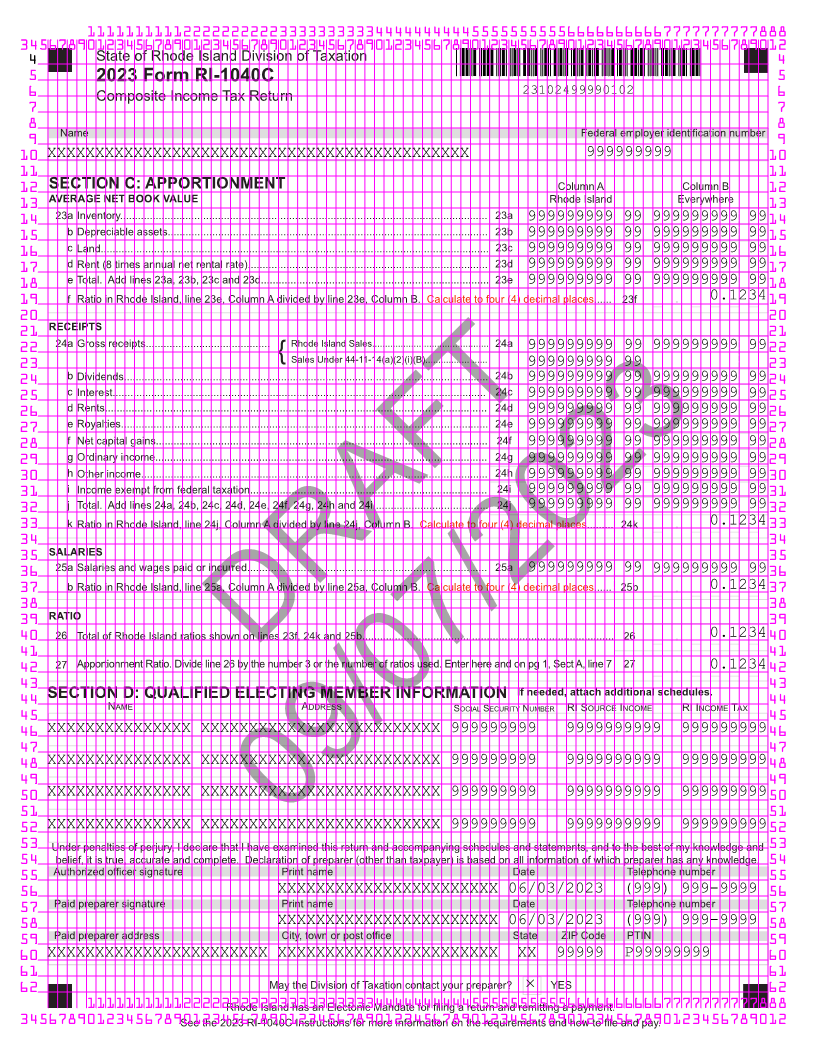

4 State of Rhode Island Division of Taxation 4

5 2023 Form RI-1040C 5

6 Composite Income Tax Return 23102499990101 6

7 7

8 8

9 Name Federal employer identification number 9

10 Amended XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 999999999 10

11 Address 11

12 Sub S Corp XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 12

13 Address 2 13

14 LLC XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 14

15 City, town or post office State ZIP code E-mail address 15

16 Partnership XXXXXXXXXXXXXXXXXXXXXXXXXXXXXX XX 99999 XXXXXXXXXXXXXXXXXXX 16

17 Year end 17

Trust

18 Calendar Year: January 1, 2023 through December 31, 2023 Fiscal Year:MM/DD/06/02/2023 through 06/01/2023MM/DD/__ 18

19 19

20 SECTION A: COMPUTATION OF INCOME 20

21 1 Total Federal Taxable income from Federal Form 1120S, line 21, Federal Form 1065, line 22 or Federal 21

22 Form 1041, line 23, plus any separately stated income or deduction items listed on Federal K-1..................................... 1 9999999999 99 22

23 MODIFICATIONS INCREASING FEDERAL TAXABLE INCOME 23

24 2a Income from obligations of any state or its political subdivisions, 24

25 other than RI (attach documentation) ...................................................................... 2a 9999999999 99 25

26 b Bonus Depreciation................................................................................................. 2b 9999999999 99 26

27 c Taxable portion of Paycheck Protection Program Loan amount under RIGL §44-30-12(b)(8)... 2c 9999999999 99 27

28 d Other modifications (attach documentation) ............................................................ 2d 9999999999 99 28

29 3 Total modifications INCREASING Federal Taxable Income. Add lines 2a, 2b, 2c and 2d .......................................... 3 9999999999 9929

30 MODIFICATIONS DECREASING FEDERAL TAXABLE INCOME 30

31 4a Income from obligations of the US government included in federal income but 31

32 exempt from state income taxes (attach documentation) ........................................ 4a 9999999999 99 32

33 b Bonus Depreciation and Section 179 Depreciation ................................................. 4b 9999999999 99 33

34 c Other modifications (attach documentation) ............................................................ 4c 9999999999 99 34

35 5 Total modifications DECREASING Federal Taxable Income. Add lines 4a, 4b and 4c............................................... 5 9999999999 99 35

36 6 Modified Federal Taxable Income. Line 1 plus line 3 less line 5.................................................................................. 6 9999999999 99 36

37 7 RI apportionment ratio from pg 2, Section C, line 27. (Multistate entities only - entities solely in RI enter 1.0000)...................... 7 _ . _ _ _ _0.123437

38 8 Rhode Island source income. Multiply line 6 by line 7 ................................................................................................. 8 9999999999 99 38

39 39

SECTION B: COMPUTATION OF TAX

40 40

41 9 Rhode Island income tax using the COMPOSITE INCOME TAX RATE. Multiply line 8 by 5.99% (0.0599)............... 9 9999999999 99 41

42 10 Qualified electing nonresident members’ percentDRAFTof ownership. If all members are nonresidents enter 1.0000...................10 _ . _ _ _ _0.111142

43 11 Rhode Island income tax of qualified electing nonresident members. Multiply line 9 by line 10 ................................. 11 9999999999 99 43

44 12 Rhode Island estimated payments made on RI-1040C-ES and amount applied 44

45 from 2022 composite return........................................................................................... 12 9999999999 99 45

46 13 Rhode Island nonresident real estate withholding of qualified electing 46

47 nonresident members.............................................................................................. 13 9999999999 99 47

48 14 Rhode Island nonresident withholding received from pass-through entities from 48

Form RI K-1. Attach form(s)................................................................................... 14

49 9999999999 99 49

50 15 Other payments....................................................................................................... 15 9999999999 99 50

51 16 Total payments. Add lines 12, 13, 14 and 15 ............................................................................................................... 16 9999999999 99 51

52 17 AMOUNT DUELARGER. If line 11 is than line 16, subtract line 16 from line 11.............................................................. 17 9999999999 99 52

18 Underestimating interest........................................................................................................................................................09/07/202318

53 9999999999 99 53

54 19 TOTAL AMOUNT DUE. Add lines 17 and 18. Complete Form RI-1040C-V .......................................................... 19 9999999999 99 54

L

55 20 OVERPAYMENTSMALLER. If line 11 is than line 16, subtract line 11 from line 16. This is the amount 55

56 overpaid. If there is an amount due for underestimating interest on line 18, subtract line 18 from line 20..... J 20 9999999999 99 56

57 21 Amount of overpayment to be refunded ...................................................................................................................... 21 9999999999 99 57

58 22 Amount of overpayment to be applied to 2024 RI-1040C estimated tax ................. 22 9999999999 99 58

59 59

60 60

61 61

62 62

1111111111222222222233333333334444444444555555555566666666667777777777888

34567890123456789012345678901234567890123456789012345678901234567890123456789012