Enlarge image

RHODE ISLAND COMPOSITE INCOME TAX RETURN

RI DIVISION OF TAXATION - ONE CAPITOL HILL

PROVIDENCE, RI 02908-5807

15102799990101

Fiscal year filers, enter fiscal year dates

MM/DD/2023 through MM/DD/2024 2023 RI-1040C-V

Name

Address

City State ZIP Code

Federal employer identification number ENTER AMOUNT ENCLOSED

State of Rhode Island Division of Taxation

2023 Form RI-1040C-V

Composite Income Tax Return Payment

What Is Form RI-1040C-V and Do You Need To Use It? How to File Your Return and Submit Payment

It is a statement you send with your payment of any balance The Rhode Island Division of Taxation has an electronic mandate

due on line 19 of your Form RI-1040C. Using Form RI-1040C-V that requires Larger Business Registrants use electronic means to

allows us to process your payment more accurately and efficiently. file returns and remit taxes beginning on January 1, 2023.

We strongly encourage you to use Form RI-1040C-V, but there is

no penalty if you do not do so. A "larger business registrant" is defined as any person who:

1) Operates as a business whose combined annual liability for all

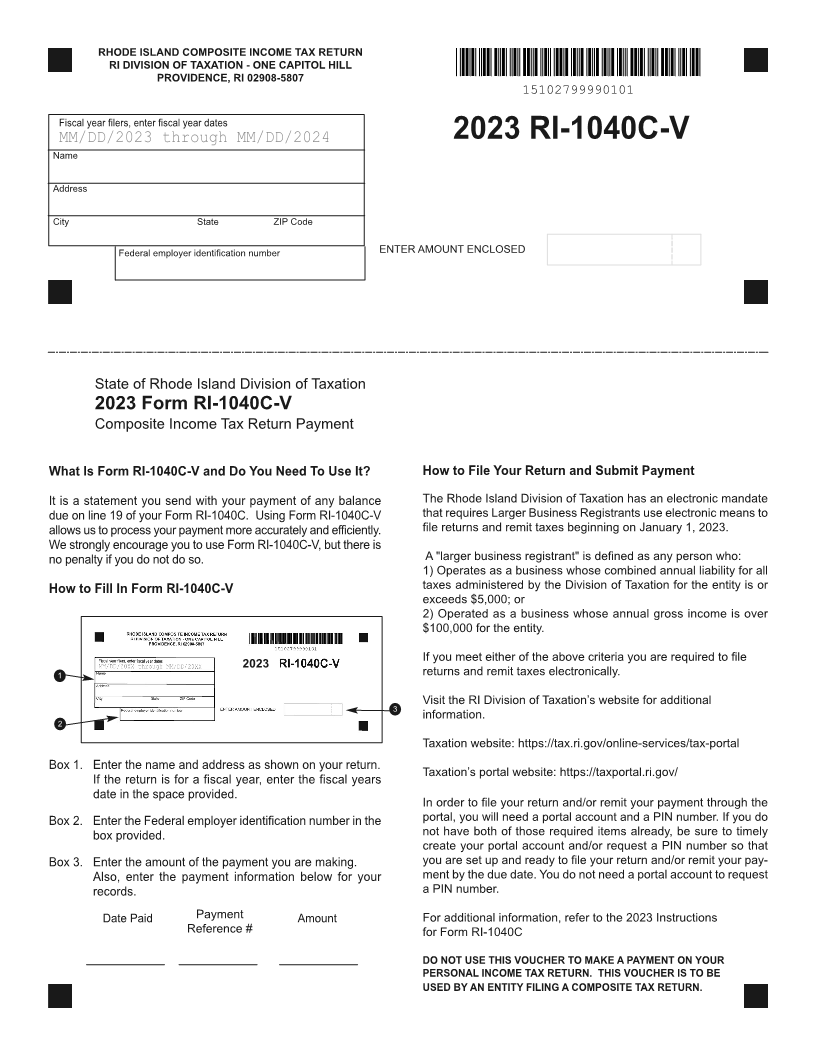

How to Fill In Form RI-1040C-V taxes administered by the Division of Taxation for the entity is or

exceeds $5,000; or

2) Operated as a business whose annual gross income is over

$100,000 for the entity.

2023 If you meet either of the above criteria you are required to file

1 returns and remit taxes electronically.

Visit the RI Division of Taxation’s website for additional

3

information.

2

Taxation website: https://tax.ri.gov/online-services/tax-portal

Box 1. Enter the name and address as shown on your return.

Taxation’s portal website: https://taxportal.ri.gov/

If the return is for a fiscal year, enter the fiscal years

date in the space provided.

In order to file your return and/or remit your payment through the

Box 2. Enter the Federal employer identification number in the portal, you will need a portal account and a PIN number. If you do

box provided. not have both of those required items already, be sure to timely

create your portal account and/or request a PIN number so that

Box 3. Enter the amount of the payment you are making. you are set up and ready to file your return and/or remit your pay-

Also, enter the payment information below for your ment by the due date. You do not need a portal account to request

records. a PIN number.

Date Paid Payment Amount For additional information, refer to the 2023 Instructions

Reference # for Form RI-1040C

DO NOT USE THIS VOUCHER TO MAKE A PAYMENT ON YOUR

PERSONAL INCOME TAX RETURN. THIS VOUCHER IS TO BE

USED BY AN ENTITY FILING A COMPOSITE TAX RETURN.