Enlarge image

2025

Form RI-1041ES

Rhode Island Fiduciary

Estimated Payment Coupons

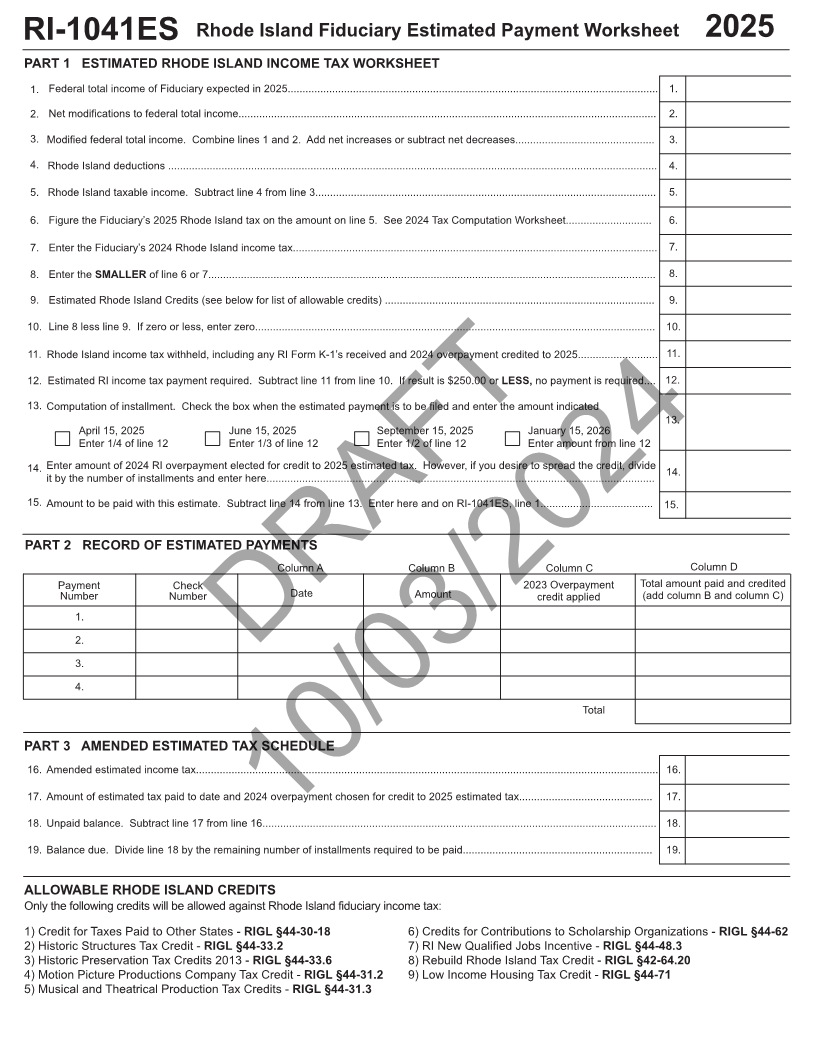

PURPOSE OF FORM PAYMENTS OF ESTIMATED TAX stallment of estimated tax, you may attach

This form provides a means of paying your Except as provided for in the next paragraph Form RI-2210 (if any of the exceptions apply)

Rhode Island income tax on a current basis on of instructions, the estimated tax on line 15 of to your Rhode Island Fiduciary income tax re-

income other than salaries or wages sub- the worksheet is payable as follows: 25% on turn explaining why an additional charge should

ject to withholding. If you are entitled to a re- or before April 15, 2025; 25% on or before not be made.

fund because the amount paid or credited as June 15, 2025; 25% on or before September Note: Estates are not required to file a decla-

estimated tax for the taxable period exceeds 15, 2025 and 25% on or before January 15, ration of estimated tax for the first two years

your actual tax liability, you must file an income 2026. after a decedent’s death.

tax return to obtain the refund.

FISCAL YEAR TAXPAYERS PENALTIES

WHO MUST MAKE ESTIMATED PAYMENTS If you report income on a fiscal year basis, The law imposes penalties and interest

Every estate and trust shall make esti- substitute the corresponding fiscal year charges for failing to pay the estimated tax due

mated Rhode Island income tax payments if months for the months specified in the previ- or for making false or fraudulent statements.

their estimated Rhode Island income tax can ous instructions. For example, if your fiscal

be reasonably expected to be $250 or more in year begins on April 1, 2025, your estimated OTHER QUESTIONS

excess of any credits allowable against their payments will be due on July 15, 2025, to- Obviously, the foregoing instructions for com-

tax, whether or not they are required to file a gether with 25% of the estimated tax. In this pleting these forms will not answer all ques-

federal estimated tax for such year. instance, 25% will be due on or before Sep- tions that may arise. If you have any doubt

tember 15, 2025; 25% on or before December regarding completion of your forms, additional

MODIFICATIONS TO FEDERAL TOTAL INCOME 15, 2025 and 25% on or before April 15, 2026 assistance may be obtained by going the Di-

Taxpayers with modifications increasing or de- vision of Taxation, One Capitol Hill, Provi-

dence, RI 02908-5810, by visiting the Division

creasing federal total income may refer to AMENDED ESTIMATED PAYMENTS

of Taxation’s website at www.tax.ri.gov, or by

Form RI-1041, Schedule M for examples of in- If, after having paid one or more installments

calling the Personal Income Tax Section at (401)

come to be entered as modifications. of tax, the taxpayer finds that his or her esti-

574-8829, option #3.

mated tax should be increased or decreased

CHANGES IN INCOME by a change inincome, he or she must file an

Even though on April 15, 2025 you do not ex- amended estimate on or before the next filing

pect your tax to be large enough to require date. If an amendment is made after September

making estimated payments, a change in in- 15th of the taxable year any balance due FREE INTERNET FILING/PAYMENT

come may require you to make estimated pay- DRAFTshould be paid at the time of filing theamend-

ment. (SEE AMENDED ESTIMATED TAX AVAILABLE

ments later.

SCHEDULE)

If you file your 2025 income tax return by Feb- You may file and pay your estimate

ruary 15, 2026 and pay the full balance of tax CREDIT FOR INCOME TAX OVERPAYMENT electronically using the

due, YOU NEED NOT: (a) make an original Your credit for income tax overpayment from RI Division of Taxation’s Portal.

estimated payment otherwise due for the first your 2024 Rhode Island income tax return may

time on January 15, 2026 or (b) pay the last be deducted from the first installment of your

installment of estimated tax otherwise due 2025 estimated tax, and any excess credit from FOR MORE INFORMATION VISIT:

and payable on January 15, 2026. succeeding installments. However, if you desire https://taxportal.ri.gov

to spread the credit, divide it by the number

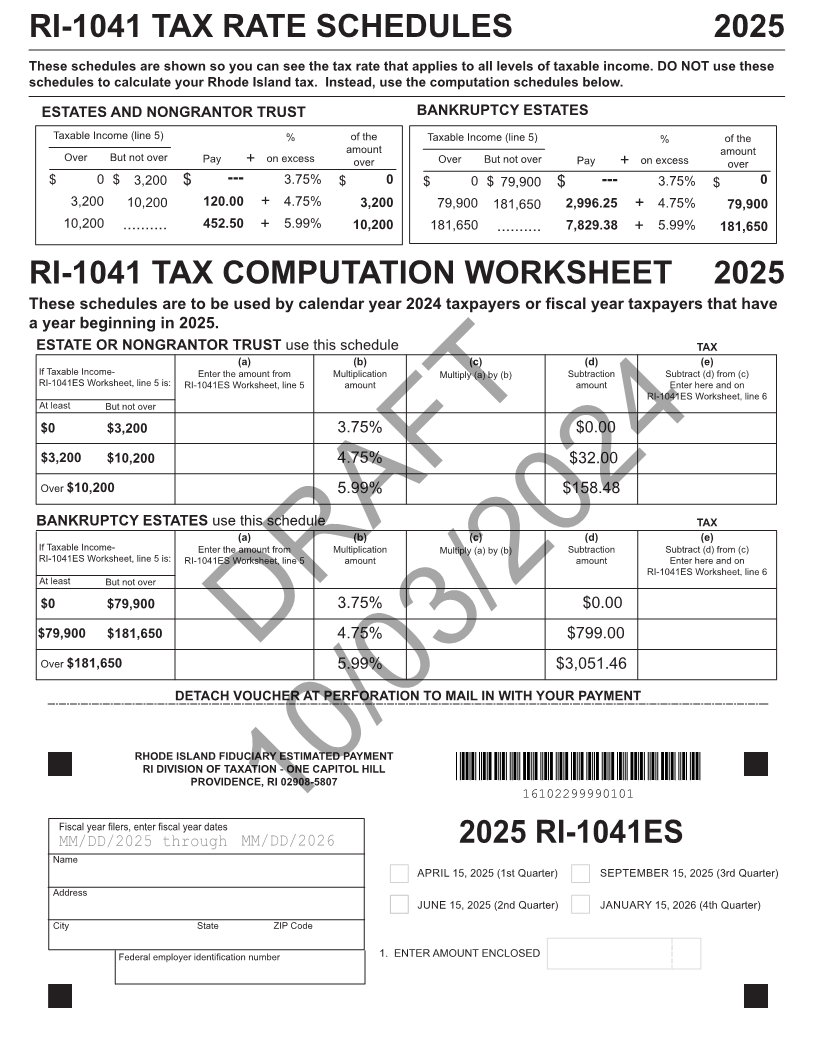

HOW TO ESTIMATE YOUR TAX FOR 2025 of installments and enter on line 14 of

Your 2025 estimated income tax may be based RI-1041ES worksheet. 10/03/2024

upon your 2024 income tax liability. If you wish

to compute your 2025 estimated income tax, CHARGE FOR UNDERPAYMENT OF IN-

use the enclosed estimated tax worksheet. STALLMENTS OF ESTIMATED TAX

An interest charge is imposed for underpay-

WHEN AND WHERE TO MAKE ESTIMATES ment of an installment of estimated tax. The

Make your first estimated payment for the pe- Rhode Island income tax law follows similar

riod January 1, 2025 through December 31, provisions of the Internal Revenue Code with

2025, on or before April 15, 2025. It must be respect to exceptions. Such charge on any un-

filed together with the payment due with the: paid installment shall be computed on the

amount by which the actual payments and

Rhode Island Division of Taxation credits applied to the tax are less than 80% of

One Capitol Hill such installment at the time it is due. If it ap-

Providence, RI 02908 pears there was an underpayment of any in-