Enlarge image

1111111111222222222233333333334444444444555555555566666666667777777777888

34567890123456789012345678901234567890123456789012345678901234567890123456789012

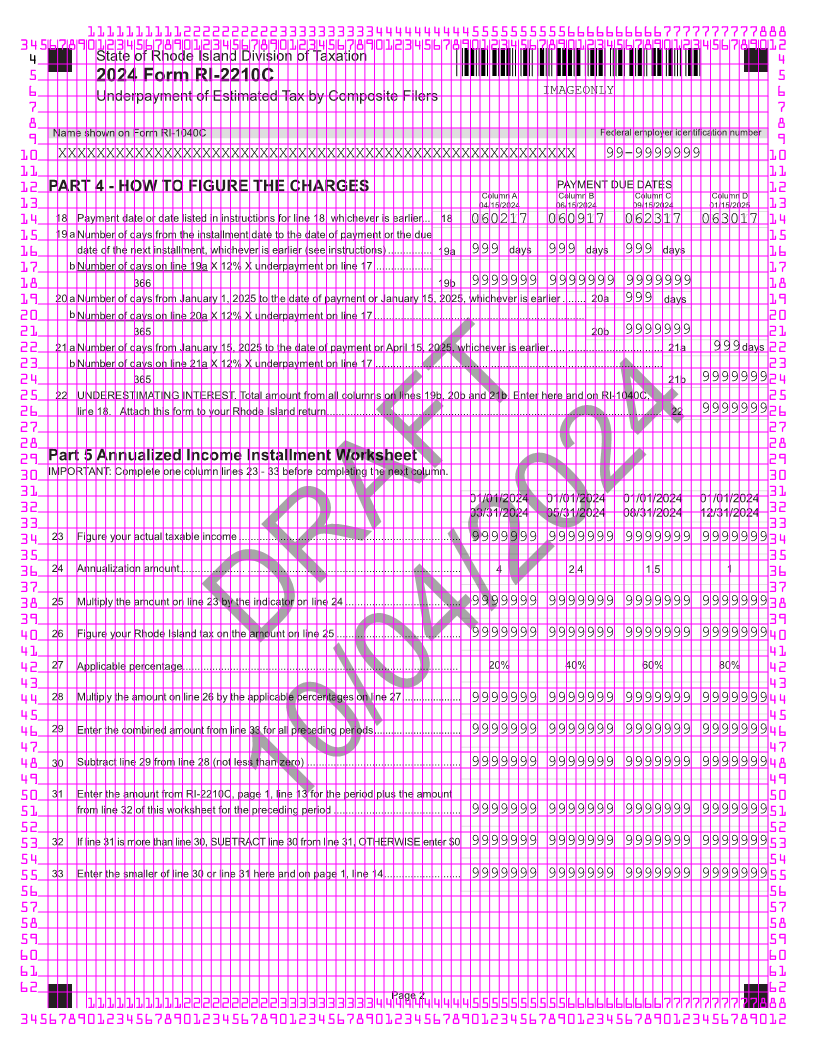

4 State of Rhode Island Division of Taxation 4

5 2024 Form RI-2210C 5

6 Underpayment of Estimated Tax by Composite Filers 24102599990101 6

7 7

8 Name shown on Form RI-1040C Federal employer identification number 8

9 9

10 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 99-9999999 10

11 11

12 CHECK THE BOX IF THE BELOW APPLIES : 12

13 13

14 TAXPAYER IS USING THE ANNUALIZATION OF INCOME METHOD 14

15 15

16 16

17 17

18 PART 1 - REQUIRED ANNUAL PAYMENT 18

19 1 Enter your 2024 RI income tax from RI-1040C, line 11............................................................................................................................... 1 9999999999 99 19

20 2 Enter 80% of the amount shown on line 1................................................................................. 2 9999999999 99 20

21 3 RI withheld taxes paid for 2024 from RI-1040C, lines 13 and 14.......................................................................................................... 3 9999999999 99 21

22 4 Subtract line 3 from line 1. If the result is $250.00 or less, do not complete the rest of this form........................................................ 4 9999999999 99 22

23 5 Enter your 2023 RI income tax from RI-1040C, line 11............................................................................................................................... 5 9999999999 99 23

24 6 EnterSMALLERthe of line 2 or line 5.................................................................................................................................................. 6 9999999999 9924

25 25

26 PART 2 - SHORTCUT METHOD 26

27 You can use this method if you meet the following conditions (Otherwise, you must complete parts 3 and 4 to figure your underestimating interest):27

28 1 You made no estimated payments ORall 4 estimated payments were equal and paid by the appropriate due dates; 28

29 2 ANDyou did not complete RI-2210C, part 5 (Annualized Income Installment Worksheet). 29

30 7 Enter the amount from Part 1, line 6 above................................................................................................................. 7 9999999999 99 30

31 8 Total withholding and estimated tax you paid from RI-1040C, lines 12, 13 and 14............................................................................... 8 9999999999 99 31

32 9 Underpayment. Subtract line 8 from line 7. If zero or less, enter $0.......................................................................... 9 9999999999 99 32

33 10 Multiply line 9 by 6.9762% (0.069762)........................................................................................................................ 10 9999999999 99 33

34 11 If the amount on line 9 was paid on or after 4/15/2025, enter $0 34

35 If the amount on line 9 was paid before 4/15/2025, make the following calculation: 35

36 The amount on line 9 (times) the number of days paid before 4/15/2025 (times) 0.000191 and enter the result here. 11 9999999999 99 36

37 12 UNDERESTIMATING INTEREST. Subtract line 11 from line 10. Enter here and on RI-1040C, line 18 37

38 Attach this form to your Rhode Island return......................................................................................................... 12 9999999999 99 38

39 39

40 PART 3 - FIGURE YOUR UNDERPAYMENT PAYMENT DUE DATES 40

Column A Column B Column C Column D

41 04/15/2024 06/15/2024 09/15/2024 01/15/2025 41

42 DRAFT 42

43 13 Divide the amount on line 6 by four (4) and enter the result in each column..... 13 9999999999999999999999999999999943

44 44

45 14 Annualized income installments from Part 5, line 33. NOTE: Complete lines 45

46 15 through 17 in one column before completing the next column.................. 14 9999999999999999999999999999999946

47 47

48 15 Enter the amount from line 13 or line 14 if applicable .................................... 15 9999999999999999999999999999999948

49 49

50 16 Rhode Island tax withheld and estimated tax paid. If line 16 is equal to or 50

51 more than line 15 for all installment periods, do not complete or file this 16 9999999999999999999999999999999951

52 form unless you report annualized income installments on line 14................ 52

17 UNDERPAYMENT. Subtract line 16 from line 15 OR10/04/2024

53 53

54 OVERPAYMENT. Subtract line 15 from line 16.................................................. 17 9999999999999999999999999999999954

55 55

56 56

57 57

58 58

59 59

60 60

61 61

62 Page 1 62

1111111111222222222233333333334444444444555555555566666666667777777777888

34567890123456789012345678901234567890123456789012345678901234567890123456789012