Enlarge image

1111111111222222222233333333334444444444555555555566666666667777777777888

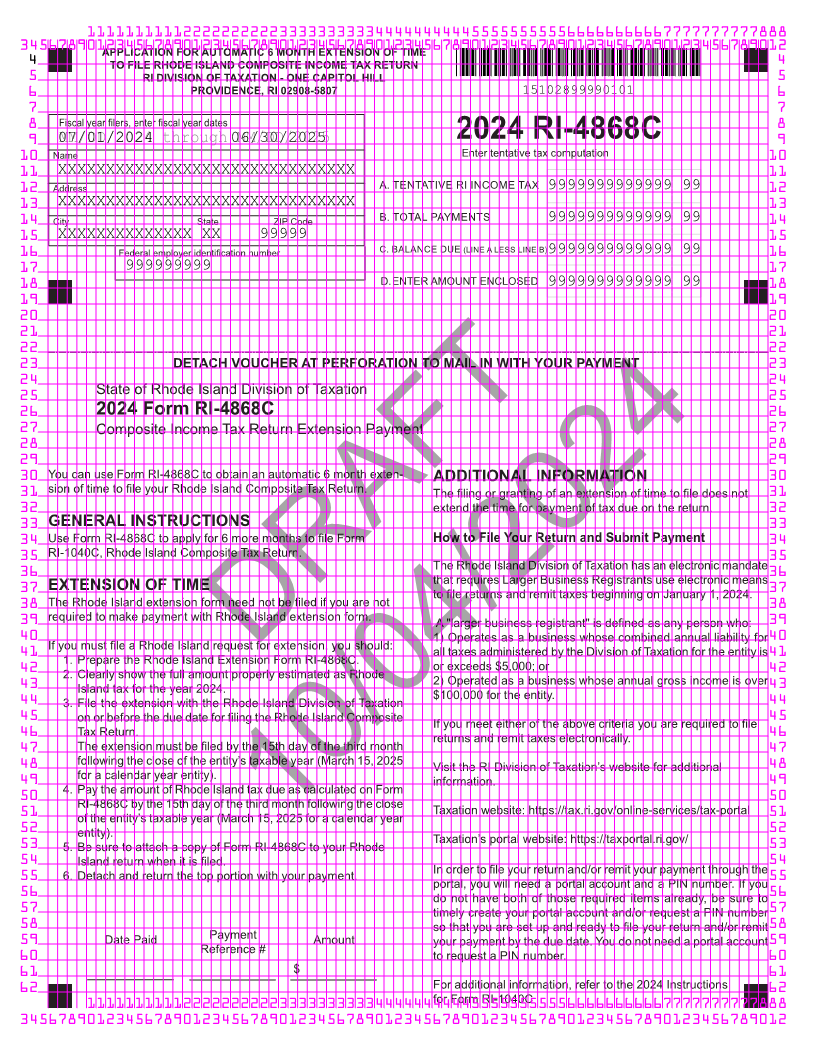

34567890123456789012345678901234567890123456789012345678901234567890123456789012APPLICATION FOR AUTOMATIC 6 MONTH EXTENSION OF TIME

4 TO FILE RHODE ISLAND COMPOSITE INCOME TAX RETURN 4

5 RI DIVISION OF TAXATION - ONE CAPITOL HILL 5

6 PROVIDENCE, RI 02908-5807 15102899990101 6

7 7

8 Fiscal year filers, enter fiscal year dates 8

9 07/01/2024MM/DD/2024 through MM/DD/202506/30/2025 2024 RI-4868C 9

10 Name Enter tentative tax computation 10

11 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 11

12 Address A. TENTATIVE RI INCOME TAX 9999999999999 99 12

13 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 13

14 City State ZIP Code B. TOTAL PAYMENTS 9999999999999 99 14

15 XXXXXXXXXXXXXX XX 99999 15

16 Federal employer identification number C. BALANCE DUE (LINE A LESS LINE B)9999999999999 99 16

17 999999999 17

18 D.ENTER AMOUNT ENCLOSED 9999999999999 99 18

19 19

20 20

21 21

22 22

23 DETACH VOUCHER AT PERFORATION TO MAIL IN WITH YOUR PAYMENT 23

24 24

25 State of Rhode Island Division of Taxation 25

26 2024 Form RI-4868C 26

27 Composite Income Tax Return Extension Payment 27

28 28

29 29

30 You can use Form RI-4868C to obtain an automatic 6 month exten- ADDITIONAL INFORMATION 30

31 sion of time to file your Rhode Island Composite Tax Return. The filing or granting of an extension of time to file does not 31

extend the time for payment of tax due on the return.

32 32

33 GENERAL INSTRUCTIONS 33

34 Use Form RI-4868C to apply for 6 more months to file Form How to File Your Return and Submit Payment 34

35 RI-1040C, Rhode Island Composite Tax Return. 35

The Rhode Island Division of Taxation has an electronic mandate

36 36

37 EXTENSION OF TIME that requires Larger Business Registrants use electronic means 37

to file returns and remit taxes beginning on January 1, 2024.

38 The Rhode Island extension form need not be filed if you are not 38

39 required to make payment with Rhode Island extension form. A "larger business registrant" is defined as any person who: 39

40 1) Operates as a business whose combined annual liability for 40

If you must file a Rhode Island request for extension, you should: all taxes administered by the Division of Taxation for the entity is

41 41

1. Prepare the Rhode Island Extension Form RI-4868C. or exceeds $5,000; or

42 2. Clearly show the full amount properly estimated as Rhode DRAFT 2) Operated as a business whose annual gross income is over 42

43 Island tax for the year 2024. $100,000 for the entity. 43

44 3. File the extension with the Rhode Island Division of Taxation 44

45 on or before the due date for filing the Rhode Island Composite If you meet either of the above criteria you are required to file 45

46 Tax Return. returns and remit taxes electronically. 46

47 The extension must be filed by the 15th day of the third month 47

48 following the close of the entity’s taxable year (March 15, 2025 Visit the RI Division of Taxation’s website for additional 48

49 for a calendar year entity). information. 49

4. Pay the amount of Rhode Island tax due as calculated on Form

50 50

RI-4868C by the 15th day of the third month following the close Taxation website: https://tax.ri.gov/online-services/tax-portal

51 of the entity’s taxable year (March 15, 2025 for a calendar year 51

52 52

entity). 10/04/2024Taxation’s portal website: https://taxportal.ri.gov/

53 5. Be sure to attach a copy of Form RI-4868C to your Rhode 53

54 Island return when it is filed. 54

55 6. Detach and return the top portion with your payment. In order to file your return and/or remit your payment through the 55

portal, you will need a portal account and a PIN number. If you

56 do not have both of those required items already, be sure to 56

57 timely create your portal account and/or request a PIN number 57

58 so that you are set up and ready to file your return and/or remit 58

59 Date Paid Payment Amount your payment by the due date. You do not need a portal account 59

Reference #

60 to request a PIN number. 60

61 $ 61

62 For additional information, refer to the 2024 Instructions 62

1111111111222222222233333333334444444444555555555566666666667777777777888for Form RI-1040C

34567890123456789012345678901234567890123456789012345678901234567890123456789012