Enlarge image

1111111111222222222233333333334444444444555555555566666666667777777777888

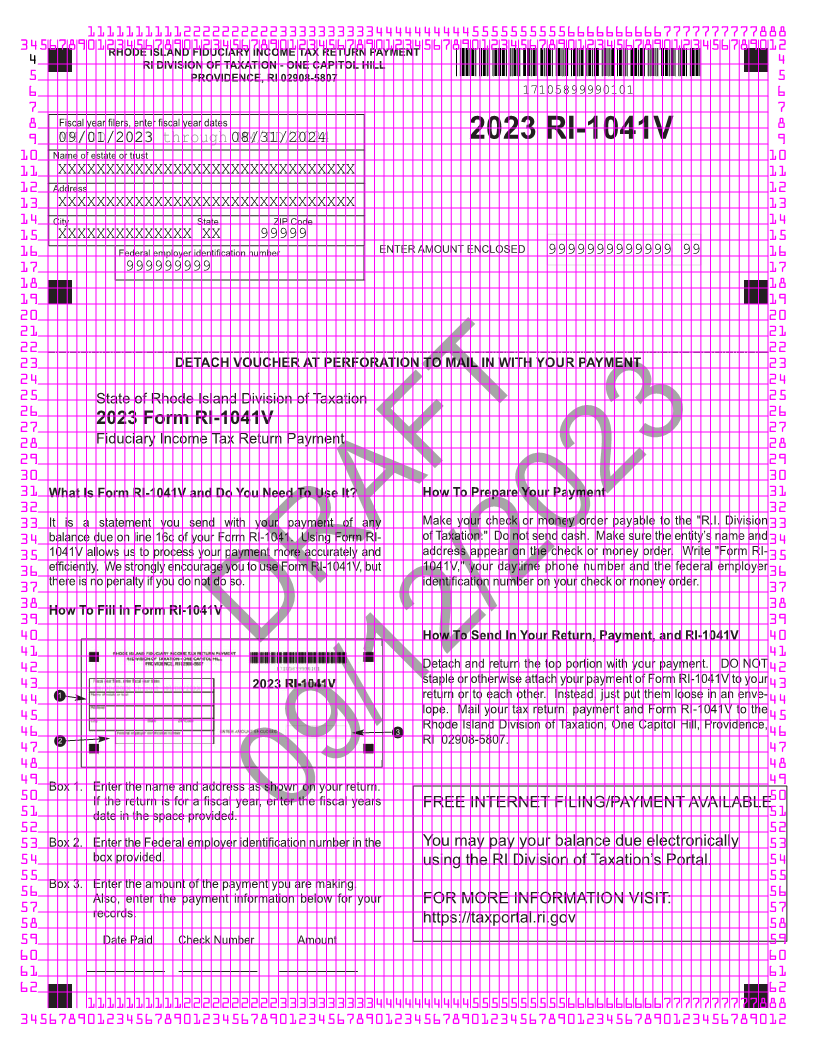

34567890123456789012345678901234567890123456789012345678901234567890123456789012RHODE ISLAND FIDUCIARY INCOME TAX RETURN PAYMENT

4 RI DIVISION OF TAXATION - ONE CAPITOL HILL 4

5 PROVIDENCE, RI 02908-5807 5

6 17105899990101 6

7 7

8 Fiscal year filers, enter fiscal year dates 8

9 09/01/2023MM/DD/2023 through MM/DD/202408/31/2024 2023 RI-1041V 9

10 Name of estate or trust 10

11 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 11

12 Address 12

13 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 13

14 City State ZIP Code 14

15 XXXXXXXXXXXXXX XX 99999 15

16 Federal employer identification number ENTER AMOUNT ENCLOSED 9999999999999 99 16

17 999999999 17

18 18

19 19

20 20

21 21

22 22

23 DETACH VOUCHER AT PERFORATION TO MAIL IN WITH YOUR PAYMENT 23

24 24

25 State of Rhode Island Division of Taxation 25

26 2023 Form RI-1041V 26

27 27

28 Fiduciary Income Tax Return Payment 28

29 29

30 30

31 What Is Form RI-1041V and Do You Need To Use It? How To Prepare Your Payment 31

32 32

33 It is a statement you send with your payment of any Make your check or money order payable to the "R.I. Division 33

34 balance due on line 16c of your Form RI-1041. Using Form RI- of Taxation." Do not send cash. Make sure the entity’s name and 34

35 1041V allows us to process your payment more accurately and address appear on the check or money order. Write "Form RI- 35

36 efficiently. We strongly encourage you to use Form RI-1041V, but 1041V," your daytime phone number and the federal employer 36

there is no penalty if you do not do so. identification number on your check or money order.

37 37

38 How To Fill In Form RI-1041V 38

39 39

How To Send In Your Return, Payment, and RI-1041V

40 40

41 41

42 DRAFT Detach and return the top portion with your payment. DO NOT 42

43 2023 staple or otherwise attach your payment of Form RI-1041V to your 43

1 return or to each other. Instead, just put them loose in an enve-

44 44

lope. Mail your tax return, payment and Form RI-1041V to the

45 45

46 3 Rhode Island Division of Taxation, One Capitol Hill, Providence, 46

2 RI 02908-5807.

47 47

48 48

49 Box 1. Enter the name and address as shown on your return. 49

50 50

If the return is for a fiscal year, enter the fiscal years FREE INTERNET FILING/PAYMENT AVAILABLE

51 date in the space provided. 51

52 52

Box 2. Enter the Federal employer identification number in the 09/12/2023You may pay your balance due electronically

53 53

54 box provided. using the RI Division of Taxation’s Portal. 54

55 Box 3. Enter the amount of the payment you are making. 55

56 56

Also, enter the payment information below for your FOR MORE INFORMATION VISIT:

57 57

58 records. https://taxportal.ri.gov 58

59 Date Paid Check Number Amount 59

60 60

61 61

62 62

1111111111222222222233333333334444444444555555555566666666667777777777888

34567890123456789012345678901234567890123456789012345678901234567890123456789012