Enlarge image

RI -1120S – Test 1

Scenario: Taxpayer named Great Atomic Pyrotechnics & Designs, Inc. at 36 Anytown Street,

Providence, RI 02908 consists of seven (7) members as listed below. Return has an

overpayment of $1,298.00 which is to be refunded.

Shareholder Name FEIN/SSN Address SH %

1 Mark Smith 100-00-6000 100 Short Street, Chicopee, MA 01020 12.50 %

2 Ann Big 500-00-1000 41 Tree Drive, Johnston, RI 02919 10.00 %

3 Billie Stevens 031-79-1111 100 Short Street, Chicopee, MA 01020 25.00%

4 Real Estate Trust 88-5678901 100 Short Street, Chicopee, MA 01020 25.00 %

5 Jacoby Maye 011-99-9999 1 Patriot Place, Foxborough, MA 02035 10.00 %

6 Dela Cruz 100-44-2002 100 Joe Nuxhall Way, Cincinnati, OH 45202 15.00 %

7 Big Grantor Trust 500-00-1000 41 Tree Drive, Johnston, RI 02919 2.50 %

Additional information:

FEIN 11-0007501

Federal Taxable Income: $56,825.00

Estimates: $ 5,000.00

Extension payments: $ 400.00

Apportionment ratios: 1.000000

Final Determination on Schedule F: No

This test will use the following sections, schedules(s) and form(s).

RI-1120S

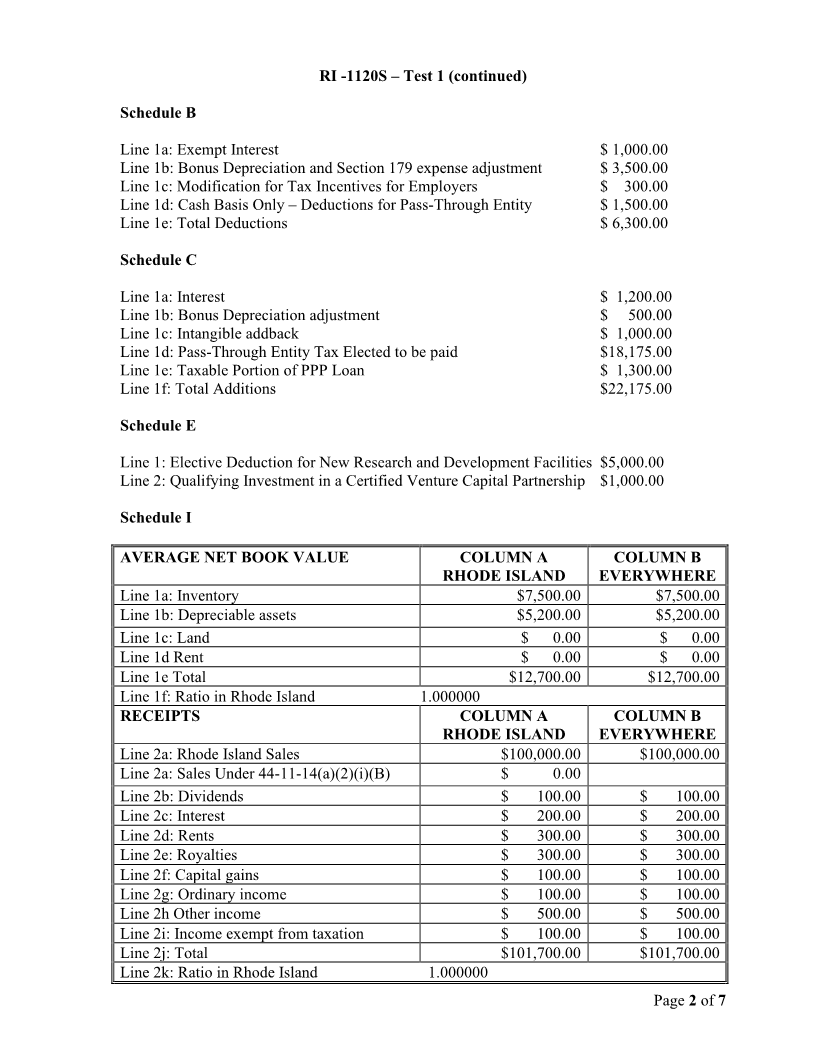

Schedule A

Schedule B

Schedule C

Schedule E

Schedule F

Schedule I

Schedule K-1

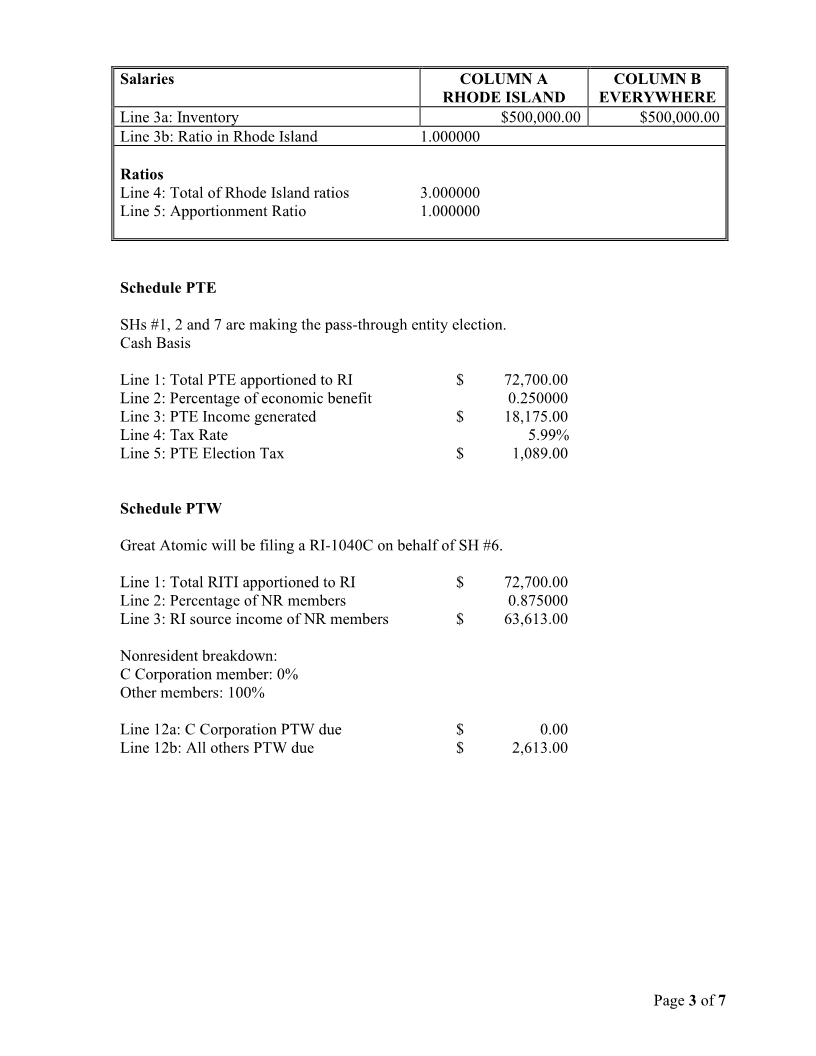

Schedule PTE

Schedule PTW

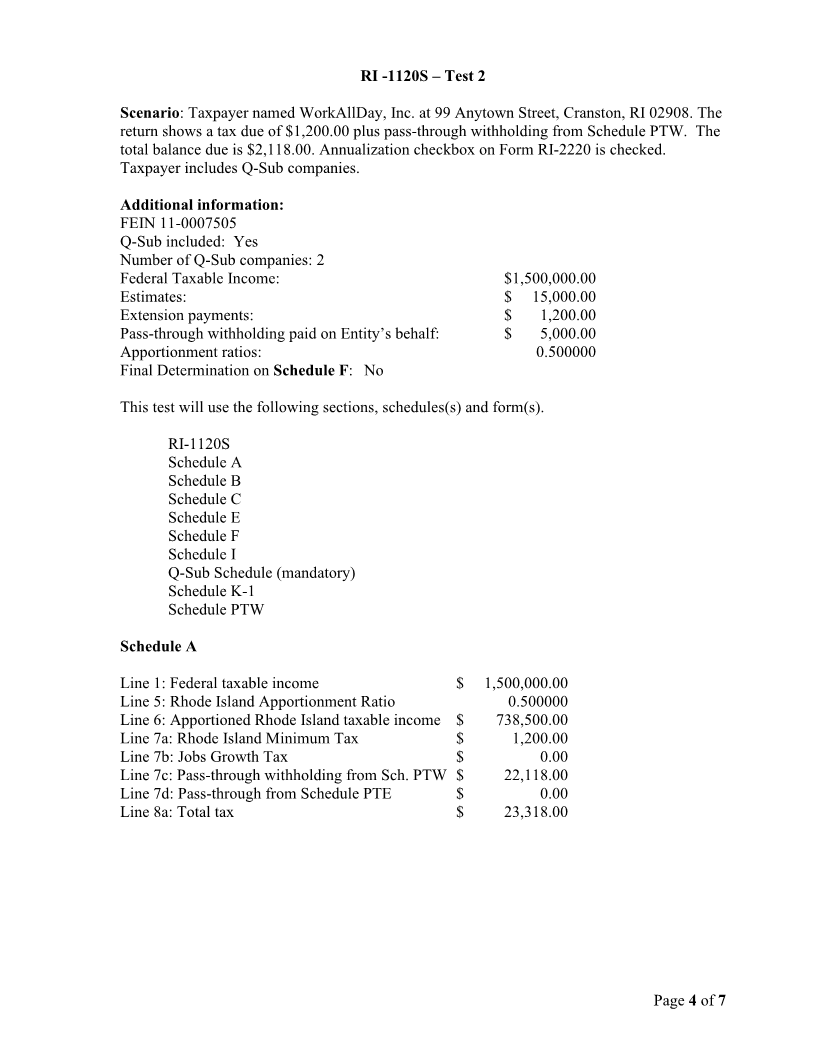

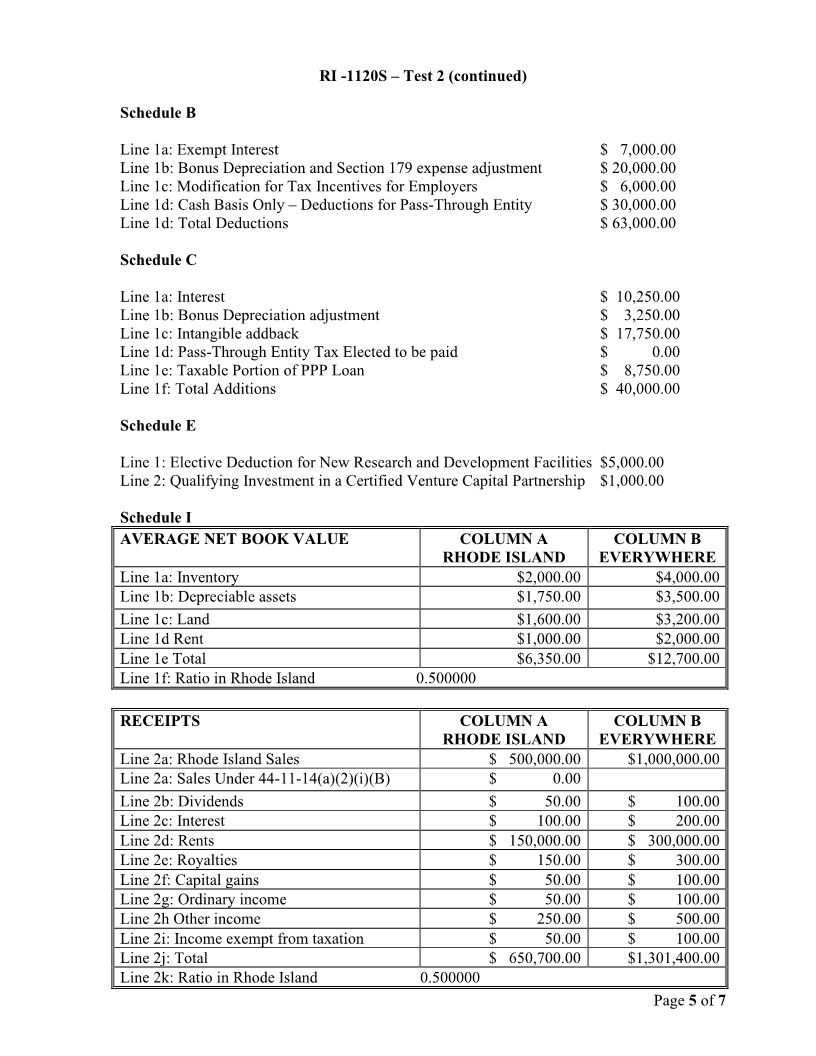

Schedule A

Line 1: Federal taxable income $ 56,825.00

Line 5: Rhode Island Apportionment Ratio 1.000000

Line 6: Apportioned Rhode Island taxable income $ 72,700.00

Line 7a: Rhode Island Minimum Tax $ 400.00

Line 7b: Jobs Growth Tax $ 0.00

Line 7c: Pass-through withholding from Sch. PTW $ 2,613.00

Line 7d: Pass-through from Schedule PTE $ 1,089.00

Line 8a: Total tax $ 4,102.00

Page 1of 7