Enlarge image

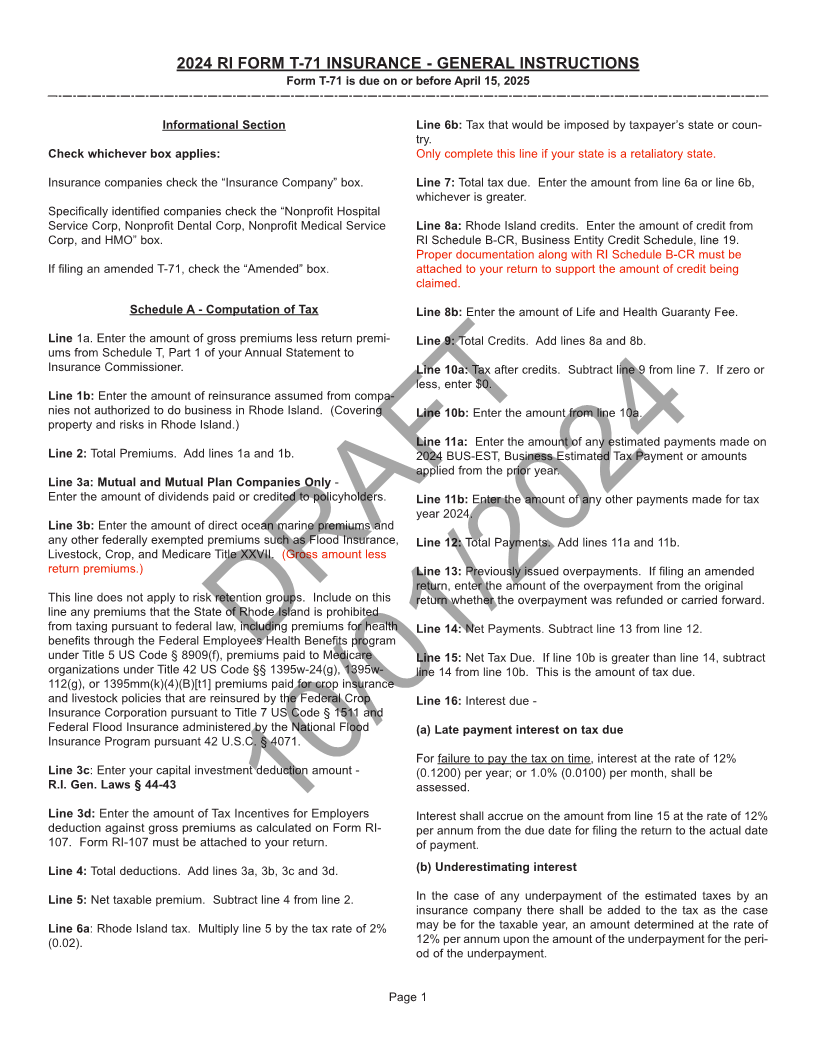

2024 RI FORM T-71 INSURANCE - GENERAL INSTRUCTIONS

Form T-71 is due on or before April 15, 2025

Informational Section Line 6b: Tax that would be imposed by taxpayer’s state or coun-

try.

Check whichever box applies: Only complete this line if your state is a retaliatory state.

Insurance companies check the “Insurance Company” box. Line T7: otal tax due. Enter the amount from line 6a or line 6b,

whichever is greater.

Specifically identified companies check the “Nonprofit Hospital

Service Corp, Nonprofit Dental Corp, Nonprofit Medical Service Line 8a: Rhode Island credits. Enter the amount of credit from

Corp, and HMO” box. RI Schedule B-CR, Business Entity Credit Schedule, line 19.

Proper documentation along with RI Schedule B-CR must be

If filing an amended T-71, check the “Amended” box. attached to your return to support the amount of credit being

claimed.

Schedule A - Computation of Tax Line 8b: Enter the amount of Life and Health Guaranty Fee.

Line 1a. Enter the amount of gross premiums less return premi- Line 9: Total Credits. Add lines 8a and 8b.

ums from Schedule T, Part 1 of your Annual Statement to

Insurance Commissioner. Line 10a: Tax after credits. Subtract line 9 from line 7. If zero or

less, enter $0.

Line 1b: Enter the amount of reinsurance assumed from compa-

nies not authorized to do business in Rhode Island. (Covering Line 10b: Enter the amount from line 10a.

property and risks in Rhode Island.)

Line 11a: Enter the amount of any estimated payments made on

Line 2: Total Premiums. Add lines 1a and 1b. 2024 BUS-EST, Business Estimated Tax Payment or amounts

applied from the prior year.

Line 3a: Mutual and Mutual Plan Companies Only -

Enter the amount of dividends paid or credited to policyholders. Line 11b: Enter the amount of any other payments made for tax

year 2024.

Line 3b: Enter the amount of direct ocean marine premiums and

any other federally exempted premiums such as Flood Insurance, Line 12: Total Payments. Add lines 11a and 11b.

Livestock, Crop, and Medicare Title XXVII. (Gross amount less

return premiums.) Line 13: Previously issued overpayments. If filing an amended

return, enter the amount of the overpayment from the original

This line does not apply to risk retention groups. Include on this return whether the overpayment was refunded or carried forward.

line any premiums that the State of Rhode Island is prohibited

from taxing pursuant to federal law, including premiums for health Line 14:Net Payments. Subtract line 13 from line 12.

benefits through the Federal Employees Health Benefits program

under Title 5 US Code § 8909(f), premiums paid to Medicare Line 15: Net T ax Due. If line 10b is greater than line 14, subtract

organizations under Title 42 US Code §§ 1395w-24(g),DRAFT1395w- line 14 from line 10b. This is the amount of tax due.

112(g), or 1395mm(k)(4)(B)[t1] premiums paid for crop insurance

and livestock policies that are reinsured by the Federal Crop Line 16: Interest due -

Insurance Corporation pursuant to Title 7 US Code § 1511 and

Federal Flood Insurance administered by the National Flood (a) Late payment interest on tax due

Insurance Program pursuant 42 U.S.C. § 4071.

For failure to pay the tax on time, interest at the rate of 12%

Line 3c: Enter your capital investment deduction amount - (0.1200) per year; or 1.0% (0.0100) per month, shall be

R.I. Gen. Laws § 44-43 assessed.

Line 3d: Enter the amount of Tax Incentives for Employers Interest shall accrue on the amount from line 15 at the rate of 12%

deduction against gross premiums as calculated on Form RI-10/01/2024per annum from the due date for filing the return to the actual date

107. Form RI-107 must be attached to your return. of payment.

Line 4: Total deductions. Add lines 3a, 3b, 3c and 3d. (b) Underestimating interest

Line 5: Net taxable premium. Subtract line 4 from line 2. In the case of any underpayment of the estimated taxes by an

insurance company there shall be added to the tax as the case

Line 6a: Rhode Island tax. Multiply line 5 by the tax rate of 2% may be for the taxable year, an amount determined at the rate of

(0.02). 12% per annum upon the amount of the underpayment for the peri-

od of the underpayment.

Page 1