Enlarge image

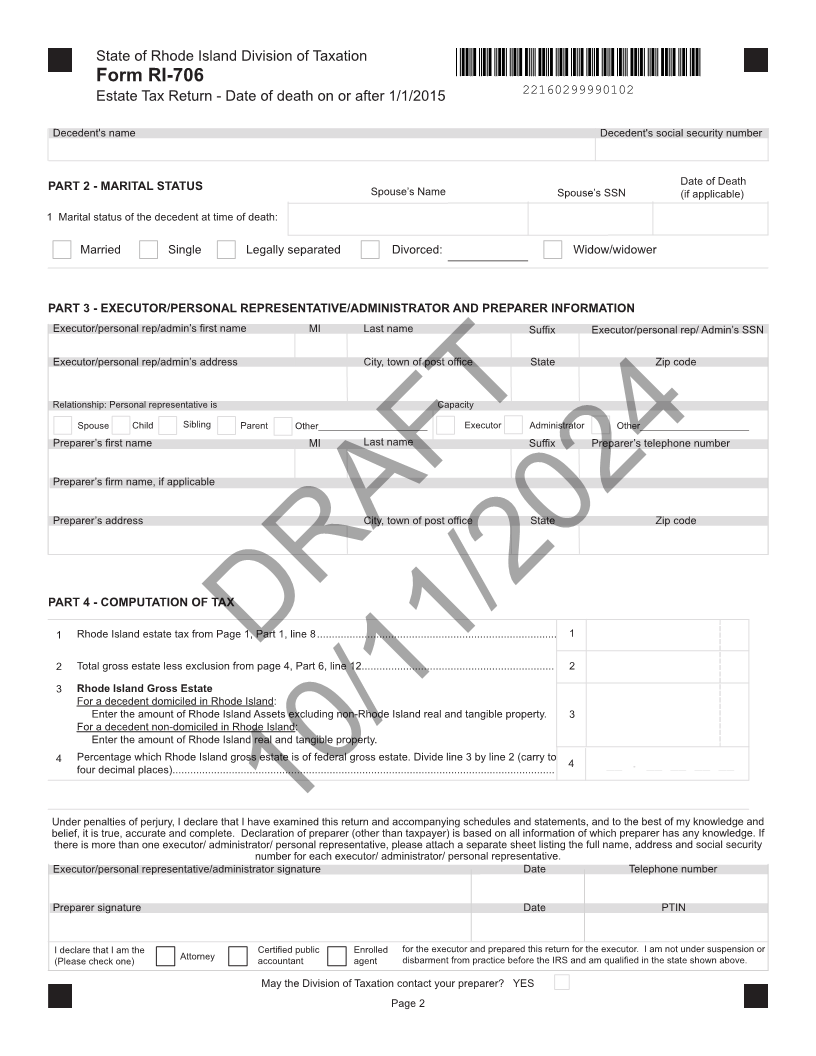

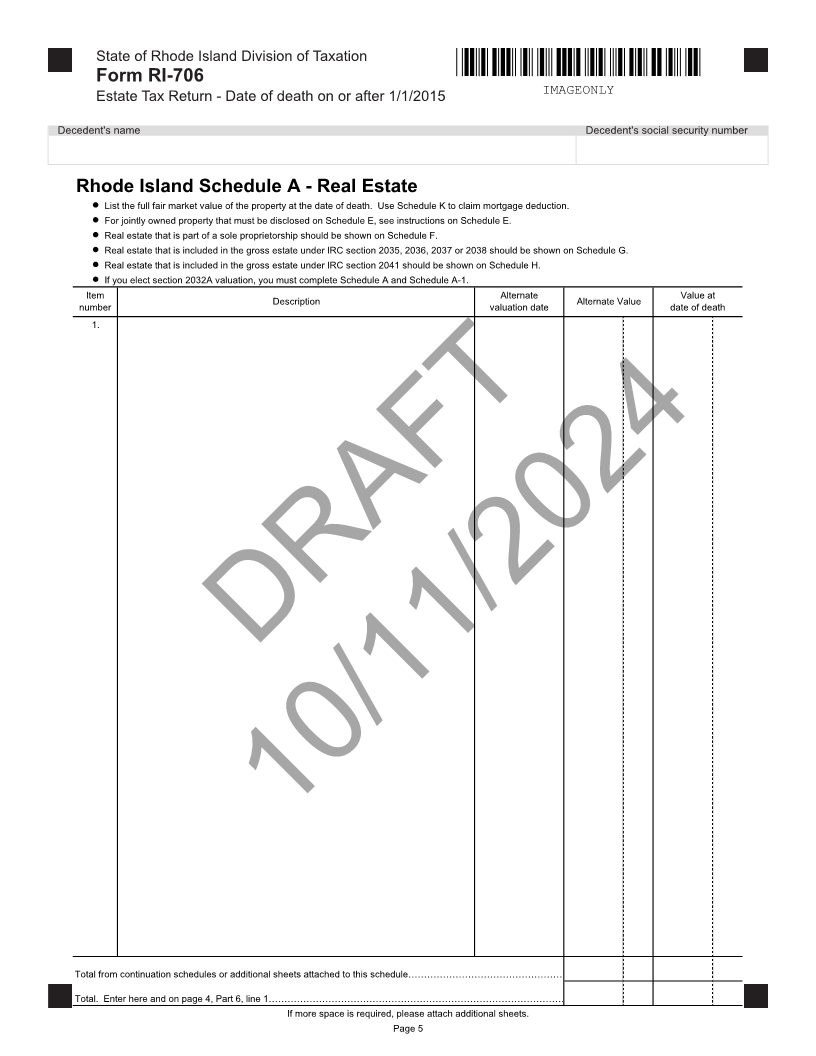

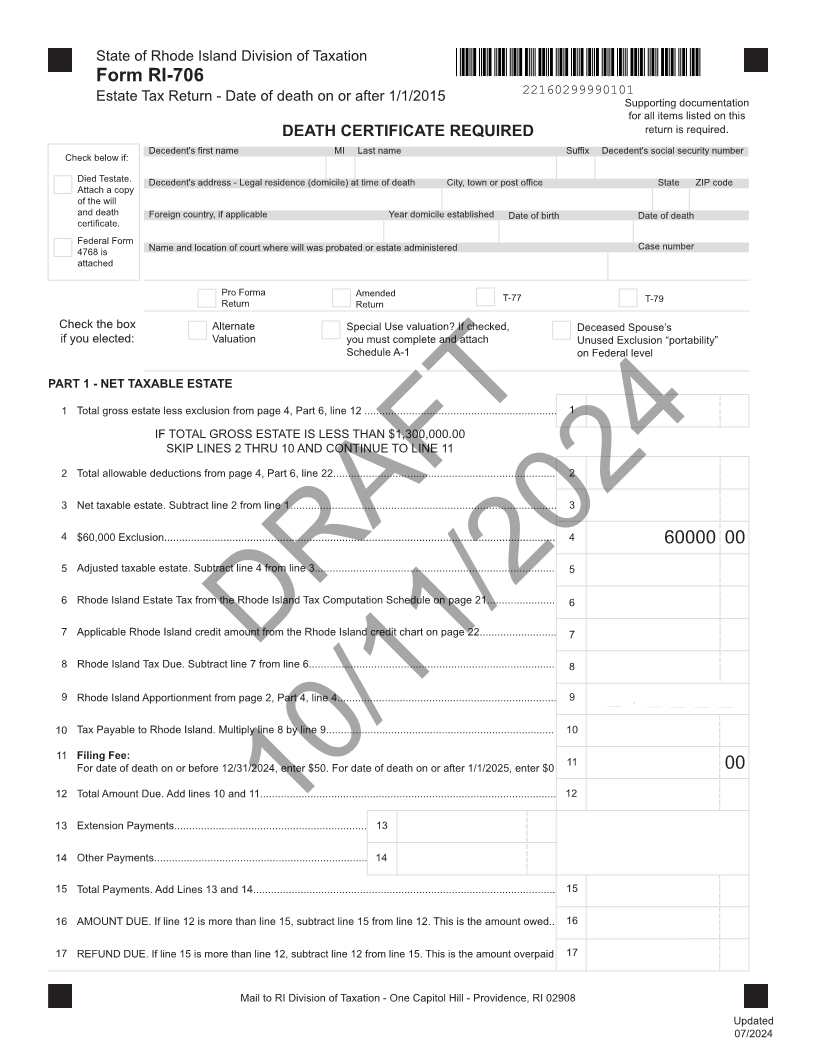

State of Rhode Island Division of Taxation

Form RI-706

22160299990101

Estate Tax Return - Date of death on or after 1/1/2015 Supporting documentation

for all items listed on this

DEATH CERTIFICATE REQUIRED return is required.

Decedent's first name MI Last name Suffix Decedent's social security number

Check below if:

Died Testate. Decedent's address - Legal residence (domicile) at time of death City, town or post office State ZIP code

Attach a copy

of the will

and death Foreign country, if applicable Year domicile established Date of birth Date of death

certificate.

Federal Form Case number

4768 is Name and location of court where will was probated or estate administered

attached

Pro Forma Amended T-77 T-79

Return Return

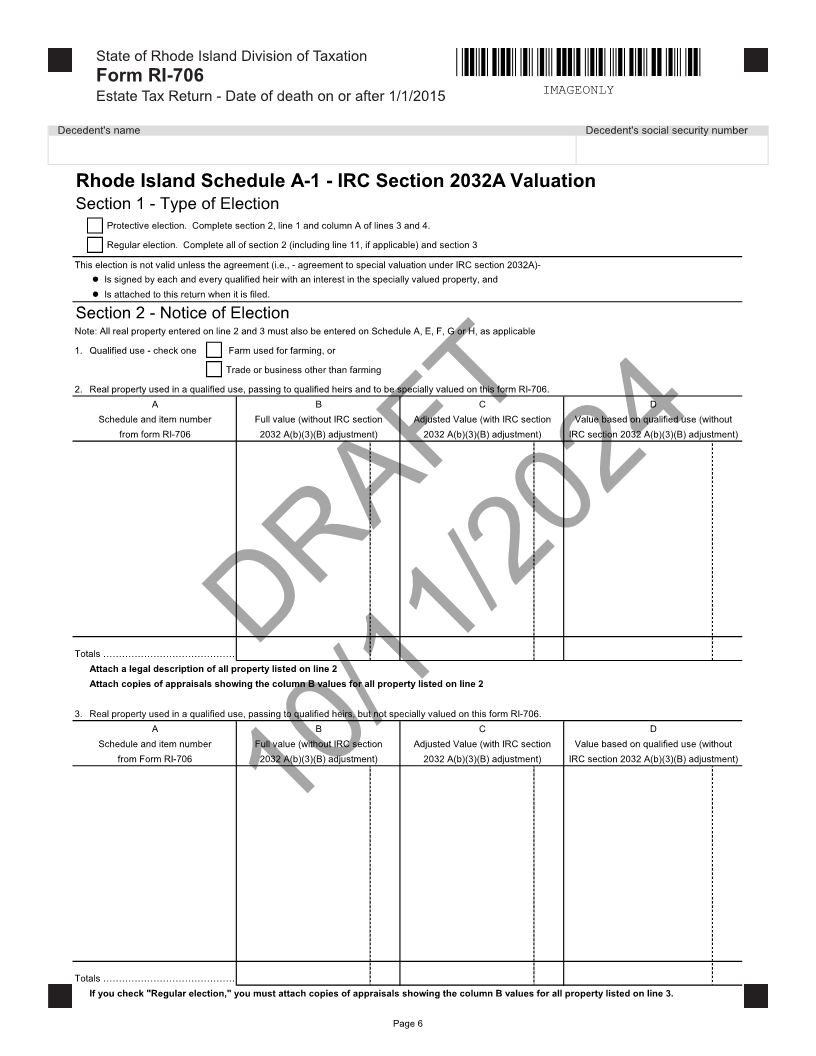

Check the box Alternate Special Use valuation? If checked, Deceased Spouse’s

if you elected: Valuation you must complete and attach Unused Exclusion “portability”

Schedule A-1 on Federal level

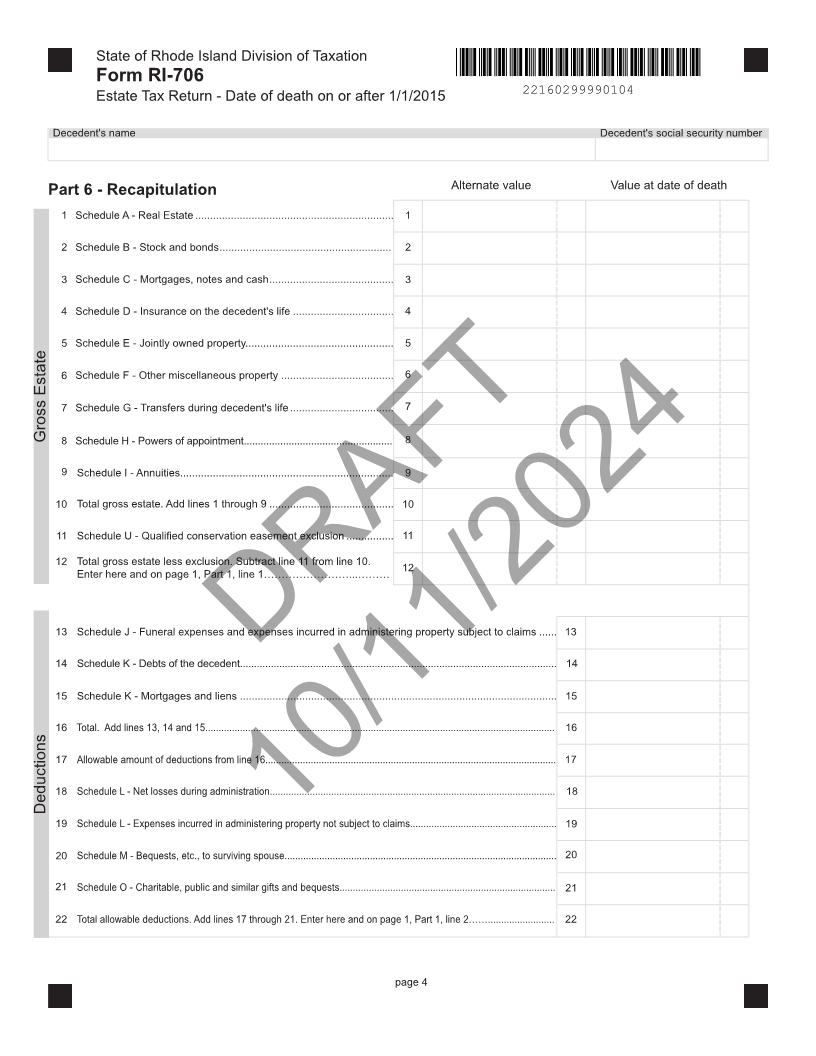

PART 1 - NET TAXABLE ESTATE

1 Total gross estate less exclusion from page 4, Part 6, line 12 ................................................................. 1

IF TOTAL GROSS ESTATE IS LESS THAN $1,300,000.00

SKIP LINES 2 THRU 10 AND CONTINUE TO LINE 11

2 Total allowable deductions from page 4, Part 6, line 22........................................................................... 2

3 Net taxable estate. Subtract line 2 from line 1.......................................................................................... 3

4 $60,000 Exclusion.................................................................................................................................... 4 60000 00

5 Adjusted taxable estate. Subtract line 4 from line 3................................................................................. 5

6 Rhode Island Estate Tax from the Rhode Island Tax Computation Schedule on page 21....................... 6

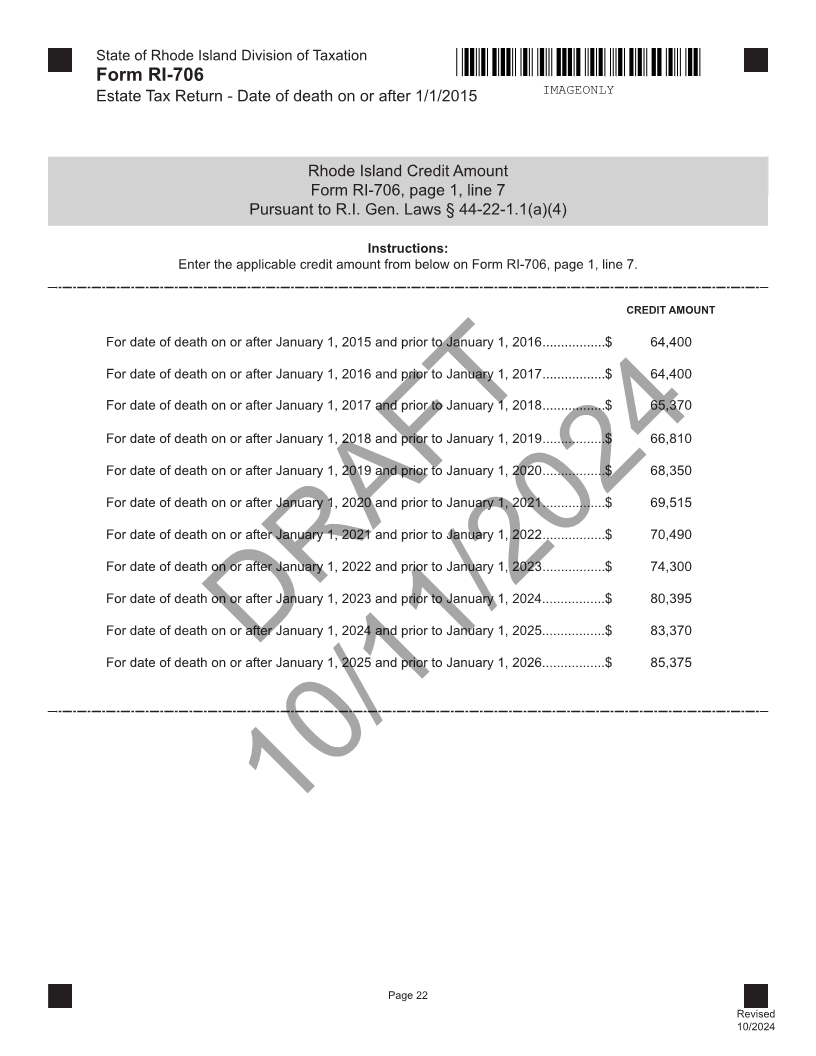

7 Applicable Rhode Island credit amount from the Rhode Island credit chart on page 22.......................... 7

8 Rhode Island Tax Due. Subtract line 7 fromDRAFTline 6................................................................................... 8

9 Rhode Island Apportionment from page 2, Part 4, line 4.......................................................................... 9

__ . __ __ __ __

10 Tax Payable to Rhode Island. Multiply line 8 by line 9............................................................................. 10

11 Filing Fee: 11

For date of death on or before 12/31/2024, enter $50. For date of death on or after 1/1/2025, enter $0 00

12 Total Amount Due. Add lines 10 and 11.................................................................................................... 12

13 Extension Payments................................................................. 13

10/11/2024

14 Other Payments........................................................................ 14

15 Total Payments. Add Lines 13 and 14...................................................................................................... 15

16 AMOUNT DUE. If line 12 is more than line 15, subtract line 15 from line 12. This is the amount owed.. 16

17 REFUND DUE. If line 15 is more than line 12, subtract line 12 from line 15. This is the amount overpaid 17

Mail to RI Division of Taxation - One Capitol Hill - Providence, RI 02908

Updated

07/2024