Enlarge image

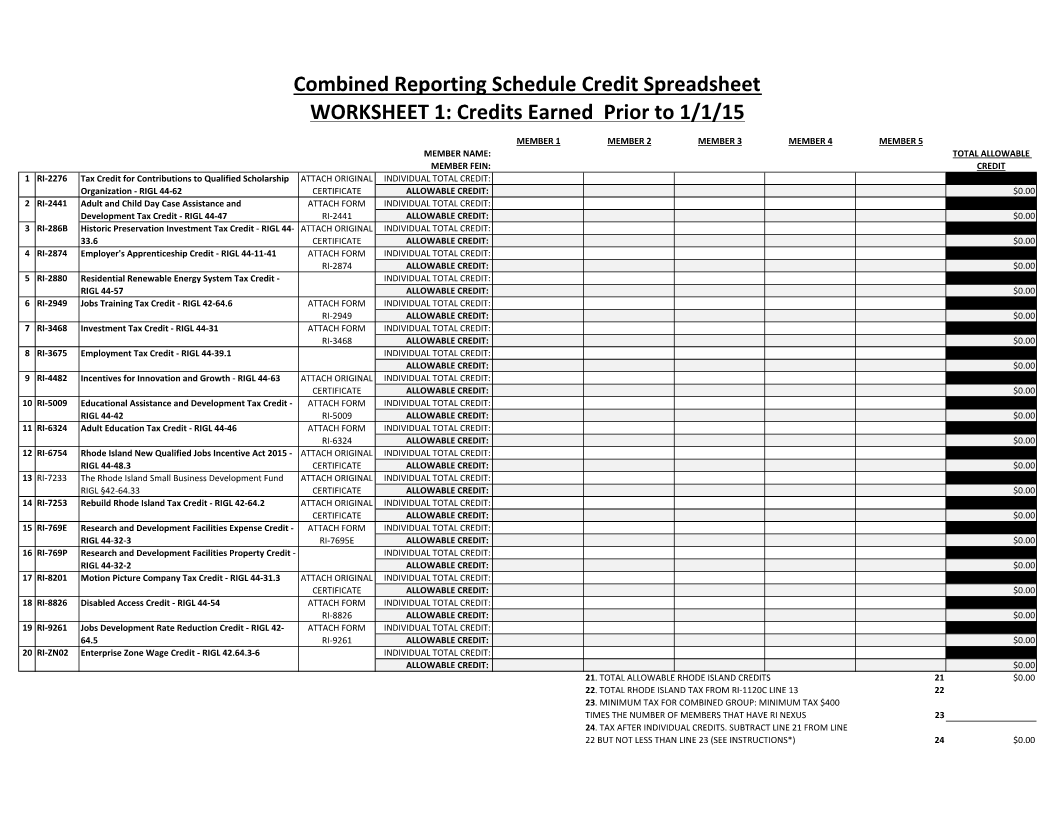

$0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00

CREDIT

TOTAL ALLOWABLE

21 22 23 24

MEMBER 5

MEMBER 4

‐1120C LINE 13

MEMBER 3

1/1/15

Spreadsheet to

Prior MEMBER 2

. TOTAL ALLOWABLE RHODE ISLAND CREDITS . TOTAL RHODE ISLAND TAX FROM RI . MINIMUM TAX FOR COMBINED GROUP: MINIMUM TAX $400 . TAX AFTER INDIVIDUAL CREDITS. SUBTRACT LINE 21 FROM LINE

Credit 21 22 23 TIMES THE NUMBER OF MEMBERS THAT HAVE RI NEXUS 24 22 BUT NOT LESS THAN LINE 23 (SEE INSTRUCTIONS*)

Earned

MEMBER 1

Schedule

Credits

1: MEMBER NAME:

MEMBER FEIN:

ALLOWABLE CREDIT: ALLOWABLE CREDIT: ALLOWABLE CREDIT: ALLOWABLE CREDIT: ALLOWABLE CREDIT: ALLOWABLE CREDIT: ALLOWABLE CREDIT: ALLOWABLE CREDIT: ALLOWABLE CREDIT: ALLOWABLE CREDIT: ALLOWABLE CREDIT: ALLOWABLE CREDIT: ALLOWABLE CREDIT: ALLOWABLE CREDIT: ALLOWABLE CREDIT: ALLOWABLE CREDIT: ALLOWABLE CREDIT: ALLOWABLE CREDIT: ALLOWABLE CREDIT: ALLOWABLE CREDIT:

Reporting INDIVIDUAL TOTAL CREDIT: INDIVIDUAL TOTAL CREDIT: INDIVIDUAL TOTAL CREDIT: INDIVIDUAL TOTAL CREDIT: INDIVIDUAL TOTAL CREDIT: INDIVIDUAL TOTAL CREDIT: INDIVIDUAL TOTAL CREDIT: INDIVIDUAL TOTAL CREDIT: INDIVIDUAL TOTAL CREDIT: INDIVIDUAL TOTAL CREDIT: INDIVIDUAL TOTAL CREDIT: INDIVIDUAL TOTAL CREDIT: INDIVIDUAL TOTAL CREDIT: INDIVIDUAL TOTAL CREDIT: INDIVIDUAL TOTAL CREDIT: INDIVIDUAL TOTAL CREDIT: INDIVIDUAL TOTAL CREDIT: INDIVIDUAL TOTAL CREDIT: INDIVIDUAL TOTAL CREDIT: INDIVIDUAL TOTAL CREDIT:

‐2441 ‐2874 ‐2949 ‐3468 ‐5009 ‐6324 ‐7695E ‐8826 ‐9261

RI RI RI RI RI RI RI RI RI

WORKSHEET CERTIFICATE ATTACH FORM CERTIFICATE ATTACH FORM ATTACH FORM ATTACH FORM CERTIFICATE ATTACH FORM ATTACH FORM CERTIFICATE CERTIFICATE CERTIFICATE ATTACH FORM CERTIFICATE ATTACH FORM ATTACH FORM

ATTACH ORIGINAL ATTACH ORIGINAL ATTACH ORIGINAL ATTACH ORIGINAL ATTACH ORIGINAL ATTACH ORIGINAL ATTACH ORIGINAL

Combined ‐ ‐ ‐ ‐ ‐

‐ ‐

41 ‐63

‐

‐ RIGL 42 ‐6

RIGL 44 ‐11 31.3‐

RIGL 44 64.2‐ ‐

‐ RIGL 44

‐ RIGL 44 RIGL 42

47 ‐ ‐64.6 31 39.1‐ ‐46 ‐

‐ RIGL 42.64.3

‐ 54‐

RIGL 44 ‐

‐

RIGL 44 RIGL 42 RIGL 44 RIGL 44 RIGL 44

62‐ ‐ ‐ ‐ ‐ ‐

RIGL 44

‐

42‐ 48.3‐ 32‐ 32‐

64.33 ‐3 ‐2

‐57 ‐

Tax Credit for Contributions to Qualified Scholarship Organization Adult and Child Day Case Assistance and Development Tax Credit Historic Preservation Investment Tax Credit 33.6 Employer's Apprenticeship Credit Residential Renewable Energy System Tax Credit RIGL 44 Jobs Training Tax Credit Investment Tax Credit Employment Tax Credit Incentives for Innovation and Growth Educational Assistance and Development Tax Credit RIGL 44 Adult Education Tax Credit Rhode Island New Qualified Jobs Incentive Act 2015 RIGL 44 The Rhode Island Small Business Development Fund RIGL §42 Rebuild Rhode Island Tax Credit Research and Development Facilities Expense Credit RIGL 44 Research and Development Facilities Property Credit RIGL 44 Motion Picture Company Tax Credit Disabled Access Credit Jobs Development Rate Reduction Credit 64.5 Enterprise Zone Wage Credit

‐2276 ‐2441 ‐286B ‐2874 ‐2880 ‐2949 ‐3468 ‐3675 ‐4482 ‐5009 ‐6324 ‐6754 ‐7233 ‐7253 ‐769E ‐769P ‐8201 ‐8826 ‐9261 ‐ZN02

RI RI RI RI RI RI RI RI RI RI RI

1RI 2RI 3RI 4RI 5RI 6RI 7RI 8RI 9RI 10 11 12 13 14 15 16 17 18 19 20