Enlarge image

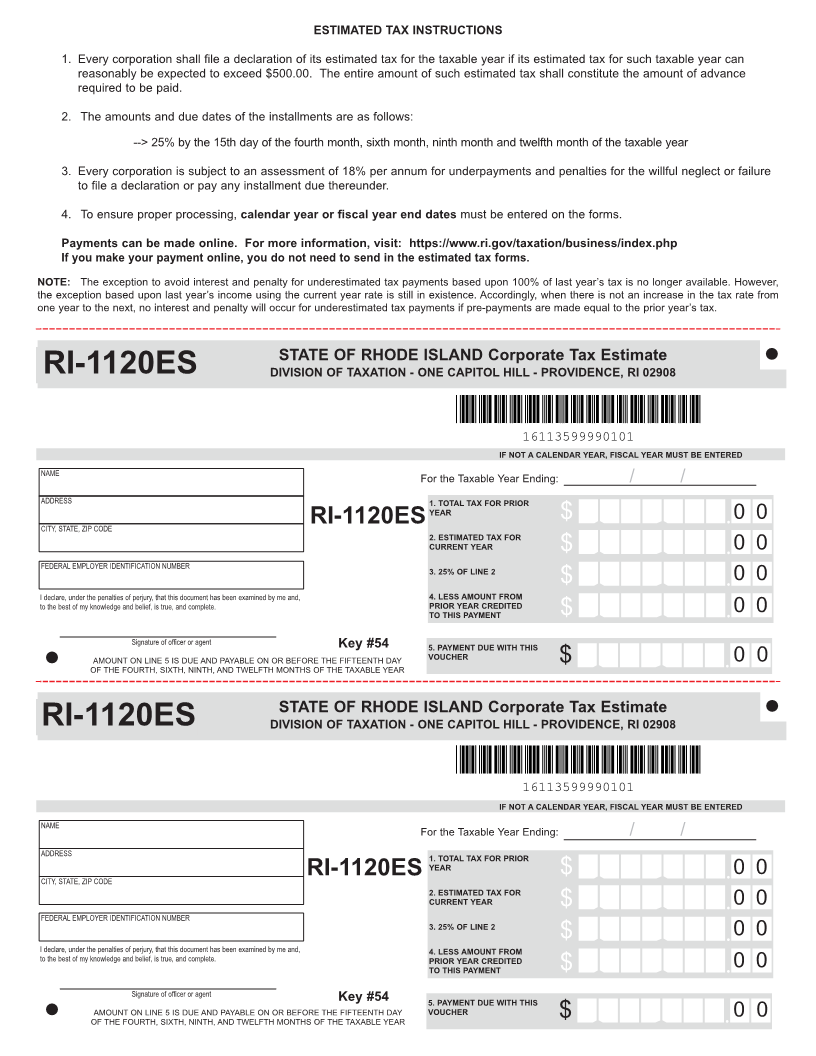

ESTIMATED TAX INSTRUCTIONS

1. Every corporation shall file a declaration of its estimated tax for the taxable year if its estimated tax for such taxable year can

reasonably be expected to exceed $500.00. The entire amount of such estimated tax shall constitute the amount of advance

required to be paid.

2. The amounts and due dates of the installments are as follows:

--> 25% by the 15th day of the fourth month, sixth month, ninth month and twelfth month of the taxable year

3. Every corporation is subject to an assessment of 18% per annum for underpayments and penalties for the willful neglect or failure

to file a declaration or pay any installment due thereunder.

4. To ensure proper processing, calendar year or fiscal year end dates must be entered on the forms.

Payments can be made online. For more information, visit: https://www.ri.gov/taxation/business/index.php

If you make your payment online, you do not need to send in the estimated tax forms.

NOTE: The exception to avoid interest and penalty for underestimated tax payments based upon 100% of last year’s tax is no longer available. However,

the exception based upon last year’s income using the current year rate is still in existence. Accordingly, when there is not an increase in the tax rate from

one year to the next, no interest and penalty will occur for underestimated tax payments if pre-payments are made equal to the prior year’s tax.

STATE OF RHODE ISLAND Corporate Tax Estimate

RI-1120ES DIVISION OF TAXATION - ONE CAPITOL HILL - PROVIDENCE, RI 02908

16113599990101

IF NOT A CALENDAR YEAR, FISCAL YEAR MUST BE ENTERED

NAME

For the Taxable Year Ending: / /

ADDRESS 1. TOTAL TAX FOR PRIOR

YEAR

$ 00

CITY, STATE, ZIP CODE RI-1120ES

2. ESTIMATED TAX FOR

CURRENT YEAR $ 00

FEDERAL EMPLOYER IDENTIFICATION NUMBER 3. 25% OF LINE 2

$ 00

I declare, under the penalties of perjury, that this document has been examined by me and, 4. LESS AMOUNT FROM

to the best of my knowledge and belief, is true, and complete. PRIOR YEAR CREDITED 00

TO THIS PAYMENT $

Signature of officer or agent Key #54 5. PAYMENT DUE WITH THIS

AMOUNT ON LINE 5 IS DUE AND PAYABLE ON OR BEFORE THE FIFTEENTH DAY VOUCHER $ 0 0

OF THE FOURTH, SIXTH, NINTH, AND TWELFTH MONTHS OF THE TAXABLE YEAR

STATE OF RHODE ISLAND Corporate Tax Estimate

RI-1120ES DIVISION OF TAXATION - ONE CAPITOL HILL - PROVIDENCE, RI 02908

16113599990101

IF NOT A CALENDAR YEAR, FISCAL YEAR MUST BE ENTERED

NAME

For the Taxable Year Ending: / /

ADDRESS 1. TOTAL TAX FOR PRIOR

YEAR

$ 00

CITY, STATE, ZIP CODE RI-1120ES

2. ESTIMATED TAX FOR

CURRENT YEAR $ 00

FEDERAL EMPLOYER IDENTIFICATION NUMBER

3. 25% OF LINE 2

$ 00

I declare, under the penalties of perjury, that this document has been examined by me and, 4. LESS AMOUNT FROM

to the best of my knowledge and belief, is true, and complete. PRIOR YEAR CREDITED 00

TO THIS PAYMENT $

Signature of officer or agent Key #54

5. PAYMENT DUE WITH THIS

AMOUNT ON LINE 5 IS DUE AND PAYABLE ON OR BEFORE THE FIFTEENTH DAY VOUCHER $ 0 0

OF THE FOURTH, SIXTH, NINTH, AND TWELFTH MONTHS OF THE TAXABLE YEAR