Enlarge image

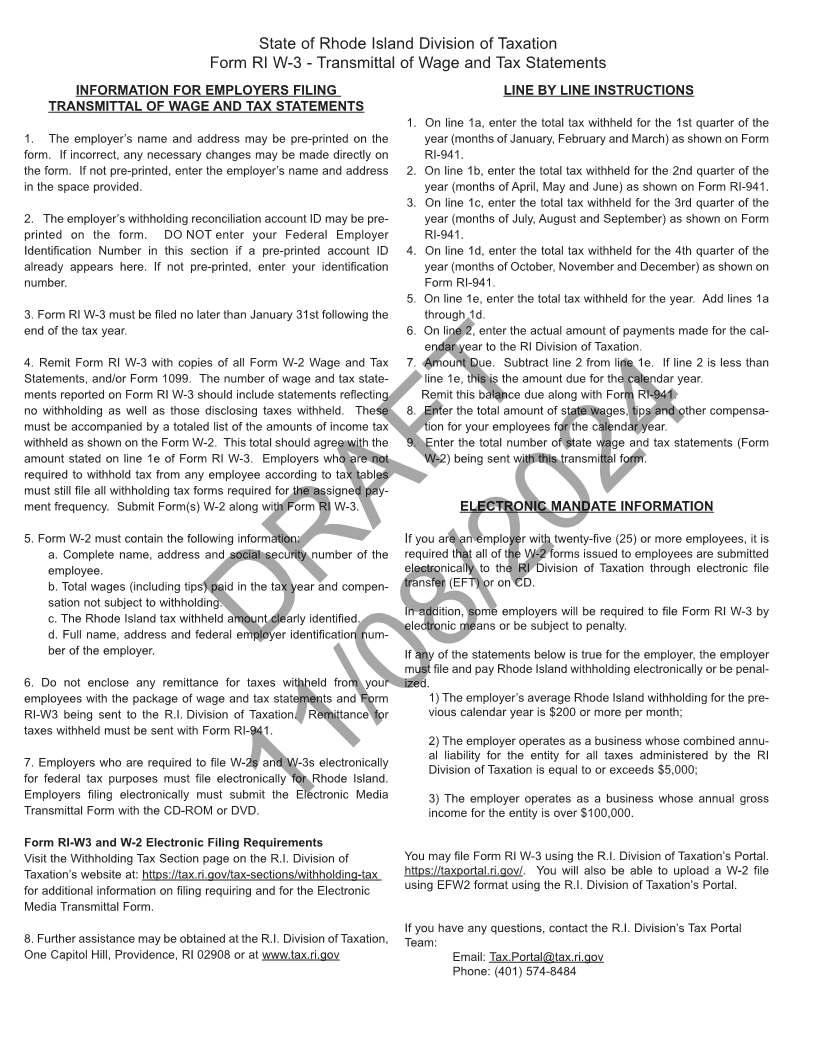

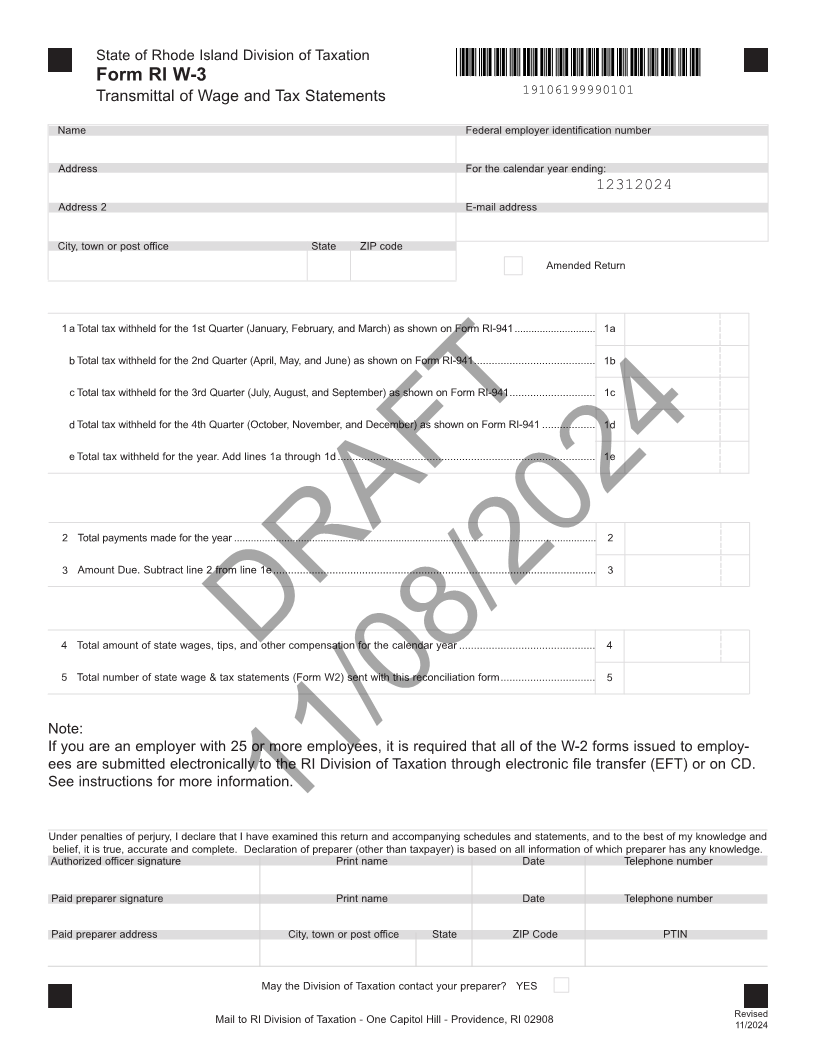

State of Rhode Island Division of Taxation

Form RI W-3

Transmittal of Wage and Tax Statements 19106199990101

Name Federal employer identification number

Address For the calendar year ending:

12312024

Address 2 E-mail address

City, town or post office State ZIP code

Amended Return

1a Total tax withheld for the 1st Quarter (January, February, and March) as shown on Form RI-941............................. 1a

b Total tax withheld for the 2nd Quarter (April, May, and June) as shown on Form RI-941......................................... 1b

c Total tax withheld for the 3rd Quarter (July, August, and September) as shown on Form RI-941............................. 1c

d Total tax withheld for the 4th Quarter (October, November, and December) as shown on Form RI-941 .................. 1d

e Total tax withheld for the year. Add lines 1a through 1d....................................................................................... 1e

2 Total payments made for the year .................................................................................................................................. 2

3 Amount Due. Subtract line 2 from line 1e............................................................................................................. 3

4 Total amount of state wages, tips, and other compensation for the calendar year .............................................. 4

DRAFT

5 Total number of state wage & tax statements (Form W2) sent with this reconciliation form................................ 5

Note:

If you are an employer with 25 or more employees, it is required that all of the W-2 forms issued to employ-

ees are submitted electronically to the RI Division of Taxation through electronic file transfer (EFT) or on CD.

See instructions for more information.

Under penalties of perjury, I declare that I have examined11/08/2024this return and accompanying schedules and statements, and to the best of my knowledge and

belief, it is true, accurate and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Authorized officer signature Print name Date Telephone number

Paid preparer signature Print name Date Telephone number

Paid preparer address City, town or post office State ZIP Code PTIN

May the Division of Taxation contact your preparer? YES

Mail to RI Division of Taxation - One Capitol Hill - Providence, RI 02908 Revised

11/2024