Enlarge image

1111111111222222222233333333334444444444555555555566666666667777777777888

34567890123456789012345678901234567890123456789012345678901234567890123456789012

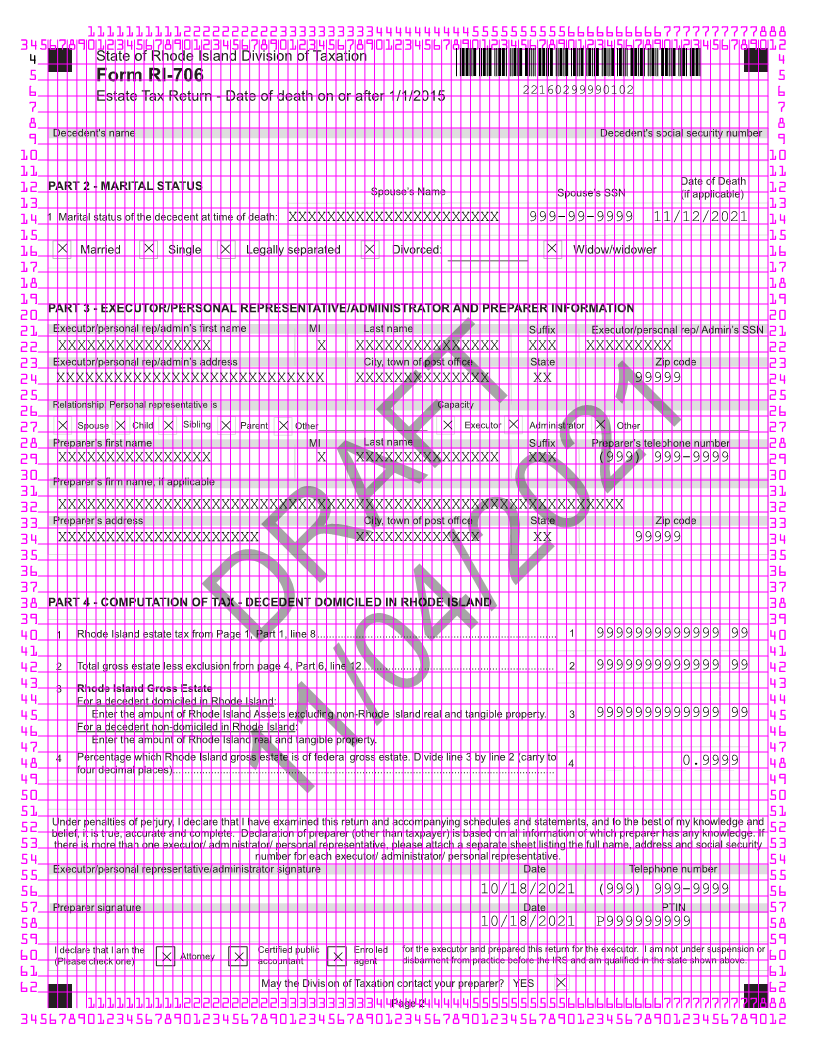

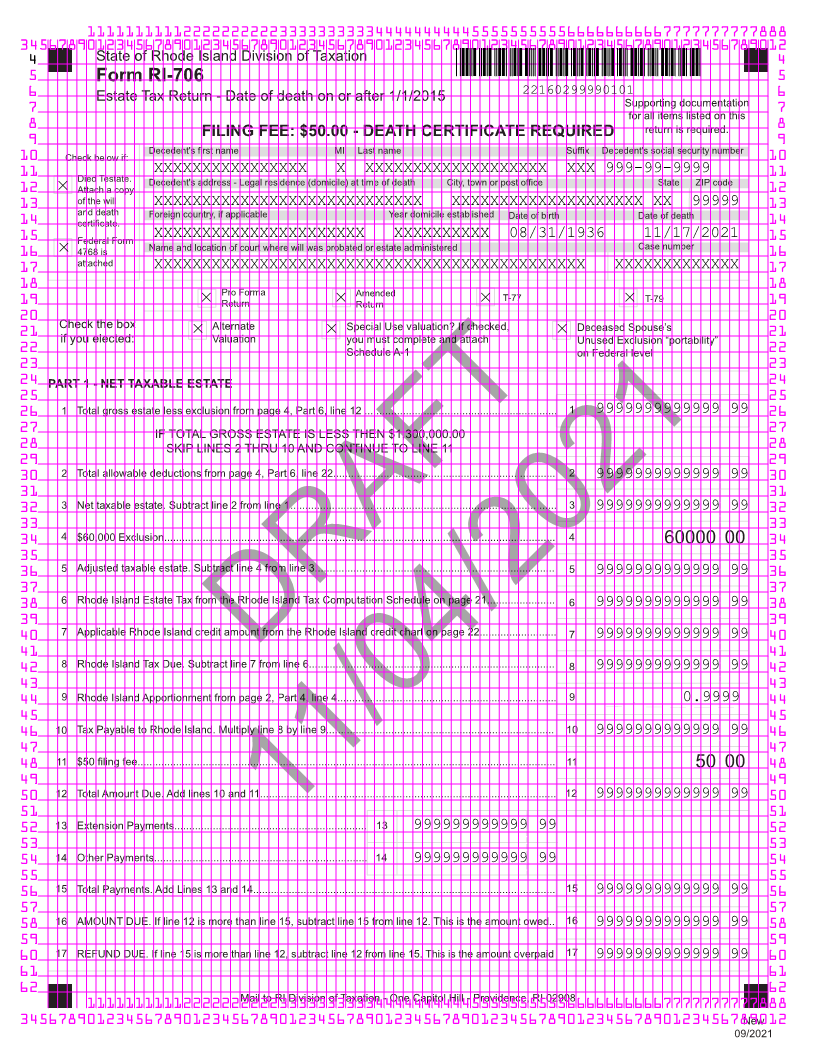

4 State of Rhode Island Division of Taxation 4

5 Form RI-706 5

6 22160299990101 6

7 Estate Tax Return - Date of death on or after 1/1/2015 Supporting documentation 7

for all items listed on this

8 FILING FEE: $50.00 - DEATH CERTIFICATE REQUIRED return is required. 8

9 9

Decedent's first name MI Last name Suffix Decedent's social security number

10 Check below if: 10

11 XXXXXXXXXXXXXXXX X XXXXXXXXXXXXXXXXXXX XXX 999-99-9999 11

Died Testate. Decedent's address - Legal residence (domicile) at time of death City, town or post office State ZIP code

12 Attach a copy 12

13 of the will XXXXXXXXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXX XX 99999 13

14 and death Foreign country, if applicable Year domicile established Date of birth Date of death 14

certificate.

15 15

Federal Form XXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXX 08/31/1936 Case number11/17/2021

16 4768 is Name and location of court where will was probated or estate administered 16

17 attached XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXX 17

18 18

19 Pro Forma Amended T-77 T-79 19

Return Return

20 20

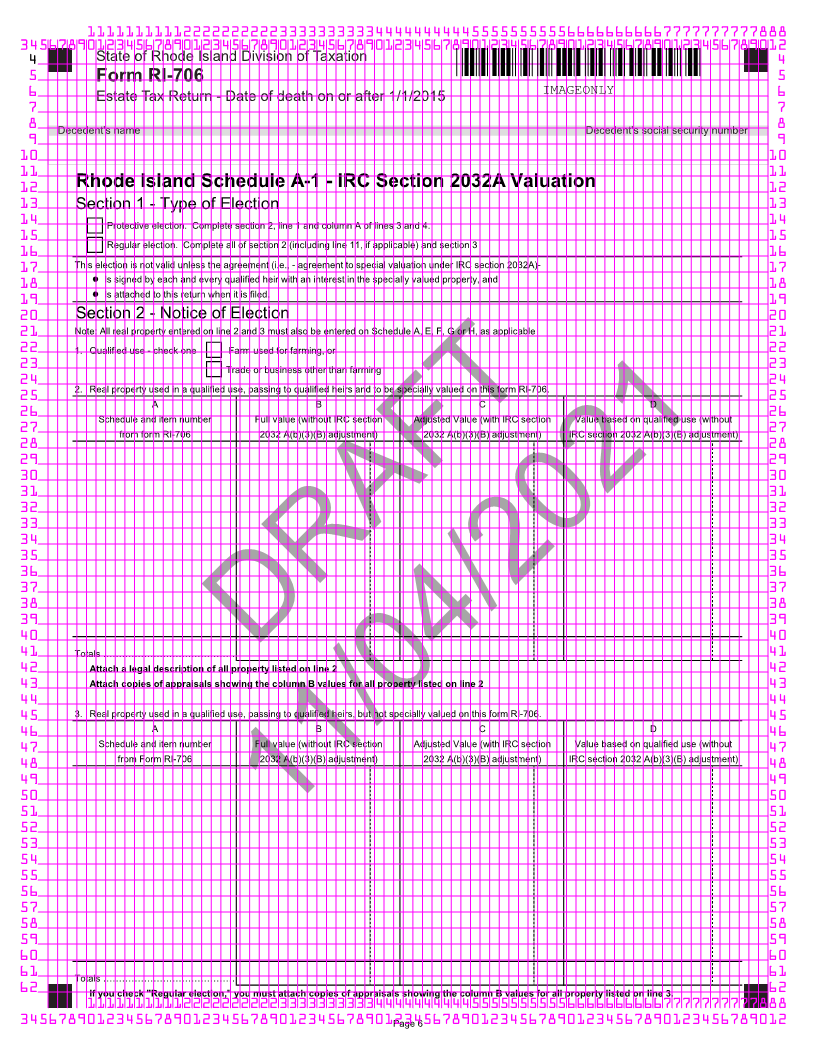

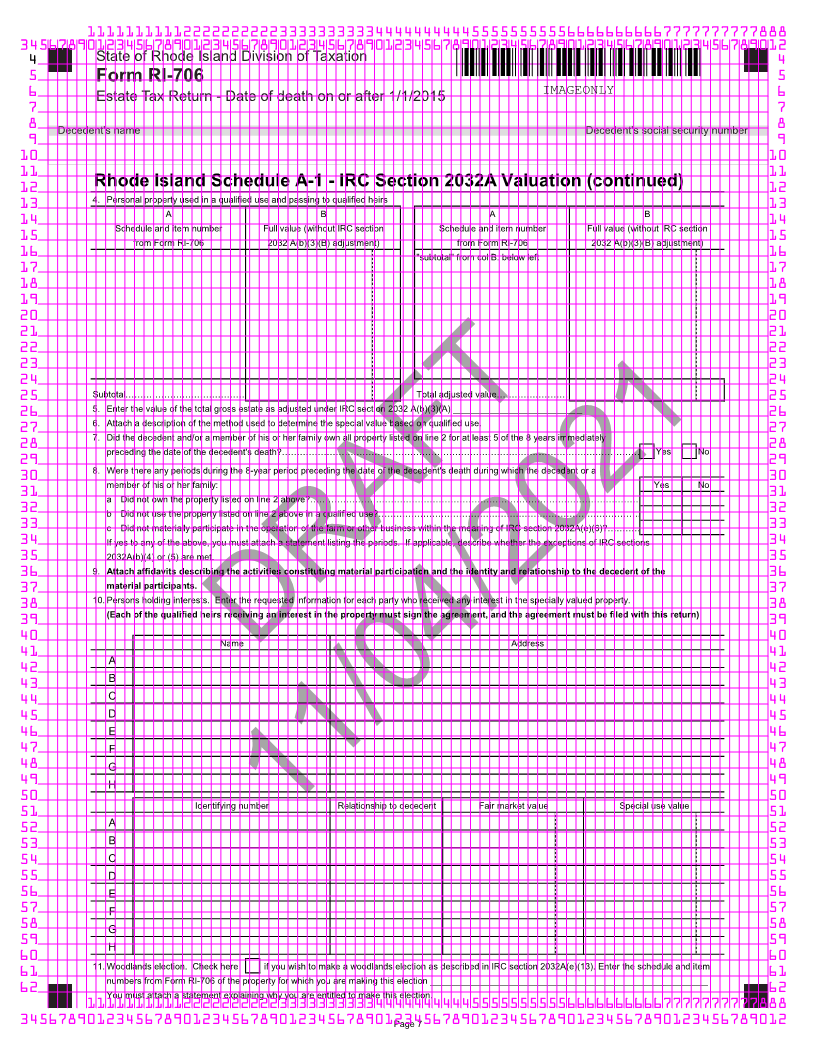

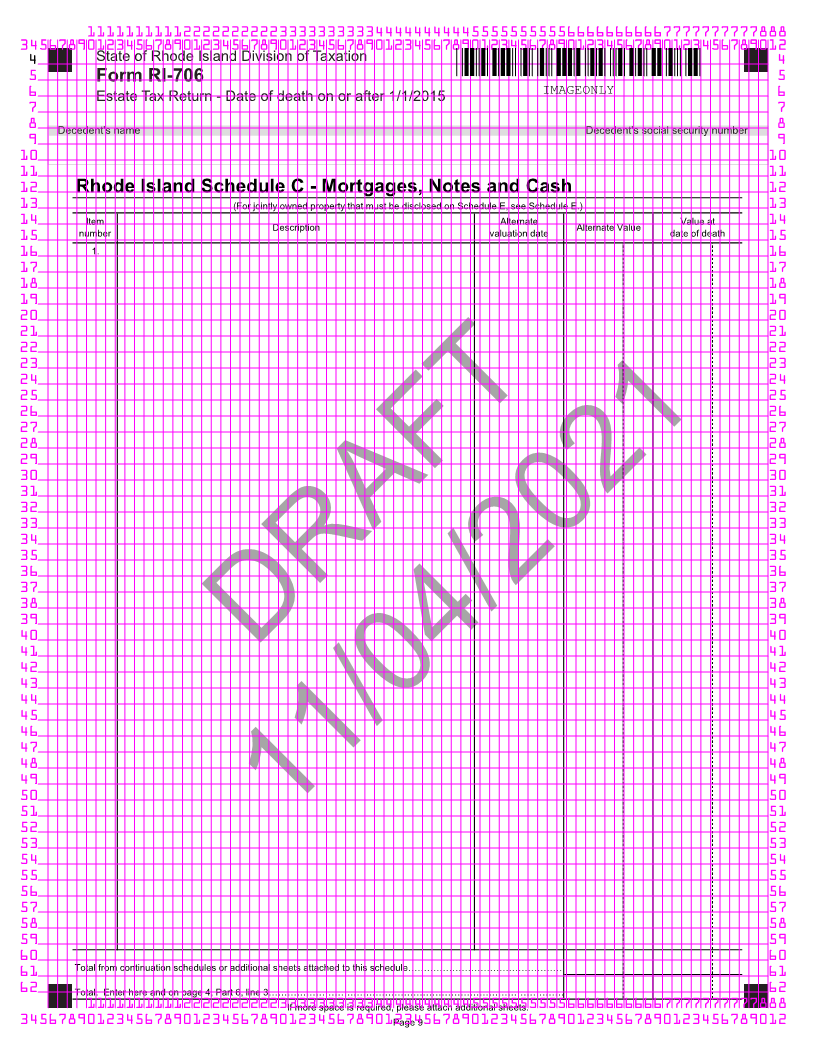

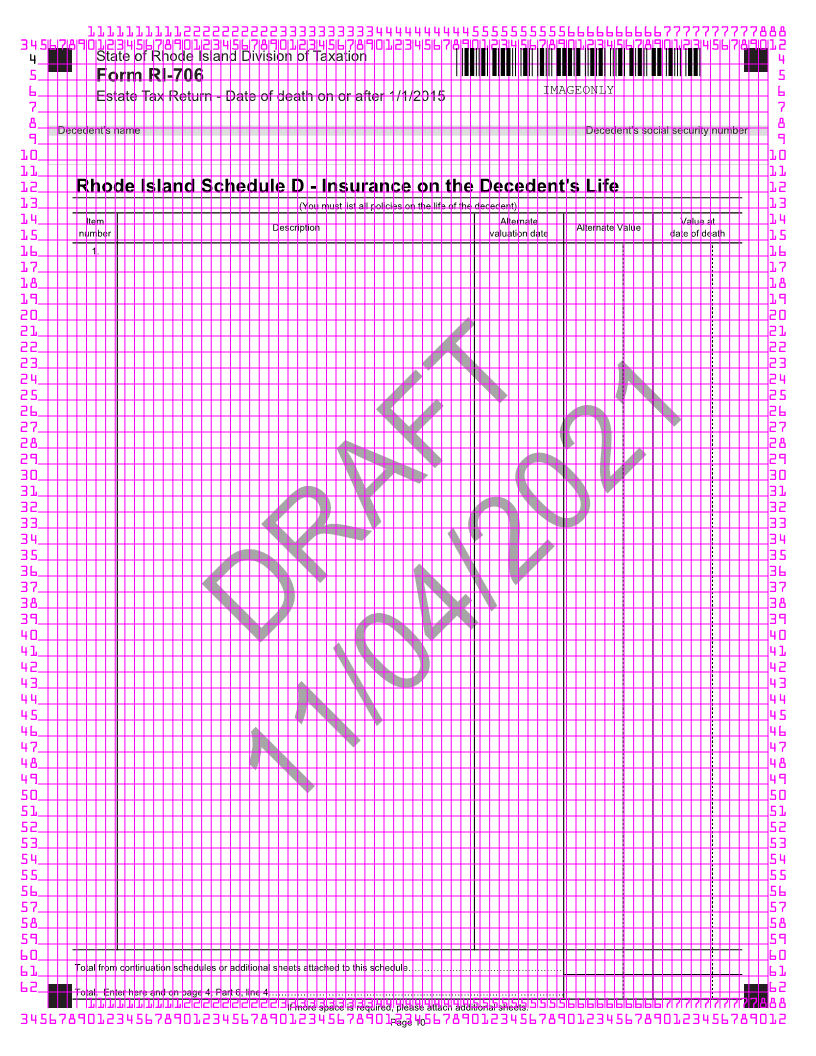

21 Check the box Alternate Special Use valuation? If checked, Deceased Spouse’s 21

if you elected: Valuation you must complete and attach Unused Exclusion “portability”

22 Schedule A-1 on Federal level 22

23 23

24 PART 1 - NET TAXABLE ESTATE 24

25 25

26 1 Total gross estate less exclusion from page 4, Part 6, line 12 ................................................................. 1 9999999999999 99 26

27 IF TOTAL GROSS ESTATE IS LESS THEN $1,300,000.00 27

28 SKIP LINES 2 THRU 10 AND CONTINUE TO LINE 11 28

29 29

30 2 Total allowable deductions from page 4, Part 6, line 22........................................................................... 2 9999999999999 99 30

31 31

32 3 Net taxable estate. Subtract line 2 from line 1.......................................................................................... 3 9999999999999 99 32

33 33

34 4 $60,000 Exclusion.................................................................................................................................... 4 60000 00 34

35 35

36 5 Adjusted taxable estate. Subtract line 4 from line 3................................................................................. 5 9999999999999 99 36

37 37

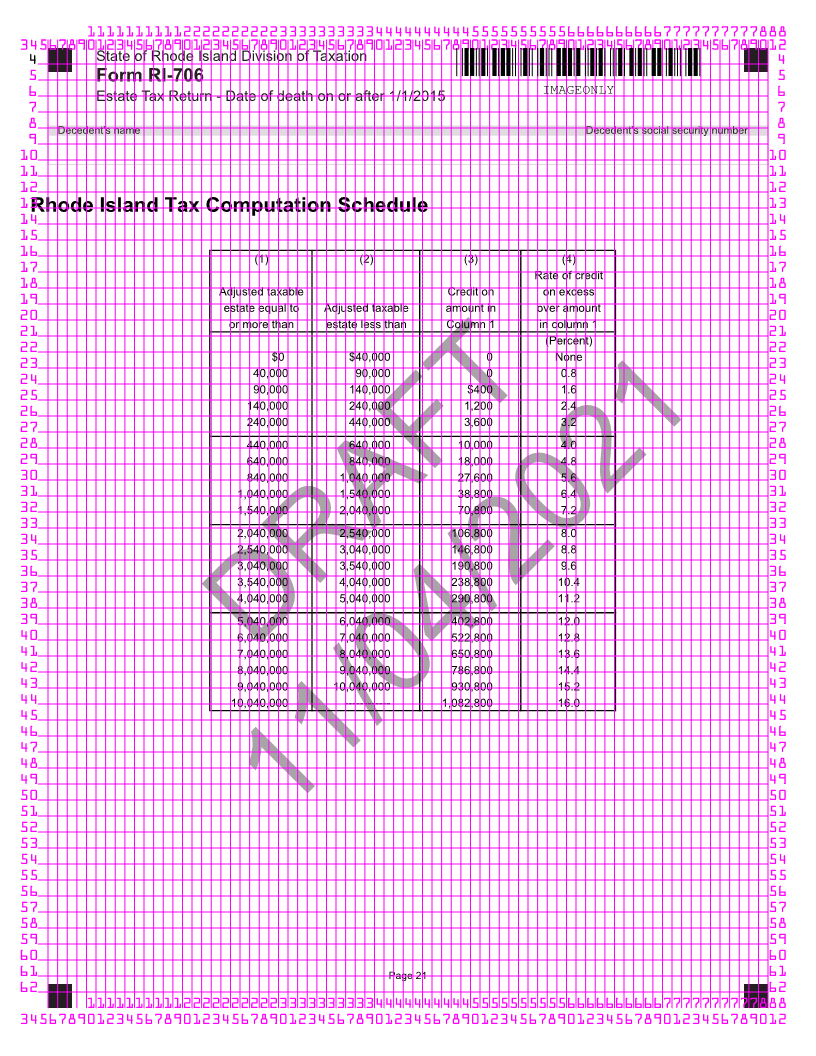

38 6 Rhode Island Estate Tax from the Rhode Island Tax Computation Schedule on page 21....................... 6 9999999999999 99 38

39 39

40 7 Applicable Rhode Island credit amount from the Rhode Island credit chart on page 22.......................... 7 9999999999999 99 40

41 41

42 8 Rhode Island Tax Due. Subtract line 7 from line 6...................................................................................DRAFT 8 9999999999999 99 42

43 43

44 9 Rhode Island Apportionment from page 2, Part 4, line 4.......................................................................... 9 0.9999 44

__ . __ __ __ __

45 45

46 10 Tax Payable to Rhode Island. Multiply line 8 by line 9............................................................................. 10 9999999999999 99 46

47 47

48 11 $50 filing fee............................................................................................................................................. 11 50 00 48

49 49

50 12 Total Amount Due. Add lines 10 and 11.................................................................................................... 12 9999999999999 99 50

51 51

52 13 Extension Payments................................................................. 13 999999999999 99 52

11/04/2021

53 53

54 14 Other Payments........................................................................ 14 999999999999 99 54

55 55

56 15 Total Payments. Add Lines 13 and 14...................................................................................................... 15 9999999999999 99 56

57 57

58 16 AMOUNT DUE. If line 12 is more than line 15, subtract line 15 from line 12. This is the amount owed.. 16 9999999999999 99 58

59 59

60 17 REFUND DUE. If line 15 is more than line 12, subtract line 12 from line 15. This is the amount overpaid 17 9999999999999 99 60

61 61

62 62

Mail to RI Division of Taxation - One Capitol Hill - Providence, RI 02908

1111111111222222222233333333334444444444555555555566666666667777777777888

34567890123456789012345678901234567890123456789012345678901234567890123456789012New

09/2021