Enlarge image

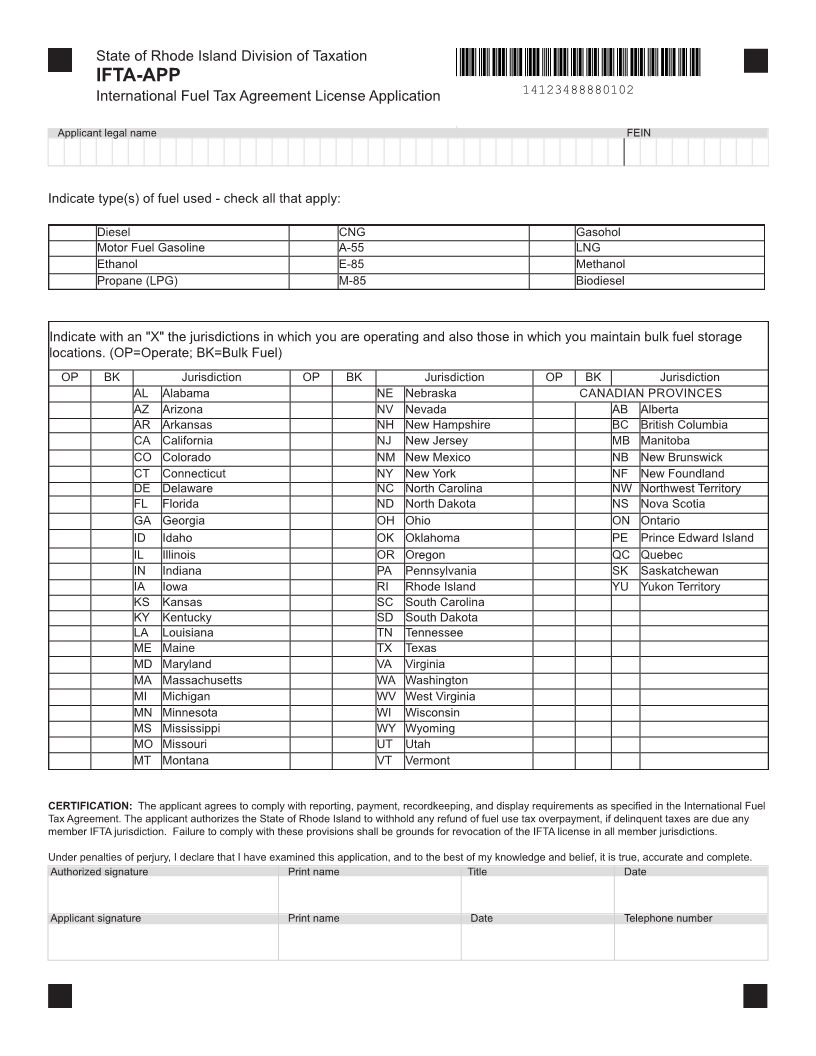

State of Rhode Island Division of Taxation

IFTA-APP

International Fuel Tax Agreement License Application 14123488880101

Applicant legal name FEIN

Business name (if different from above) Registration period ending

1 2 / 3 1 / 2 0 Y Y

Physical address City, town or post office State ZIP code

Mailing address (include apt., office or unit #, if any) City, town or post office State ZIP code

USDOT number International Registration Plan (IRP) registration number

Date you began or will begin IFTA in Rhode Island If you previously registered for IFTA with another jurisdiction, enter jurisdiction below

/ /

Contact name for questions regarding IFTA quarterly tax reporting Telephone number

( ) -

E-mail address

Type of business: Individual Corporation Partnership Other (specify) _____________

Ownership Information:

Enter the names, titles, social security numbers and residence addresses of principal officers of a corporation or of

members, partners, owners, etc.

Social security City or Town/

Name Title Address

number State/ZIP

Decal Order and License Application

Number of vehicles....................................................

Mail to RI Division of Taxation - One Capitol Hill - Providence, RI 02908