Enlarge image

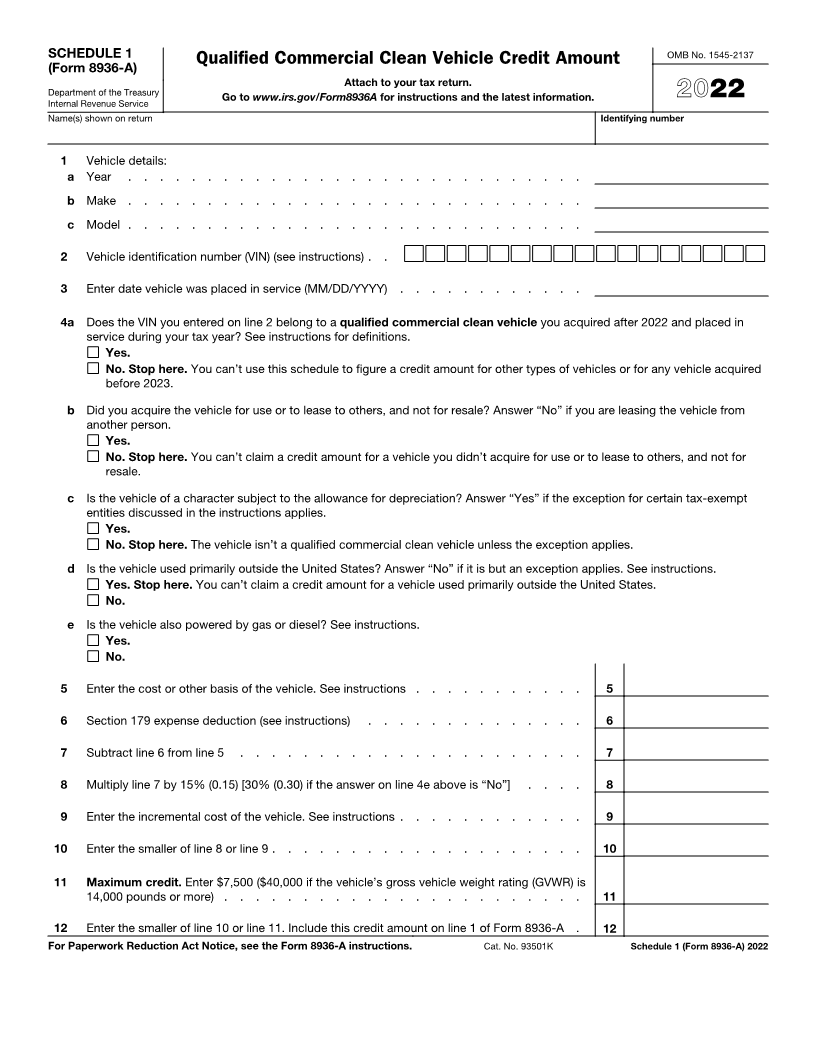

SCHEDULE 1 OMB No. 1545-2137

Qualified Commercial Clean Vehicle Credit Amount

(Form 8936-A)

Attach to your tax return.

Department of the Treasury Go to www.irs.gov/Form8936A for instructions and the latest information. 2022

Internal Revenue Service

Name(s) shown on return Identifying number

1 Vehicle details:

a Year . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b Make . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

c Model . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 Vehicle identification number (VIN) (see instructions) . .

3 Enter date vehicle was placed in service (MM/DD/YYYY) . . . . . . . . . . . .

4 a Does the VIN you entered on line 2 belong to a qualified commercial clean vehicle you acquired after 2022 and placed in

service during your tax year? See instructions for definitions.

Yes.

No. Stop here. You can’t use this schedule to figure a credit amount for other types of vehicles or for any vehicle acquired

before 2023.

b Did you acquire the vehicle for use or to lease to others, and not for resale? Answer “No” if you are leasing the vehicle from

another person.

Yes.

No. Stop here. You can’t claim a credit amount for a vehicle you didn’t acquire for use or to lease to others, and not for

resale.

c Is the vehicle of a character subject to the allowance for depreciation? Answer “Yes” if the exception for certain tax-exempt

entities discussed in the instructions applies.

Yes.

No. Stop here. The vehicle isn’t a qualified commercial clean vehicle unless the exception applies.

d Is the vehicle used primarily outside the United States? Answer “No” if it is but an exception applies. See instructions.

Yes. Stop here. You can’t claim a credit amount for a vehicle used primarily outside the United States.

No.

e Is the vehicle also powered by gas or diesel? See instructions.

Yes.

No.

5 Enter the cost or other basis of the vehicle. See instructions . . . . . . . . . . . 5

6 Section 179 expense deduction (see instructions) . . . . . . . . . . . . . . 6

7 Subtract line 6 from line 5 . . . . . . . . . . . . . . . . . . . . . . 7

8 Multiply line 7 by 15% (0.15) [30% (0.30) if the answer on line 4e above is “No”] . . . . 8

9 Enter the incremental cost of the vehicle. See instructions . . . . . . . . . . . . 9

10 Enter the smaller of line 8 or line 9 . . . . . . . . . . . . . . . . . . . . 10

11 Maximum credit. Enter $7,500 ($40,000 if the vehicle’s gross vehicle weight rating (GVWR) is

14,000 pounds or more) . . . . . . . . . . . . . . . . . . . . . . . 11

12 Enter the smaller of line 10 or line 11. Include this credit amount on line 1 of Form 8936-A . 12

For Paperwork Reduction Act Notice, see the Form 8936-A instructions. Cat. No. 93501K Schedule 1 (Form 8936-A) 2022