Enlarge image

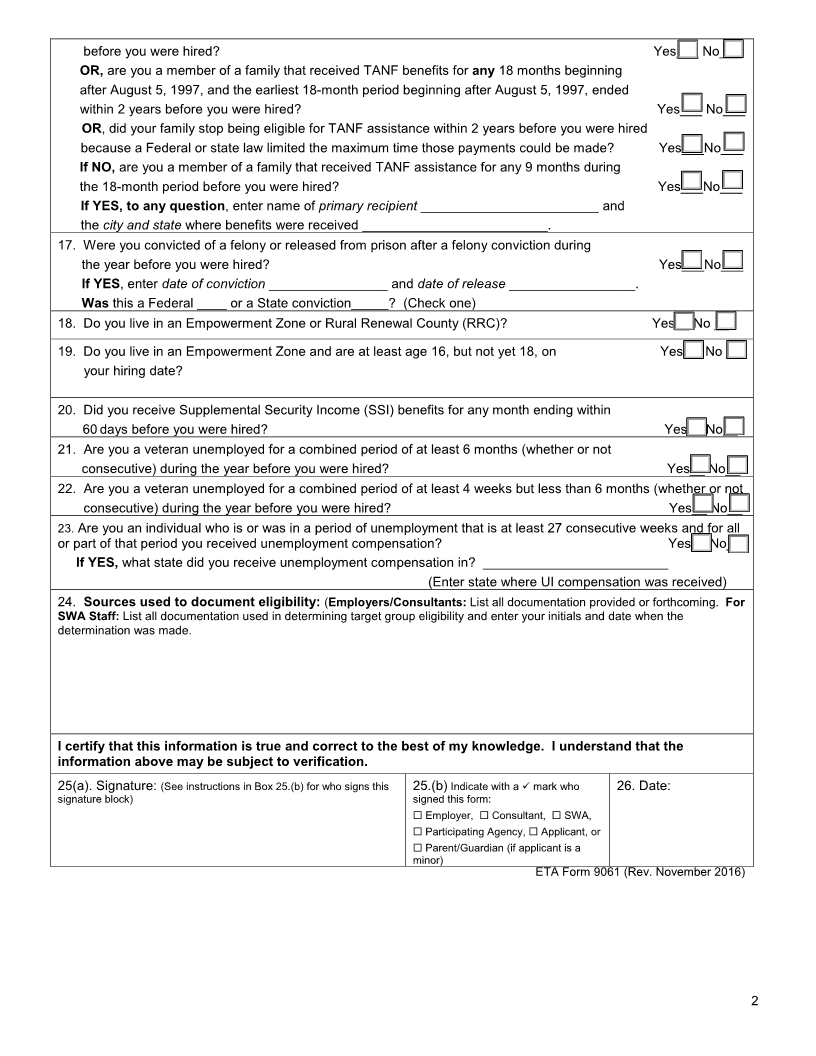

U.S. Department Of Labor OMB Control No. 1205-0371

Employment and Training Administration Individual Characteristics Form (ICF) Expiration Date: March 31, 2023

Work Opportunity Tax Credit

1. Control No. (For Agency use only) 2. Date Received (For Agency Use only)

APPLICANT INFORMATION

(See instructions on reverse)

EMPLOYER INFORMATION

3. Employer Name 4. Employer Address and Telephone 5. Employer Federal ID Number (EIN)

APPLICANT INFORMATION

6. Applicant Name (Last, First, MI) 7. Social Security Number 8. Have you worked for this employer

before? Yes ____ No ____

If YES, enter last date of

employment: ____________

APPLICANT CHARACTERISTICS FOR WOTC TARGET GROUP CERTIFICATION

9. Employment Start Date 10. Starting Wage 11. Position

12. Are you at least age 16, but under age 40? Yes ___ No ___

If YES, enter your date of birth _____________________

13. Are you a Veteran of the U.S. Armed Forces? Yes ___ No ___

If NO , go to Box 14.

If YES , are you a member of a family that received Supplemental Nutrition Assistance

Program (SNAP) benefits (Food Stamps) for at least 3 months during the 15 months

before you were hired? Yes ___ No ___

If YES, enter name of primary recipient _______________________ and

city and state where benefits were received _________________.

OR , are you a veteran entitled to compensation for a service-connected disability? Yes ___ No ___

If YES , were you discharged or released from active duty within a year before you were hired? Yes ___ No ___

OR, were you unemployed for a combined period of at least 6 months (whether or not

consecutive) during the year before you were hired? Yes ___ No ___

14. Are you a member of a family that received Supplemental Nutrition Assistance Program

(SNAP) (formerly Food Stamps) benefits for the 6 months before you were hired? Yes ___ No___

OR,received SNAP benefits for at least a 3-month period within the last 5 months

But you are no longer receiving them? Yes ___ No___

If YES to either question, enter name of primary recipient _____________________ and city

And state where benefits were received _____________________.

15. Were you referred to an employer by a Vocational Rehabilitation Agency approved by

a State? Yes ___ No___

OR, by an Employment Network under the Ticket to Work Program? Yes ___ No___

OR , by the Department of Veterans Affairs? Yes ___ No___

16. Are you a member of a family that received TANF assistance for at least the last 18 months

1