Enlarge image

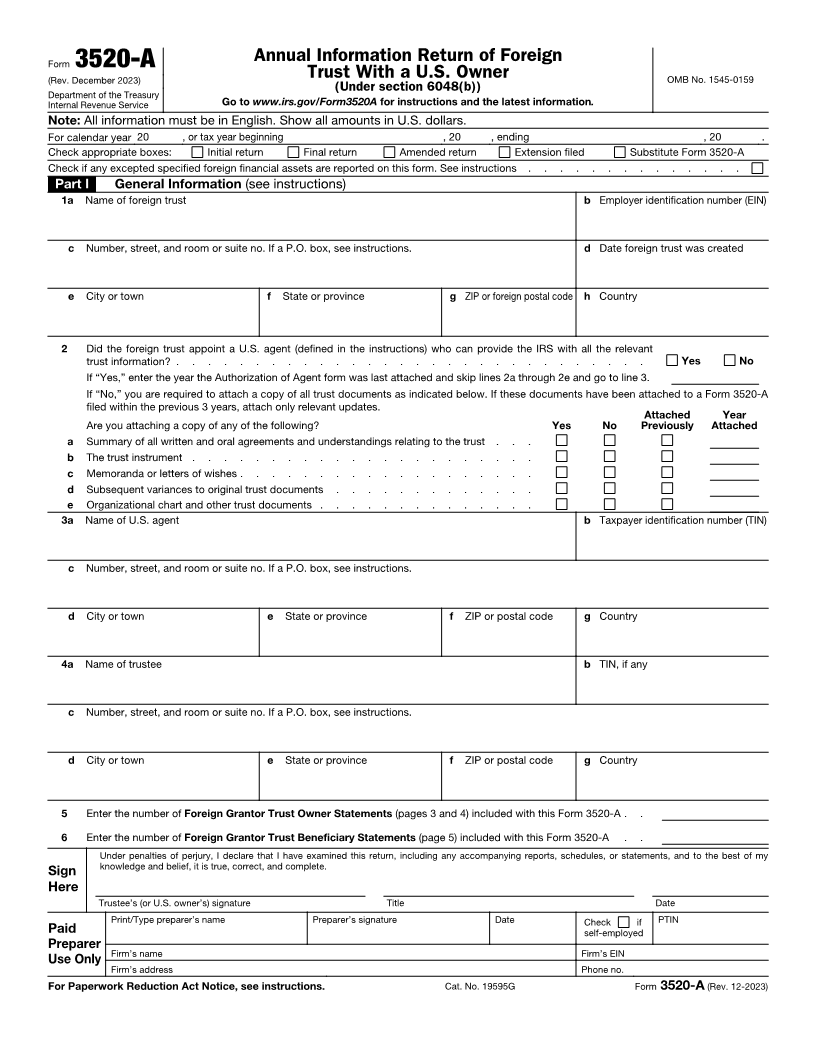

Annual Information Return of Foreign

Form 3520-A

(Rev. December 2023) Trust With a U.S. Owner OMB No. 1545-0159

Department of the Treasury (Under section 6048(b))

Internal Revenue Service Go to www.irs.gov/Form3520A for instructions and the latest information .

Note: All information must be in English. Show all amounts in U.S. dollars.

For calendar year 20 , or tax year beginning , 20 , ending , 20 .

Check appropriate boxes: Initial return Final return Amended return Extension filed Substitute Form 3520-A

Check if any excepted specified foreign financial assets are reported on this form. See instructions . . . . . . . . . . . . . .

Part I General Information (see instructions)

1a Name of foreign trust b Employer identification number (EIN)

c Number, street, and room or suite no. If a P.O. box, see instructions. d Date foreign trust was created

e City or town f State or province g ZIP or foreign postal code h Country

2 Did the foreign trust appoint a U.S. agent (defined in the instructions) who can provide the IRS with all the relevant

trust information? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Yes No

If “Yes,” enter the year the Authorization of Agent form was last attached and skip lines 2a through 2e and go to line 3.

If “No,” you are required to attach a copy of all trust documents as indicated below. If these documents have been attached to a Form 3520-A

filed within the previous 3 years, attach only relevant updates.

Attached Year

Are you attaching a copy of any of the following? Yes No Previously Attached

a Summary of all written and oral agreements and understandings relating to the trust . . .

b The trust instrument . . . . . . . . . . . . . . . . . . . . . .

c Memoranda or letters of wishes . . . . . . . . . . . . . . . . . . .

d Subsequent variances to original trust documents . . . . . . . . . . . . .

e Organizational chart and other trust documents . . . . . . . . . . . . . .

3a Name of U.S. agent b Taxpayer identification number (TIN)

c Number, street, and room or suite no. If a P.O. box, see instructions.

d City or town e State or province f ZIP or postal code g Country

4a Name of trustee b TIN, if any

c Number, street, and room or suite no. If a P.O. box, see instructions.

d City or town e State or province f ZIP or postal code g Country

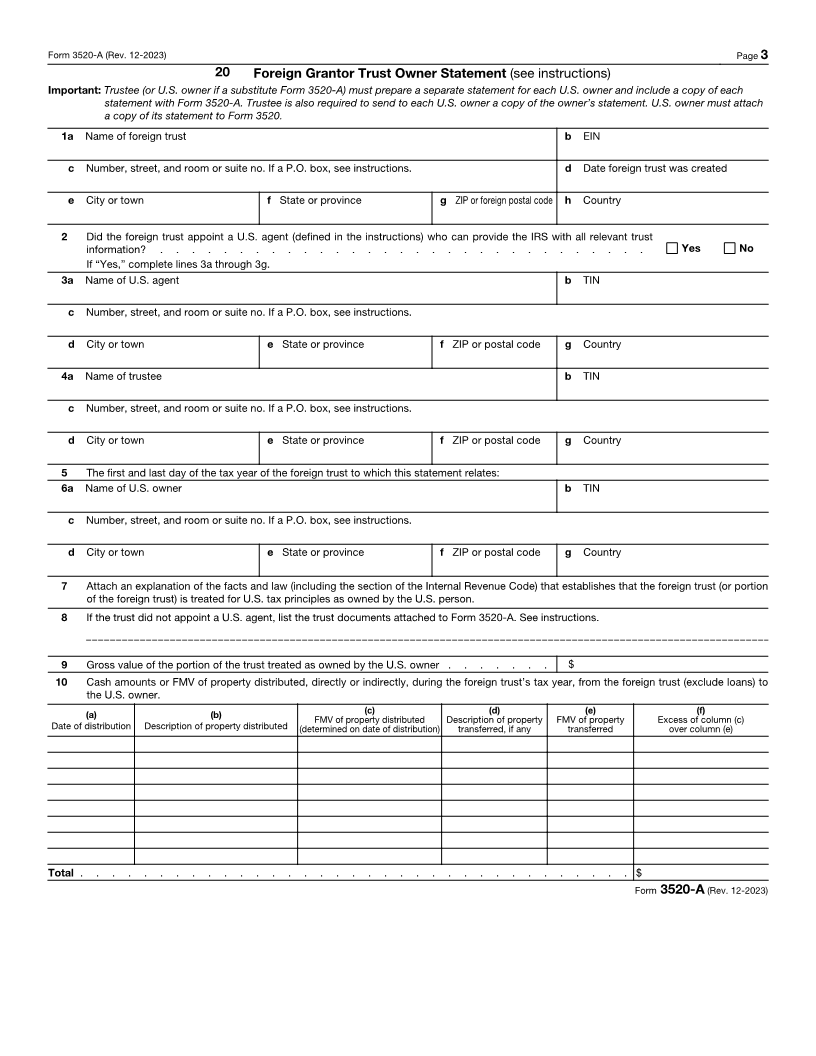

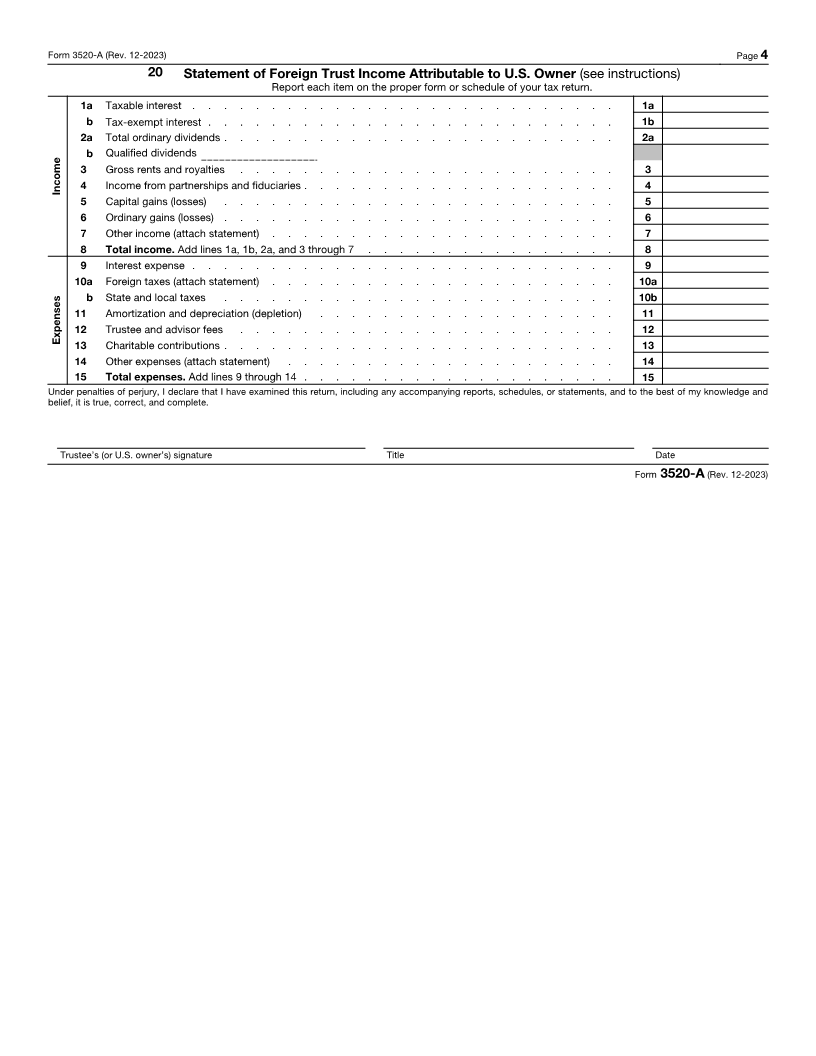

5 Enter the number of Foreign Grantor Trust Owner Statements (pages 3 and 4) included with this Form 3520-A . .

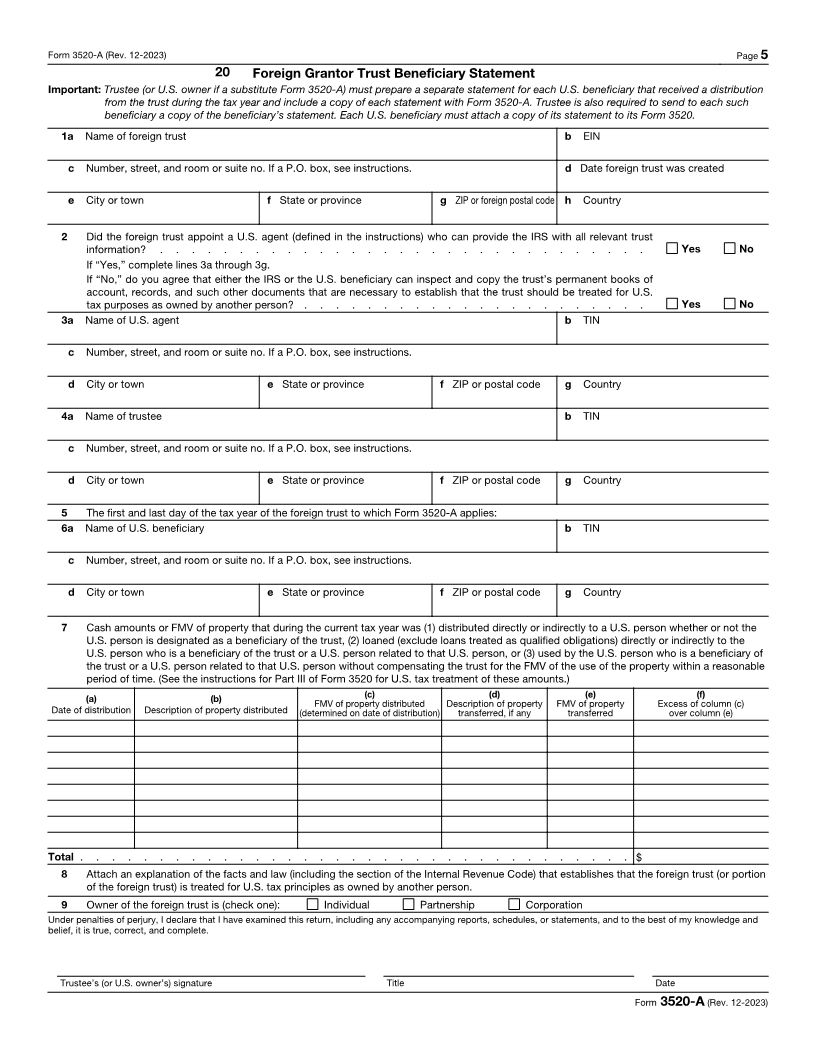

6 Enter the number of Foreign Grantor Trust Beneficiary Statements (page 5) included with this Form 3520-A . .

Under penalties of perjury, I declare that I have examined this return, including any accompanying reports, schedules, or statements, and to the best of my

Sign knowledge and belief, it is true, correct, and complete.

Here

Trustee’s (or U.S. owner’s) signature Title Date

Print/Type preparer’s name Preparer’s signature Date Check if PTIN

Paid self-employed

Preparer

Firm’s name Firm’s EIN

Use Only

Firm’s address Phone no.

For Paperwork Reduction Act Notice, see instructions. Cat. No. 19595G Form 3520-A (Rev. 12-2023)