Enlarge image

Form 8554-EP Application for Renewal of Enrollment to

(February 2022) Practice Before the Internal Revenue Service as OMB No. 1545-0946

Department of the Treasury an Enrolled Retirement Plan Agent (ERPA)

Internal Revenue Service

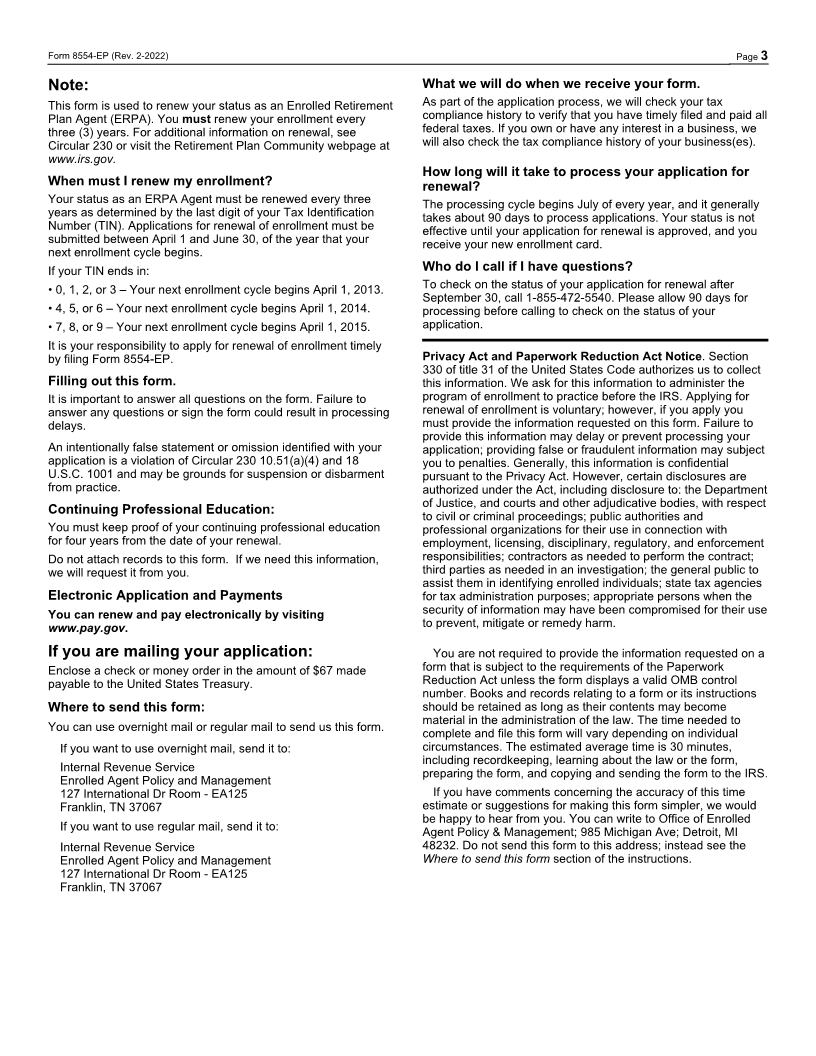

Important things you need to know and do before you file this form:

For IRS use:

• The Renewal Fee is $67.

• You must complete 72 hours of Continuing Professional Education (ERPA–CPE) over the three-year

enrollment cycle to remain active. This must include at least 2 hours of Ethics CPE each year. Enrollment Number:

• Exception: If this is your first renewal, you have to complete 2 hours of CPE for each month you were

enrolled, including 2 hours of Ethics each year.

Date Enrolled:

You can file this form and pay electronically at www.pay.gov. This fee is non-refundable and applies

regardless of your enrollment status.

Part 1. Enrollment Status

I want approval for Active Enrolled Retirement Plan Agent status.

Are you currently under suspension or disbarment? . . . . . Yes No

I want approval to remain or be placed into Inactive Retirement status.

Note:Inactive Retirement status is not available to individuals who are under suspension or disbarment.

If you want approval for Active Enrolled Retirement Plan Agent status, enter the number of CPE and Ethics hours you earned in each

year of the current enrollment cycle.

Year 1 Year 2 Year 3 Total

CPE

Ethics

Part 2. Identifying Information

1 Last four digits of your Social Security Number

If you do not have an SSN, please check this box.

2 Your Enrollment Number

3 Your Full Legal Name

Last First MI

4 Your Current Address

Check if this is a new address

Number Street Suite or Apt. Number

City State Zip Code Country

Your email Address:

Your Contact Number:

For Privacy Act and Paperwork Reduction Act Notice, see page 3. Catalog Number 51484G Form 8554-EP (Rev. 2-2022)