Enlarge image

Form Salary Reduction Simplified Employee Pension— OMB No. 1545-1012

5305A-SEP

(Rev. June 2006) Individual Retirement Accounts Do not file

Contribution Agreement with the Internal

Department of the Treasury Revenue Service

Internal Revenue Service (Under section 408(k) of the Internal Revenue Code)

amends its salary reduction SEP by adopting the following Model Salary Reduction

Name of employer SEP under Internal Revenue Code section 408(k) and the instructions to this form.

Note: An employer may not establish a salary reduction SEP after 1996.

Article I—Eligibility Requirements (check applicable boxes—see instructions)

Provided the requirements of Article III are met, the employer agrees to permit elective deferrals to be made in each calendar year to the

individual retirement accounts or individual retirement annuities (IRAs), established by or for all employees who are at least years old

(not to exceed 21 years) and have performed services for the employer in at least years (not to exceed 3 years) of the immediately

preceding 5 years. This simplified employee pension (SEP) includes does not include employees covered under a collective

bargaining agreement, includes does not include certain nonresident aliens, and includes does not include employees

whose total compensation during the year is less than $450*.

Article II—Elective Deferrals (see instructions)

A. Salary Reduction Amount. An eligible employee may elect to have his or her compensation reduced by a specified percentage or amount

per pay period, as designated in writing to the employer.

B. Timing of Elective Deferrals. No deferral election may be based on compensation an eligible employee received, or had a right to receive,

before execution of the deferral election.

Article III—SEP Requirements (see instructions)

The employer agrees that each employee’s elective deferrals to the SEP will be:

A. Based only on the first $220,000* of compensation.

B. Limited annually to the smaller of: (1) 25% of compensation; or (2) the section 402(g) limit for the tax year.

C. Limited further, under section 415, if the employer makes nonelective contributions to this or another SEP.

D. Paid to the employee’s IRA trustee, custodian, or insurance company (for an annuity contract) or, if necessary, an IRA established for an

employee by the employer.

E. Made only if at least 50% of the employer’s employees eligible to participate elect to have amounts contributed to the SEP. If the 50%

requirement is not satisfied as of the end of any calendar year, then all of the elective deferrals made by the employees for that calendar year

will be considered “disallowed deferrals” (IRA contributions that are not SEP-IRA contributions).

F. Made only if the employer had 25 or fewer employees eligible to participate at all times during the prior calendar year.

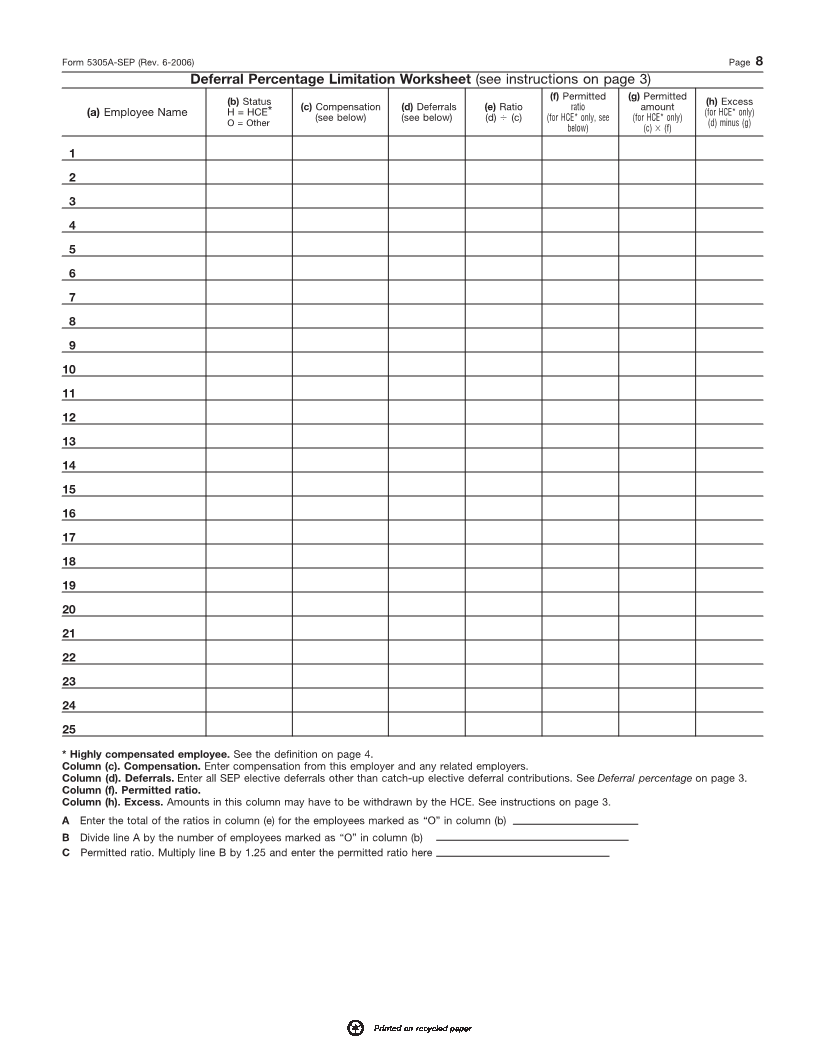

G. Adjusted only if deferrals to this SEP for any calendar year do not meet the “deferral percentage limitation” described on page 3.

Article IV—Excess SEP Contributions (see instructions)

Elective deferrals by a “highly compensated employee” must satisfy the deferral percentage limitation under section 408(k)(6)(A)(iii). Amounts in

excess of this limitation will be deemed excess SEP contributions for the affected highly compensated employee or employees.

Article V—Notice Requirements (see instructions)

A. The employer will notify each highly compensated employee, by March 15 following the end of the calendar year to which any excess SEP

contributions relate, of the excess SEP contributions to the highly compensated employee’s SEP-IRA for the applicable year. The notification will

specify the amount of the excess SEP contributions, whether they must be withdrawn, the calendar year in which any excess contributions are

includible in income, and must provide an explanation of applicable penalties if the excess contributions that must be withdrawn are not

withdrawn on time.

B. The employer will notify each employee who makes an elective deferral to a SEP that, until March 15 after the year of the deferral, any

transfer or distribution from that employee’s SEP-IRA of SEP contributions (or income on these contributions) attributable to elective deferrals

made that year will be includible in income for purposes of sections 72(t) and 408(d)(1).

C. The employer will notify each employee by March 15 of each year of any disallowed deferrals to the employee’s SEP-IRA for the preceding

calendar year. Such notification will specify the amount of the disallowed deferrals and the calendar year in which those deferrals are includible

in income and must provide an explanation of applicable penalties if the disallowed deferrals are not withdrawn on time.

Article VI—Top-Heavy Requirements (see instructions)

A. Unless paragraph B is checked, the employer will satisfy the top-heavy requirements of section 416 by making a minimum contribution each

year to the SEP-IRA of each employee eligible to participate in this SEP (other than a key employee as defined in section 416(i)). This

contribution, in combination with other nonelective contributions, if any, is equal to the smaller of 3% of each eligible nonkey employee’s

compensation or a percentage of such compensation equal to the percentage of compensation at which elective (not including catch-up elective

deferral contributions) and nonelective contributions are made under this SEP (and any other SEP maintained by the employer) for the year for

the key employee for whom such percentage is the highest for the year.

* This is the amount for 2006. For later years, the limit may be increased for cost-of-living adjustments. Increases, if any, to the amounts in this form that are subject

to cost-of-living adjustments (COLAs), are announced by the IRS in a news release, in the Internal Revenue Bulletin, and on the IRS website at www.irs.gov.

For Paperwork Reduction Act Notice, see page 7. Cat. No. 64362R Form 5305A-SEP (Rev. 6-2006)