- 3 -

Enlarge image

|

Application for Recognition of Exemption

Form 1028 Under Section 521 of the Internal Revenue Code

(Rev. September 2006) For the use of farmers', fruit growers', or like associations applying for recognition of OMB No. 1545-0058

Department of the Treasury exemption as cooperatives.

Internal Revenue Service ▶ See separate instructions.

If your organization does not have an organizing document, do not file this application. Every organization must furnish all the information specified

on the form and in the instructions. An attachment may be used if more space is needed for any item. If the required information and appropriate

documents are not submitted along with Form 8718 (with payment of the appropriate user fee), the application may be returned to you.

Part I Identification

1a Full name of organization (See instructions.) b Employer identification number (See

instructions.)

2a Number, street, and room or suite no. (or P.O. box number if mail is not delivered to street address)

b City or town, county, state, and ZIP code

3 Name and telephone number (including area code) of person to be 4 Date incorporated or formed

contacted during business hours

5 Month the annual accounting period ends

6 a Has the organization filed Federal income tax returns? . . . . . . . . . . . . . . . . . Yes No

b If “Yes,” state the form numbers, years filed, and Internal Revenue office where filed ▶

Part II Type of Entity and Organizational Documents (See instructions)

Check the applicable entity box below and attach a conformed copy of the organizing and operational documents listed.

Corporation—Articles of Incorporation, bylaws

Other—Constitution or Articles of Association, bylaws

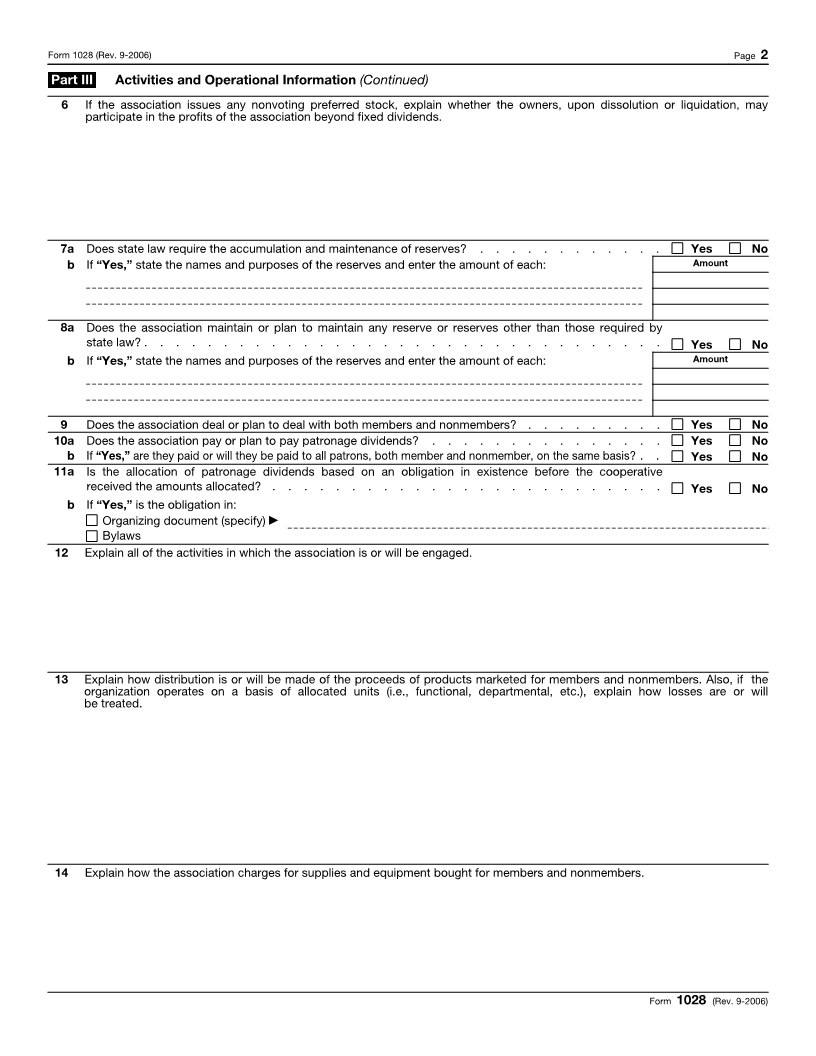

Part III Activities and Operational Information

1 Number of shares of each class of capital stock currently outstanding, if any, the value of the consideration for which issued,

and the rate of dividend paid: Shares Amount Rate of Dividend

a Preferred stock (voting) . . . . . . . . . . 1a

b Preferred stock (nonvoting) . . . . . . . . . 1b

c Common stock (voting) . . . . . . . . . . 1c

d Common stock (nonvoting) . . . . . . . . . 1d

2 Number of shares of capital stock (other than nonvoting preferred) owned by:

a Producers . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2a

b Nonproducers . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2b

c Current and active producers . . . . . . . . . . . . . . . . . . . . . . . 2c

d Total number of shares—Add lines 2a and 2b . . . . . . . . . . . . . . . . . . 2d

e Percentage owned by current and active producers—Divide line 2c by line 2d . . . . . . . 2e %

3 What provision is made for retiring the voting stock held by a nonproducer?

4 Describe who is accorded voting rights in the cooperative and how many votes one person may have. If a person may be

entitled to more than one vote, explain in detail how voting rights are acquired.

5 Legal rate of interest in the state where the association is located . . . . . . . . . . . ▶

Under penalties of perjury, I declare that I am authorized to sign this application on behalf of the above organization; and I have examined this application,

Please including the accompanying statements, and to the best of my knowledge and belief it is true, correct, and complete. (See General Instruction “C.”)

Sign ▲

Here

(Signature) (Title or authority of signer) (Date)

For Paperwork Reduction Act Notice, see page 2 of the separate instructions. Cat. No. 17138N Form 1028 (Rev. 9-2006)

|