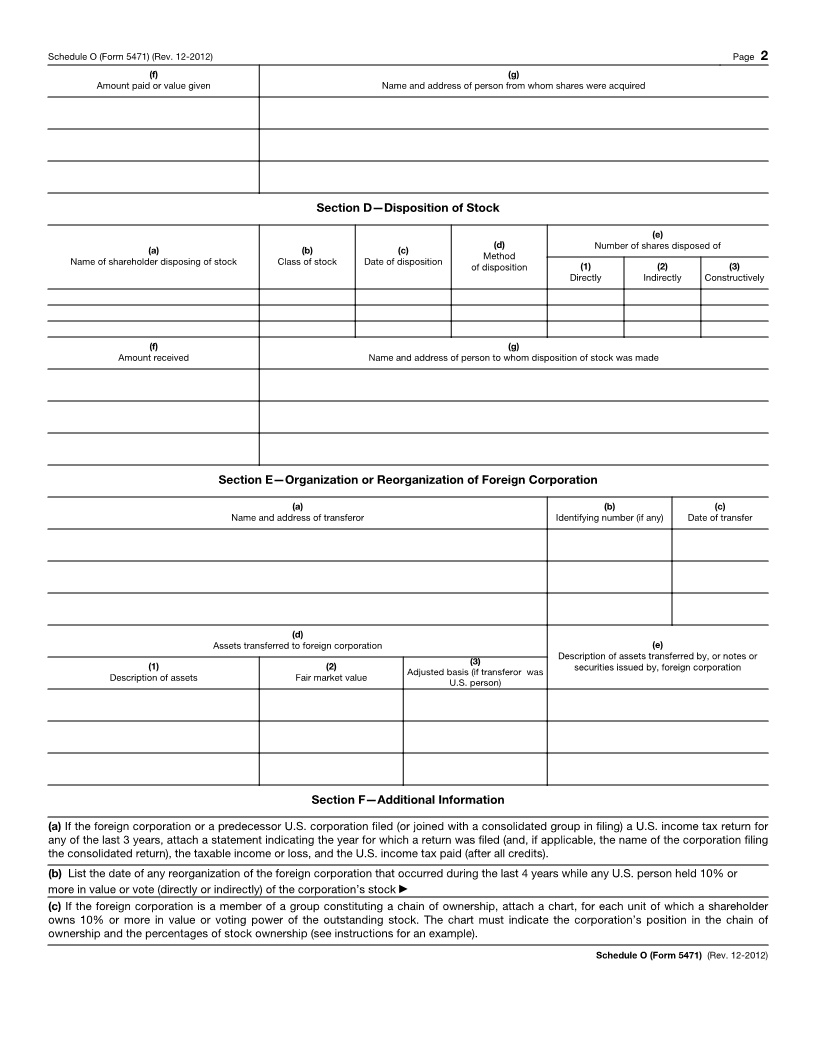

Enlarge image

SCHEDULE O Organization or Reorganization of Foreign

(Form 5471) Corporation, and Acquisitions and

OMB No. 1545-0704

(Rev. December 2012) Dispositions of its Stock

Department of the Treasury Information about Schedule O (Form 5471) and its instructions is at www.irs.gov/form5471

Internal Revenue Service ▶ Attach to Form 5471.

Name of person filing Form 5471 Identifying number

Name of foreign corporation EIN (if any) Reference ID number (see instructions)

Important: Complete a separate Schedule O for each foreign corporation for which information must be reported.

Part I To Be Completed by U.S. Officers and Directors

(a) (b) (c) (d) (e)

Name of shareholder for whom Address of shareholder Identifying number Date of original Date of additional

acquisition information is reported of shareholder 10% acquisition 10% acquisition

Part II To Be Completed by U.S. Shareholders

Note: If this return is required because one or more shareholders became U.S. persons, attach a list showing the names

of such persons and the date each became a U.S. person.

Section A—General Shareholder Information

(b) (c)

(a) For shareholder’s latest U.S. income tax return filed, indicate: Date (if any) shareholder

Name, address, and identifying number of (1) (2) (3) last filed information

shareholder(s) filing this schedule Type of return Date return filed Internal Revenue Service Center return under section 6046

(enter form number) where filed for the foreign corporation

Section B—U.S. Persons Who Are Officers or Directors of the Foreign Corporation

(d)

(a) (b) (c) Check appropriate

Name of U.S. officer or director Address Social security number box(es)

Officer Director

Section C—Acquisition of Stock

(e)

(a) (b) (c) (d) Number of shares acquired

Name of shareholder(s) filing this schedule Class of stock Date of Method of

acquired acquisition acquisition (1) (2) (3)

Directly Indirectly Constructively

For Paperwork Reduction Act Notice, see the Instructions for Form 5471. Cat. No. 61200O Schedule O (Form 5471) (Rev. 12-2012)