- 4 -

Enlarge image

|

Form 8916-A (2018) Page 4

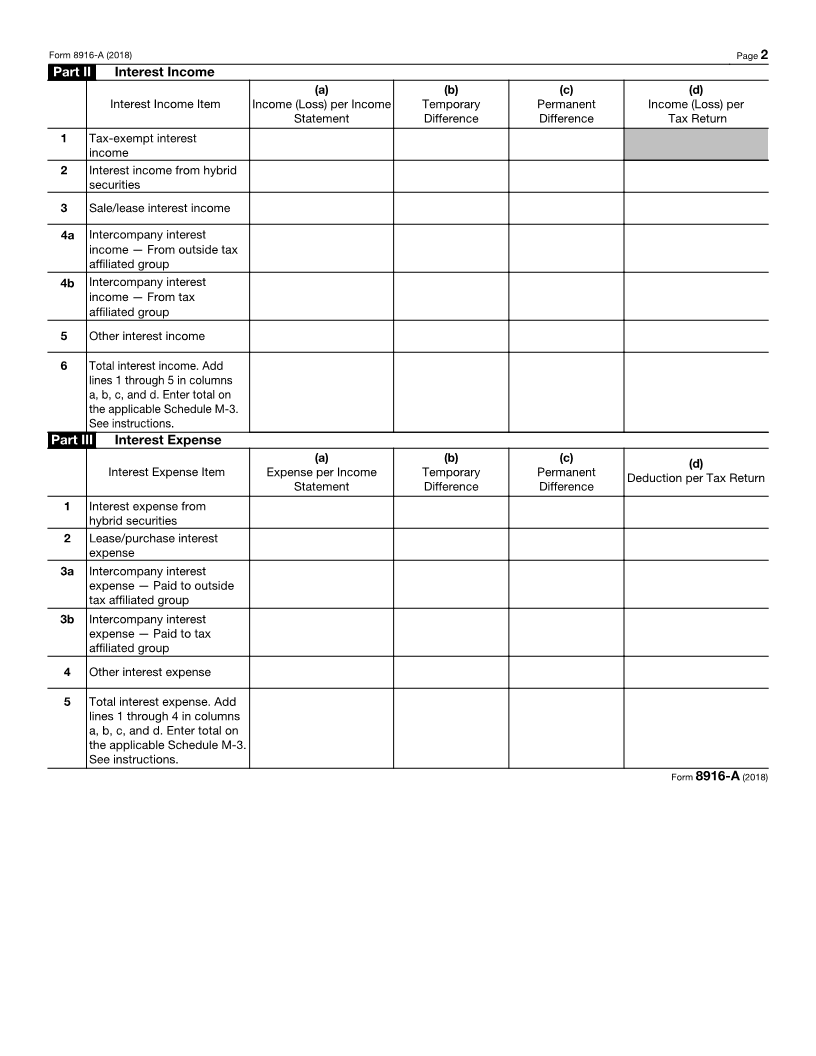

Part II. Interest Income Line 2

Line 1 Report on line 2, column (a), total interest expense from

periodic payments from transactions characterized as a

Report on line 1, column (a), tax-exempt interest income lease for financial accounting and as a purchase for tax

defined under section 103. Complete columns (b) and (c), as purposes. Report on line 2, column (d), total interest expense

applicable. from periodic payments from transactions characterized as a

Line 2 purchase for financial accounting and as a lease for tax

Report on line 2, column (a), the total amount of interest purposes. Complete columns (b) and (c), as applicable. See

income included on Schedule M-3, Part I, line 11, from the instructions for Schedule M-3, Part III, line 34 (Form

hybrid securities characterized as debt for financial 1120), line 35 (Forms 1120-L and 1120-PC), or line 28

accounting and as equity for tax purposes. Report on line 2, (Forms 1120S and 1065).

column (d), the total amount of interest income from hybrid Line 3a

securities characterized as equity for financial accounting Report on line 3a total intercompany interest expense

and as debt for tax purposes. Complete columns (b) and (c), included on Schedule M-3, Part I, line 4 but not included on

as applicable. Report interest income from a debt that is Schedule M-3, Part I, line 11. Report hybrid security interest

both a hybrid debt and a related party debt on line 2 and not expense or deduction on line 1 and purchase/lease interest

on line 4a or 4b. expense or deduction on line 2 and not on line 3a.

Line 3 Line 3b

Report on line 3, column (a), the total interest income from Report on line 3b total intercompany interest expense to an

periodic payments from transactions characterized as a entity within the tax affiliated group. Report hybrid security

lease for financial accounting and as a sale for tax purposes. interest expense or deduction on line 1 and purchase/lease

Report on line 3, column (d), the total interest income from interest expense or deduction on line 2 and not on line 3b.

periodic payments from transactions characterized as a sale

for financial accounting and as a lease for tax purposes. Note. Report interest expense from a debt that is botha

Complete columns (b) and (c), as applicable. See the hybrid debt and a related party debt on line 1 and noton line

instructions for sale versus lease for Schedule M-3, Part II, 3a or 3b.

line 18 (Forms 1120 and 1120-L), line 17 (Form 1120-PC), or Line 4

line 16 (Forms 1120S and 1065). Report on line 4 total interest expense not required to be

Line 4a reported on lines 1 through 3b.

Report on line 4a total intercompany interest income from an Line 5

entity included on Schedule M-3, Part I, line 4 but not Line 5 must equal the amounts for all columns reported on

included on Schedule M-3, Part I, line 11. Report hybrid Schedule M-3 (Form 1120), Part III, line 8; Schedule M-3

security interest income on line 2 and sale/lease interest (Forms 1120-PC and 1120-L), Part III, line 36; Schedule M-3

income on line 3 and not on line 4a. (Form 1065), Part III, line 27; or Schedule M-3 (Form 1120S),

Line 4b Part III, line 26. See the instructions for the applicable

Report on line 4b total intercompany interest income from an Schedule M-3.

entity within the tax affiliated group. Report hybrid security Paperwork Reduction Act Notice. We ask forthe

interest income on line 2 and sale/lease interest income on information on this form to carry out the InternalRevenue

line 3 and not on line 4b. laws of the United States. You are required togive us the

Note. Report interest income from a debt that is both a information. We need it to ensure that youare complying

hybrid debt and a related party debt on line 2 and noton line with these laws and to allow us to figureand collect the right

4a or 4b. amount of tax.

Line 5 You are not required to provide the information requested

Report on line 5 total interest income not required to be on a form that is subject to the Paperwork Reduction Act

reported on lines 1 through 4b. unless the form displays a valid OMB control number. Books

Line 6 or records relating to a form or its instructions must be

retained as long as their contents may become material in

Line 6 must equal the amount for all columns reported on the administration of any Internal Revenue law. Generally,

Schedule M-3, Part II, line 13 (Forms 1120, 1120-L, and tax returns and return information are confidential, as

1120-PC) or line 11 (Forms 1120S and 1065). See the required by section 6103.

instructions for the applicable Schedule M-3.

The time needed to complete and file this form will vary

Part III. Interest Expense depending on individual circumstances. The estimated

Line 1 burden for business taxpayers filing this form is approved

under OMB control number 1545-0123 and is included in the

Report on line 1, column (a), total interest expense from estimates shown in the instructions for their business income

hybrid securities characterized as debt for financial tax return.

accounting and as equity for tax purposes. Report on line 1,

column (d), total interest expense from hybrid securities If you have comments concerning the accuracy of these

characterized as equity for financial accounting and as debt time estimates or suggestions for making this form simpler,

for tax purposes. Complete columns (b) and (c), as we would be happy to hear from you. See the instructions

applicable. Report interest expense from a debt that is both for the tax return with which this form is filed.

a hybrid debt and a related party debt on line 1 and not on

line 3a or 3b.

|