Enlarge image

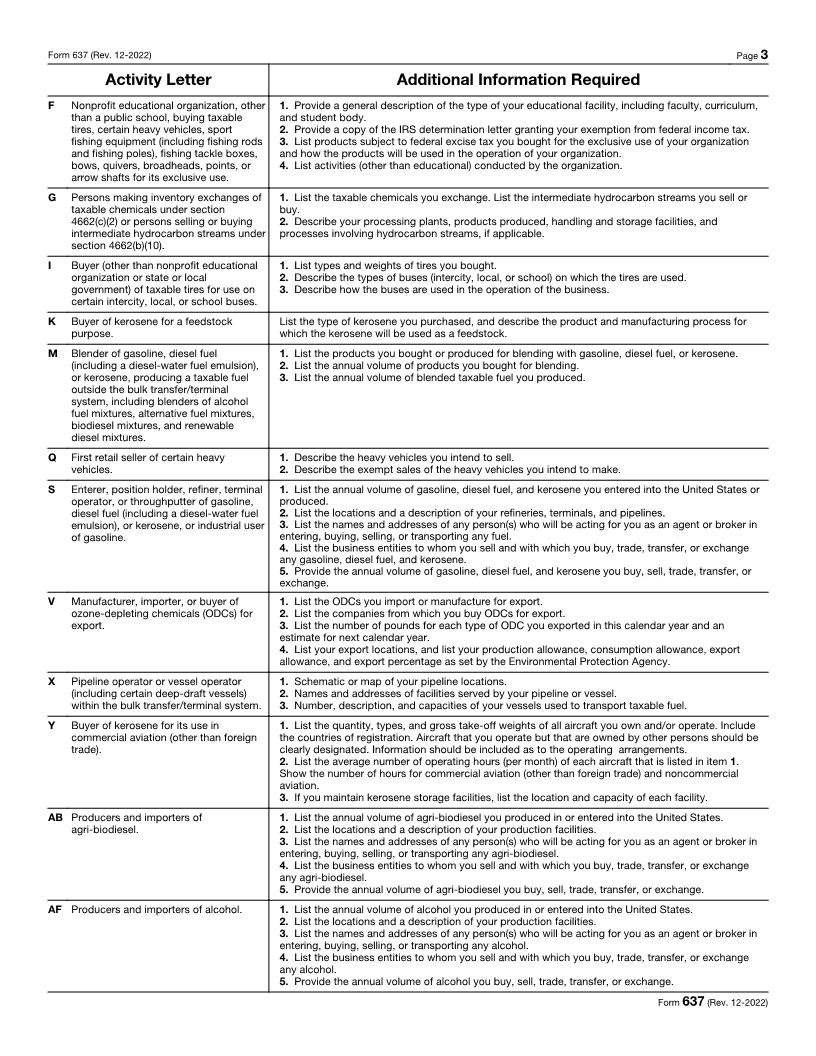

Application for Registration

Form 637 OMB No. 1545-1835

(Rev. December 2022) (For Certain Excise Tax Activities)

Department of the Treasury Go to www.irs.gov/Form637 for the latest information.

Internal Revenue Service

Part I Identification of Applicant

Legal name of entity (or individual) for which the employer identification number (EIN) was secured Employer identification number (EIN)

Trade name of business if different from above Telephone number

Mailing address (number, street, and room or suite no.; if P.O. box, see instructions) Fax number

City or town, state or province, country, and ZIP or foreign postal code

Type or print

If you listed a P.O. box above, or if your street address is different from your mailing address, list your street address (including city or town, state or province, country,

and ZIP or foreign postal code)

Part II Activities. Enter the activity letter from the chart on pages 2–5 and a brief description of each activity for which you’re

applying for registration. Also, attach the Additional Information Required for each activity to which this application applies.

Activity Letter Activity Description

Part III General Information

Section A—For All Applicants

Answer all the questions below. Attach a separate sheet(s), as needed, to answer lines2b through 7. Identify each sheet with your

name and employer identification number at the top, and write the number of the line to which each answer applies. If any questions

don’t apply to you, explain why.

1a Are you filing, or will you be required to file, Form 720, Quarterly Federal Excise Tax Return? . . . . . Yes No

b Have you previously applied to be registered by any IRS office? . . . . . . . . . . . . . . . Yes No

c Have you, or any related entity, had a Certificate of Registry or Letter of Registration revoked or suspended

by any IRS office? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Yes No

d If you answered “Yes” to (b) or (c), enter the name of the IRS office

2 a List the date your business started: Month Year

b Explain in detail your business activity.

3 For all other business entities to which you’re related, list:

a The name and EIN of the related entity,

b The percentage of ownership, and

c How you are related (for example, stock, partnership, etc.).

4 List all addresses of current business operations (include out-of-state or foreign operations, if applicable).

5 List the address where your books and records are kept (if different from the address in Part I).

6 List the names and taxpayer identification numbers (TINs) of all business owners, corporate officers, members, or partners.

7 List the name and phone number of a person whom we can contact about this application.

Section B—For All Fuel Applicants

If you’re applying for fuel activities K, M, , S, X,Y AB AF,AL,AM,CC NB, QR, SA, SB,UA,UB,UP , , , orUV, you must complete line 8.

8 Describe any changes in your ownership or changes of controlling stock ownership in the past 2 years. If none, enter “None.”

Also see Changes in Registration in the instructions.

Go to Section C on Page 2

For Privacy Act and Paperwork Reduction Act Notice, see instructions. Cat. No. 49952H Form 637 (Rev. 12-2022)