Enlarge image

Withholding Certificate OMB No. 1545-0074

Form W-4P for Periodic Pension or Annuity Payments

Department of the Treasury Give Form W-4P to the payer of your pension or annuity payments. 2023

Internal Revenue Service

Step 1: (a) First name and middle initial Last name (b) Social security number

Enter

Address

Personal

Information

City or town, state, and ZIP code

(c) Single orMarried filing separately

Married filing jointly orQualifying surviving spouse

Head of household (Check only if you’re unmarried and pay more than half the costs of keeping up a home for yourself and a qualifying individual.)

Complete Steps 2–4 ONLY if they apply to you; otherwise, skip to Step 5. See pages 2 and 3 for more information on each step

and how to elect to have no federal income tax withheld (if permitted).

Step 2: Complete this step if you (1) have income from a job or more than one pension/annuity, or (2) are married filing

Income jointly and your spouse receives income from a job or a pension/annuity. See page 2 for examples on how to

From a Job complete Step 2.

and/or Do only one of the following.

Multiple (a) Reserved for future use.

Pensions/

Annuities (b) Complete the items below.

(Including a (i) If you (and/or your spouse) have one or more jobs, then enter the total taxable annual pay

Spouse’s from all jobs, plus any income entered on Form W-4, Step 4(a), for the jobs less the

Job/ deductions entered on Form W-4, Step 4(b), for the jobs. Otherwise, enter “-0-” . . . $

Pension/ (ii) If you (and/or your spouse) have any other pensions/annuities that pay less annually than

Annuity) this one, then enter the total annual taxable payments from all lower-paying pensions/

annuities. Otherwise, enter “-0-” . . . . . . . . . . . . . . . . . . . $

(iii) Add the amounts from items (i) and (ii) and enter the total here . . . . . . . . . $

TIP: To be accurate, submit a new Form W-4P for all other pensions/annuities if you haven’t updated your

withholding since 2021 or this is a new pension/annuity that pays less than the other(s). Submit a new Form W-4 for

your job(s) if you have not updated your withholding since 2019. If you have self-employment income, see page 2.

Complete Steps 3–4(b) on this form only if (b)(i) is blank and this pension/annuity pays the most annually. Otherwise, do not complete

Steps 3–4(b) on this form.

Step 3: If your total income will be $200,000 or less ($400,000 or less if married filing jointly):

Claim Multiply the number of qualifying children under age 17 by $2,000 $

Dependent

and Other Multiply the number of other dependents by $500 . . . . . . $

Credits Add other credits, such as foreign tax credit and education tax credits $

Add the amounts for qualifying children, other dependents, and other credits and enter the

total here . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 $

Step 4 (a) Other income (not from jobs or pension/annuity payments). If you want tax withheld

(optional): on other income you expect this year that won’t have withholding, enter the amount of

Other other income here. This may include interest, taxable social security, and dividends . 4(a) $

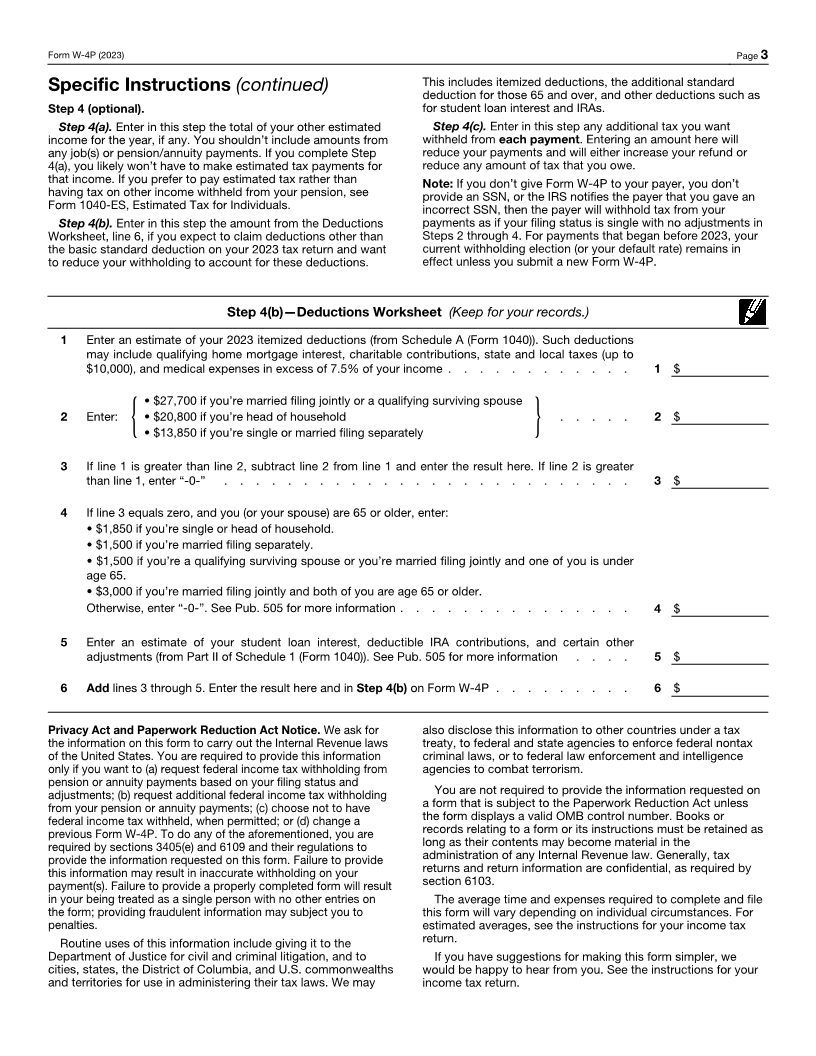

Adjustments (b) Deductions. If you expect to claim deductions other than the basic standard deduction

and want to reduce your withholding, use the Deductions Worksheet on page 3 and

enter the result here . . . . . . . . . . . . . . . . . . . . . . 4(b) $

(c) Extra withholding. Enter any additional tax you want withheld from each payment . 4(c) $

Step 5:

Sign

Here Your signature (This form is not valid unless you sign it.) Date

For Privacy Act and Paperwork Reduction Act Notice, see page 3. Cat. No. 10225T Form W-4P (2023)