Enlarge image

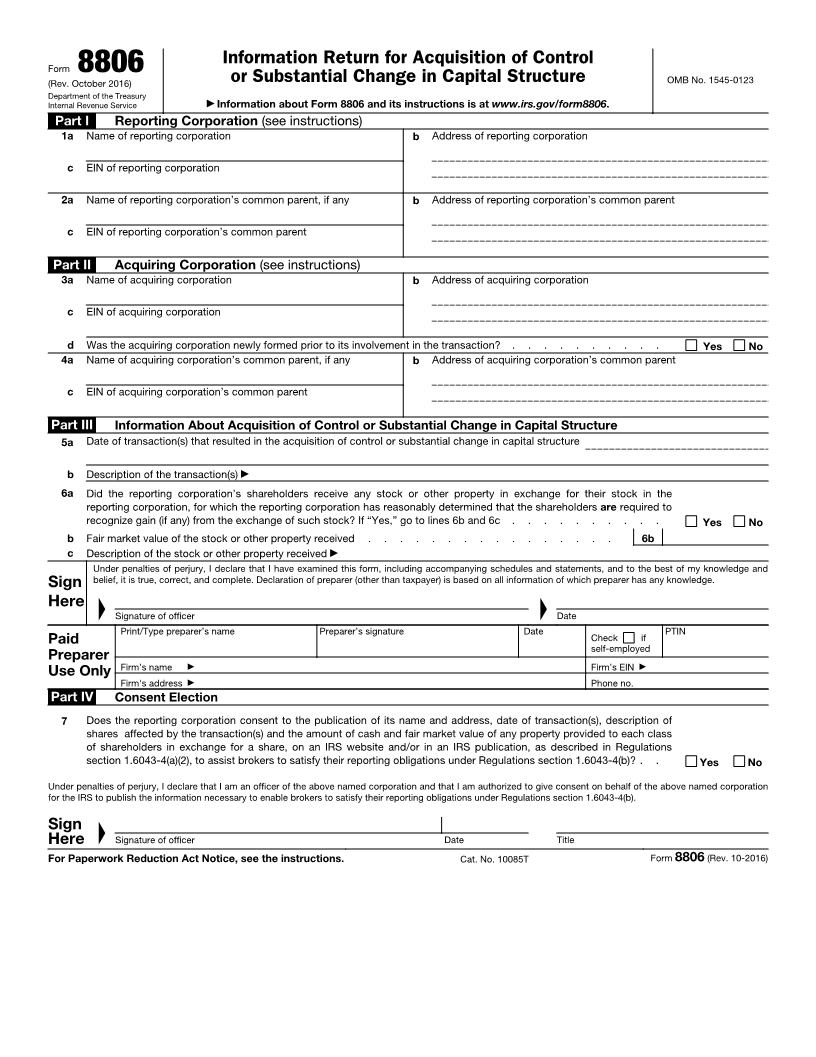

Information Return for Acquisition of Control

Form 8806 OMB No. 1545-0123

(Rev. October 2016) or Substantial Change in Capital Structure

Department of the Treasury

Internal Revenue Service ▶ Information about Form 8806 and its instructions is at www.irs.gov/form8806.

Part I Reporting Corporation (see instructions)

1a Name of reporting corporation b Address of reporting corporation

c EIN of reporting corporation

2a Name of reporting corporation’s common parent, if any b Address of reporting corporation’s common parent

c EIN of reporting corporation’s common parent

Part II Acquiring Corporation (see instructions)

3a Name of acquiring corporation b Address of acquiring corporation

c EIN of acquiring corporation

d Was the acquiring corporation newly formed prior to its involvement in the transaction? . . . . . . . . . . Yes No

4a Name of acquiring corporation’s common parent, if any b Address of acquiring corporation’s common parent

c EIN of acquiring corporation’s common parent

Part III Information About Acquisition of Control or Substantial Change in Capital Structure

5a Date of transaction(s) that resulted in the acquisition of control or substantial change in capital structure

b Description of the transaction(s) ▶

6a Did the reporting corporation’s shareholders receive any stock or other property in exchange for their stock in the

reporting corporation, for which the reporting corporation has reasonably determined that the shareholders are required to

recognize gain (if any) from the exchange of such stock? If “Yes,” go to lines 6b and 6c . . . . . . . . . . Yes No

b Fair market value of the stock or other property received . . . . . . . . . . . . . . . . 6b

c Description of the stock or other property received ▶

Under penalties of perjury, I declare that I have examined this form, including accompanying schedules and statements, and to the best of my knowledge and

Sign belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

▲ ▲

Here

Signature of officer Date

Print/Type preparer’s name Preparer’s signature Date PTIN

Paid Check if

self-employed

Preparer

Use Only Firm’s name ▶ Firm’s EIN ▶

Firm's address ▶ Phone no.

Part IV Consent Election

7 Does the reporting corporation consent to the publication of its name and address, date of transaction(s), description of

shares affected by the transaction(s) and the amount of cash and fair market value of any property provided to each class

of shareholders in exchange for a share, on an IRS website and/or in an IRS publication, as described in Regulations

section 1.6043-4(a)(2), to assist brokers to satisfy their reporting obligations under Regulations section 1.6043-4(b)? . . Yes No

Under penalties of perjury, I declare that I am an officer of the above named corporation and that I am authorized to give consent on behalf of the above named corporation

for the IRS to publish the information necessary to enable brokers to satisfy their reporting obligations under Regulations section 1.6043-4(b).

▲

Sign

Here Signature of officer Date Title

For Paperwork Reduction Act Notice, see the instructions. Cat. No. 10085T Form 8806 (Rev. 10-2016)