Enlarge image

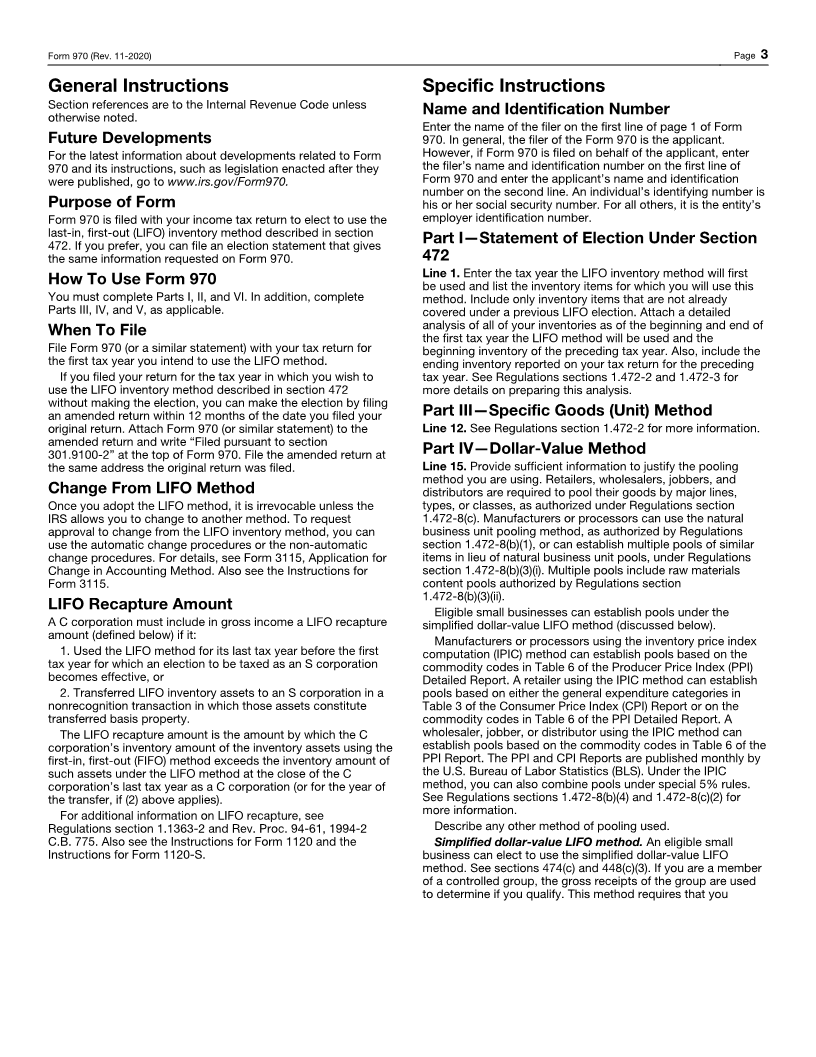

Form 970 Application To Use LIFO Inventory Method OMB No. 1545-0042

(Rev. November 2020) ▶ Attach to your tax return. Attachment

Department of the Treasury ▶ Go to www.irs.gov/Form970 for the latest information. Sequence No. 122

Internal Revenue Service

Name of filer (name of parent corporation if a consolidated group) (see instructions) Filer’s identification number (see instructions)

Name of applicant(s) (if different from filer) and identification number(s)

Part I Statement of Election Under Section 472 Yes No

1 The applicant elects to use the LIFO inventory method for the tax year ending (enter month, day, year) ▶

for the following goods (enter here):

See instructions and attach a statement if necessary.

2 In an attached statement, identify and describe the inventory method(s) used by the applicant in the prior tax year

for the goods covered by this election.

3 a Is the applicant already using the LIFO inventory method for any other goods? . . . . . . . . . . . .

b If “Yes” to line 3a, attach a statement identifying and describing the goods and the LIFO methods used.

4 a Has the applicant ever used the LIFO inventory method for the goods covered by this election? . . . . . .

b If “Yes” to line 4a, attach a statement listing the tax years for which the LIFO inventory method was used and

explaining why the LIFO inventory method was discontinued.

5 The applicant will not use the LIFO inventory method to account for the following goods (enter here): ▶

Attach a statement if necessary.

Part II LIFO Inventory Requirements Yes No

6 a Did the applicant value the closing inventories of goods covered by this election at cost for the tax year

immediately preceding the tax year specified on line 1? . . . . . . . . . . . . . . . . . . .

b If “No” to line 6a, did the applicant value the beginning inventories of goods covered by this election at cost for

the tax year specified on line 1 as required by section 472(d)? . . . . . . . . . . . . . . . . .

If “No” to line 6b, attach an explanation.

c If “Yes” to line 6b, will the applicant account for the adjustment required by section 472(d) over a 3-year period?

If “No” to line 6c, attach an explanation.

7 a When determining the beginning inventories of goods covered by this election, did the applicant treat those goods

as being acquired for a unit cost that is equal to the total cost of those goods divided by the total number of units

on hand? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b If “No” to line 7a, attach an explanation.

8 a Did the applicant (or any member of the same group of financially related corporations as defined in section

472(g)) issue credit statements or reports to shareholders, partners, other proprietors, or beneficiaries covering the

tax year specified on line 1? . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b If “Yes” to line 8a, attach a statement describing the recipient(s), the date(s) of issuance, and the inventory

method(s) used to determine income, profit, or loss in those statements.

9 a Will the applicant determine beginning and ending inventories at cost regardless of market value? . . . . .

b If “No” to line 9a, attach an explanation.

10 a As a condition of adopting the LIFO inventory method, Regulations section 1.472-4 requires a taxpayer to agree

to make any adjustments incident to the change to, the change from, or the use of, the LIFO inventory method

that, upon the examination of the taxpayer’s income tax return, the IRS determines are necessary to clearly reflect

income. Does the applicant agree to this condition? . . . . . . . . . . . . . . . . . . . . .

b If “No” to line 10a, the applicant is not eligible to use the LIFO inventory method and does not need to file Form 970.

Part III Specific Goods (Unit) Method

11 Under Regulations section 1.472-1, the types of goods in the opening inventory must be compared with similar types of goods

in the closing inventories. Attach a list of the types or categories of goods that will be compared, describe the goods that will

be included in each type or category, and identify the unit of measure (pounds, barrels, feet, etc.) used for each type or

category.

For Paperwork Reduction Act Notice, see the instructions. Cat. No. 17057T Form 970 (Rev. 11-2020)