Enlarge image

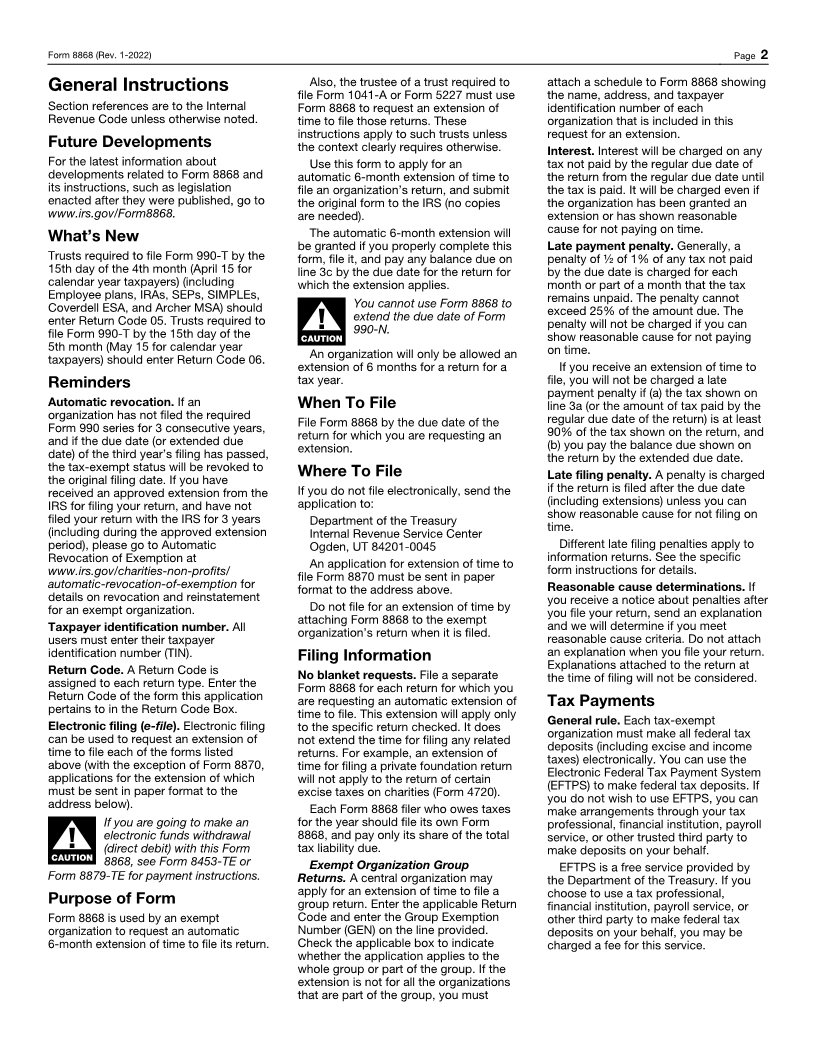

Application for Automatic Extension of Time To File an

Form 8868

Exempt Organization Return

(Rev. January 2022) OMB No. 1545-0047

Department of the Treasury ▶ File a separate application for each return.

Internal Revenue Service ▶ Go to www.irs.gov/Form8868 for the latest information.

Electronic filing (e-file). You can electronically file Form 8868 to request a 6-month automatic extension of time to file any of the

forms listed below with the exception of Form 8870, Information Return for Transfers Associated With Certain Personal Benefit

Contracts, for which an extension request must be sent to the IRS in paper format (see instructions). For more details on the electronic

filing of this form, visit www.irs.gov/e-file-providers/e-file-for-charities-and-non-profits.

Automatic 6-Month Extension of Time. Only submit original (no copies needed).

All corporations required to file an income tax return other than Form 990-T (including 1120-C filers), partnerships, REMICs, and trusts

must use Form 7004 to request an extension of time to file income tax returns.

Type or Name of exempt organization or other filer, see instructions. Taxpayer identification number (TIN)

print

File by the Number, street, and room or suite no. If a P.O. box, see instructions.

due date for

filing your City, town or post office, state, and ZIP code. For a foreign address, see instructions.

return. See

instructions.

Enter the Return Code for the return that this application is for (file a separate application for each return) . . . . . .

Application Return Application Return

Is For Code Is For Code

Form 990 or Form 990-EZ 01 Form 1041-A 08

Form 4720 (individual) 03 Form 4720 (other than individual) 09

Form 990-PF 04 Form 5227 10

Form 990-T (sec. 401(a) or 408(a) trust) 05 Form 6069 11

Form 990-T (trust other than above) 06 Form 8870 12

Form 990-T (corporation) 07

• The books are in the care of ▶

Telephone No. ▶ Fax No. ▶

• If the organization does not have an office or place of business in the United States, check this box . . . . . . . . . ▶

• If this is for a Group Return, enter the organization’s four digit Group Exemption Number (GEN) . If this is

for the whole group, check this box . . . ▶ . If it is for part of the group, check this box . . . . ▶ and attach

a list with the names and TINs of all members the extension is for.

1 I request an automatic 6-month extension of time until , 20 , to file the exempt organization return for

the organization named above. The extension is for the organization’s return for:

▶ calendar year 20 or

▶ tax year beginning , 20 , and ending , 20 .

2 If the tax year entered in line 1 is for less than 12 months, check reason: Initial return Final return

Change in accounting period

3 a If this application is for Forms 990-PF, 990-T, 4720, or 6069, enter the tentative tax, less any

nonrefundable credits. See instructions. 3a $

b If this application is for Forms 990-PF, 990-T, 4720, or 6069, enter any refundable credits and

estimated tax payments made. Include any prior year overpayment allowed as a credit. 3b $

c Balance due. Subtract line 3b from line 3a. Include your payment with this form, if required, by

using EFTPS (Electronic Federal Tax Payment System). See instructions. 3c $

Caution: If you are going to make an electronic funds withdrawal (direct debit) with this Form 8868, see Form 8453-TE and Form 8879-TE for payment

instructions.

For Privacy Act and Paperwork Reduction Act Notice, see instructions. Cat. No. 27916D Form 8868 (Rev. 1-2022)