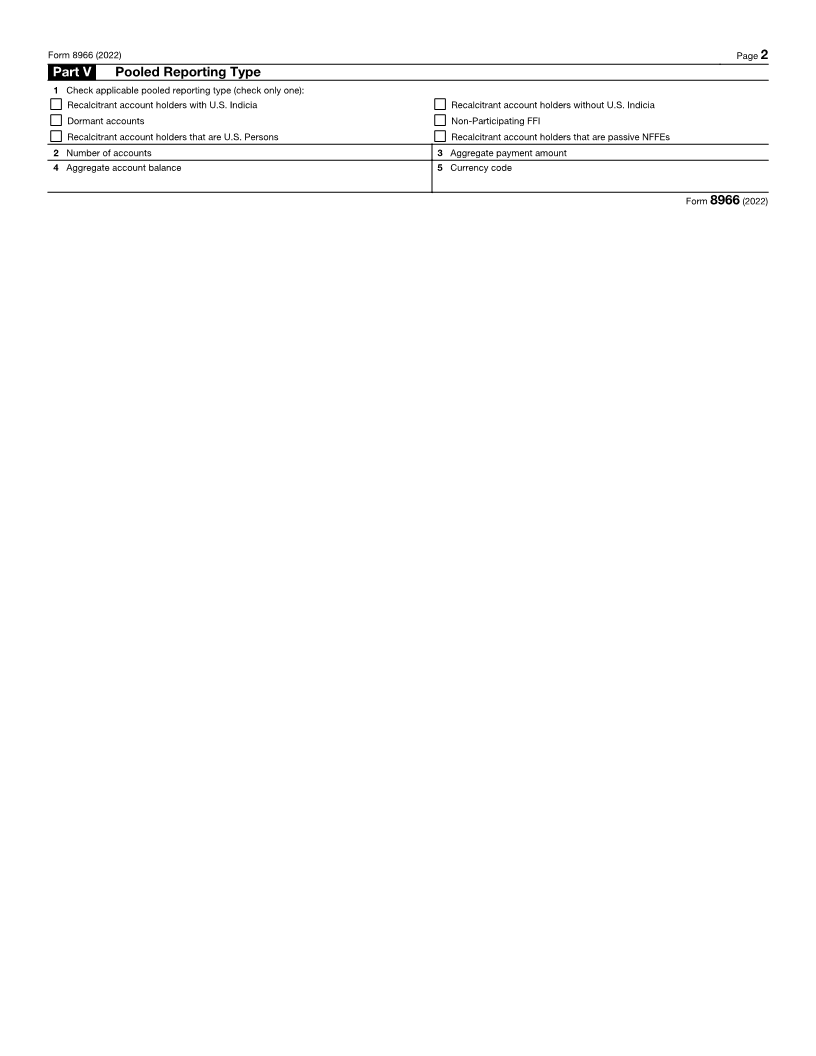

Enlarge image

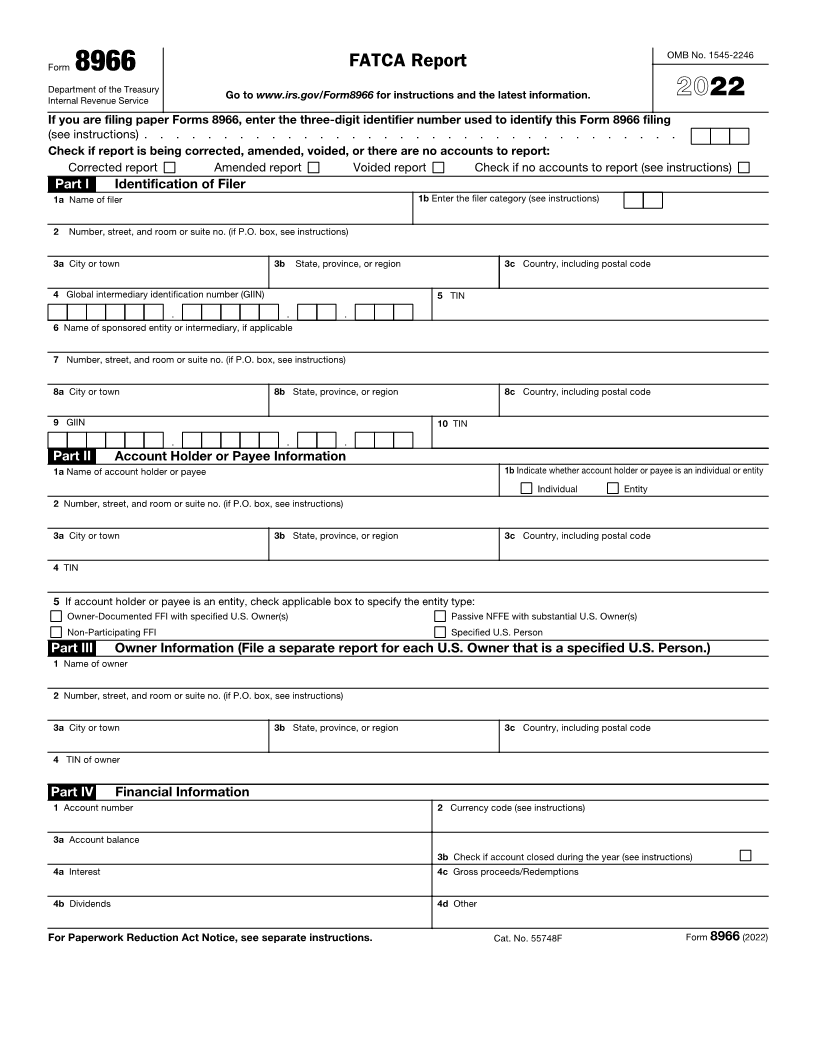

OMB No. 1545-2246

Form 8966 FATCA Report

Department of the Treasury

Internal Revenue Service Go to www.irs.gov/Form8966 for instructions and the latest information. 2022

If you are filing paper Forms 8966, enter the three-digit identifier number used to identify this Form 8966 filing

(see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Check if report is being corrected, amended, voided, or there are no accounts to report:

Corrected report Amended report Voided report Check if no accounts to report (see instructions)

Part I Identification of Filer

1a Name of filer 1b Enter the filer category (see instructions)

2 Number, street, and room or suite no. (if P.O. box, see instructions)

3a City or town 3b State, province, or region 3c Country, including postal code

4 Global intermediary identification number (GIIN) 5 TIN

. . .

6 Name of sponsored entity or intermediary, if applicable

7 Number, street, and room or suite no. (if P.O. box, see instructions)

8a City or town 8b State, province, or region 8c Country, including postal code

9 GIIN 10 TIN

. . .

Part II Account Holder or Payee Information

1a Name of account holder or payee 1b Indicate whether account holder or payee is an individual or entity

Individual Entity

2 Number, street, and room or suite no. (if P.O. box, see instructions)

3a City or town 3b State, province, or region 3c Country, including postal code

4 TIN

5 If account holder or payee is an entity, check applicable box to specify the entity type:

Owner-Documented FFI with specified U.S. Owner(s) Passive NFFE with substantial U.S. Owner(s)

Non-Participating FFI Specified U.S. Person

Part III Owner Information (File a separate report for each U.S. Owner that is a specified U.S. Person.)

1 Name of owner

2 Number, street, and room or suite no. (if P.O. box, see instructions)

3a City or town 3b State, province, or region 3c Country, including postal code

4 TIN of owner

Part IV Financial Information

1 Account number 2 Currency code (see instructions)

3a Account balance

3b Check if account closed during the year (see instructions)

4a Interest 4c Gross proceeds/Redemptions

4b Dividends 4d Other

For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 55748F Form 8966 (2022)