Enlarge image

OMB No. 1545-0155

Investment Credit

Form 3468

Attach to your tax return.

Department of the Treasury Go to www.irs.gov/Form3468 for instructions and the latest information. Attachment 2022

Internal Revenue Service Sequence No. 174

Name(s) shown on return Identifying number

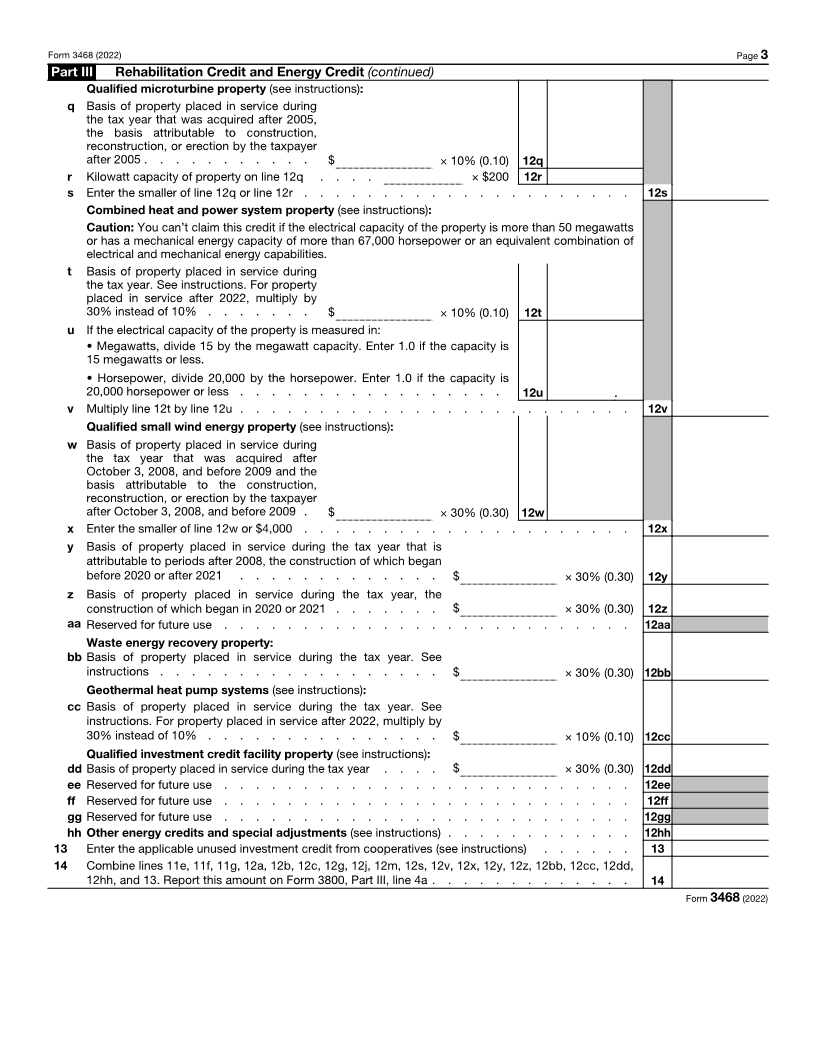

Part I Information Regarding the Election To Treat the Lessee as the Purchaser of Investment Credit Property

If you are claiming the investment credit as a lessee based on a section 48(d) (as in effect on November 4, 1990) election, provide the

following information. If you acquired more than one property as a lessee, attach a statement showing the information below.

1 Name of lessor:

2 Address of lessor:

3 Description of property:

4 Amount for which you were treated as having acquired the property . . . . . . . . . . . . . $

Part II Qualifying Advanced Coal Project Credit, Qualifying Gasification Project Credit, Qualifying Advanced

Energy Project Credit, and Advanced Manufacturing Investment Credit

5 Qualifying advanced coal project credit (see instructions):

a Qualified investment in integrated

gasification combined cycle property placed

in service during the tax year for projects

described in section 48A(d)(3)(B)(i) . . . $ × 20% (0.20) 5a

b Qualified investment in advanced coal-

based generation technology property

placed in service during the tax year for

projects described in section 48A(d)(3)(B)(ii) $ × 15% (0.15) 5b

c Qualified investment in advanced coal-

based generation technology property

placed in service during the tax year for

projects described in section 48A(d)(3)(B)(iii) $ × 30% (0.30) 5c

d Total. Add lines 5a, 5b, and 5c . . . . . . . . . . . . . . . . . . . . . . . . 5d

6 Qualifying gasification or advanced energy project credit (see instructions):

a Qualified investment in property placed in

service during the tax year (a) of advanced

energy project property or (b) of qualified

gasification property for which credits

were allocated or reallocated after October

3, 2008, and that includes equipment that

separates and sequesters at least 75% of

the project’s carbon dioxide emissions . $ × 30% (0.30) 6a

b Qualified investment in property other than

in 6a above placed in service during the

tax year . . . . . . . . . . . $ × 20% (0.20) 6b

c Total. Add lines 6a and 6b . . . . . . . . . . . . . . . . . . . . . . . . . 6c

7 Advanced manufacturing investment credit (see instructions):

Basis in qualified property as part of an advanced manufacturing

facility, placed in service during the tax year and after 2022, the

construction of which began after August 9, 2022 . . . . . $ × 25% (0.25) 7

8 Reserved for future use . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Enter the applicable unused investment credit from cooperatives (see instructions) . . . . . . 9

10 Add lines 5d, 6c, 7, and 9. Report this amount on Form 3800, Part III, line 1a (see instructions if you

entered an amount on line 7) . . . . . . . . . . . . . . . . . . . . . . . . 10

For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 12276E Form 3468 (2022)