- 4 -

Enlarge image

|

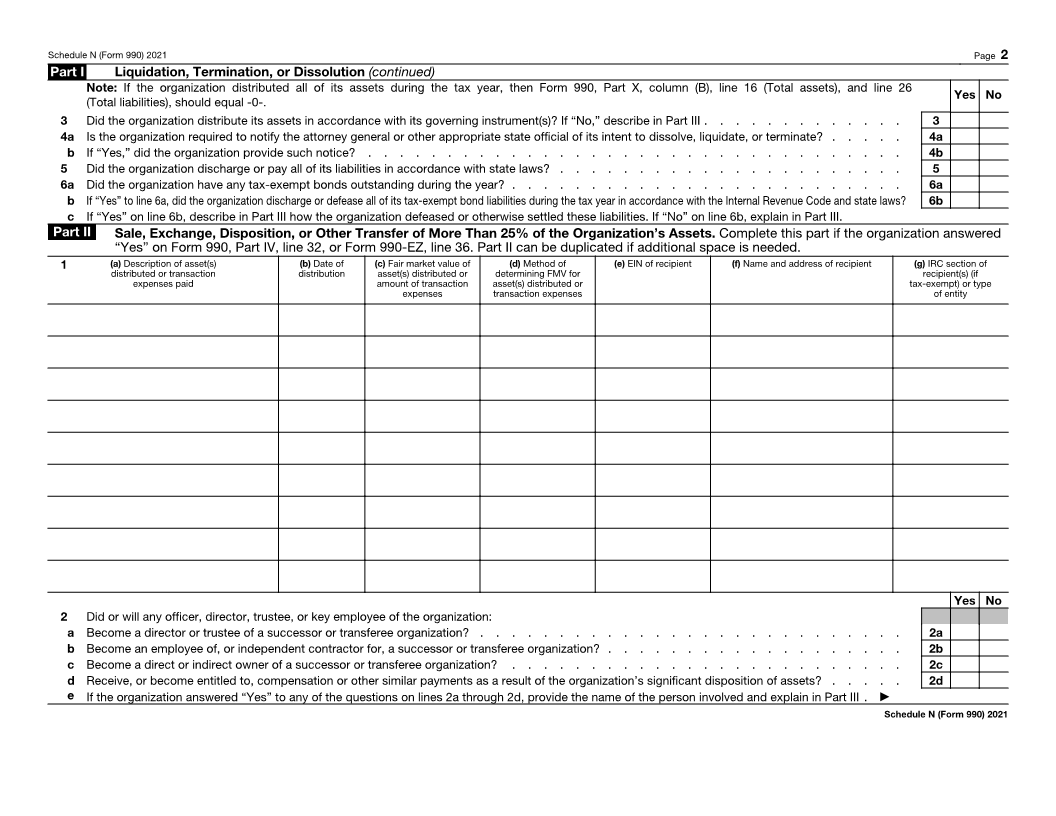

Schedule N (Form 990) 2021 Page 4

General Instructions An organization must support any limited liability companies (LLCs). Report

claim to have liquidated, “individual” if the recipient isn’t an entity.

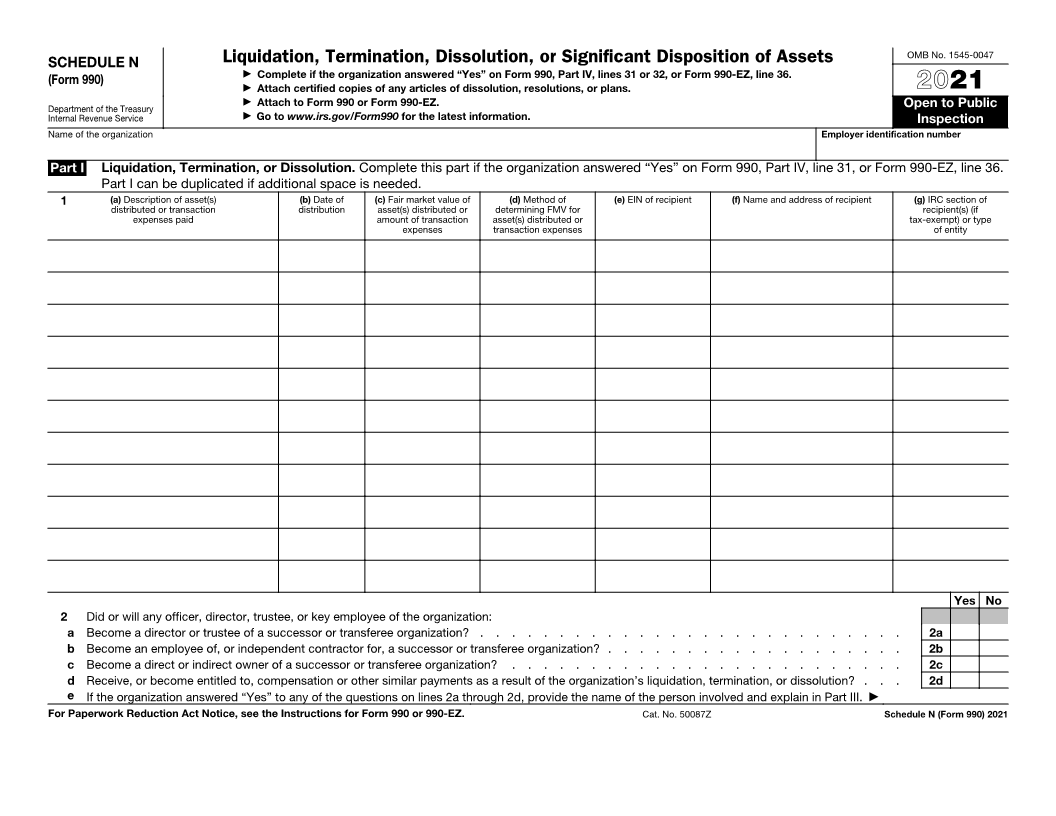

Section references are to the Internal Revenue terminated, dissolved, or merged Line 2. Report whether any officer, director,

Code unless otherwise noted. ▲!

CAUTION by attaching a certified copy of its trustee, orkey employee listed in Form 990,

Future developments. For the latest articles of dissolution or merger. Part VII, Section A, is (or is expected to

information about developments related to If a certified copy of its articles of dissolution become) involved in a successor or transferee

Schedule N (Form 990), such as legislation or merger isn’t available, the organization may organization by governing, controlling, or

enacted after the schedule and its instructions submit resolutions of its governing board having a financial interest in that organization.

were published, go to www.IRS.gov/Form990. approving dissolution or merger, and/or plans “Having a financial interest” includes

Note: Terms in bold are defined in the of liquidation or merger approved by its receiving payments from a successor or

Glossary of the Instructions for Form 990. governing board. An organization filing transferee organization as an employee,

Schedule N shouldn’t report its liquidation, independent contractor, or in any other

Purpose of Schedule termination, or dissolution in a letter to IRS capacity.

Exempt Organizations, Determinations (“EO

Schedule N (Form 990) is used by an Determinations”). EO Determinations no Line 2a. Check “Yes” if any officer, director,

organization that files Form 990 or Form 990- longer issues letters confirming that the trustee, or key employee listed in Form 990,

EZ to report going out of existence or organization’s tax-exempt status was Part VII, Section A, is (or is expected to

disposing of more than 25% of its net assets terminated upon its liquidation, termination, or become) a director or trustee of a successor

through sale, exchange, or other disposition. dissolution. or transferee organization.

An organization that completely liquidated, Line 1. List assets transferred in the Line 2b. Check “Yes” if any officer,

terminated, or dissolved and ceased liquidation, termination, dissolution, or director, trustee, or key employee listed in

operations during the tax year must complete merger. Form 990, Part VII, Section A, is (or is

Part I. An organization that was still in the expected to become) an employee of, or

process of winding up its affairs at the end of If there are more transactions to report in independent contractor for, a successor or

the tax year, but hadn’t completely liquidated, Part I than space available, Part I can be transferee organization.

terminated, or dissolved and ceased duplicated to report the additional

operations, shouldn’t complete Part I, but transactions. Line 2c. Check “Yes” if any officer, director,

trustee, or key employee listed on Form 990,

may need to complete Part II. An organization Column (a). Assets should be aggregated Part VII, Section A, is (or is expected to

that has made a significant disposition of into categories and should be sufficiently become) an owner, whether direct or indirect,

net assets must complete Part II. For an described. Separately list related transaction in a successor or transferee organization.

organization filing Form 990-EZ, see the expenses of at least $10,000. A transaction

Instructions for Form 990-EZ, line 36, for Part expense consists of a payment to a Line 2d.Check “Yes” if any officer, director,

II reporting requirements. An organization that professional or other third party for services trustee, or key employee listed on Form 990,

has terminated its operations and has no rendered to assist in the transaction or in the Part VII, Section A, has received or is expected

plans for future activities must complete only winding down of the organization’s activities, to receive “compensation or other similar

Part I and not Part II of this schedule. such as attorney or accountant fees. payment” as a result of the liquidation,

If there are more transactions to report in Brokerage fees shouldn’t be included as termination, or dissolution of the organization,

Parts I and II than space available, those parts transaction expenses in column (a), but whether paid by the organization or a

can be duplicated to report the additional should be included in the fair market value successor or transferee organization. For this

transactions. Use Part III to report additional (FMV) amount in column (c). purpose, “compensation or other similar

payment” includes a severance payment, a

narrative information. See Part III instructions Column (b). Enter the date the assets were “change in control” payment, or any other

later. distributed or the date when the transaction payment that wouldn’t have been made to the

expense was paid. individual if the dissolution, liquidation, or

Who Must File Column (c). Enter the FMV of the asset termination of the organization hadn’t occurred.

Any organization that answered “Yes” to Form distributed or the amount of transaction Line 2e. If the organization checked “Yes”

990, Part IV,Checklist of Required Schedules, expense paid. to any of the other questions on lines 2a

line 31 or 32, or Form 990-EZ, line 36, must Column (d). Enter the method of valuation through 2d, provide the name of the person

complete and attach Schedule N to Form 990 for the asset being distributed. Methods of involved, and explain in Part III the nature of

or Form 990-EZ, as applicable. valuation include appraisals, comparables, the listed person’s relationship with the

If an organization isn’t required to file Form book value, actual cost (with or without successor or transferee organization and the

990 or Form 990-EZ but chooses to do so, it depreciation), and outstanding offers (among type of benefit received or to be received by

must file a complete return and provide all of other methods). For transaction expenses, the person.

the information requested, including the provide the method for determining the Line 3. Check “Yes” if the organization’s

required schedules. amount of the expense, such as an hourly rate assets were distributed in accordance with its

or fixed fee. governing instrument.

Specific Instructions Columns (e) and (f). Enter the EIN, name, Line 4a. Check “Yes” if the organization is

and address of each recipient of assets required to notify a state attorney general or

Part I. Liquidation, Termination, or distributed or transaction expenses paid. other appropriate state official of the

Dissolution Don’t enter social security numbers of organization’s intent to dissolve, liquidate, or

individual recipients. For membership terminate.

If the organization answered “Yes” to Form organizations that transfer assets to individual

990, Part IV, line 31, it must complete Part I. If members, the names of individual members Line 4b. Check “Yes” if the organization

the organization answered “Yes” to Form needn’t be reported. Rather, the members provided the notice described in line 4a.

990-EZ, line 36, because it fully liquidated, may be aggregated into specific classes of Line 5. Check “Yes” if the organization

dissolved, or terminated during the tax year, it membership, or they may be aggregated into discharged or paid all of its liabilities in

must complete Part I. An organization must one group, if there is only one class of accordance with state law.

answer “Yes” to either of these lines if it has membership. Line 6a. Check “Yes” and complete line 6b if

ceased operations and has no plans to Column (g).Enter the section of the Internal the organization had any tax-exempt bonds

continue any activities or operations in the Revenue Code under which the transferee outstanding during the year.

future. This includes an organization that has organization is tax-exempt (for instance, section Line 6b. Check “Yes” and complete line 6c if

dissolved, liquidated, terminated, or merged 501(c)(3) or 501(c)(4)), if it is exempt. For the organization discharged or defeased all of

into a successor organization. recipients that aren’t tax-exempt under a its tax-exempt bond liabilities during the tax

particular section of the Code, enter the type of year. Leave line 6b blank if the answer to

entity. Examples of types of entities are line 6a is “No.”

government agencies orgovernmental units,or

|