Enlarge image

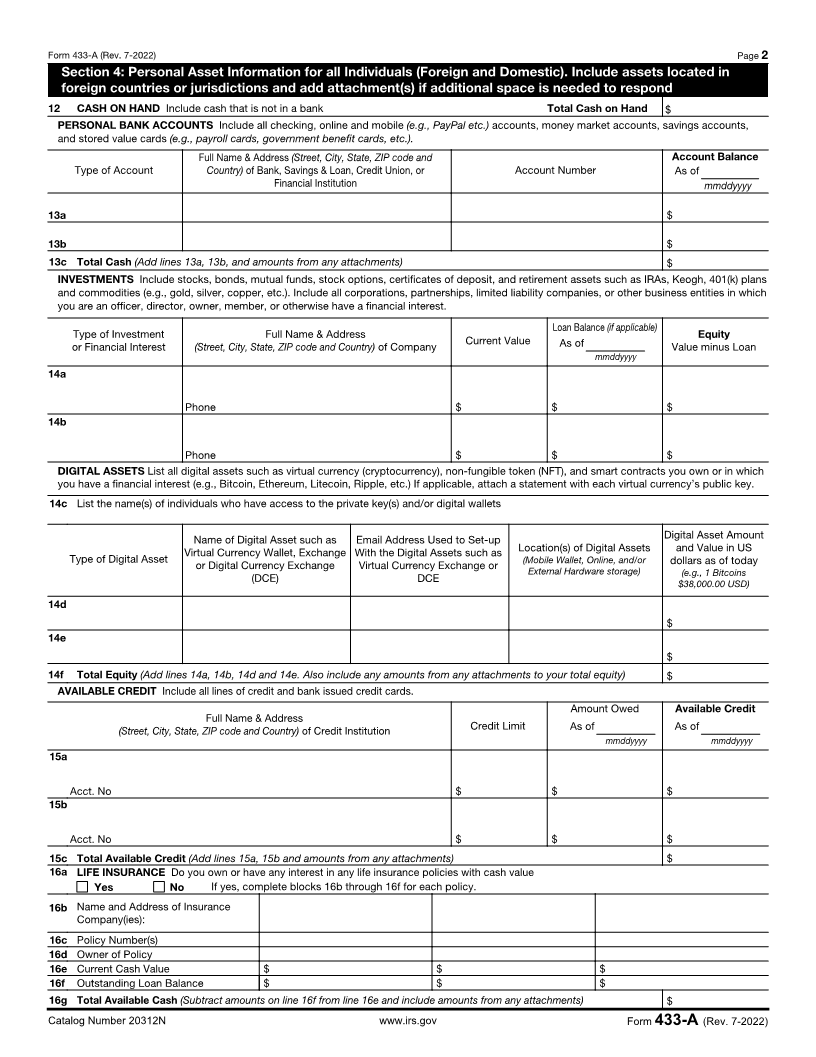

Form 433-A Collection Information Statement for Wage

(July 2022)

Department of the Treasury Earners and Self-Employed Individuals

Internal Revenue Service

Wage Earners Complete Sections 1, 2, 3, 4, and 5 including the signature line on page 4. Answer all questions or write N/A if the question is not applicable.

Self-Employed Individuals Complete Sections 1, 3, 4, 5, 6 and 7 and the signature line on page 4. Answer all questions or write N/A if the question is not applicable.

For Additional Information, refer to Publication 1854, "How To Prepare a Collection Information Statement."

Include attachments if additional space is needed to respond completely to any question.

Section 1: Personal Information

1a Full Name of Taxpayer and Spouse (if applicable) 2c Provide information on all other persons in household or claimed as

dependents

1b Address (street, city, state, ZIP code and country) Name Age Relationship

3a Do you or your spouse have any outside business interests? Include

any interest in an LLC, LLP, corporation, partnership, etc.

1c County of Residence 1d Home Phone

( ) Yes (percentage of ownership %) No

1e Cell Phone 1f Work Phone Title

( ) ( ) 3b Business name

2a Marital Status: Married Unmarried (Single, Divorced, Widowed)

2b SSN or ITIN Date of Birth (mmddyyyy) 3c Type of business (select one)

Taxpayer Partnership LLC Corporation

Spouse Other

Section 2: Employment Information for Wage Earners

If you or your spouse have self-employment income instead of, or in addition to wage income, complete Business Information in Sections 6 and 7.

Taxpayer Spouse

4a Taxpayer's Employer Name 5a Spouse's Employer Name

4b Address (street, city, state, ZIP code and country) 5b Address (street, city, state, ZIP code and country)

4c Work Telephone Number 4d Does employer allow contact at work 5c Work Telephone Number 5d Does employer allow contact at work

( ) Yes No ( ) Yes No

4e How long with this employer 4f Occupation 5e How long with this employer 5f Occupation

(years) (months) (years) (months)

4g Number claimed as a dependent 4h Pay Period: 5g Number claimed as a dependent 5h Pay Period:

on your Form 1040 Weekly Bi-weekly on your Form 1040 Weekly Bi-weekly

Monthly Other Monthly Other

Section 3: Other Financial Information (Attach copies of applicable documentation)

6 Are you a party to a lawsuit (If yes, answer the following) Yes No

Location of Filing Represented by Docket/Case No.

Plaintiff Defendant

Amount of Suit Possible Completion Date (mmddyyyy) Subject of Suit

$

7 Have you ever filed bankruptcy (If yes, answer the following) Yes No

Date Filed (mmddyyyy) Date Dismissed (mmddyyyy) Date Discharged (mmddyyyy) Petition No. Location Filed

8 In the past 10 years, have you lived outside of the U.S for 6 months or longer (If yes, answer the following) Yes No

Dates lived abroad: from (mmddyyyy) To (mmddyyyy)

9a Are you the beneficiary of a trust, estate, or life insurance policy including those located in foreign countries or Yes No

jurisdictions (If yes, answer the following)

Place where recorded: EIN:

Name of the trust, estate, or policy Anticipated amount to be received When will the amount be received

$

9b Are you a trustee, fiduciary, or contributor of a trust Yes No

Name of the trust: EIN:

10 Do you have a safe deposit box (business or personal) including those located in foreign countries or jurisdictions Yes No

(If yes, answer the following)

Location (Name, address and box number(s)) Contents Value

$

11 In the past 10 years, have you transferred any assets with a fair market value of more than $10,000 including real Yes No

property, for less than their full value (if yes, answer the following)

List Asset(s) Value at Time of Transfer Date Transferred (mmddyyyy) To Whom or Where was it Transferred

$

Catalog Number 20312N www.irs.gov Form 433-A (Rev. 7-2022)