Enlarge image

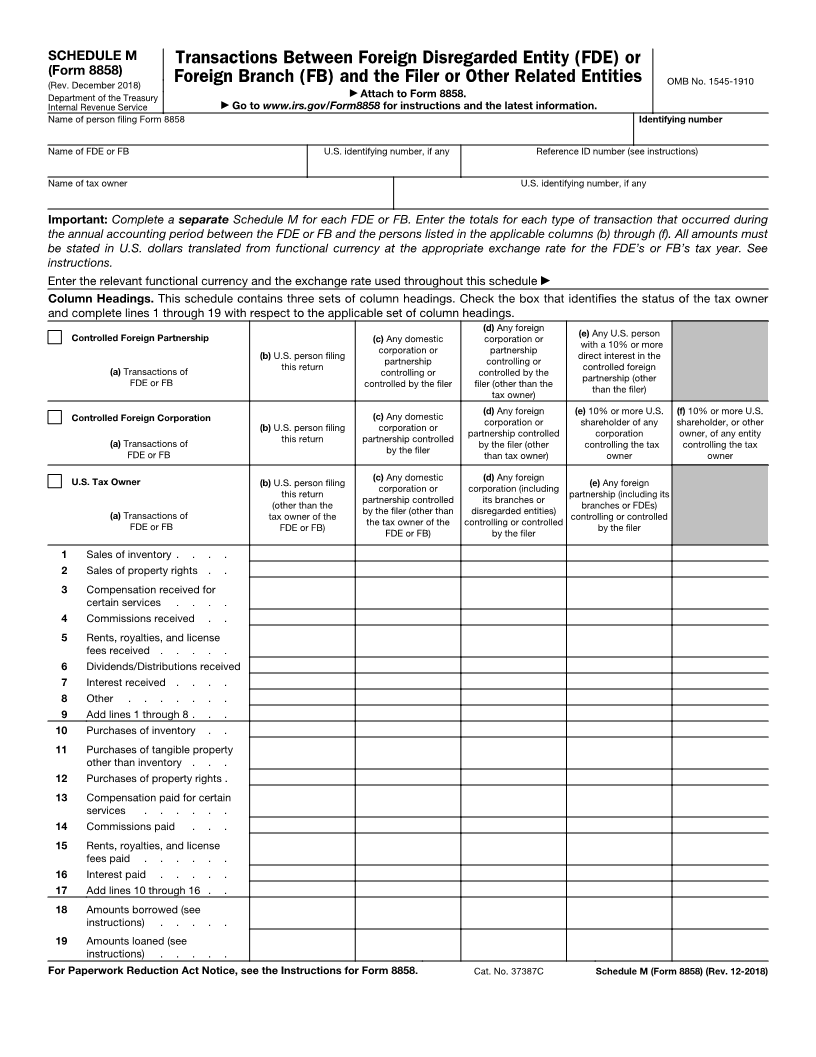

SCHEDULE M Transactions Between Foreign Disregarded Entity (FDE) or

(Form 8858)

(Rev. December 2018) Foreign Branch (FB) and the Filer or Other Related Entities OMB No. 1545-1910

Department of the Treasury ▶ Attach to Form 8858.

Internal Revenue Service ▶ Go to www.irs.gov/Form8858 for instructions and the latest information.

Name of person filing Form 8858 Identifying number

Name of FDE or FB U.S. identifying number, if any Reference ID number (see instructions)

Name of tax owner U.S. identifying number, if any

Important: Complete a separate Schedule M for each FDE or FB. Enter the totals for each type of transaction that occurred during

the annual accounting period between the FDE or FB and the persons listed in the applicable columns (b) through (f). All amounts must

be stated in U.S. dollars translated from functional currency at the appropriate exchange rate for the FDE’s or FB’s tax year. See

instructions.

Enter the relevant functional currency and the exchange rate used throughout this schedule ▶

Column Headings. This schedule contains three sets of column headings. Check the box that identifies the status of the tax owner

and complete lines 1 through 19 with respect to the applicable set of column headings.

(d) Any foreign

Controlled Foreign Partnership (c) Any domestic corporation or (e) Any U.S. person

(b) U.S. person filing corporation or partnership with a 10% or more

(a) Transactions of this return partnership controlling or direct interest in the

controlling or controlled by the controlled foreign

FDE or FB controlled by the filer filer (other than the partnership (other

tax owner) than the filer)

Controlled Foreign Corporation (c) Any domestic (d) Any foreign (e) 10% or more U.S. (f) 10% or more U.S.

(b) U.S. person filing corporation or corporation or shareholder of any shareholder, or other

(a) Transactions of this return partnership controlled partnership controlled corporation owner, of any entity

FDE or FB by the filer by the filer (other controlling the tax controlling the tax

than tax owner) owner owner

U.S. Tax Owner (b) U.S. person filing (c) Any domestic (d) Any foreign (e) Any foreign

this return corporation or corporation (including partnership (including its

(other than the partnership controlled its branches or

(a) Transactions of tax owner of the by the filer (other than disregarded entities) branches or FDEs)

FDE or FB FDE or FB) the tax owner of the controlling or controlled controlling or controlled

FDE or FB) by the filer by the filer

1 Sales of inventory . . . .

2 Sales of property rights . .

3 Compensation received for

certain services . . . .

4 Commissions received . .

5 Rents, royalties, and license

fees received . . . . .

6 Dividends/Distributions received

7 Interest received . . . .

8 Other . . . . . . .

9 Add lines 1 through 8 . . .

10 Purchases of inventory . .

11 Purchases of tangible property

other than inventory . . .

12 Purchases of property rights .

13 Compensation paid for certain

services . . . . . .

14 Commissions paid . . .

15 Rents, royalties, and license

fees paid . . . . . .

16 Interest paid . . . . .

17 Add lines 10 through 16 . .

18 Amounts borrowed (see

instructions) . . . . .

19 Amounts loaned (see

instructions) . . . . .

For Paperwork Reduction Act Notice, see the Instructions for Form 8858. Cat. No. 37387C Schedule M (Form 8858) (Rev. 12-2018)