Enlarge image

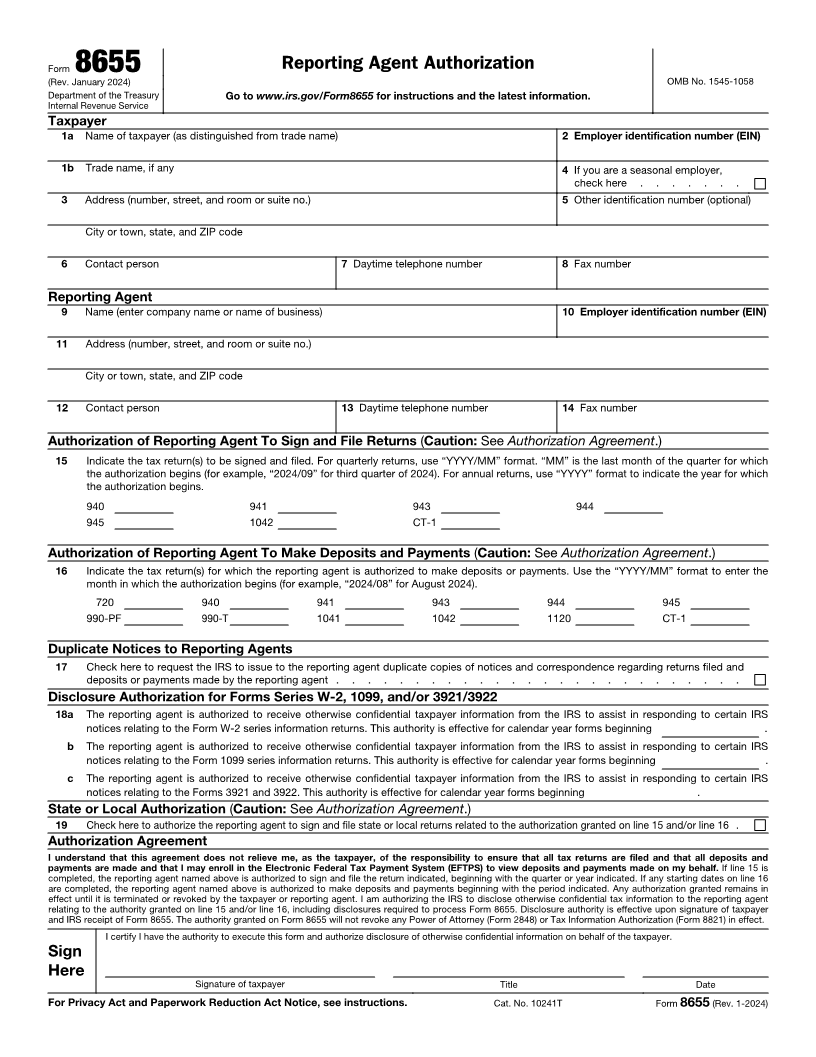

Form 8655 Reporting Agent Authorization

(Rev. January 2024) OMB No. 1545-1058

Department of the Treasury Go to www.irs.gov/Form8655 for instructions and the latest information.

Internal Revenue Service

Taxpayer

1a Name of taxpayer (as distinguished from trade name) 2 Employer identification number (EIN)

1b Trade name, if any 4 If you are a seasonal employer,

check here . . . . . . .

3 Address (number, street, and room or suite no.) 5 Other identification number (optional)

City or town, state, and ZIP code

6 Contact person 7 Daytime telephone number 8 Fax number

Reporting Agent

9 Name (enter company name or name of business) 10 Employer identification number (EIN)

11 Address (number, street, and room or suite no.)

City or town, state, and ZIP code

12 Contact person 13 Daytime telephone number 14 Fax number

Authorization of Reporting Agent To Sign and File Returns (Caution: See Authorization Agreement.)

15 Indicate the tax return(s) to be signed and filed. For quarterly returns, use “YYYY/MM” format. “MM” is the last month of the quarter for which

the authorization begins (for example, “2024/09” for third quarter of 2024). For annual returns, use “YYYY” format to indicate the year for which

the authorization begins.

940 941 943 944

945 1042 CT-1

Authorization of Reporting Agent To Make Deposits and Payments (Caution: See Authorization Agreement.)

16 Indicate the tax return(s) for which the reporting agent is authorized to make deposits or payments. Use the “YYYY/MM” format to enter the

month in which the authorization begins (for example, “2024/08” for August 2024).

720 940 941 943 944 945

990-PF 990-T 1041 1042 1120 CT-1

Duplicate Notices to Reporting Agents

17 Check here to request the IRS to issue to the reporting agent duplicate copies of notices and correspondence regarding returns filed and

deposits or payments made by the reporting agent . . . . . . . . . . . . . . . . . . . . . . . . . .

Disclosure Authorization for Forms Series W-2, 1099, and/or 3921/3922

18 a The reporting agent is authorized to receive otherwise confidential taxpayer information from the IRS to assist in responding to certain IRS

notices relating to the Form W-2 series information returns. This authority is effective for calendar year forms beginning .

b The reporting agent is authorized to receive otherwise confidential taxpayer information from the IRS to assist in responding to certain IRS

notices relating to the Form 1099 series information returns. This authority is effective for calendar year forms beginning .

c The reporting agent is authorized to receive otherwise confidential taxpayer information from the IRS to assist in responding to certain IRS

notices relating to the Forms 3921 and 3922. This authority is effective for calendar year forms beginning .

State or Local Authorization (Caution: See Authorization Agreement.)

19 Check here to authorize the reporting agent to sign and file state or local returns related to the authorization granted on line 15 and/or line 16 .

Authorization Agreement

I understand that this agreement does not relieve me, as the taxpayer, of the responsibility to ensure that all tax returns are filed and that all deposits and

payments are made and that I may enroll in the Electronic Federal Tax Payment System (EFTPS) to view deposits and payments made on my behalf. If line 15 is

completed, the reporting agent named above is authorized to sign and file the return indicated, beginning with the quarter or year indicated. If any starting dates on line 16

are completed, the reporting agent named above is authorized to make deposits and payments beginning with the period indicated. Any authorization granted remains in

effect until it is terminated or revoked by the taxpayer or reporting agent. I am authorizing the IRS to disclose otherwise confidential tax information to the reporting agent

relating to the authority granted on line 15 and/or line 16, including disclosures required to process Form 8655. Disclosure authority is effective upon signature of taxpayer

and IRS receipt of Form 8655. The authority granted on Form 8655 will not revoke any Power of Attorney (Form 2848) or Tax Information Authorization (Form 8821) in effect.

I certify I have the authority to execute this form and authorize disclosure of otherwise confidential information on behalf of the taxpayer.

Sign

Here

Signature of taxpayer Title Date

For Privacy Act and Paperwork Reduction Act Notice, see instructions. Cat. No. 10241T Form 8655 (Rev. 1-2024)