Enlarge image

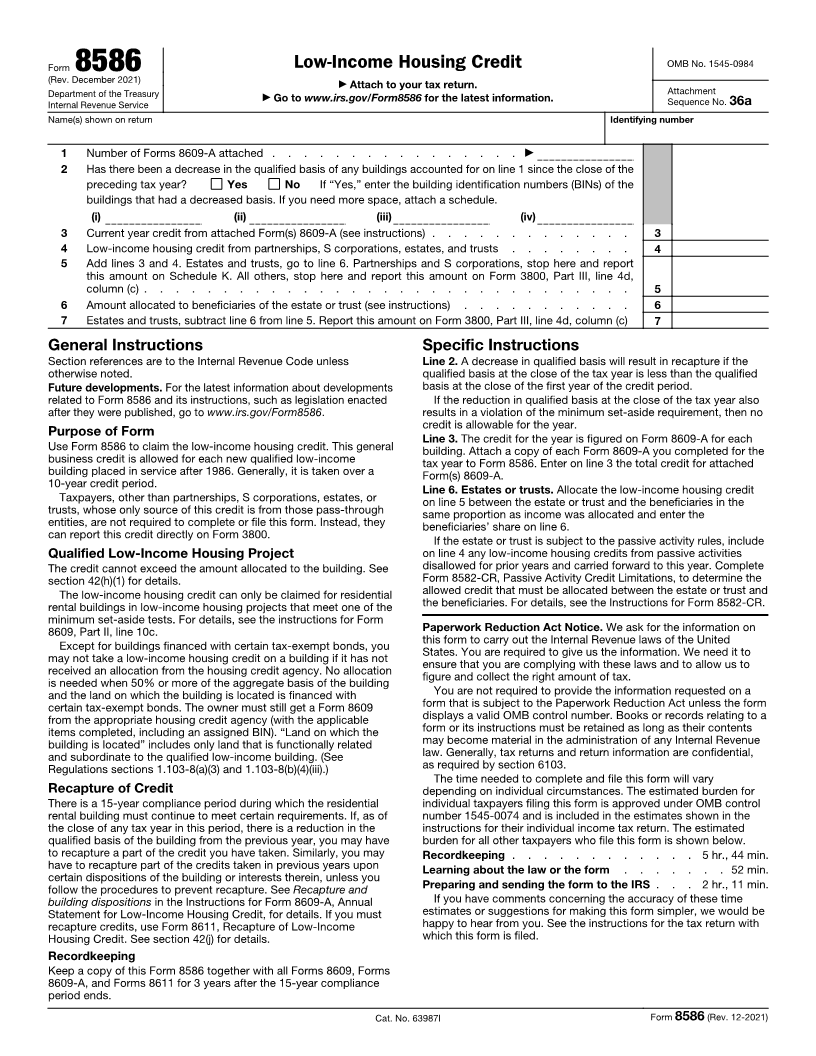

Low-Income Housing Credit OMB No. 1545-0984

Form (Rev. December 2021)8586 ▶ Attach to your tax return.

Attachment

Department of the Treasury ▶ Go to www.irs.gov/Form8586 for the latest information. Sequence No. 36a

Internal Revenue Service

Name(s) shown on return Identifying number

1 Number of Forms 8609-A attached . . . . . . . . . . . . . . . . ▶

2 Has there been a decrease in the qualified basis of any buildings accounted for on line 1 since the close of the

preceding tax year? Yes No If “Yes,” enter the building identification numbers (BINs) of the

buildings that had a decreased basis. If you need more space, attach a schedule.

(i) (ii) (iii) (iv)

3 Current year credit from attached Form(s) 8609-A (see instructions) . . . . . . . . . . . . . 3

4 Low-income housing credit from partnerships, S corporations, estates, and trusts . . . . . . . . 4

5 Add lines 3 and 4. Estates and trusts, go to line 6. Partnerships and S corporations, stop here and report

this amount on Schedule K. All others, stop here and report this amount on Form 3800, Part III, line 4d,

column (c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Amount allocated to beneficiaries of the estate or trust (see instructions) . . . . . . . . . . . 6

7 Estates and trusts, subtract line 6 from line 5. Report this amount on Form 3800, Part III, line 4d, column (c) 7

General Instructions Specific Instructions

Section references are to the Internal Revenue Code unless Line 2. A decrease in qualified basis will result in recapture if the

otherwise noted. qualified basis at the close of the tax year is less than the qualified

Future developments. For the latest information about developments basis at the close of the first year of the credit period.

related to Form 8586 and its instructions, such as legislation enacted If the reduction in qualified basis at the close of the tax year also

after they were published, go to www.irs.gov/Form8586. results in a violation of the minimum set-aside requirement, then no

credit is allowable for the year.

Purpose of Form Line 3. The credit for the year is figured on Form 8609-A for each

Use Form 8586 to claim the low-income housing credit. This general building. Attach a copy of each Form 8609-A you completed for the

business credit is allowed for each new qualified low-income tax year to Form 8586. Enter on line 3 the total credit for attached

building placed in service after 1986. Generally, it is taken over a Form(s) 8609-A.

10-year credit period. Line 6. Estates or trusts. Allocate the low-income housing credit

Taxpayers, other than partnerships, S corporations, estates, or on line 5 between the estate or trust and the beneficiaries in the

trusts, whose only source of this credit is from those pass-through same proportion as income was allocated and enter the

entities, are not required to complete or file this form. Instead, they beneficiaries’ share on line 6.

can report this credit directly on Form 3800. If the estate or trust is subject to the passive activity rules, include

Qualified Low-Income Housing Project on line 4 any low-income housing credits from passive activities

The credit cannot exceed the amount allocated to the building. See disallowed for prior years and carried forward to this year. Complete

section 42(h)(1) for details. Form 8582-CR, Passive Activity Credit Limitations, to determine the

The low-income housing credit can only be claimed for residential allowed credit that must be allocated between the estate or trust and

rental buildings in low-income housing projects that meet one of the the beneficiaries. For details, see the Instructions for Form 8582-CR.

minimum set-aside tests. For details, see the instructions for Form

8609, Part II, line 10c. Paperwork Reduction Act Notice. We ask for the information on

Except for buildings financed with certain tax-exempt bonds, you this form to carry out the Internal Revenue laws of the United

may not take a low-income housing credit on a building if it has not States. You are required to give us the information. We need it to

received an allocation from the housing credit agency. No allocation ensure that you are complying with these laws and to allow us to

is needed when 50% or more of the aggregate basis of the building figure and collect the right amount of tax.

and the land on which the building is located is financed with You are not required to provide the information requested on a

certain tax-exempt bonds. The owner must still get a Form 8609 form that is subject to the Paperwork Reduction Act unless the form

from the appropriate housing credit agency (with the applicable displays a valid OMB control number. Books or records relating to a

items completed, including an assigned BIN). “Land on which the form or its instructions must be retained as long as their contents

building is located” includes only land that is functionally related may become material in the administration of any Internal Revenue

and subordinate to the qualified low-income building. (See law. Generally, tax returns and return information are confidential,

Regulations sections 1.103-8(a)(3) and 1.103-8(b)(4)(iii).) as required by section 6103.

The time needed to complete and file this form will vary

Recapture of Credit depending on individual circumstances. The estimated burden for

There is a 15-year compliance period during which the residential individual taxpayers filing this form is approved under OMB control

rental building must continue to meet certain requirements. If, as of number 1545-0074 and is included in the estimates shown in the

the close of any tax year in this period, there is a reduction in the instructions for their individual income tax return. The estimated

qualified basis of the building from the previous year, you may have burden for all other taxpayers who file this form is shown below.

to recapture a part of the credit you have taken. Similarly, you may Recordkeeping . . . . . . . . . . . . 5 hr., 44 min.

have to recapture part of the credits taken in previous years upon Learning about the law or the form . . . . . . . 52 min.

certain dispositions of the building or interests therein, unless you

follow the procedures to prevent recapture. See Recapture and Preparing and sending the form to the IRS . . . 2 hr., 11 min.

building dispositions in the Instructions for Form 8609-A, Annual If you have comments concerning the accuracy of these time

Statement for Low-Income Housing Credit, for details. If you must estimates or suggestions for making this form simpler, we would be

recapture credits, use Form 8611, Recapture of Low-Income happy to hear from you. See the instructions for the tax return with

Housing Credit. See section 42(j) for details. which this form is filed.

Recordkeeping

Keep a copy of this Form 8586 together with all Forms 8609, Forms

8609-A, and Forms 8611 for 3 years after the 15-year compliance

period ends.

Cat. No. 63987I Form 8586 (Rev. 12-2021)