Enlarge image

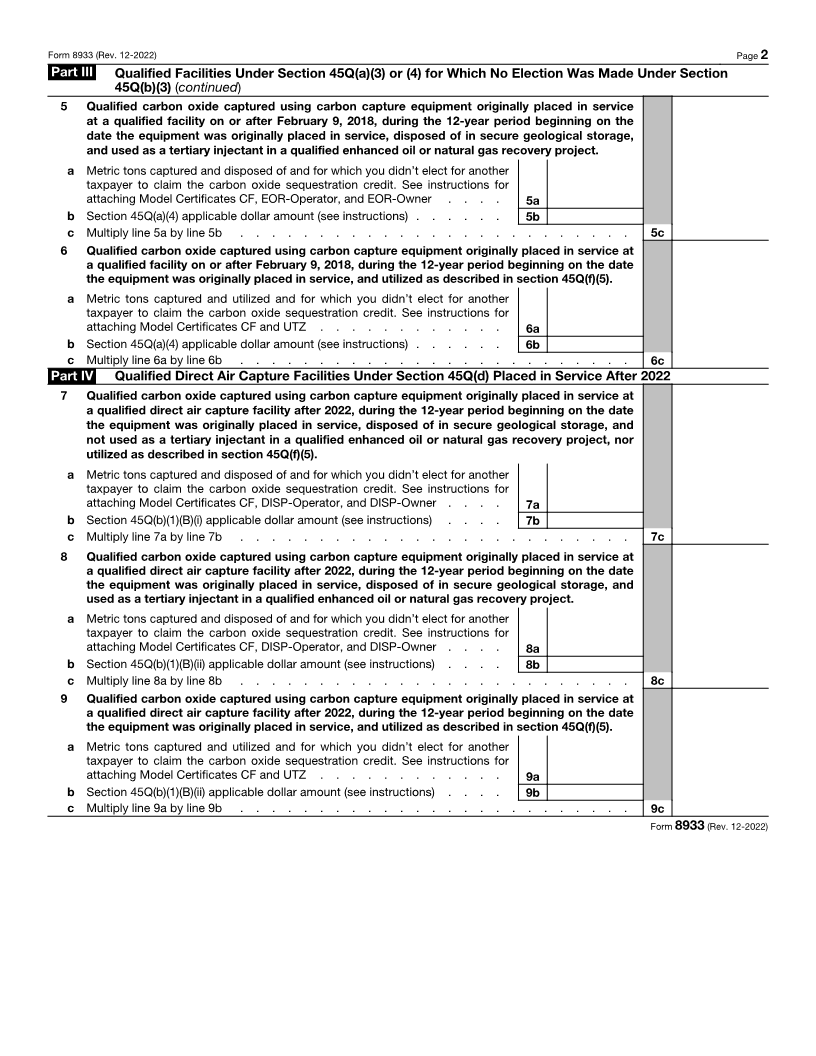

Carbon Oxide Sequestration Credit OMB No. 1545-2132

Form 8933

(Rev. December 2022) Attach to your tax return.

Department of the Treasury Go to www.irs.gov/Form8933 for instructions and the latest information. Attachment

Internal Revenue Service Sequence No. 165

Name(s) shown on return Identifying number

Part I Information About You

Check the applicable box(es). See instructions before completing this form.

1 Captured qualified carbon oxide during the tax year . . . . . . . . . . . . . . . . . . . . . . . .

2 Physically disposed, used, or utilized captured qualified carbon oxide during the tax year . . . . . . . . . . .

3 Elected to allow another taxpayer to claim the carbon oxide sequestration credit that you would’ve otherwise been

entitled to . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4 Another taxpayer elected to allow you to claim the carbon oxide sequestration credit that they would’ve otherwise been

entitled to . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 Reserved for future use . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6 Reserved for future use . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7 Reserved for future use . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8 Reserved for future use . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Part II Facilities at Which Qualified Carbon Oxide Qualifies for a Credit Under Section 45Q(a)(1) or (2), or for

Which an Election Was Made Under Section 45Q(b)(3)

1 Qualified carbon oxide captured using carbon capture equipment originally placed in service

at a qualified facility before February 9, 2018, disposed of in secure geological storage, and not

used as a tertiary injectant in a qualified enhanced oil or natural gas recovery project, nor

utilized as described in section 45Q(f)(5).

a Metric tons captured and disposed of and for which you didn’t elect for another

taxpayer to claim the carbon oxide sequestration credit. See instructions for

attaching Model Certificates CF, DISP-Operator, and DISP-Owner . . . . 1a

b Inflation-adjusted credit rate (see instructions) . . . . . . . . . . . 1b

c Multiply line 1a by line 1b . . . . . . . . . . . . . . . . . . . . . . . . . 1c

2 Qualified carbon oxide captured using carbon capture equipment originally placed in service at

a qualified facility before February 9, 2018, disposed of in secure geological storage, and used

as a tertiary injectant in a qualified enhanced oil or natural gas recovery project.

a Metric tons captured and disposed of and for which you didn’t elect for another

taxpayer to claim the carbon oxide sequestration credit. See instructions for

attaching Model Certificates CF, EOR-Operator, and EOR-Owner . . . . 2a

b Inflation-adjusted credit rate (see instructions) . . . . . . . . . . . 2b

c Multiply line 2a by line 2b . . . . . . . . . . . . . . . . . . . . . . . . . 2c

3 Qualified carbon oxide captured using carbon capture equipment originally placed in service at

a qualified facility before February 9, 2018, and utilized as described in section 45Q(f)(5).

a Metric tons captured and utilized and for which you didn’t elect for another

taxpayer to claim the carbon oxide sequestration credit. See instructions for

attaching Model Certificates CF and UTZ . . . . . . . . . . . . 3a

b Inflation-adjusted credit rate (see instructions) . . . . . . . . . . . 3b

c Multiply line 3a by line 3b . . . . . . . . . . . . . . . . . . . . . . . . . 3c

Part III Qualified Facilities Under Section 45Q(a)(3) or (4) for Which No Election Was Made Under Section

45Q(b)(3)

4 Qualified carbon oxide captured using carbon capture equipment originally placed in service

at a qualified facility on or after February 9, 2018, during the 12-year period beginning on the

date the equipment was originally placed in service, disposed of in secure geological storage,

and not used as a tertiary injectant in a qualified enhanced oil or natural gas recovery project,

nor utilized as described in section 45Q(f)(5).

a Metric tons captured and disposed of and for which you didn’t elect for another

taxpayer to claim the carbon oxide sequestration credit. See instructions for

attaching Model Certificates CF, DISP-Operator, and DISP-Owner . . . . 4a

b Section 45Q(a)(3) applicable dollar amount (see instructions) . . . . . . 4b

c Multiply line 4a by line 4b . . . . . . . . . . . . . . . . . . . . . . . . . 4c

For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 37748H Form 8933 (Rev. 12-2022)