- 4 -

Enlarge image

|

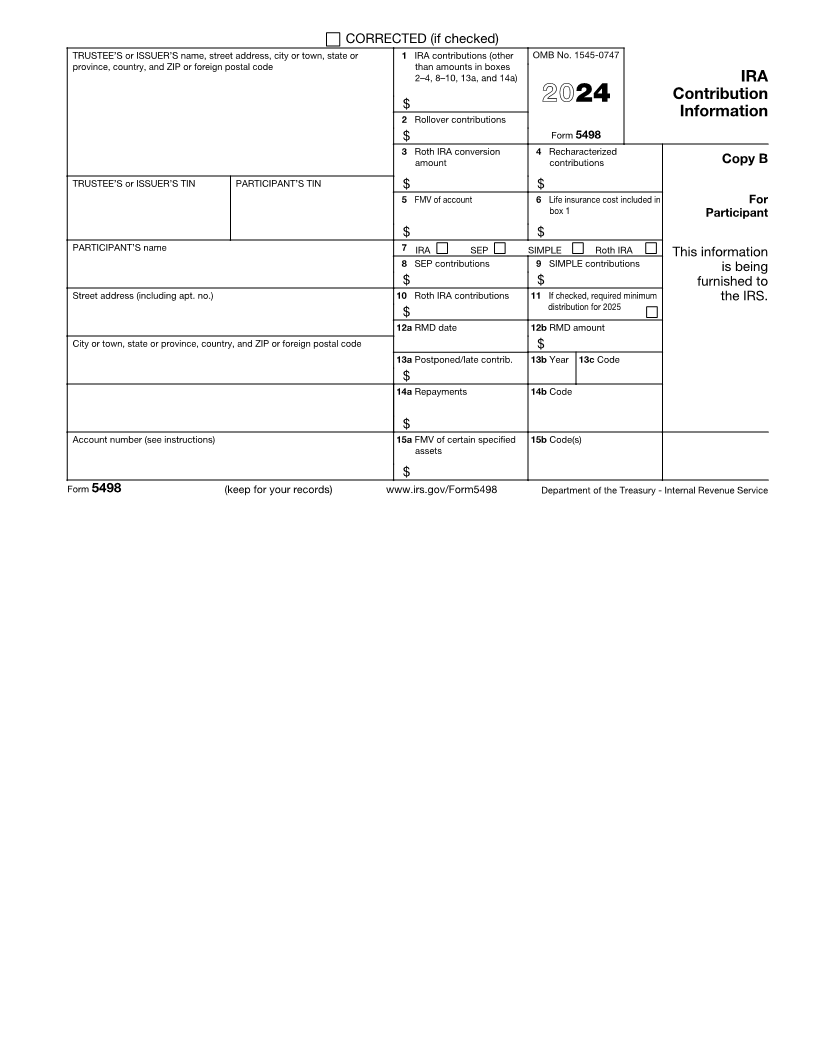

Instructions for Participant Box 13a. Shows the amount of a late rollover contribution (more than 60 days after

The information on Form 5498 is submitted to the IRS by the trustee or issuer of your distribution) made in 2024 and certified by the participant, or a postponed contribution

individual retirement arrangement (IRA) to report contributions, including any catch-up made in 2024 for a prior year. This amount is not reported in box 1 or 2.

contributions, rollovers, repayments, required minimum distributions (RMDs), and the Box 13b. Shows the year to which the postponed contribution in box 13a was

fair market value (FMV) of the account. For information about IRAs, including reporting credited. If a late rollover contribution is shown in box 13a, this box will be blank.

rollovers, repayments, and potential deductibility of contributions, see the instructions Box 13c. For participants who made a postponed contribution due to an extension of

for Forms 1040, 1040-SR, and 8606; and Pubs. 560, 590-A, and 590-B. the contribution due date because of a federally designated disaster, shows the code

Participant’s taxpayer identification number (TIN). For your protection, this form FD.

may show only the last four digits of your TIN (SSN, ITIN, ATIN, or EIN). However, the For participants who served in designated combat zones, qualified hazardous duty

trustee or issuer has reported your complete TIN to the IRS. areas, or direct support areas, shows the appropriate code. The codes are EO13239

Account number. May show an account or other unique number the trustee or issuer for Afghanistan and associated direct support areas, EO12744 for the Arabian

assigned to distinguish your account. Peninsula areas, PL115-97 for the Sinai Peninsula of Egypt, and EO13119 (or

Box 1. Shows traditional IRA contributions for 2024 you made in 2024 and through PL106-21) for the Yugoslavia operations areas. For additional information, including a

April 15, 2025. This box does not include amounts in boxes 2–4, 8–10, 13a, and 14a. list of locations within the designated combat zones, qualified hazardous duty areas,

and direct support areas, see Pub. 3. For updates to the list of locations, go to

Box 2. Shows any rollover, including a direct rollover to a traditional or Roth IRA, or a www.irs.gov/Newsroom/Combat-Zones .

qualified rollover contribution (including a military death gratuity or SGLI payment) to a For a participant who makes a rollover of a qualified plan loan offset, shows the

Roth IRA you made in 2024. Conversions from your traditional, SEP, or SIMPLE IRAs code PO.

to Roth IRAs are shown in box 3. Any late rollover contributions are shown in box 13a.

Box 3. Shows the amount converted from traditional, SEP, or SIMPLE IRAs to Roth For a participant who has used the self-certification procedure for a late rollover

IRAs in 2024. contribution, shows the code SC.

Box 4. Shows amounts recharacterized from transferring any part of the contribution Box 14a. Shows the amount of any repayment of a qualified reservist distribution, a

(plus earnings) from one type of IRA to another. qualified disaster distribution, or a qualified birth or adoption distribution.

Box 5. Shows the FMV of all investments in your account at year end. However, if a Box 14b. Shows the code QR for the repayment of a qualified reservist distribution,

decedent’s name is shown, the amount reported may be the FMV on the date of code DD for repayment of a qualified disaster distribution, or code BA for repayment

death. If the FMV shown is zero for a decedent, the executor or administrator of the of a qualified birth or adoption distribution.

estate may request a date-of-death value from the financial institution. Box 15a. Shows the FMV of the investments in the IRA that are specified in the

Box 6. Shows for endowment contracts only the amount allocable to the cost of life categories identified in box 15b.

insurance. Subtract this amount from your allowable IRA contribution included in box 1 Box 15b. The following codes show the type(s) of investments held in your account for

to compute your IRA deduction. which the FMV is required to be reported in box 15a.

Box 7. May show the kind of IRA reported on this Form 5498. A—Stock or other ownership interest in a corporation that is not readily tradable on an

Boxes 8 and 9. Show traditional and Roth SEP (box 8) and SIMPLE (box 9) established securities market.

contributions made in 2024, including contributions made in 2024 for 2023, but not B—Short- or long-term debt obligation that is not traded on an established securities

including contributions made in 2025 for 2024. market.

Box 10. Shows Roth IRA contributions (and rollovers from a QTP) you made in 2024 C—Ownership interest in a limited liability company or similar entity (unless the

and through April 15, 2025. Do not deduct on your income tax return. interest is traded on an established securities market).

Box 11. If the box is checked, you must take an RMD for 2025. An RMD may be D—Real estate.

required even if the box is not checked. If you do not take the RMD for 2025, you are E—Ownership interest in a partnership, trust, or similar entity (unless the interest is

subject to an excise tax on the amount not distributed. traded on an established securities market).

Box 12a.Shows the date by which the RMD amount in box 12b must be distributed to F—Option contract or similar product that is not offered for trade on an established

avoid the excise tax on the undistributed amount for 2025. option exchange.

Box 12b.Shows the amount of the RMD for 2025. If box 11 is checked and there is no G—Other asset that does not have a readily available FMV.

amount in this box, the trustee or issuer must provide you the amount or offer to H—More than two types of assets (listed in A through G) are held in this IRA.

calculate the amount in a separate statement by January 31, 2025.

|