Enlarge image

Form 706-CE Certificate of Payment of Foreign Death Tax

OMB No. 1545-0260

(Rev. October 2019) ▶ Go to www.irs.gov/Form706CE for the latest information.

Department of the Treasury

Internal Revenue Service ▶ For Paperwork Reduction Act Notice, see instructions.

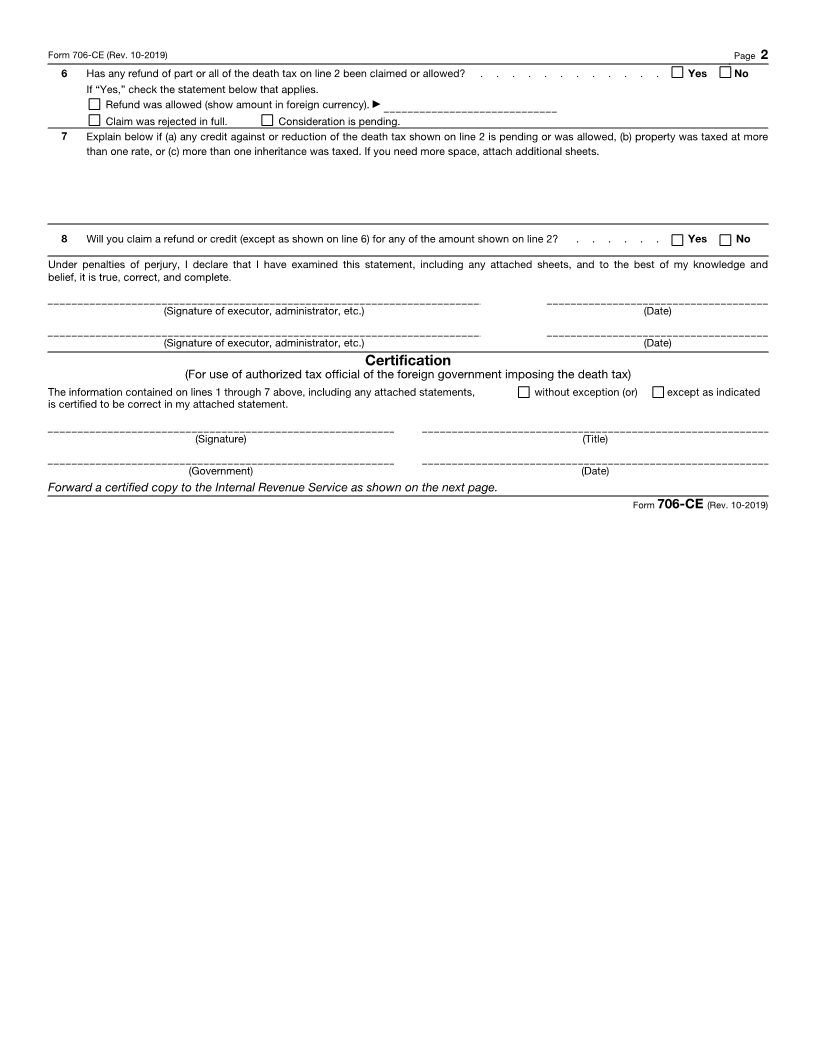

Decedent’s first name and middle initial Decedent’s last name Social security number

Country of citizenship at time of death Country of legal residence (domicile) at time of death Date of death

Last address (number and street; city, town, or post office; state or province; country; and ZIP or foreign postal code)

Name of executor, administrator, etc.

Address (number and street; apt. or suite no.; city, town, or post office; state or province; country; and ZIP or foreign postal code)

1 Name of foreign government imposing the tax 2 Death tax finally determined by that government. Do not include any interest

or penalty. Show amount in foreign currency.

3 Was the amount on line 2 figured under the provisions of a death tax convention? . . . . . . . . . . Yes No

4 List amount(s) of death tax paid (other than interest and penalties) and the date(s) of payment. Show amount(s) in foreign currency.

5 The description, location, and value (as established and accepted by the death tax officials of the government named above) of the property

subjected to the death tax are as follows:

Value

Item Description and location (show in

Number foreign currency)

1

(If necessary, attach additional sheets and follow the same format.) Cat. No. 10149C Form 706-CE (Rev. 10-2019)