- 2 -

Enlarge image

|

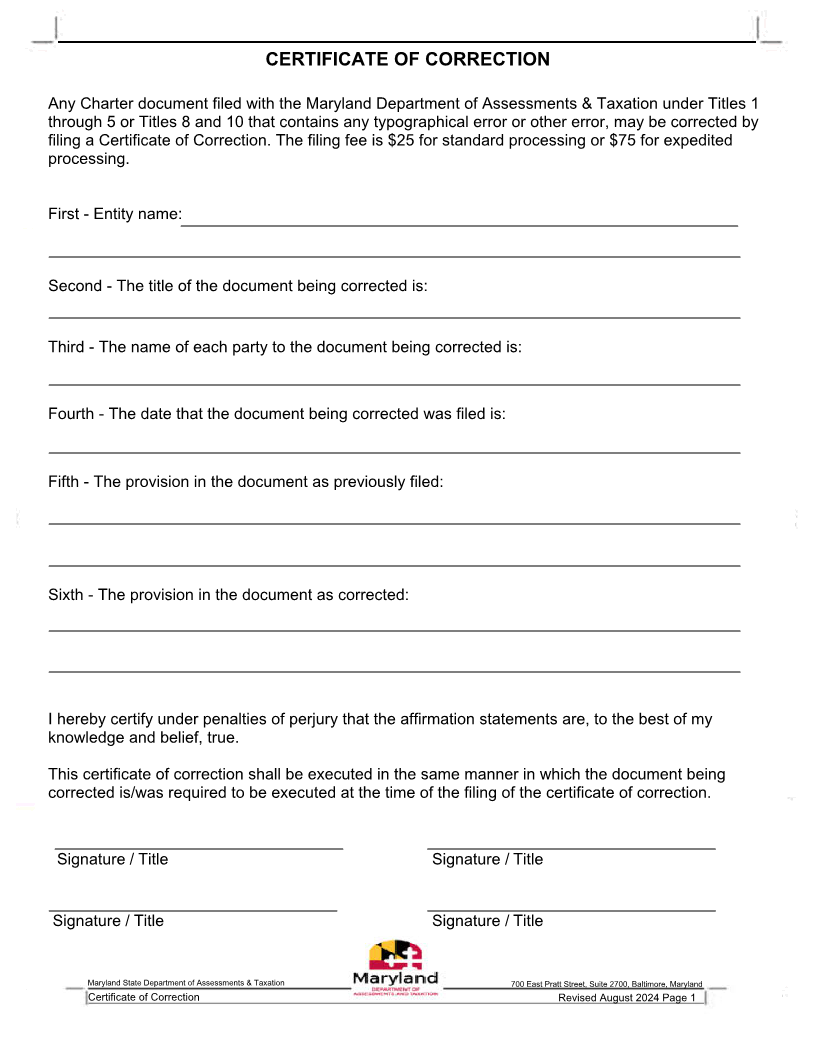

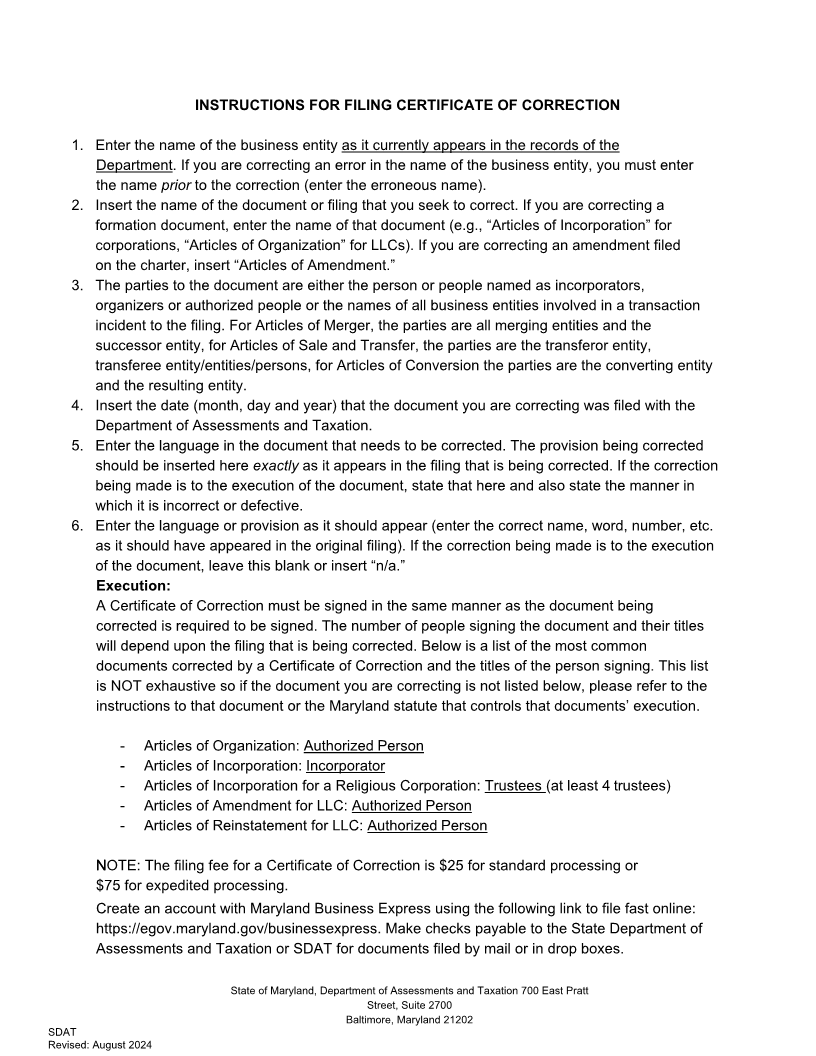

INSTRUCTIONS FOR FILING CERTIFICATE OF CORRECTION

1. Enter the name of the business entity as it currently appears in the records of the

Department. If you are correcting an error in the name of the business entity, you must enter

the name prior to the correction (enter the erroneous name).

2. Insert the name of the document or filing that you seek to correct. If you are correcting a

formation document, enter the name of that document (e.g., “Articles of Incorporation” for

corporations, “Articles of Organization” for LLCs). If you are correcting an amendment filed

on the charter, insert “Articles of Amendment.”

3. The parties to the document are either the person or people named as incorporators,

organizers or authorized people or the names of all business entities involved in a transaction

incident to the filing. For Articles of Merger, the parties are all merging entities and the

successor entity, for Articles of Sale and Transfer, the parties are the transferor entity,

transferee entity/entities/persons, for Articles of Conversion the parties are the converting entity

and the resulting entity.

4. Insert the date (month, day and year) that the document you are correcting was filed with the

Department of Assessments and Taxation.

5. Enter the language in the document that needs to be corrected. The provision being corrected

should be inserted here exactly as it appears in the filing that is being corrected. If the correction

being made is to the execution of the document, state that here and also state the manner in

which it is incorrect or defective.

6. Enter the language or provision as it should appear (enter the correct name, word, number, etc.

as it should have appeared in the original filing). If the correction being made is to the execution

of the document, leave this blank or insert “n/a.”

Execution:

A Certificate of Correction must be signed in the same manner as the document being

corrected is required to be signed. The number of people signing the document and their titles

will depend upon the filing that is being corrected. Below is a list of the most common

documents corrected by a Certificate of Correction and the titles of the person signing. This list

is NOT exhaustive so if the document you are correcting is not listed below, please refer to the

instructions to that document or the Maryland statute that controls that documents’ execution.

- Articles of Organization: Authorized Person

- Articles of Incorporation: Incorporator

- Articles of Incorporation for a Religious Corporation: Trustees (at least 4 trustees)

- Articles of Amendment for LLC: Authorized Person

- Articles of Reinstatement for LLC: Authorized Person

N NOTE: The filing fee for a Certificate of Correction is $25 for standard processing or

$75 for expedited processing.

Create an account with Maryland Business Express using the following link to file fast online:

https://egov.maryland.gov/businessexpress. Make checks payable to the State Department of

Assessments and Taxation or SDAT for documents filed by mail or in drop boxes.

State of Maryland, Department of Assessments and Taxation 700 East Pratt

Street, Suite 2700

Baltimore, Maryland 21202

SDAT

Revised: August 2024

|