Enlarge image

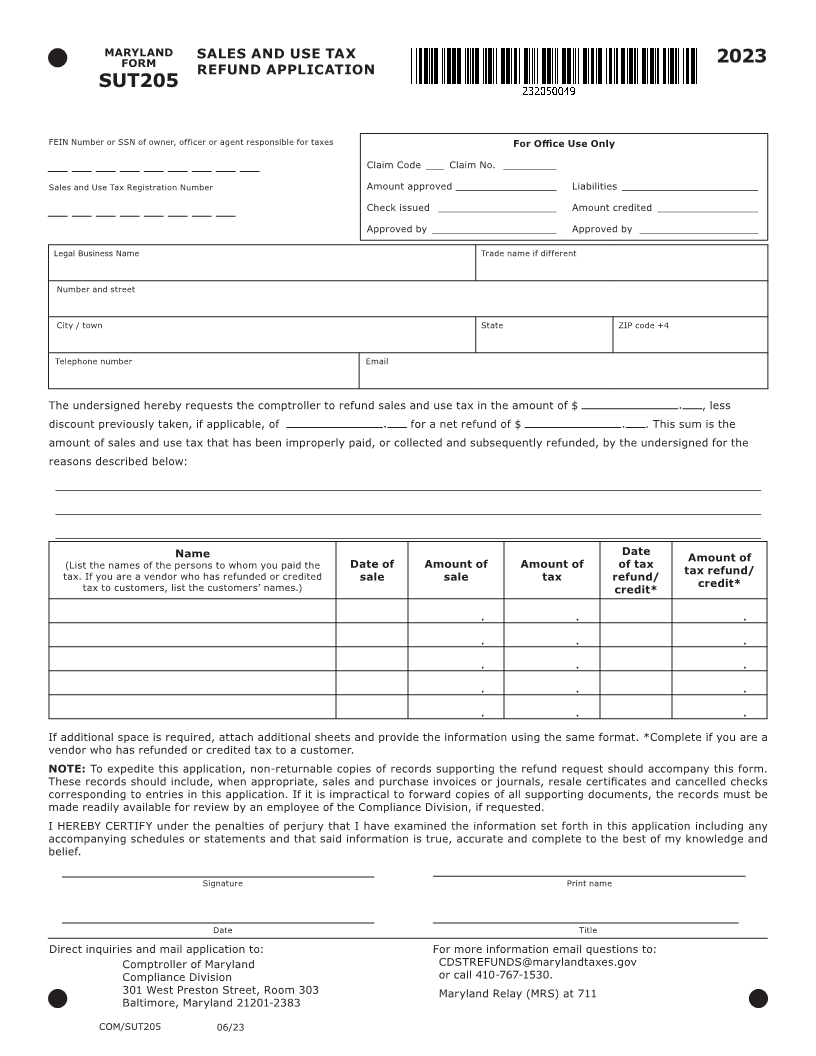

MARYLAND SALES AND USE TAX 2023

FORM

REFUND APPLICATION

SUT205

FEIN Number or SSN of owner, officer or agent responsible for taxes For Office Use Only

Claim Code ___ Claim No. _________

Sales and Use Tax Registration Number Amount approved _________________ Liabilities _______________________

Check issued ____________________ Amount credited _________________

Approved by _____________________ Approved by ____________________

Legal Business Name Trade name if different

Number and street

City / town State ZIP code +4

Telephone number Email

The undersigned hereby requests the comptroller to refund sales and use tax in the amount of $ , less

discount previously taken, if applicable, of for a net refund of $ . This sum is the

amount of sales and use tax that has been improperly paid, or collected and subsequently refunded, by the undersigned for the

reasons described below:

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

Name Date Amount of

(List the names of the persons to whom you paid the Date of Amount of Amount of of tax tax refund/

tax. If you are a vendor who has refunded or credited sale sale tax refund/ credit*

tax to customers, list the customers’ names.) credit*

. . .

. . .

. . .

. . .

. . .

If additional space is required, attach additional sheets and provide the information using the same format. *Complete if you are a

vendor who has refunded or credited tax to a customer.

NOTE: To expedite this application, non-returnable copies of records supporting the refund request should accompany this form.

These records should include, when appropriate, sales and purchase invoices or journals, resale certificates and cancelled checks

corresponding to entries in this application. If it is impractical to forward copies of all supporting documents, the records must be

made readily available for review by an employee of the Compliance Division, if requested.

I HEREBY CERTIFY under the penalties of perjury that I have examined the information set forth in this application including any

accompanying schedules or statements and that said information is true, accurate and complete to the best of my knowledge and

belief.

Signature Print name

Date Title

Direct inquiries and mail application to: For more information email questions to:

Comptroller of Maryland CDSTREFUNDS@marylandtaxes.gov

Compliance Division or call 410-767-1530.

301 West Preston Street, Room 303 Maryland Relay (MRS) at 711

Baltimore, Maryland 21201-2383

COM/SUT205 06/23