Enlarge image

Print Reset

Form For Accounting Periods

Charitable Activities Section Beginning in:

Oregon Department of Justice

100 SW Market Street VOICE (971) 673-1880

CT-12S Portland, OR 97201-5702 TTY (800) 735-2900

For Split-Interest Trusts Email: charitable@doj.state.or.us FAX (971) 673-1882

Website: https://www.doj.state.or.us

Line-by-line instructions for completing the annual 2022

report form can be found on our website.

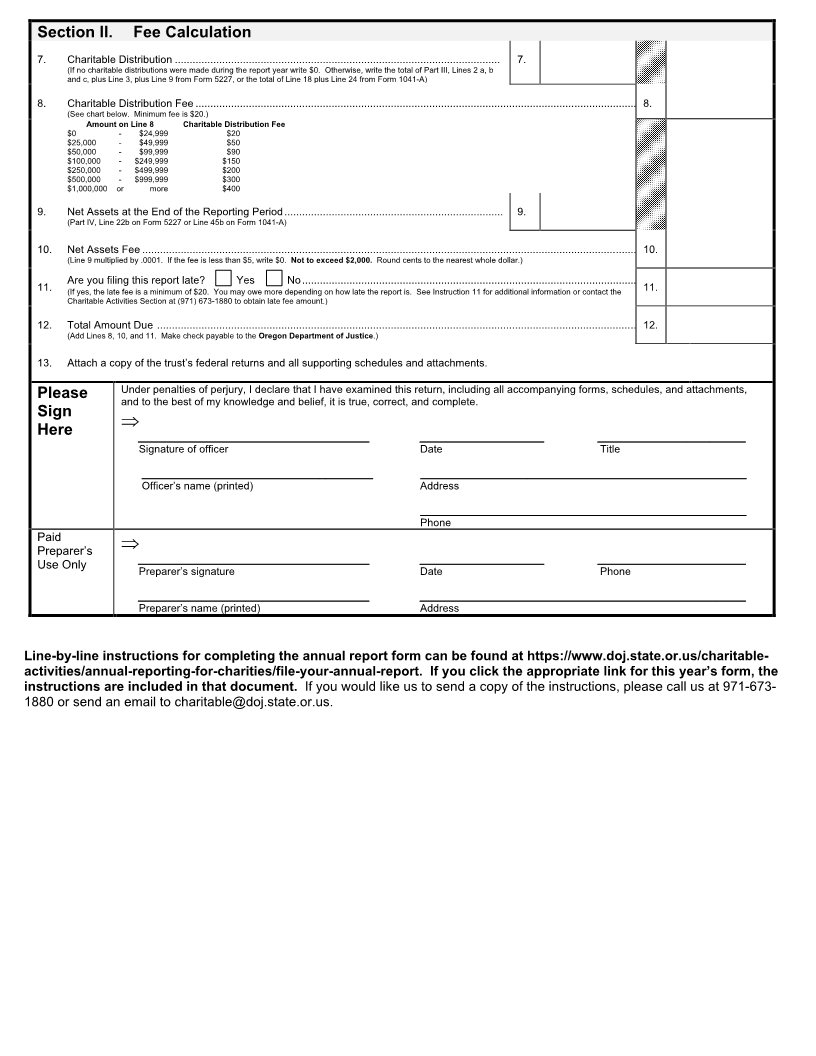

Section I. General Information

1. Cross Through Incorrect Items and Correct Here:

(See instructions for change of name or accounting period.)

Registration #:

Organization Name:

Address:

City, State, Zip:

Phone: Fax: Amended

Email: Report?

Period Beginning: / / Period Ending: / /

2. Has the trust or any of its officers, directors, trustees, or key employees ever signed a voluntary agreement with any

government agency or been a party to legal action in any court or administrative agency regarding charitable solicitation,

administration, management, or fiduciary practices? If yes, attach explanation of each such agreement or action. See Yes No

instructions.

3. During this reporting period, did the trust amend any trust documents OR did the trust receive a determination or ruling from

the Internal Revenue Service relating to its status? If yes, attach a copy of the amended document or IRS communication. Yes No

4. Is the trust ceasing operations and is this the final report? (If yes, see instructions on how to close your registration.) Yes No

5. Provide contact information for the person responsible for retaining the trust’s records.

Name Position Phone Mailing Address & Email Address

6. List of Officers, Directors, Trustees and Key Employees – List each person who held one of these positions at any time during the year even if they

did not receive compensation. Attach additional sheets if necessary. If an attached IRS form includes substantially the same compensation

information, the phrase “See IRS Form” may be entered in lieu of completing this section.

(A) Name, mailing address, daytime phone number (B) Title & (C)

and email address average Compensation

weekly hours (enter $0 if

devoted to position unpaid)

position

Name:

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Address: _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Phone:

(_ _ _)_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Email:

Name:

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Address: _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Phone: (_ _ _)_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Email:

Name:

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Address:

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Phone:

(_ _ _)_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Email:

Form Continued on Reverse Side