Enlarge image

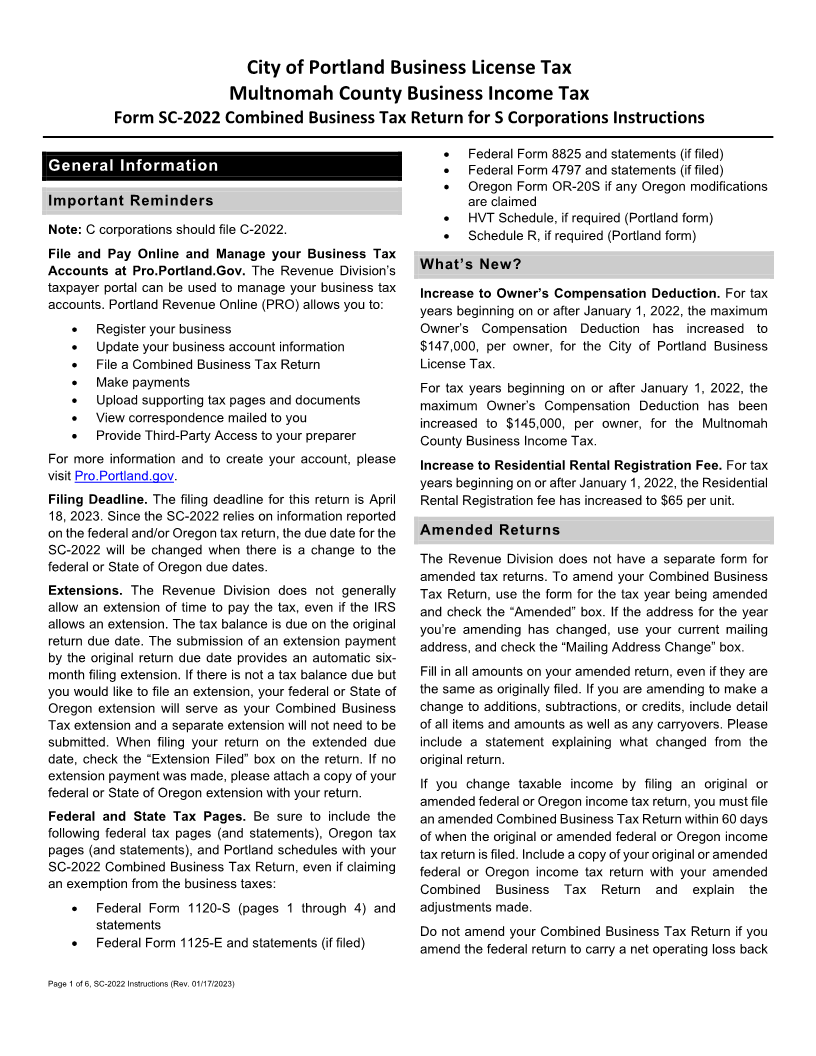

City of Portland Business License Tax

Multnomah County Business Income Tax

Form SC-2022 Combined Business Tax Return for S Corporations Instructions

• Federal Form 8825 and statements (if filed)

General Information • Federal Form 4797 and statements (if filed)

• Oregon Form OR-20S if any Oregon modifications

Important Reminders are claimed

• HVT Schedule, if required (Portland form)

Note: C corporations should file C-2022. • Schedule R, if required (Portland form)

File and Pay Online and Manage your Business Tax

Accounts at Pro.Portland.Gov. The Revenue Division’s What’s New?

taxpayer portal can be used to manage your business tax Increase to Owner’s Compensation Deduction. For tax

accounts. Portland Revenue Online (PRO) allows you to: years beginning on or after January 1, 2022, the maximum

• Register your business Owner’s Compensation Deduction has increased to

• Update your business account information $147,000, per owner, for the City of Portland Business

• File a Combined Business Tax Return License Tax.

• Make payments For tax years beginning on or after January 1, 2022, the

• Upload supporting tax pages and documents maximum Owner’s Compensation Deduction has been

• View correspondence mailed to you increased to $145,000, per owner, for the Multnomah

• Provide Third-Party Access to your preparer County Business Income Tax.

For more information and to create your account, please For tax

Increase to Residential Rental Registration Fee.

visit Pro.Portland.gov.

years beginning on or after January 1, 2022, the Residential

Filing Deadline. The filing deadline for this return is April Rental Registration fee has increased to $65 per unit.

18, 2023. Since the SC-2022 relies on information reported

on the federal and/or Oregon tax return, the due date for the Amended Returns

SC-2022 will be changed when there is a change to the

The Revenue Division does not have a separate form for

federal or State of Oregon due dates.

amended tax returns. To amend your Combined Business

Extensions. The Revenue Division does not generally Tax Return, use the form for the tax year being amended

allow an extension of time to pay the tax, even if the IRS and check the “Amended” box. If the address for the year

allows an extension. The tax balance is due on the original you’re amending has changed, use your current mailing

return due date. The submission of an extension payment address, and check the “Mailing Address Change” box.

by the original return due date provides an automatic six-

month filing extension. If there is not a tax balance due but Fill in all amounts on your amended return, even if they are

you would like to file an extension, your federal or State of the same as originally filed. If you are amending to make a

Oregon extension will serve as your Combined Business change to additions, subtractions, or credits, include detail

Tax extension and a separate extension will not need to be of all items and amounts as well as any carryovers. Please

submitted. When filing your return on the extended due include a statement explaining what changed from the

date, check the “Extension Filed” box on the return. If no original return.

extension payment was made, please attach a copy of your

If you change taxable income by filing an original or

federal or State of Oregon extension with your return.

amended federal or Oregon income tax return, you must file

Federal and State Tax Pages. Be sure to include the an amended Combined Business Tax Return within 60 days

following federal tax pages (and statements), Oregon tax of when the original or amended federal or Oregon income

pages (and statements), and Portland schedules with your tax return is filed. Include a copy of your original or amended

SC-2022 Combined Business Tax Return, even if claiming federal or Oregon income tax return with your amended

an exemption from the business taxes: Combined Business Tax Return and explain the

• Federal Form 1120-S (pages 1 through 4) and adjustments made.

statements Do not amend your Combined Business Tax Return if you

• Federal Form 1125-E and statements (if filed) amend the federal return to carry a net operating loss back

Page 1 of 6, SC-2022 Instructions (Rev. 01/17/2023)