Enlarge image

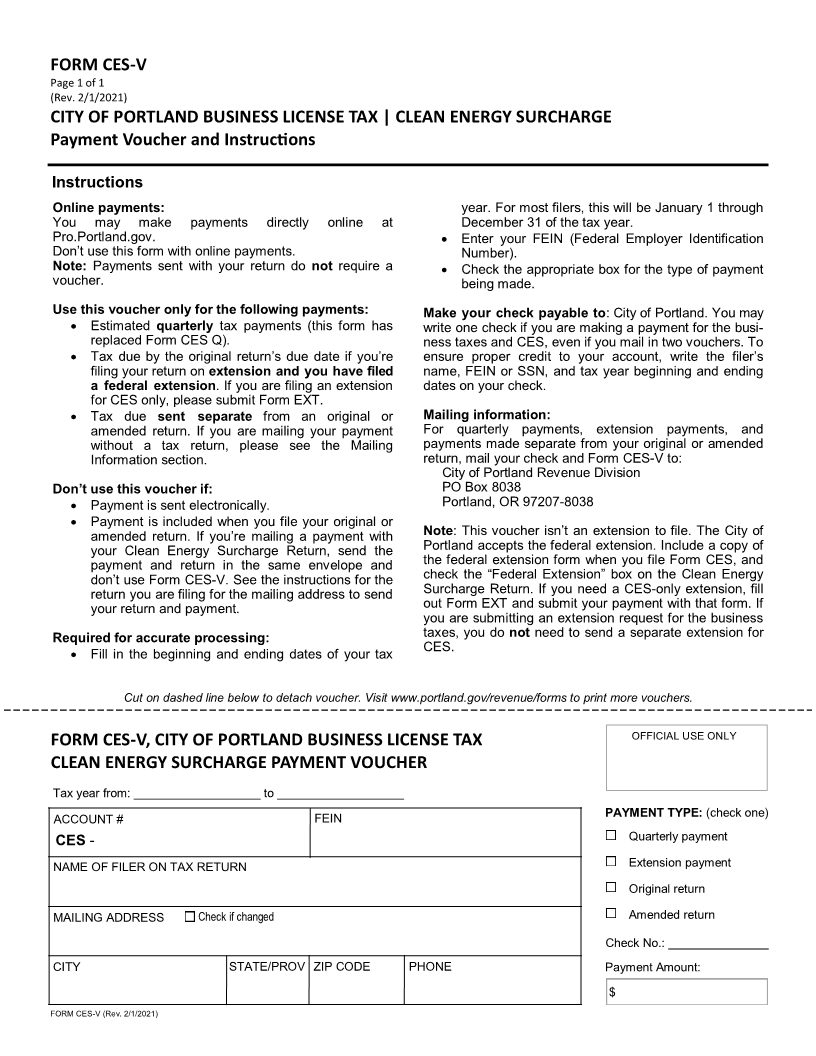

FORM CES V-

Page 1 of 1

(Rev. 2/1/2021)

CITY OF PORTLAND BUSINESS LICENSE TAX | CLEAN ENERGY SURCHARGE

Payment Voucher and Instructions

Instructions

Online payments: year. For most filers, this will be January 1 through

You may make payments directly online at December 31 of the tax year.

Pro.Portland.gov. • Enter your FEIN (Federal Employer Identification

Don’t use this form with online payments. Number).

Note: Payments sent with your return do not require a • Check the appropriate box for the type of payment

voucher. being made.

Use this voucher only for the following payments: Make your check payable to: City of Portland. You may

• Estimated quarterly tax payments (this form has write one check if you are making a payment for the busi-

replaced Form CES Q). ness taxes and CES, even if you mail in two vouchers. To

• Tax due by the original return s’ due date if you re’ ensure proper credit to your account, write the filer’s

filing your return on extension and you have filed name, FEIN or SSN, and tax year beginning and ending

a federal extension. If you are filing an extension dates on your check.

for CES only, please submit Form EXT.

• Tax due sent separate from an original or Mailing information:

amended return. If you are mailing your payment For quarterly payments, extension payments, and

without a tax return, please see the Mailing payments made separate from your original or amended

Information section. return, mail your check and Form CES-V to:

City of Portland Revenue Division

Don’t use this voucher if: PO Box 8038

• Payment is sent electronically. Portland, OR 97207-8038

• Payment is included when you file your original or

amended return. If you’re mailing a payment with Note: This voucher isn’t an extension to file. The City of

your Clean Energy Surcharge Return, send the Portland accepts the federal extension. Include a copy of

payment and return in the same envelope and the federal extension form when you file Form CES, and

don’t use Form CES-V. See the instructions for the check the “Federal Extension box” on the Clean Energy

return you are filing for the mailing address to send Surcharge Return. If you need a CES only- extension, fill

your return and payment. out Form EXT and submit your payment with that form. If

you are submitting an extension request for the business

Required for accurate processing: taxes, you do not need to send a separate extension for

CES.

• Fill in the beginning and ending dates of your tax

Cut on dashed line below to detach voucher. Visit www.portland.gov/revenue/forms to print more vouchers.

OFFICIAL USE ONLY

FORM CES V,- CITY OF PORTLAND BUSINESS LICENSE TAX

CLEAN ENERGY SURCHARGE PAYMENT VOUCHER

Tax year from: ___________________ to ___________________

ACCOUNT # FEIN PAYMENT TYPE: (check one)

CES - Quarterly payment

NAME OF FILER ON TAX RETURN Extension payment

Original return

MAILING ADDRESS Check if changed Amended return

Check No.: _______________

CITY STATE/PROV ZIP CODE PHONE Payment Amount:

$

FORM CES-V (Rev. 2/1/2021)