Enlarge image

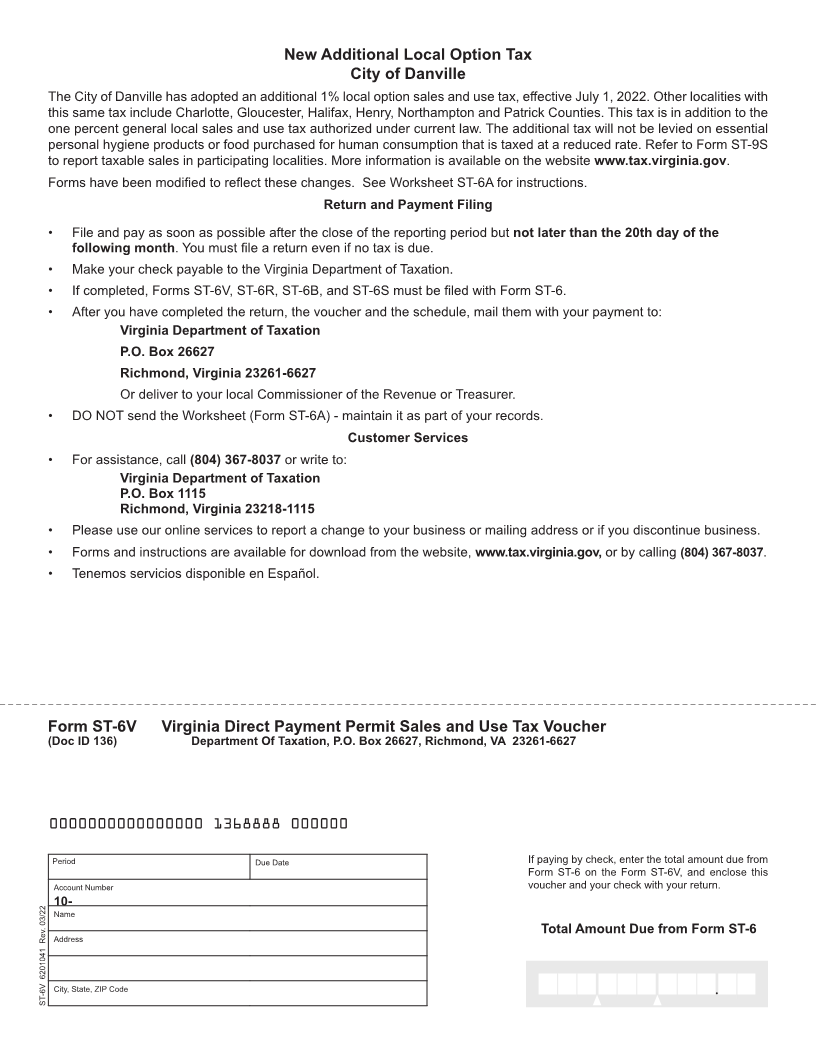

Form ST-6 Virginia Direct Payment Permit

Sales and Use Tax Return

For Periods Beginning On and After July 1, 2022 *VAST06124888*

Mailing address: Virginia Department Of Taxation, Direct Payment Permit Sales And Use Tax, P.O. Box 26627, Richmond, VA 23261-6627

Name Account Number

10-

Address Filing Period (Enter month or quarter and year)

City, State, ZIP Code Due Date

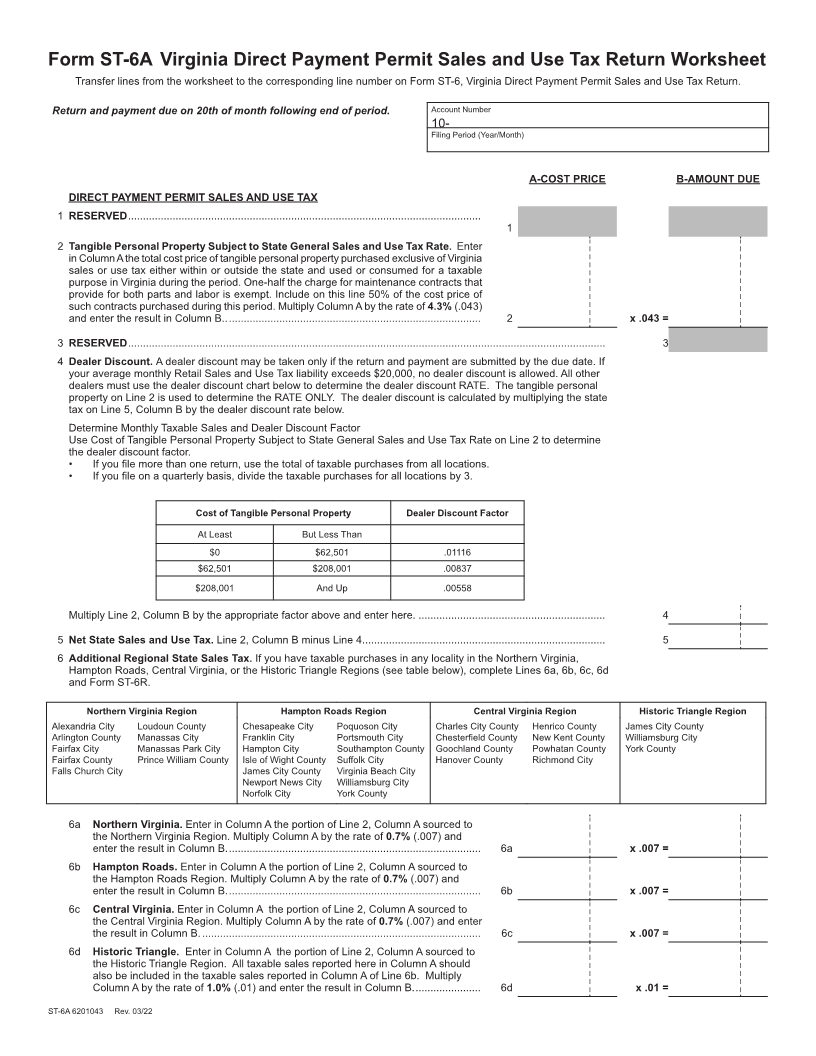

DIRECT PAYMENT PERMIT SALES AND USE TAX A-COST PRICE B-AMOUNT DUE

1 RESERVED 1

2 Tangible Personal Property Subject to State General Sales and Use Tax Rate. Enter cost

of tangible personal property in Column A (See ST-6A Worksheet). Multiply Column A by

the rate of 4.3% (.043) and enter the result in Column B. 2 x .043 =

3 RESERVED

3

4 Dealer Discount. See ST-6A Worksheet. 4

5 Net State Sales and Use Tax. Line 2, Column B minus Line 4. 5

6 Additional Regional State Sales Tax. See ST-6A Worksheet.

6a Northern Virginia. Enter the portion of Line 2, Column A attributable to Northern

Virginia in Column A on this line. Multiply Column A by the rate of 0.7% (.007) and

enter the result in Column B. 6a x .007 =

6b Hampton Roads. Enter the portion of Line 2, Column A attributable to Hampton

Roads in Column A on this line. Multiply Column A by the rate of 0.7% (.007) and

enter the result in Column B. 6b x .007 =

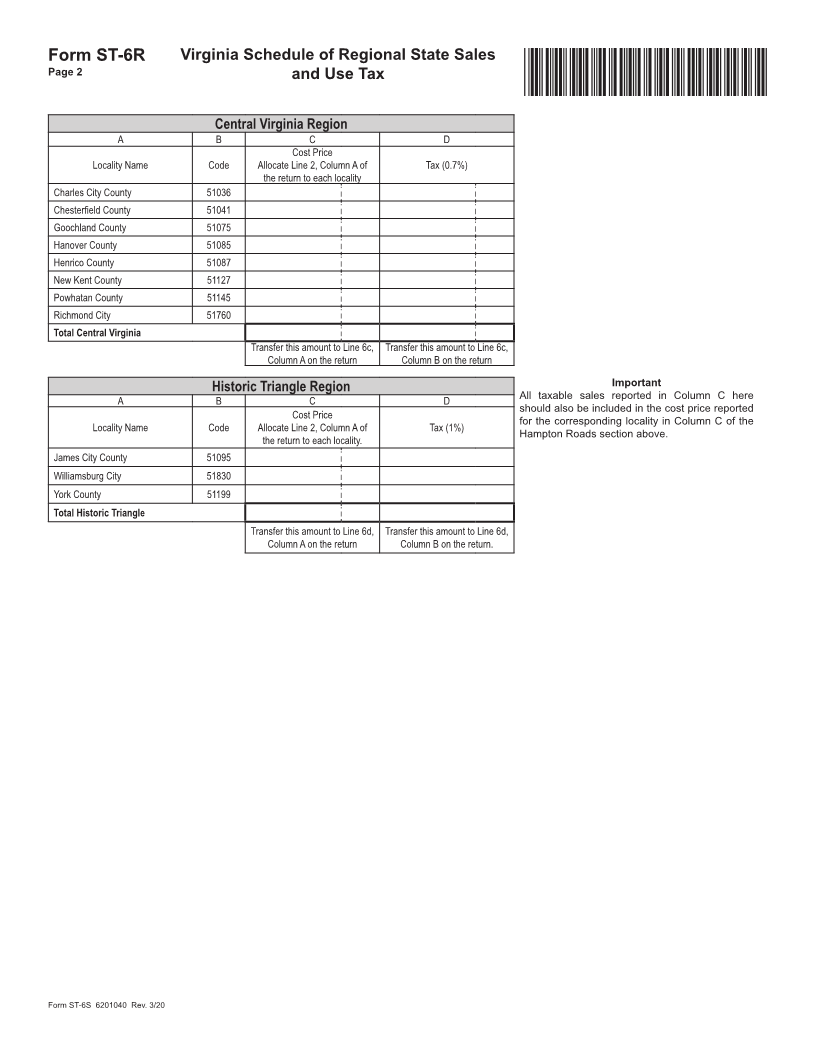

6c Central Virginia. Enter the portion of Line 2, Column A attributable to Central

Virginia in Column A on this line. Multiply Column A by the rate of 0.7% (.007) and

enter result in Column B. 6c x .007 =

6d Historic Triangle. Enter the portion of Line 2, Column A attributable to the Historic

Triangle in Column A on this line. All taxable sales reported here in Column A should

also be included in the taxable sales reported in Column A of Line 6b. Multiply

Column A by the rate of 1.0% (.01) and enter the result in Column B. 6d x .01 =

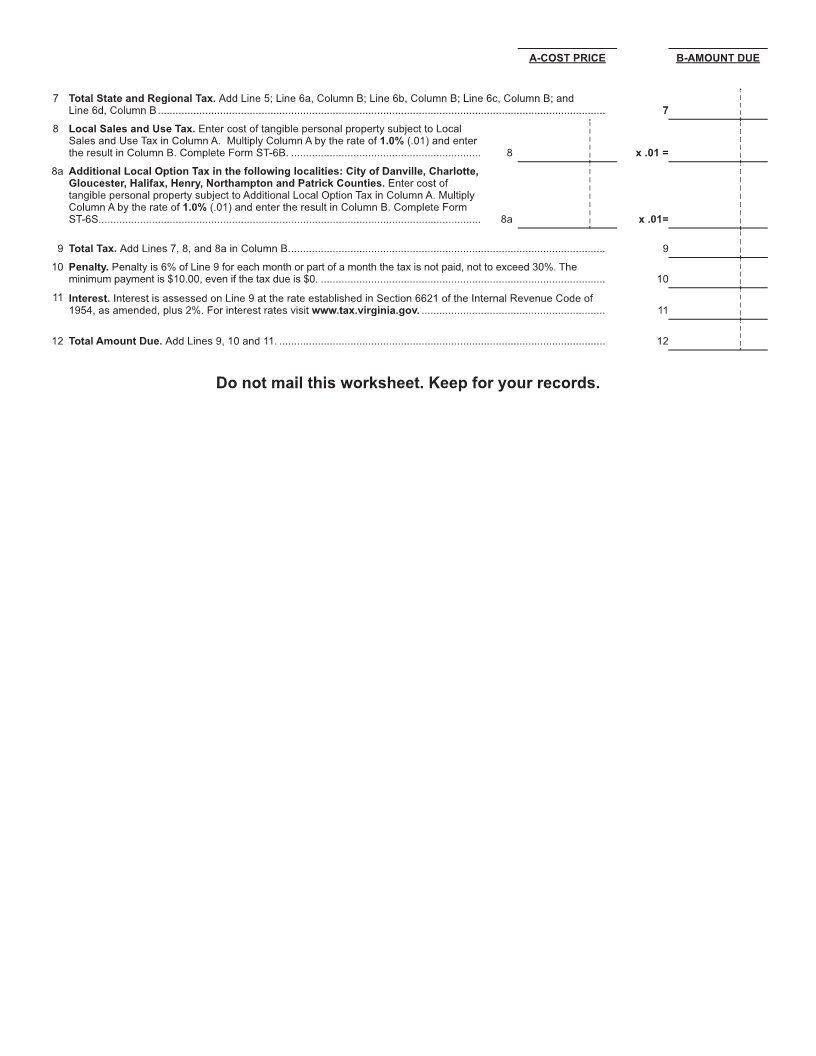

7 Total State and Regional Tax. Add Line 5; Line 6a, Column B; Line 6b, Column B;

Line 6c, Column B; and Line 6d, Column B 7

8 Local Sales and Use Tax. Enter cost of tangible personal property subject to Local Sales

and Use Tax in Column A. Multiply Column A by the rate of 1.0% (.01) and enter the result

in Column B. See ST-6A Worksheet and complete Form ST-6B. 8 x .01 =

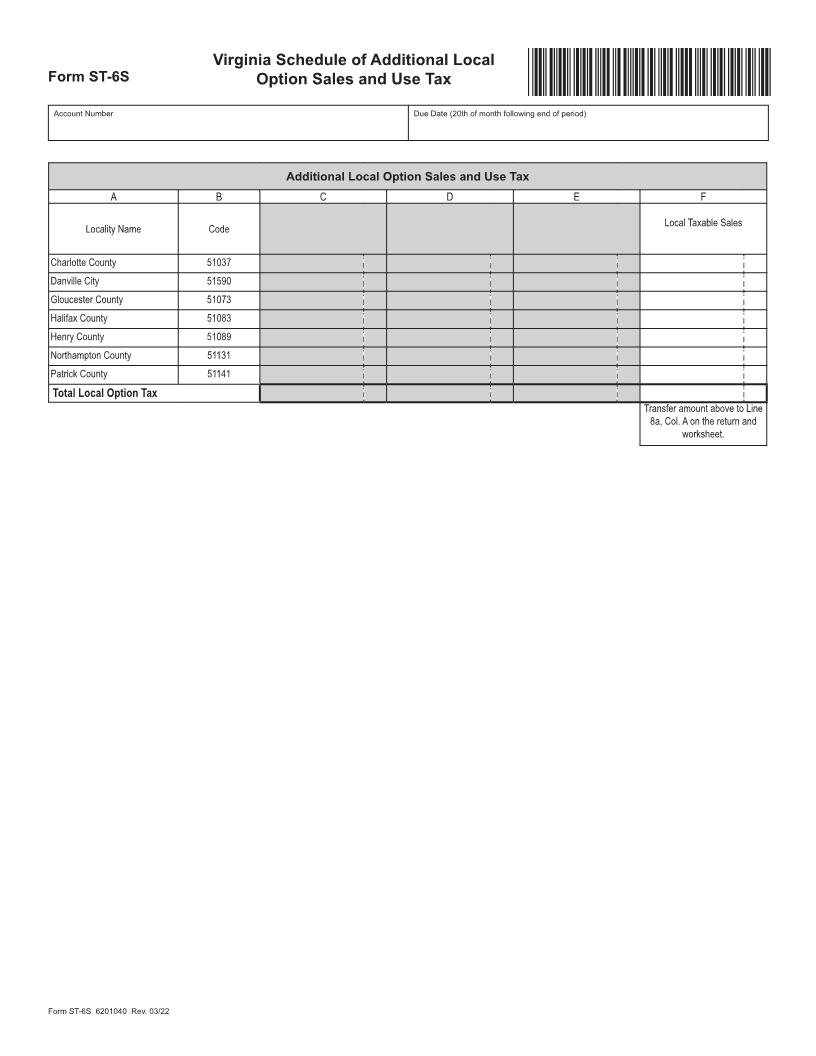

8a Additional Local Option Tax in the following localities: City of Danville, Charlotte,

Gloucester, Halifax, Henry,Northampton and Patrick Counties. Enter cost of tangible

property subject to Additional Local Option Sales and Use Tax from Column F of Form ST-

6S in Column A. Multiply Column A by 1.0% (.01) and enter the result in Column B. 8a x .01 =

9 Total State, Regional, Local, and Additional Local Tax. Add Lines 7, 8, and 8a in Column B. 9

10 Penalty. See ST-6A Worksheet. 10

11 Interest. See ST-6A Worksheet. 11

12 Total Amount Due. Add Lines 9, 10, and 11. Also enter this amount on Form ST-6V. 12

Declaration and Signature.

I declare that this return (including accompanying schedules and statements) has been examined by me and to the best of my knowledge and belief is true, correct and complete.

Signature Date Phone Number

General. A Direct Payment Permit is issued on the condition that the holder will file returns with the Department and allocate the local tax so that no county or city will

lose any revenue because of the issuance of the permit. Form ST-6 is used to report and pay the tax. Form ST-6 should not be filed unless previously authorized by the

Tax Commissioner as set forth in Va. Code § 58.1-624.

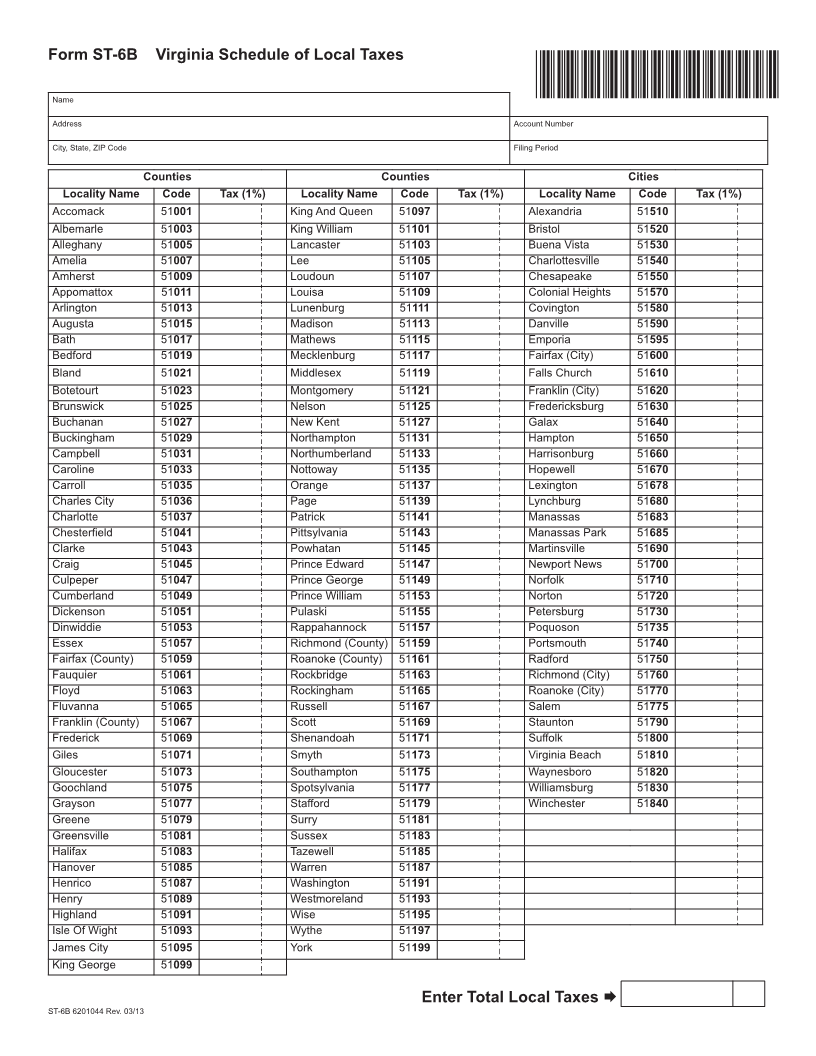

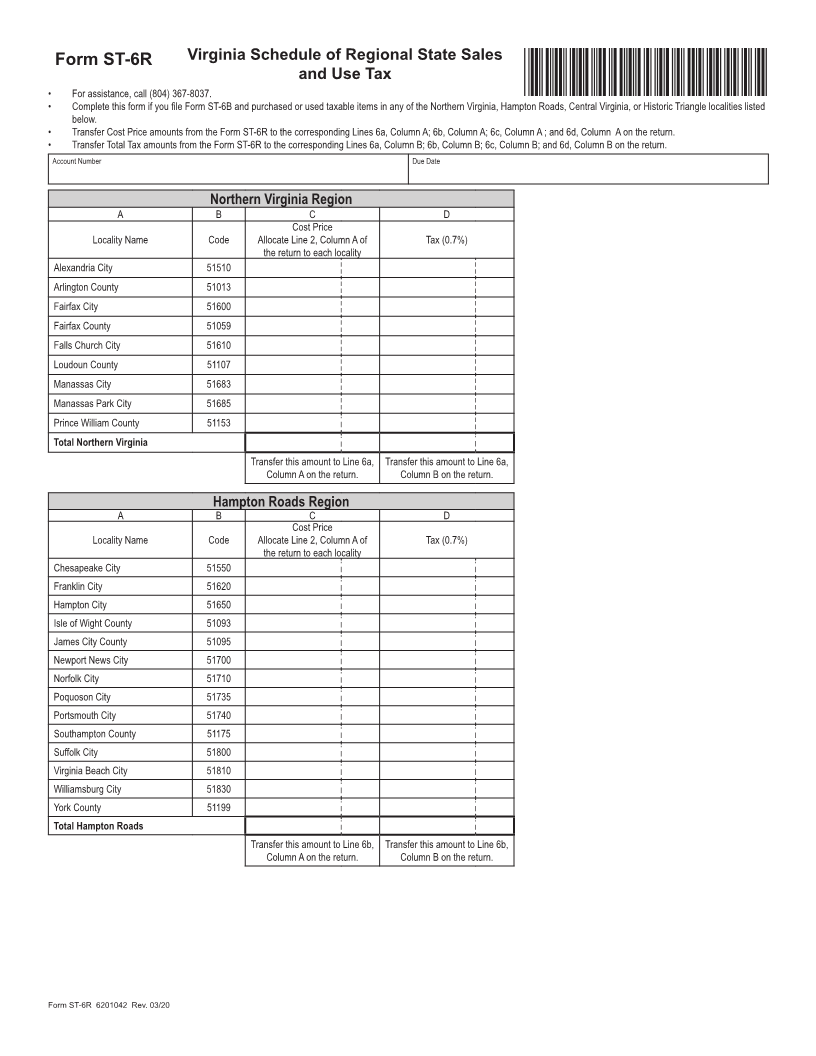

Local and Regional Schedules. Use Forms ST-6B and ST-6R to allocate the 1% local tax, the 0.7% Northern Virginia, Hampton Roads, and Central Virginia state

sales and use tax and the 1% Historic Triangle state sales and use tax. For the appropriate county or city, enter the total of the following items:

A. The cost price and tax of all tangible personal property purchased tax exempt in the locality and used for a taxable purpose during the month. A purchase

made in Virginia is subject to the local tax in the county or city where the purchase was originally made.

B. The tax due on the cost price of all tangible personal property purchased exclusive of Virginia tax outside Virginia and used for a taxable purpose during the

period. A purchase made outside Virginia is subject to local tax in the county or city where the property is used.

Additional Local Option Schedule. Use Form ST-6S for additional local option sales and use tax in the counties listed above in Line 8a.

Filing Procedure. Mail the forms with your payment to the Department of Taxation, P.O. Box 26627, Richmond, Virginia 23261-6627, or deliver to your local

Commissioner of the Revenue or Treasurer, as soon as possible after the close of the reporting period, but not later than the 20th day of the following month.

A return must be filed for each reporting period even if no tax is due.

ST-6 6210042 Rev. 03/22