Enlarge image

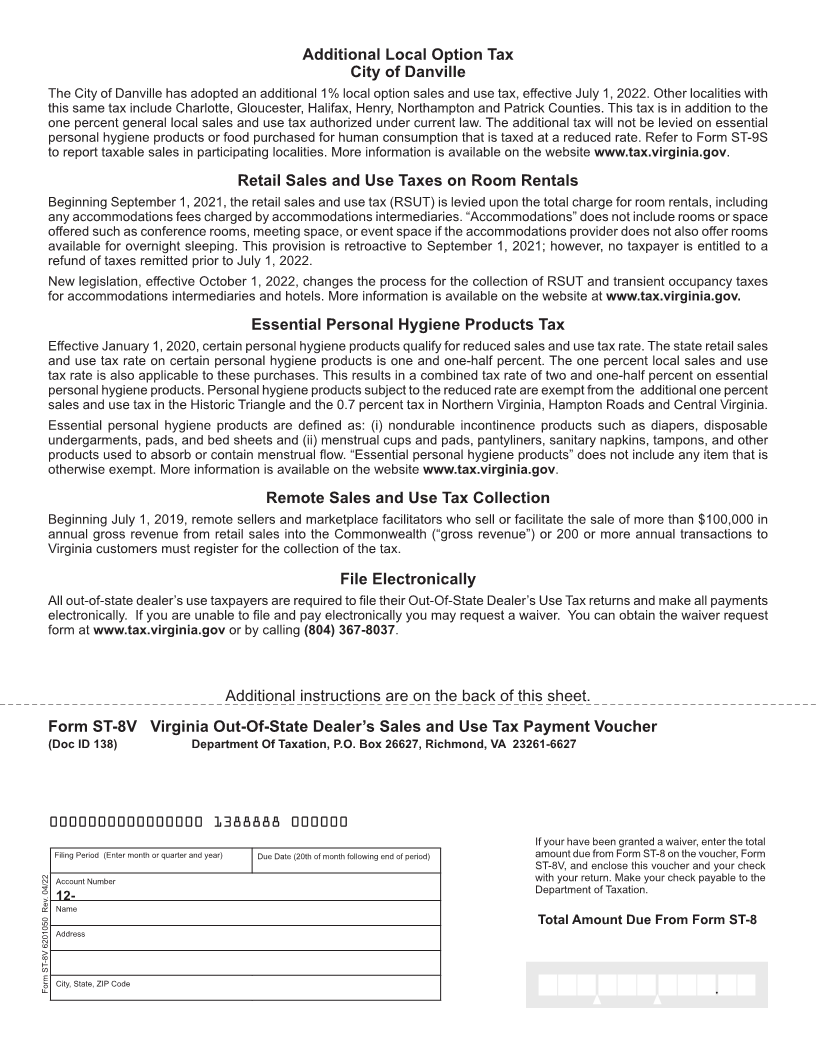

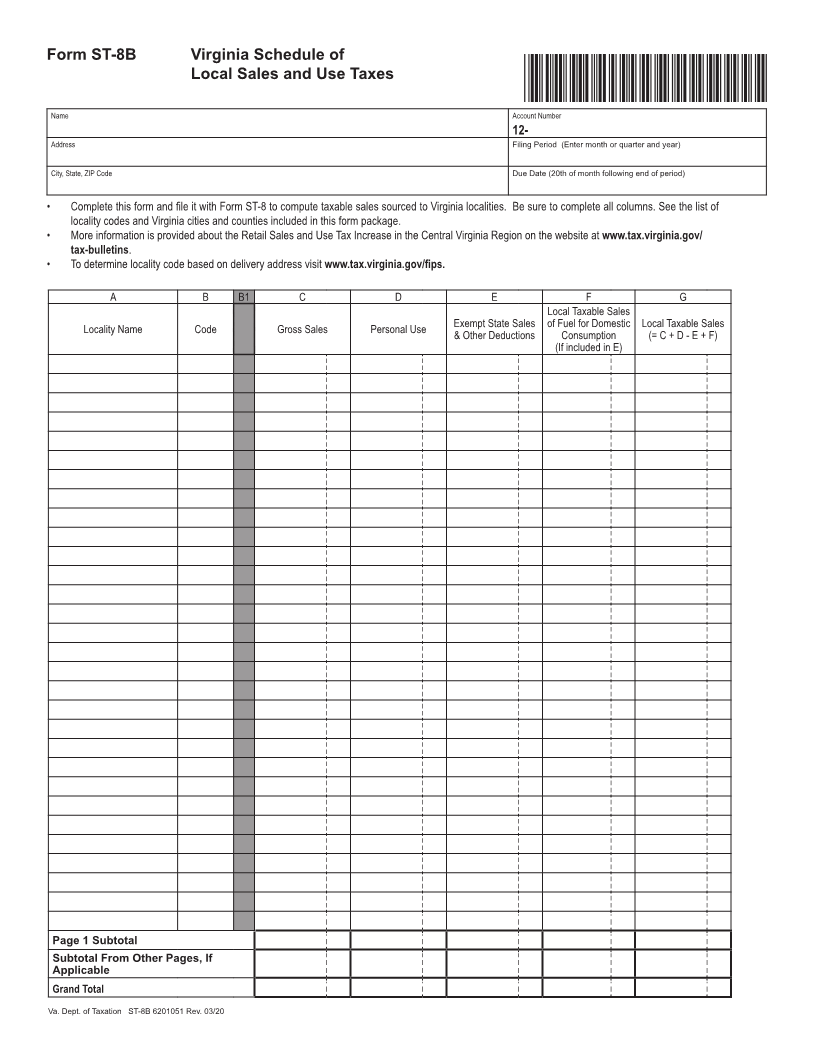

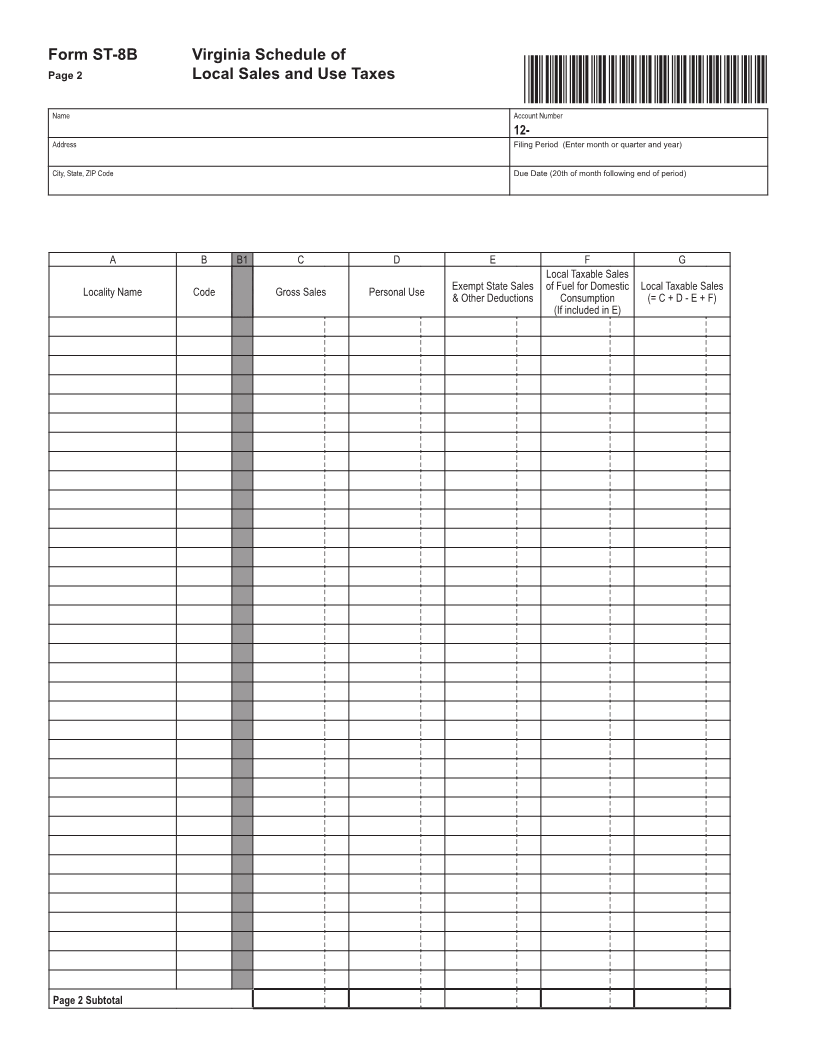

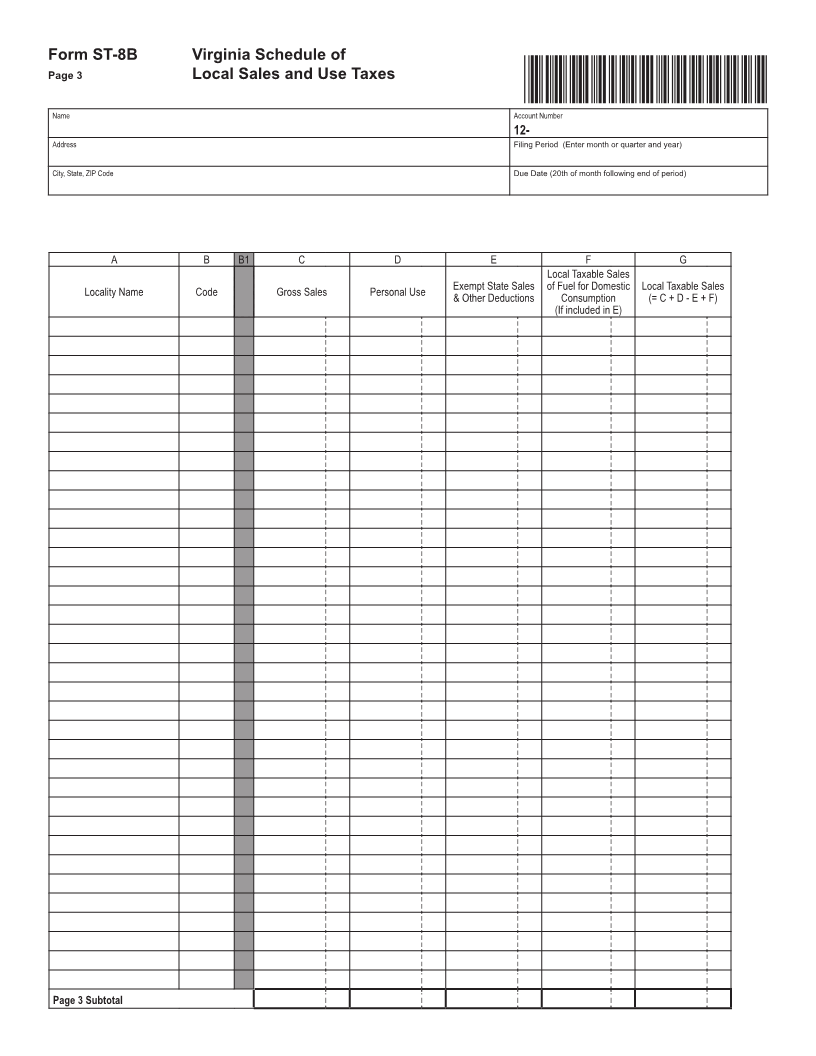

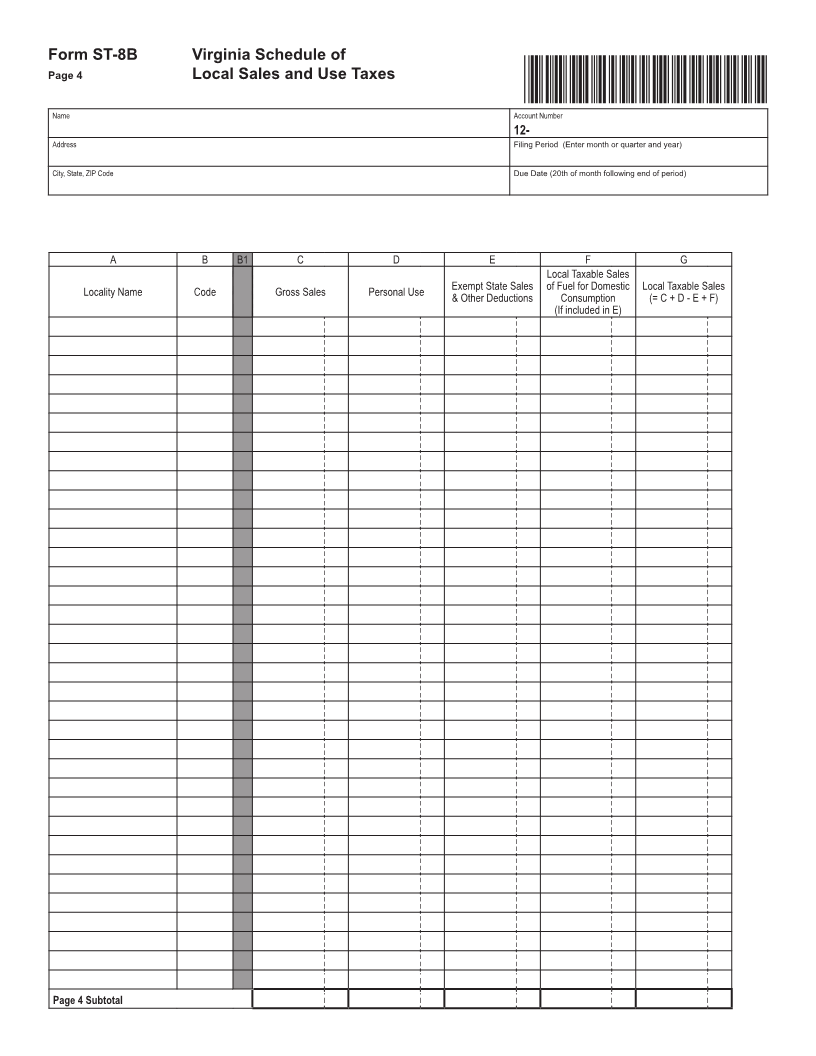

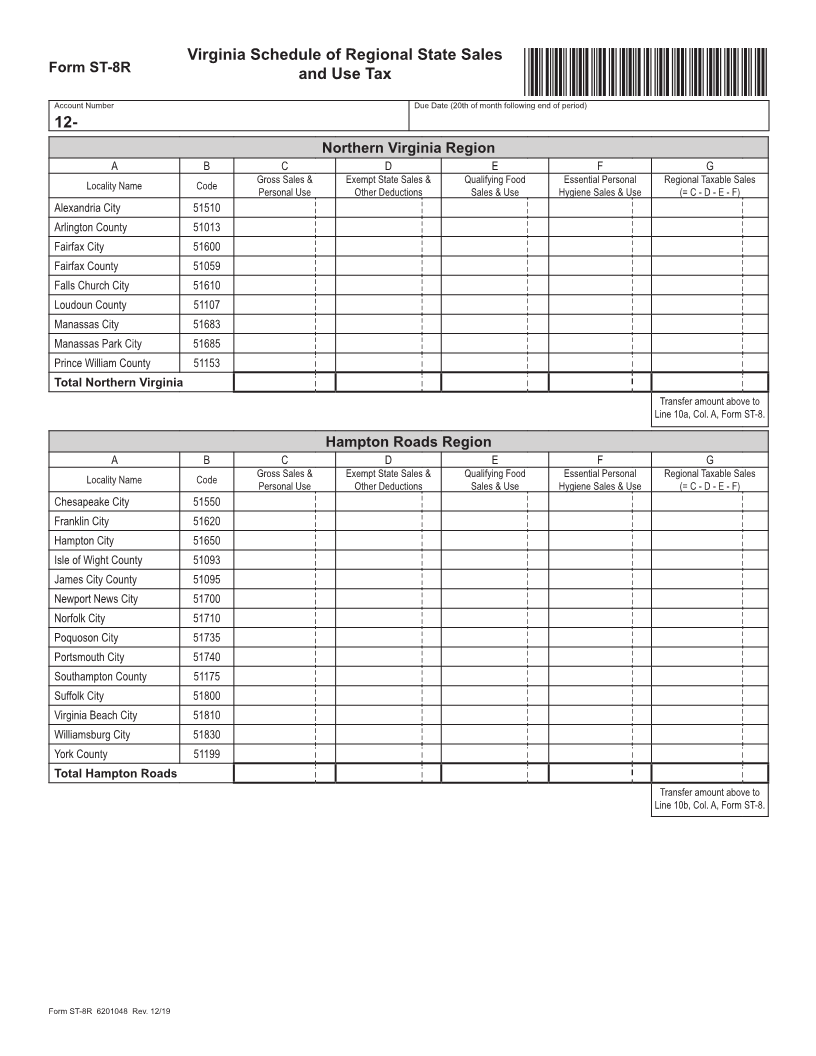

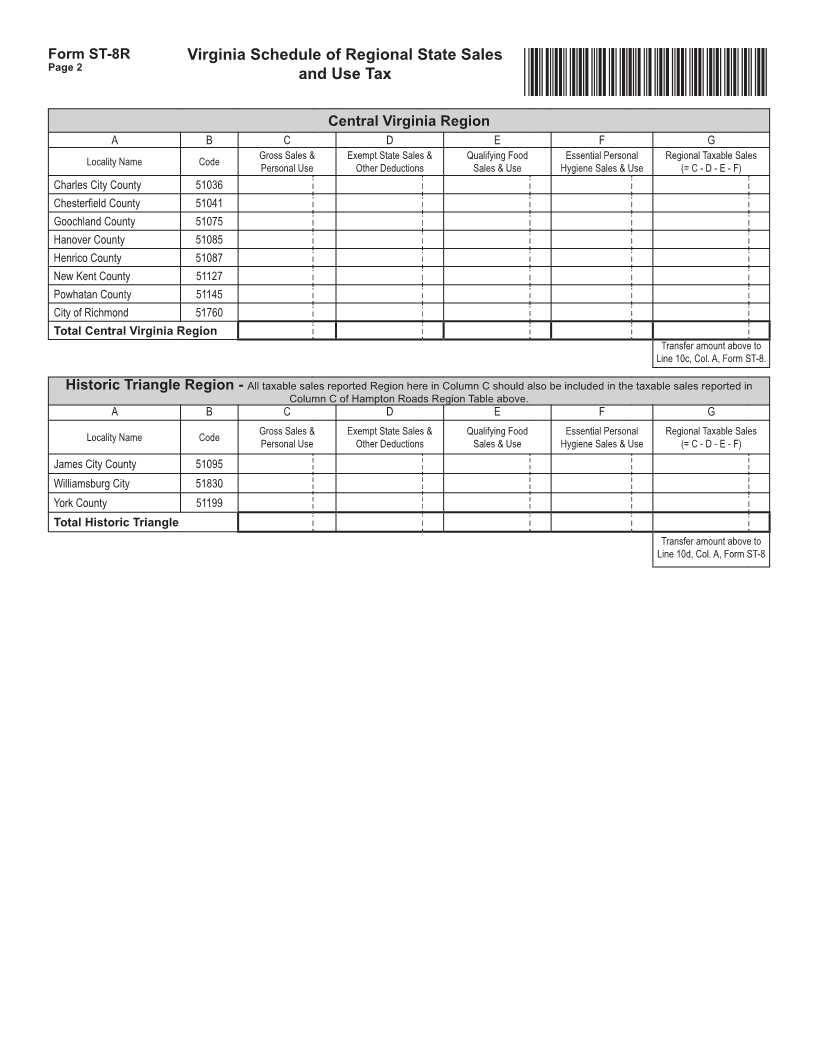

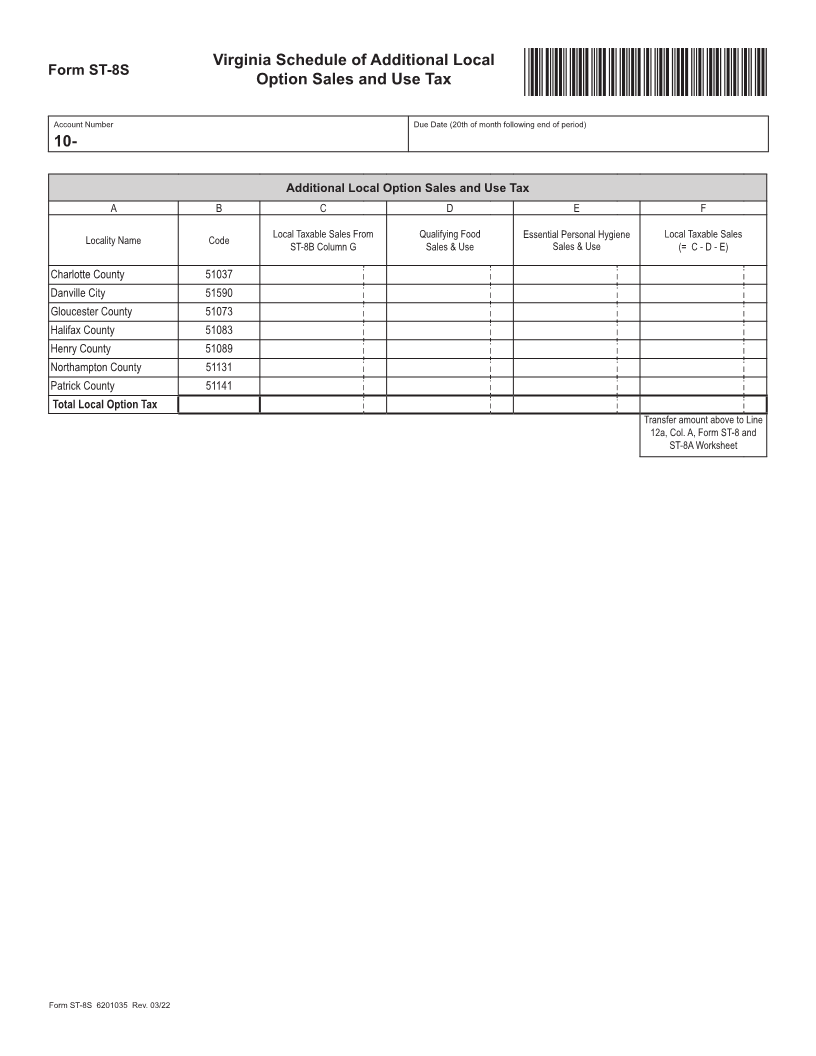

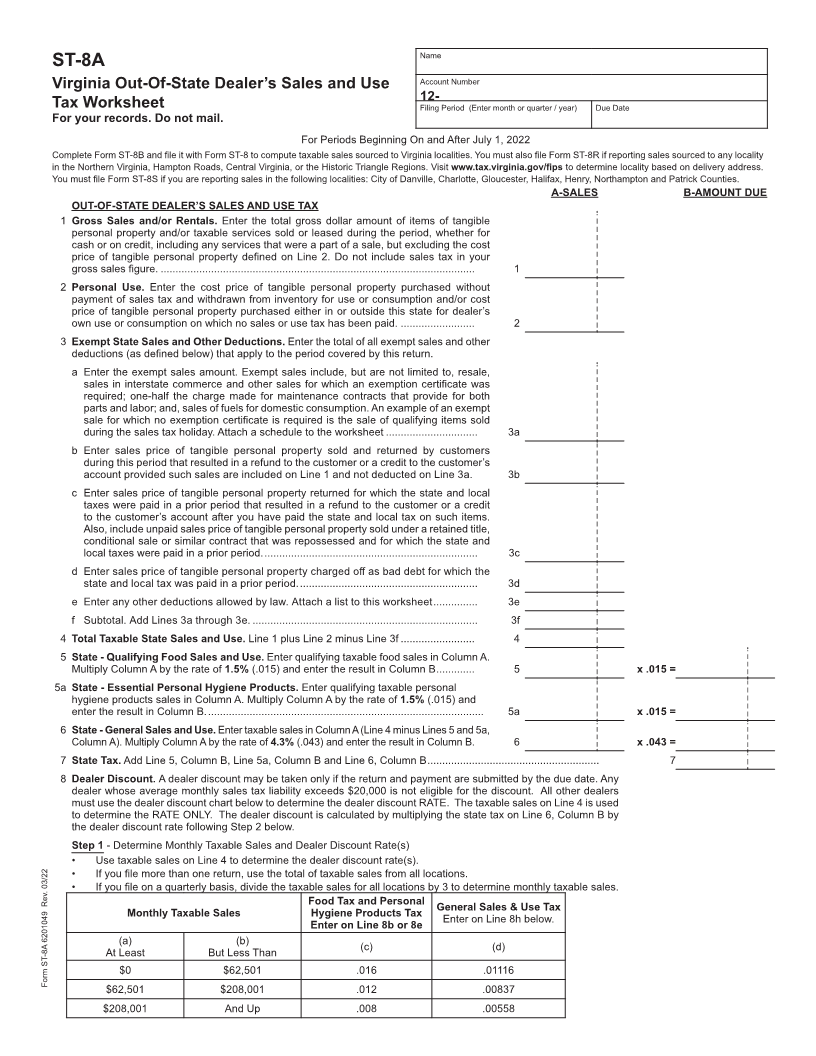

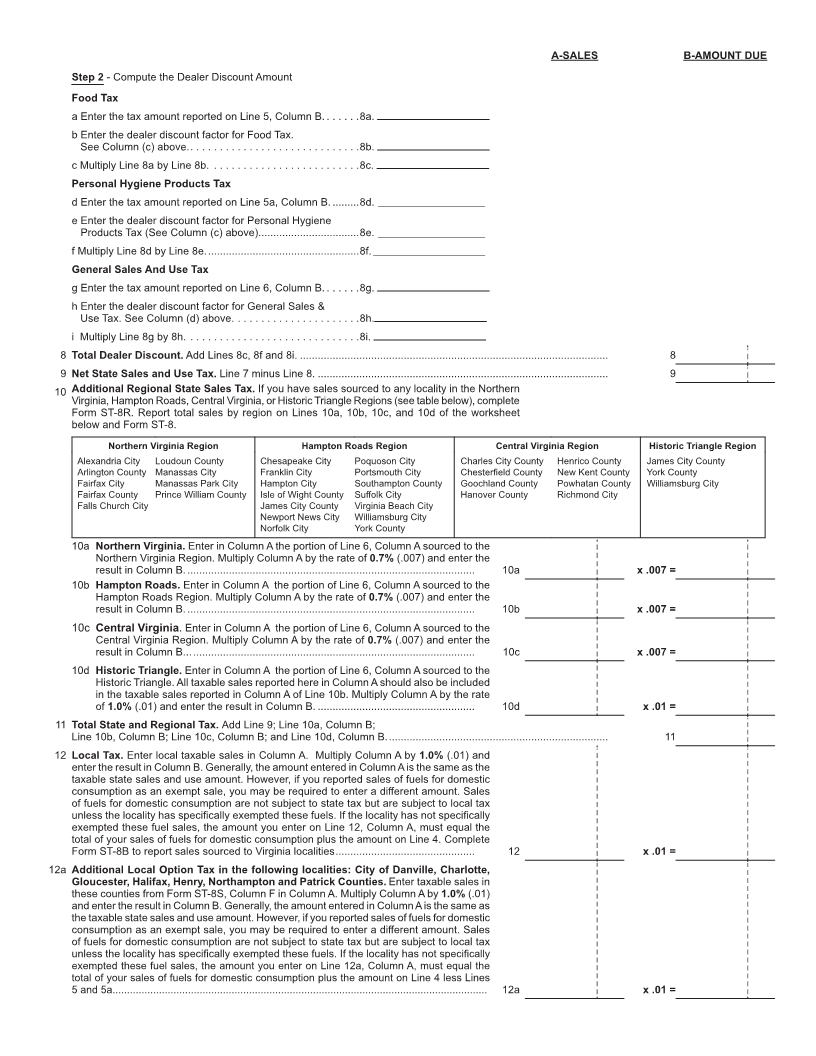

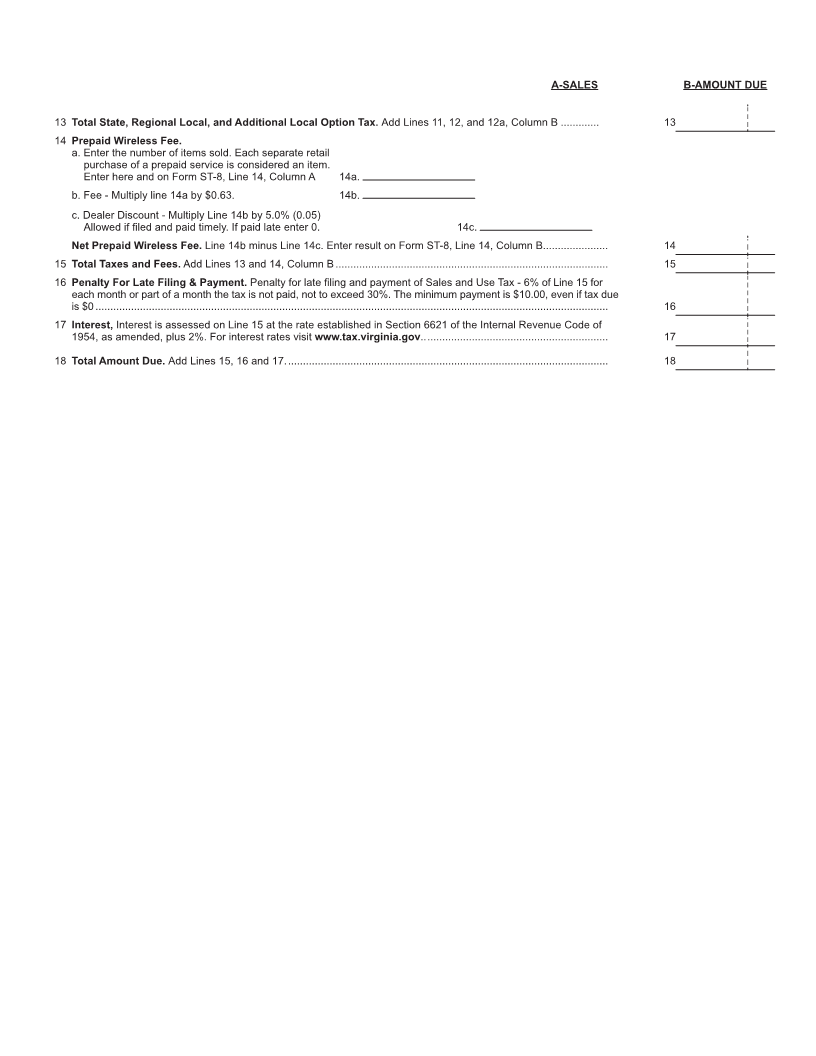

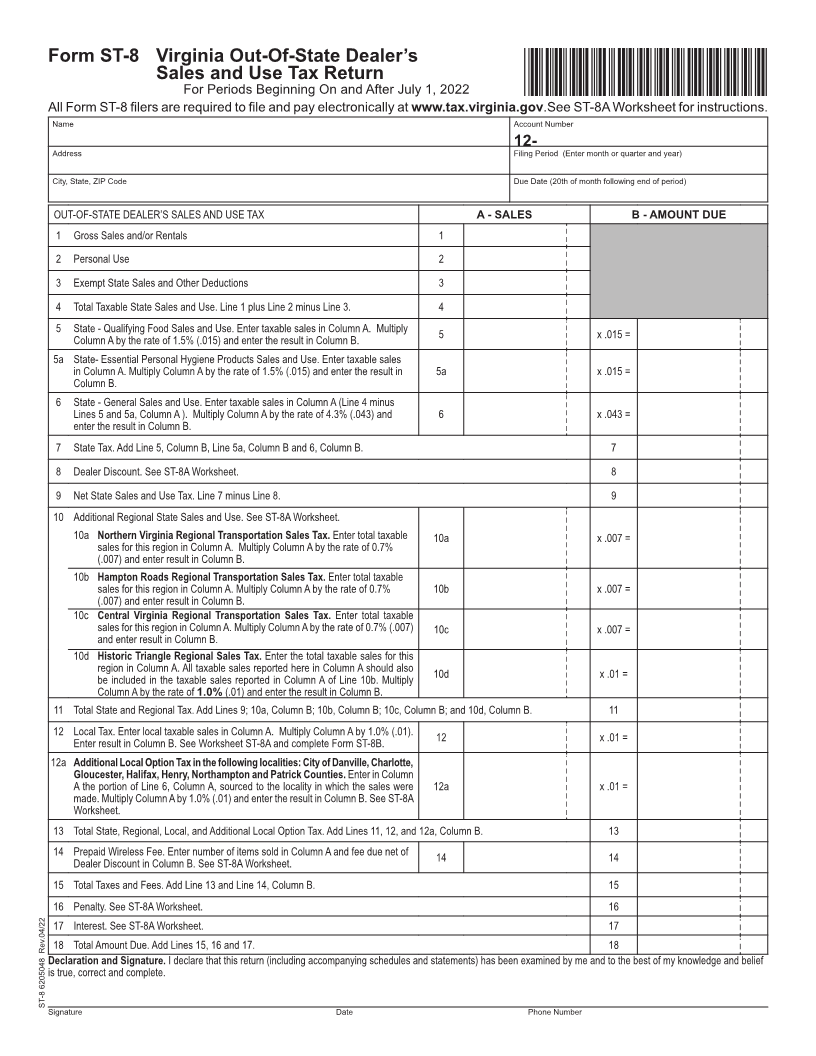

Form ST-8 Virginia Out-Of-State Dealer’s Sales and Use Tax Return For Periods Beginning On and After July 1, 2022 *VAST08124888* All Form ST-8 filers are required to file and pay electronically at www.tax.virginia.gov.See ST-8A Worksheet for instructions. Name Account Number 12- Address Filing Period (Enter month or quarter and year) City, State, ZIP Code Due Date (20th of month following end of period) OUT-OF-STATE DEALER’S SALES AND USE TAX A - SALES B - AMOUNT DUE 1 Gross Sales and/or Rentals 1 2 Personal Use 2 3 Exempt State Sales and Other Deductions 3 4 Total Taxable State Sales and Use. Line 1 plus Line 2 minus Line 3. 4 5 State - Qualifying Food Sales and Use. Enter taxable sales in Column A. Multiply 5 x .015 = Column A by the rate of 1.5% (.015) and enter the result in Column B. 5a State- Essential Personal Hygiene Products Sales and Use. Enter taxable sales in Column A. Multiply Column A by the rate of 1.5% (.015) and enter the result in 5a x .015 = Column B. 6 State - General Sales and Use. Enter taxable sales in Column A (Line 4 minus Lines 5 and 5a, Column A ). Multiply Column A by the rate of 4.3% (.043) and 6 x .043 = enter the result in Column B. 7 State Tax. Add Line 5, Column B, Line 5a, Column B and 6, Column B. 7 8 Dealer Discount. See ST-8A Worksheet. 8 9 Net State Sales and Use Tax. Line 7 minus Line 8. 9 10 Additional Regional State Sales and Use. See ST-8A Worksheet. 10a Northern Virginia Regional Transportation Sales Tax. Enter total taxable 10a x .007 = sales for this region in Column A. Multiply Column A by the rate of 0.7% (.007) and enter result in Column B. 10b Hampton Roads Regional Transportation Sales Tax. Enter total taxable sales for this region in Column A. Multiply Column A by the rate of 0.7% 10b x .007 = (.007) and enter result in Column B. 10c Central Virginia Regional Transportation Sales Tax. Enter total taxable sales for this region in Column A. Multiply Column A by the rate of 0.7% (.007) 10c x .007 = and enter result in Column B. 10d Historic Triangle Regional Sales Tax. Enter the total taxable sales for this region in Column A. All taxable sales reported here in Column A should also 10d x .01 = be included in the taxable sales reported in Column A of Line 10b. Multiply Column A by the rate of 1.0% (.01) and enter the result in Column B. 11 Total State and Regional Tax. Add Lines 9; 10a, Column B; 10b, Column B; 10c, Column B; and 10d, Column B. 11 12 Local Tax. Enter local taxable sales in Column A. Multiply Column A by 1.0% (.01). 12 x .01 = Enter result in Column B. See Worksheet ST-8A and complete Form ST-8B. 12a Additional Local Option Tax in the following localities: City of Danville, Charlotte, Gloucester, Halifax, Henry, Northampton and Patrick Counties. Enter in Column A the portion of Line 6, Column A, sourced to the locality in which the sales were 12a x .01 = made. Multiply Column A by 1.0% (.01) and enter the result in Column B. See ST-8A Worksheet. 13 Total State, Regional, Local, and Additional Local Option Tax. Add Lines 11, 12, and 12a, Column B. 13 14 Prepaid Wireless Fee. Enter number of items sold in Column A and fee due net of 14 14 Dealer Discount in Column B. See ST-8A Worksheet. 15 Total Taxes and Fees. Add Line 13 and Line 14, Column B. 15 16 Penalty. See ST-8A Worksheet. 16 17 Interest. See ST-8A Worksheet. 17 18 Total Amount Due. Add Lines 15, 16 and 17. 18 Declaration and Signature. I declare that this return (including accompanying schedules and statements) has been examined by me and to the best of my knowledge and belief is true, correct and complete. ST-8 6205048 Rev.04/22 Signature Date Phone Number