Enlarge image

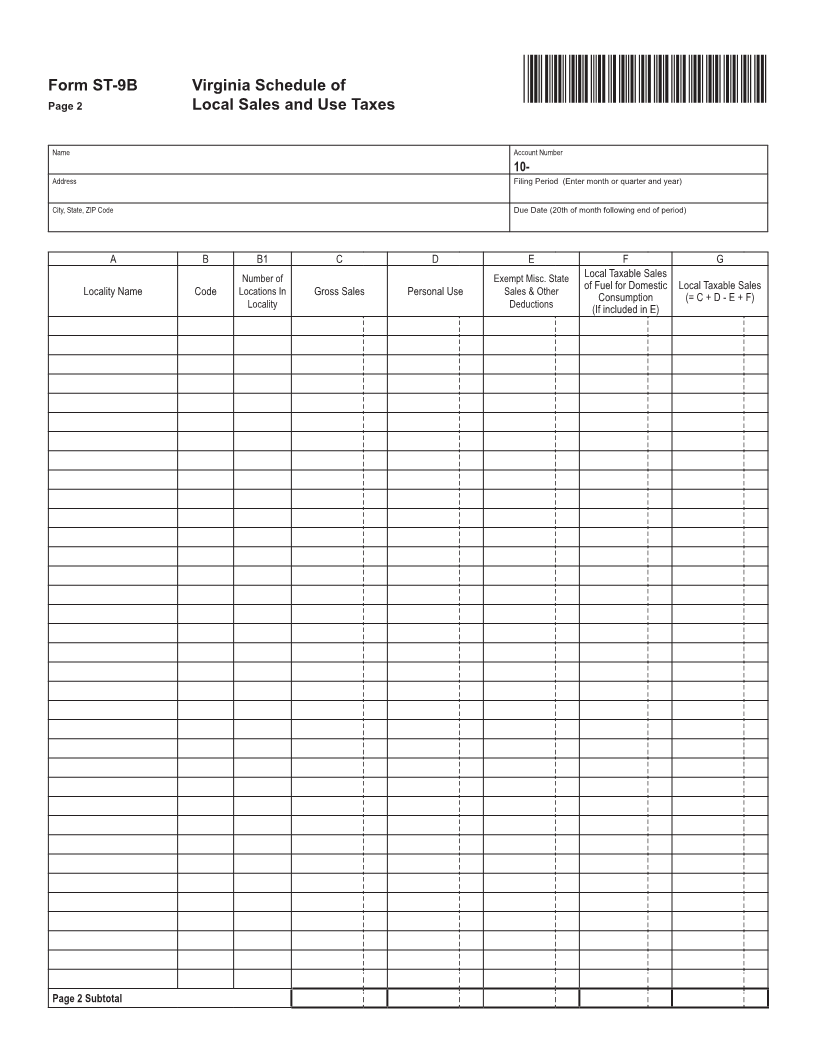

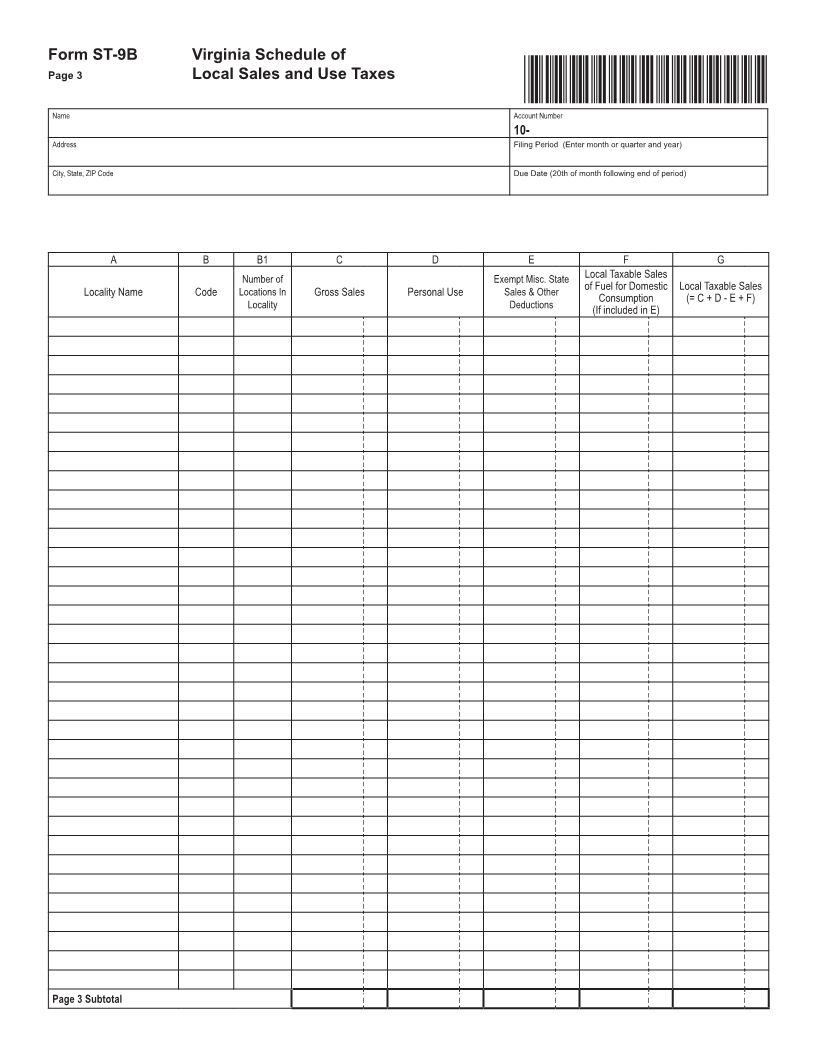

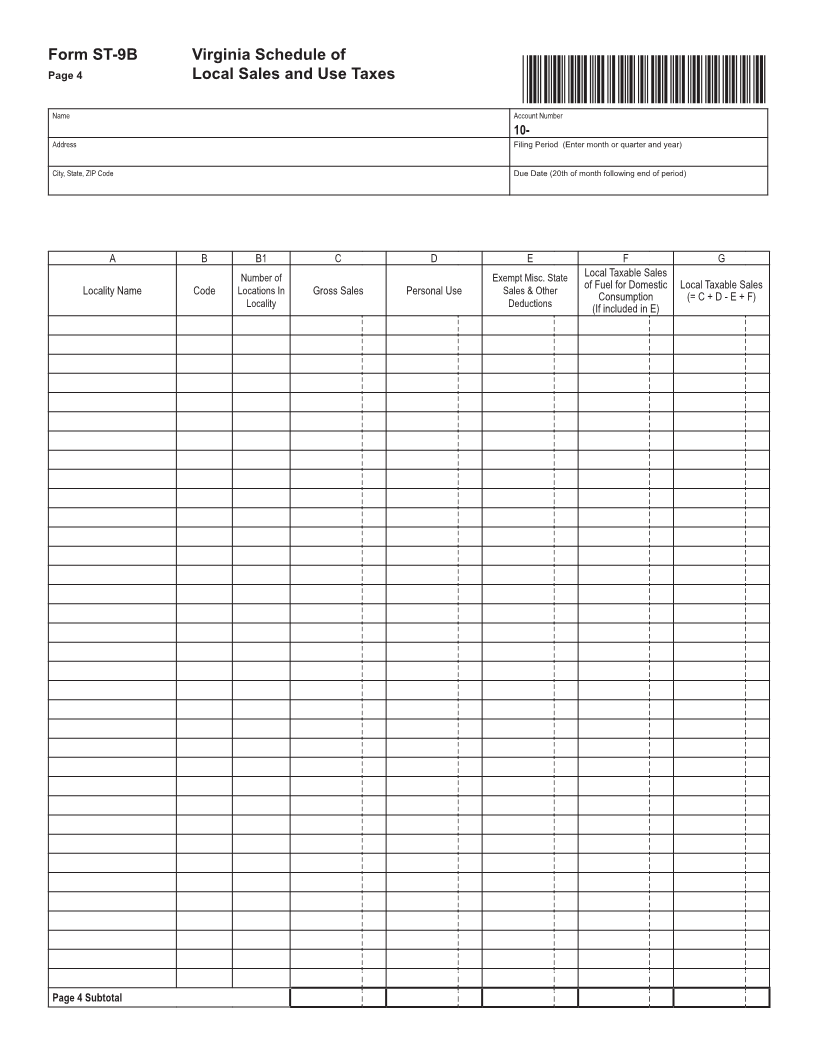

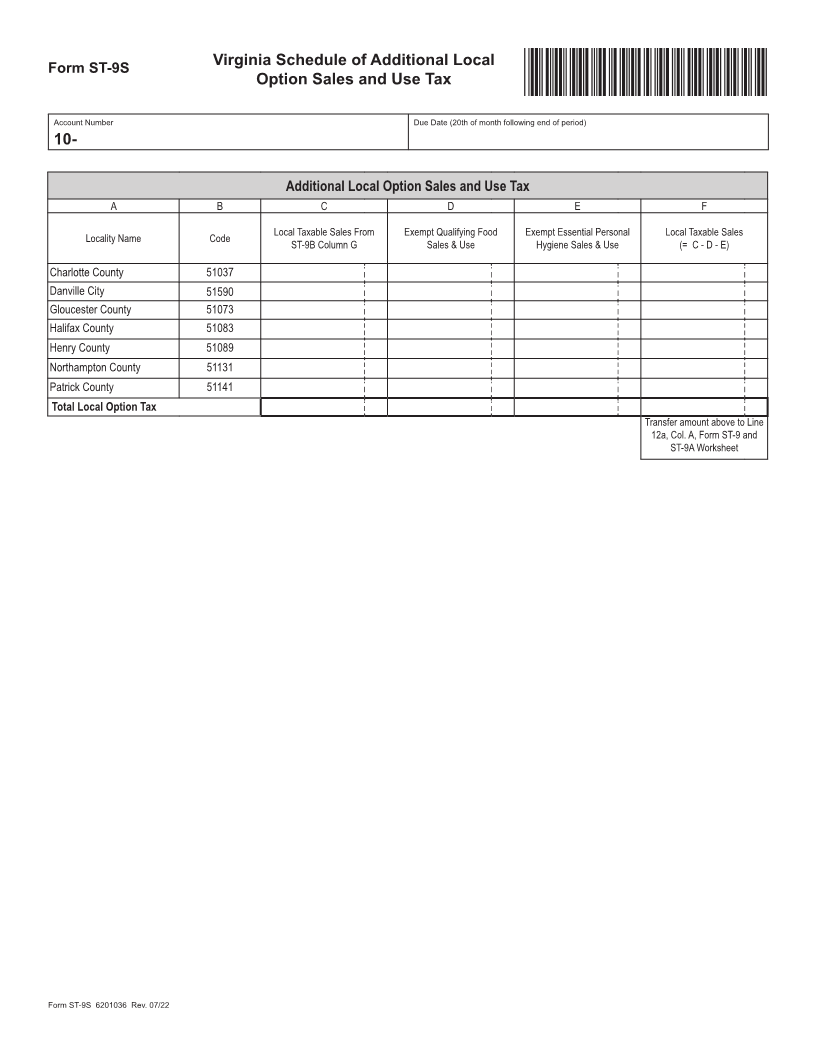

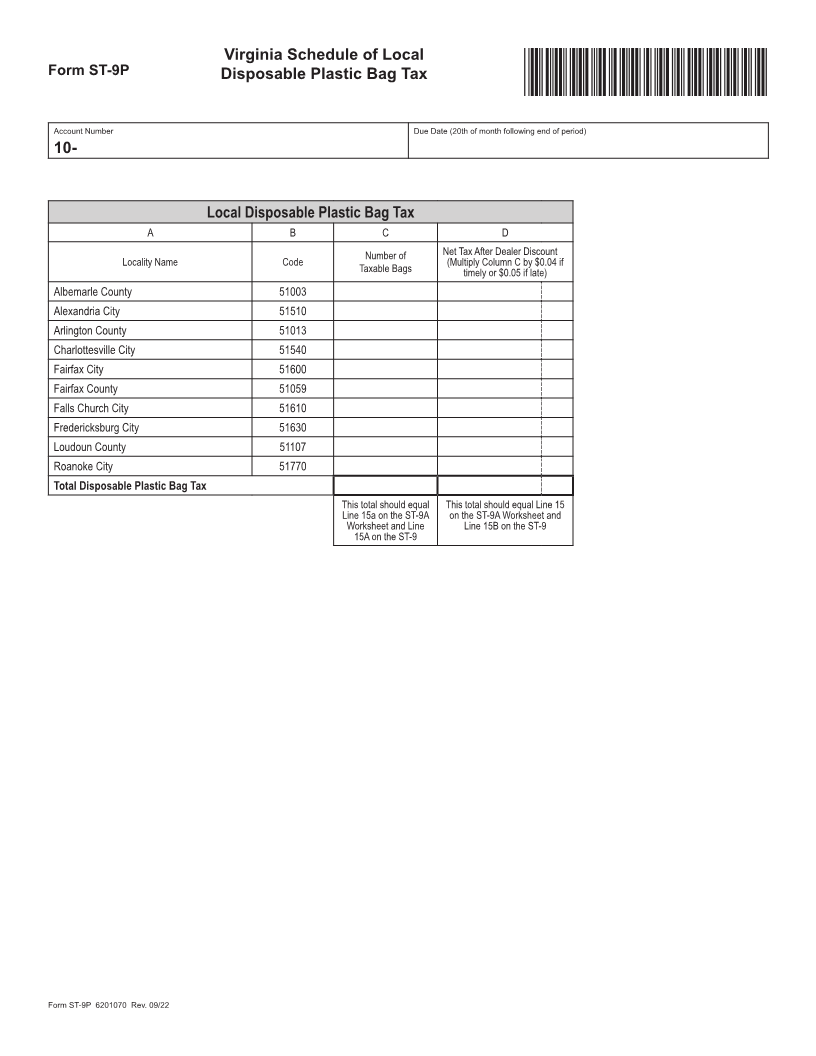

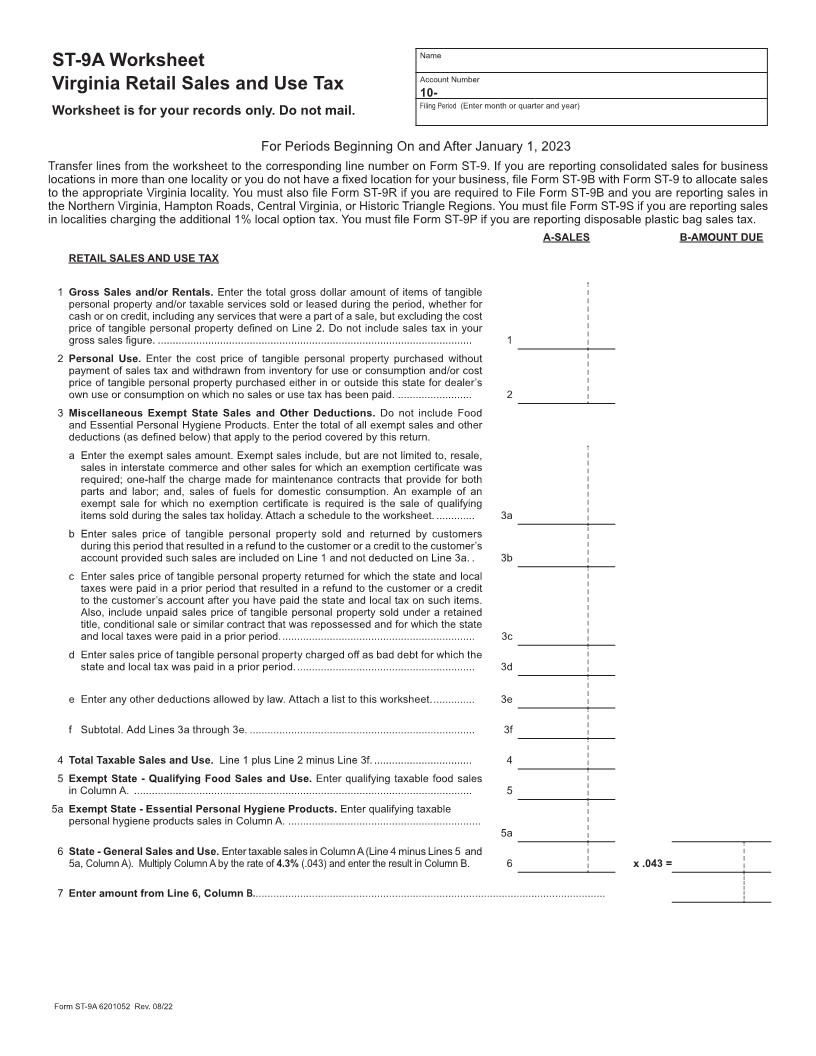

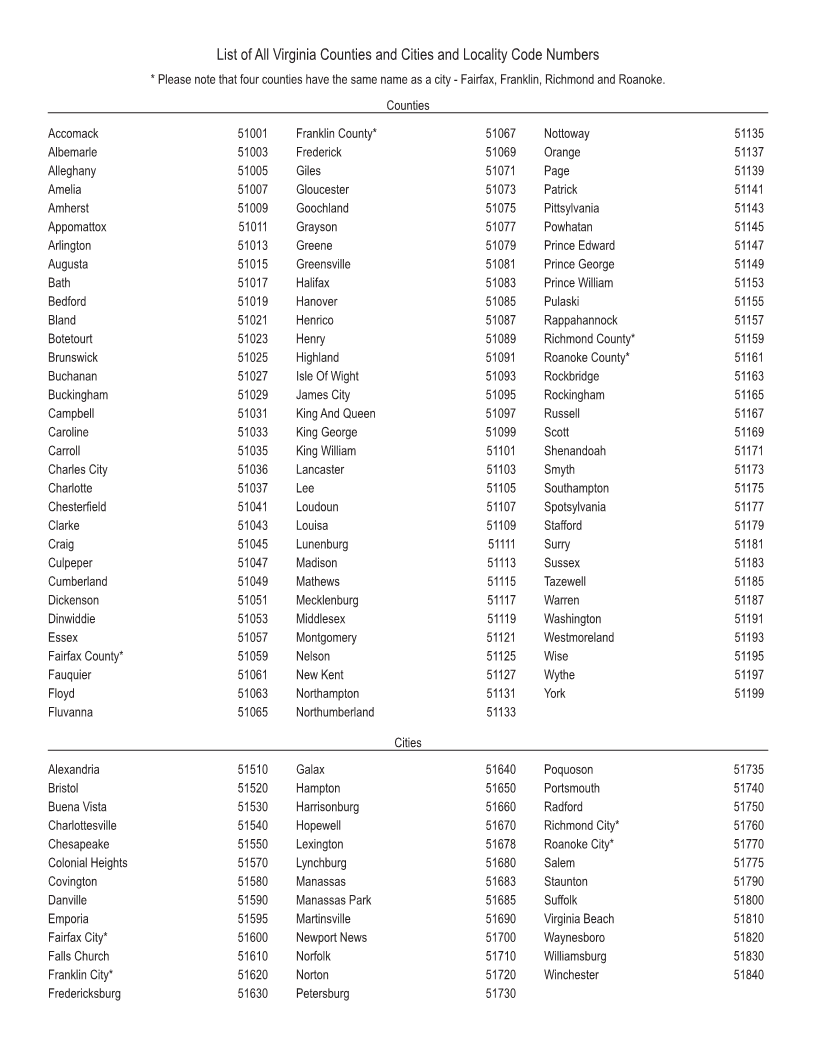

Form ST-9 Virginia Retail Sales and Use Tax Return For Periods Beginning On and After January 1, 2023 All Form ST-9 filers are required to file and pay electronically at www.tax.virginia.gov. *VAST09127888* See ST-9A Worksheet for instructions. Name Account Number 10- Address Filing Period (Enter month or quarter and year) City, State, ZIP Code Due Date (20th of month following end of period) RETAIL SALES AND USE TAX A - SALES B - AMOUNT DUE 1 Gross Sales and/or Rentals 1 2 Personal Use 2 3 Miscellaneous Exempt State Sales and Other Deductions. Do not include Food 3 and Essential Personal Hygiene Products. See instructions. 4 Total Taxable Sales and Use. Line 1 plus Line 2 minus Line 3. 4 5 Exempt State - Qualifying Food Sales and Use. Enter taxable sales in Column A. 5 5a Exempt State - Essential Personal Hygiene Products Sales and Use. Enter 5a taxable sales in Column A. 6 State - General Sales and Use. Enter taxable sales in Column A (Line 4 minus Lines 5 and 5a, Column A ). Multiply Column A by the rate of 4.3% (.043) and enter 6 x .043 = the result in Column B. 7 Enter amount from Line 6, Column B. 7 8 Dealer Discount. See Form ST-9A Worksheet. 8 9 Net State Tax. Line 7, Column B minus Line 8. 9 10a Northern Virginia Regional Transportation Sales Tax. Enter total taxable sales for this region in Column A. Multiply Column A by the rate of 0.7% (.007) and enter 10a x .007 = result in Column B. 10b Hampton Roads Regional Transportation Sales Tax. Enter total taxable sales for this region in Column A. Multiply Column A by the rate of 0.7% (.007) and enter 10b x .007 = result in Column B. 10c Central Virginia Regional Transportation Sales Tax. Enter total taxable sales for this region in Column A. Multiply Column A by the rate of 0.7% (.007) and enter 10c x .007 = result in Column B 10d Historic Triangle Regional Sales Tax. Enter total taxable sales for this area in Column A. All taxable sales reported here in Column A should also be included in 10d x .01 = the taxable sales reported in Column A of Line 10b. Multiply Column A by the rate of 1.0% (.01) and enter result in Column B. 11 Total State and Regional Tax. Add Lines 9; 10a, Column B; 10b, Column B; 10c, Column B; and 10d, Column B. 11 12 Local Tax. Enter local taxable sales in Column A. Multiply Column A by the rate of 12 x .01 = 1.0% (.01) and enter the result in Column B. See ST-9A Worksheet. 12a Additional Local Option Tax. Enter in Column A the sales sourced to localities from the ST-9A Worksheet, Line 12a. Multiply Column A by 1.0% (.01) and enter the result 12a x .01 = in Column B. See ST-9A Worksheet. 13 Total State, Regional, Local, and Additional Local Option Tax. Add Lines 11, 12 and 12a, Column B. 13 14 Prepaid Wireless Fee. Enter number of items sold in Column A and fee due net of 14 14 Dealer Discount in Column B. See ST-9A Worksheet. 15 Disposable Plastic Bag Tax. Enter the total number of disposable plastic bags sourced to localities in Column A and the tax due net of Dealer Discount in Column 15 15 B. If reporting for more than one locality, complete Form ST-9P before entering amounts on this line. See ST-9A Worksheet for instructions. 16 Total Taxes and Fees. Add Lines 13, 14 and 15, Column B. 16 17 Penalty. See ST-9A Worksheet. 17 18 Interest. See ST-9A Worksheet. 18 19 Total Amount Due. Add Lines 16, 17 and 18. 19 Declaration and Signature. I declare that this return (including accompanying schedules and statements) has been examined by me and to the best of my knowledge and belief is true, correct and complete. ST-9 6210051 Rev. 08/22 Signature Date Phone Number