Enlarge image

Worksheet OR-CRC

Claim of Right Income Repayments

General instructions Note: If you’re reporting an addition on Schedule OR-ASC-

NP, enter the total repayment amount in the federal column

If you had to repay an amount that you included in your and the amount taxed by Oregon in the Oregon column.

Oregon income in an earlier year, you may be able to claim If you're not claiming the Oregon repayment credit, there is

a credit for the Oregon tax you paid on that income when

nothing else you need to do.

you file your return for the repayment year.

The Oregon claim of right income repayment credit may

be claimed on your Oregon personal income tax return if: How do I calculate the credit?

• Your repayment is more than $3,000, Gather the following items for the reported year (the year

• You paid Oregon tax on the income you repaid, and the income was taxed by Oregon):

• You're claiming the repayment credit or deduction on your

federal return. • A copy of your Oregon tax return, including any amended

returns or adjustment notices.

Repayments of $3,000 or less don’t qualify for the Oregon • Oregon tax tables or rate charts.

credit. Note: Corporations may file for relief of tax on repaid

• If you filed a part-year or nonresident return, a blank part-

income; refer to Form OR-20 instructions.

year or nonresident return form. Follow the instructions

For more information about claim of right income repay- for Worksheet B to complete the form.

ments, see Internal Revenue Service Publication 535.

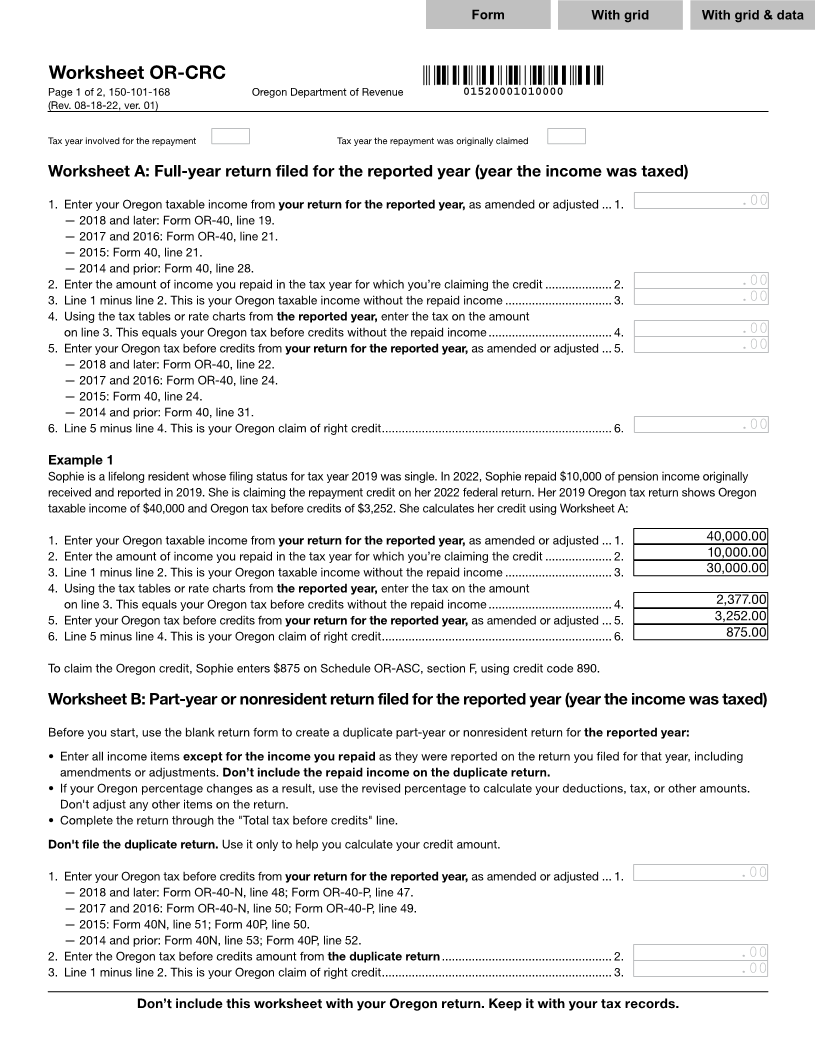

Use Worksheet A if you filed a full-year return. Use Work-

This worksheet needs to be kept with your records. sheet B if you filed a part-year or nonresident return for the

reported year.

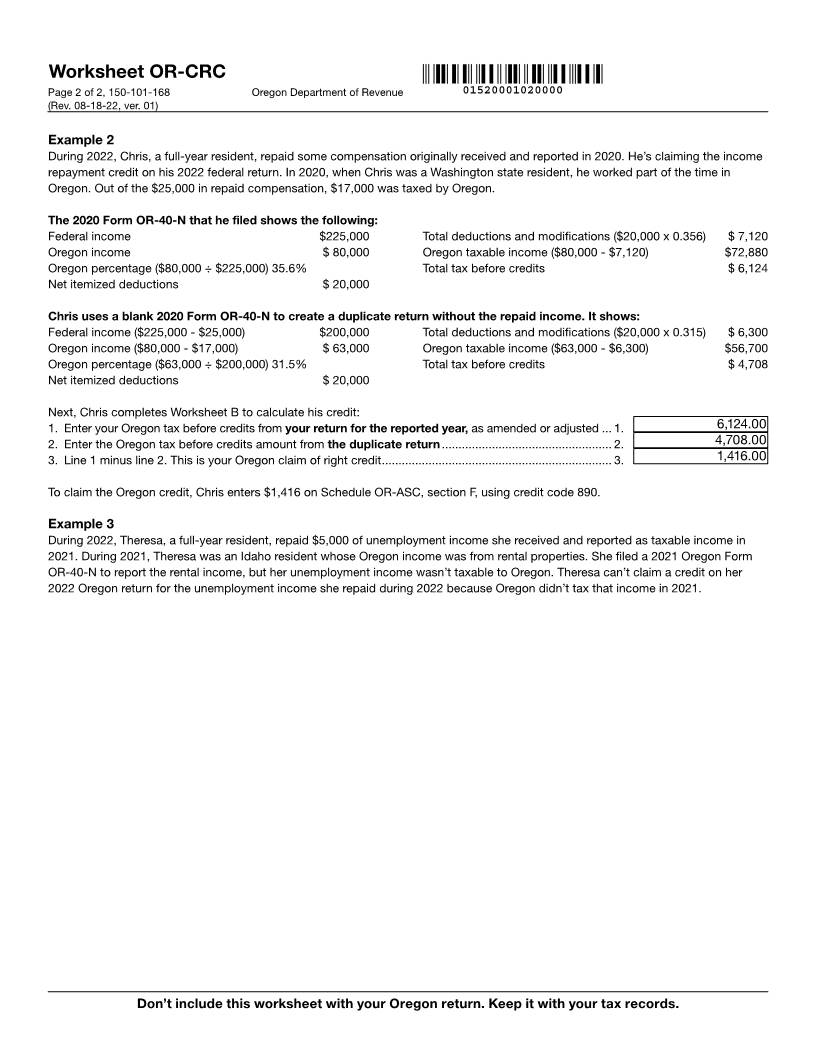

What if I’m claiming the federal Multiple years. If you repaid income from more than one

deduction? tax year, complete a separate worksheet for each year that

the income was reported and taxed by Oregon. Claim the

The federal repayment deduction is claimed on the same total of all credits on the return you’re filing for the repay-

schedule where you reported the income or as an itemized ment year.

deduction on Schedule A, depending on the type of income

you repaid. You can't claim both the federal repayment

deduction and the Oregon repayment credit. If you claim the Where do I claim the credit?

Oregon repayment credit, you must add back the amount of

any repayment deduction claimed on the return. Claim the credit on the return you’re filing for the repay-

ment year:

Full-year filers. If you’re filing a full-year return for the

repayment year and you’re deducting the repayment amount — 2014 and prior: Form 40, line 43, mark box 43b; Form 40P

on Schedule OR-A or any federal form or schedule, report an or 40N, line 60, mark box 60b.

addition on Schedule OR-ASC Section A, using code 103 if — 2015 through 2020: Schedule OR-ASC, section 5; Schedule

you're claiming the credit. If you're not claiming the repay- OR-ASC-NP, section 7; use code 890.

ment credit, there is nothing else you need to do. — 2021 and later: Schedule OR-ASC, section F; Schedule

OR-ASC-NP, section H; use code 890.

Part-year or nonresident filers. If you’re filing a part-year

or nonresident return for the repayment year, claiming the

Oregon repayment credit, and deducting the repayment Do you have questions or need help?

amount:

• As an itemized deduction on Schedule OR-A: Use a minus www.oregon.gov/dor

sign with the repayment amount to report a negative 503-378-4988 or 800-356-4222

modification on Schedule OR-ASC-NP, Section D, using questions.dor@ dor.oregon.gov

code 649.

• On another federal form or schedule: Report an addition Contact us for ADA accommodations or assistance in other

on Schedule OR-ASC-NP, Section A, using code 103. languages.

150-101-168 (Rev. 08-18-22) Page 1 of 1