Enlarge image

1 1

1 2 2 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 Form With grid With grid & data2 84 85

3 4 82 83

3 3

4 4

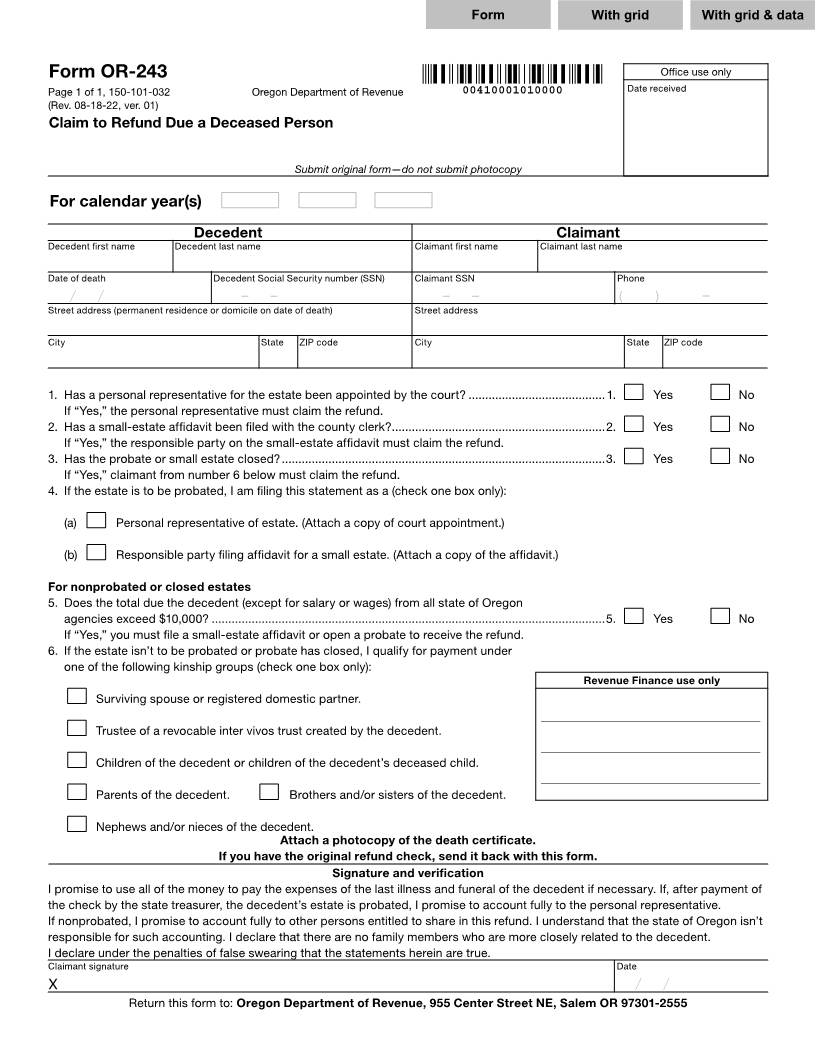

5 Form OR-243 Office use only 5

6 Page 1 of 1, 150-101-032 Oregon Department of Revenue 00410001010000 Date received 6

7 (Rev. 08-18-22, ver. 01) 7

8 Claim to Refund Due a Deceased Person 8

9 9

10 10

11 Submit original form—do not submit photocopy 11

12 12

13 For calendar year(s) 9999 9999 9999 13

14 14

15 Decedent Claimant 15

16 Decedent first name Decedent last name Claimant first name Claimant last name 16

17 17

18 XXXXXXXXXXXXDate of death XXXXXXXXXXXXXXXXXXXXDecedent Social Security number (SSN) XXXXXXXXXXXXClaimant SSN XXXXXXXXXXXXXXXXXXXXPhone 18

19 19

20 Street99/99/9999/address/(permanent residence or999-99-9999domicile-on date-of death) 999-99-9999Street-address- (999)( )999-9999- 20

21 21

22 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXCity State ZIP code XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXCity State ZIP code 22

23 23

XXXXXXXXXXXXXXXXXXXXX XX XXXXX-XXXX XXXXXXXXXXXXXXXXXXXXX XX XXXXX-XXXX

24 24

25 1. Has a personal representative for the estate been appointed by the court? .........................................1. X Yes X No 25

26 If “Yes,” the personal representative must claim the refund. 26

27 2. Has a small-estate affidavit been filed with the county clerk? ................................................................2. X Yes X No 27

28 If “Yes,” the responsible party on the small-estate affidavit must claim the refund. 28

29 3. Has the probate or small estate closed? .................................................................................................3. X Yes X No 29

30 If “Yes,” claimant from number 6 below must claim the refund. 30

31 4. If the estate is to be probated, I am filing this statement as a (check one box only): 31

32 32

33 (a) X Personal representative of estate. (Attach a copy of court appointment.) 33

34 34

35 (b) X Responsible party filing affidavit for a small estate. (Attach a copy of the affidavit.) 35

36 36

37 For nonprobated or closed estates 37

38 5. Does the total due the decedent (except for salary or wages) from all state of Oregon 38

39 agencies exceed $10,000? ......................................................................................................................5. X Yes X No 39

40 If “Yes,” you must file a small-estate affidavit or open a probate to receive the refund. 40

41 6. If the estate isn’t to be probated or probate has closed, I qualify for payment under 41

42 one of the following kinship groups (check one box only): 42

43 Revenue Finance use only 43

44 X Surviving spouse or registered domestic partner. 44

45 _______________________________________________ 45

46 X Trustee of a revocable inter vivos trust created by the decedent. 46

47 _______________________________________________ 47

48 X Children of the decedent or children of the decedent’s deceased child. 48

49 _______________________________________________ 49

50 X Parents of the decedent. X Brothers and/or sisters of the decedent. 50

51 51

52 X Nephews and/or nieces of the decedent. 52

53 Attach a photocopy of the death certificate. 53

54 If you have the original refund check, send it back with this form. 54

55 Signature and verification 55

56 I promise to use all of the money to pay the expenses of the last illness and funeral of the decedent if necessary. If, after payment of 56

57 the check by the state treasurer, the decedent’s estate is probated, I promise to account fully to the personal representative. 57

58 If nonprobated, I promise to account fully to other persons entitled to share in this refund. I understand that the state of Oregon isn’t 58

59 responsible for such accounting. I declare that there are no family members who are more closely related to the decedent. 59

60 I declare under the penalties of false swearing that the statements herein are true. 60

61 Claimant signature Date 61

62 X 99/99/9999/ / 62

63 Return this form to: Oregon Department of Revenue, 955 Center Street NE, Salem OR 97301-2555 63

64 64

1 2 65 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 65 84 85

3 4 82 83

66 66